Ethereum often gets criticized for its “loose” monetary policy.

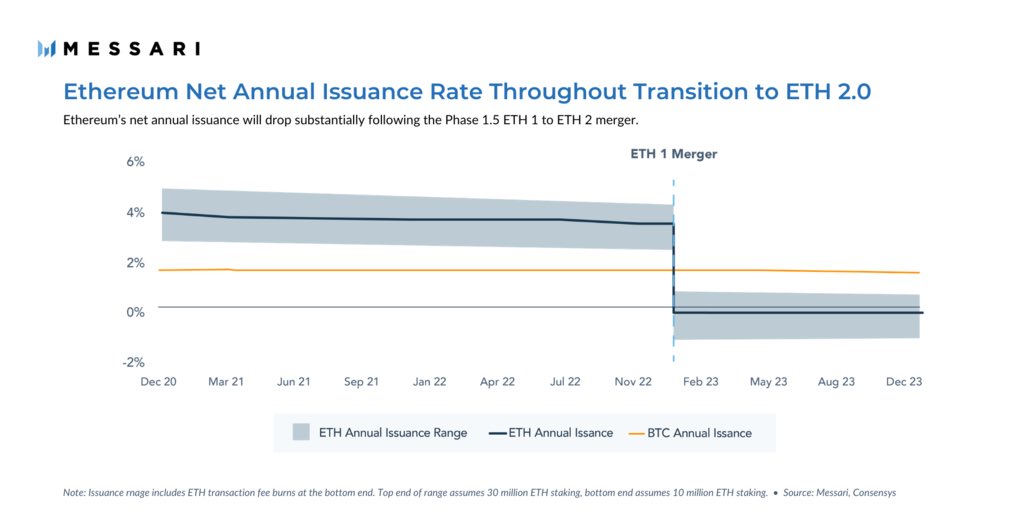

However after Phase 1.5 (ETH 1.x merge into ETH 2), it is likely ETH’s annual inflation rate will drop well below 1% if not 𝗻𝗲𝗴𝗮𝘁𝗶𝘃𝗲.

At this point ETH’s inflation rate would be far lower than BTC’s.

1/

However after Phase 1.5 (ETH 1.x merge into ETH 2), it is likely ETH’s annual inflation rate will drop well below 1% if not 𝗻𝗲𝗴𝗮𝘁𝗶𝘃𝗲.

At this point ETH’s inflation rate would be far lower than BTC’s.

1/

If you’re an Ethereum skeptic you’re probably thinking “how is this possible?”

It all starts with Ethereum’s shift to Proof of Stake (PoS).

It all starts with Ethereum’s shift to Proof of Stake (PoS).

One of the core value propositions of PoS is that stakers are theoretically more willing to pay significantly higher capital costs per a dollar of rewards.

This is because they only face an opportunity cost on their investment and don’t experience any depreciation (like ASICs).

This is because they only face an opportunity cost on their investment and don’t experience any depreciation (like ASICs).

Higher capital costs are good because that increases the cost to attack Ethereum.

And the benefit of this is that Ethereum can get an equal amount of security for less dollar rewards (ETH issuance).

And the benefit of this is that Ethereum can get an equal amount of security for less dollar rewards (ETH issuance).

In other words PoS allows Ethereum to achieve an equal amount of security while issuing significantly less ETH.

Combine this lower issuance with transaction fee burns (EIP 1559) and there’s the potential for Ethereum’s annual issuance rate to drop negative - all while still staying secure.

But Phase 1.5 is anywhere from 12-24 months out.

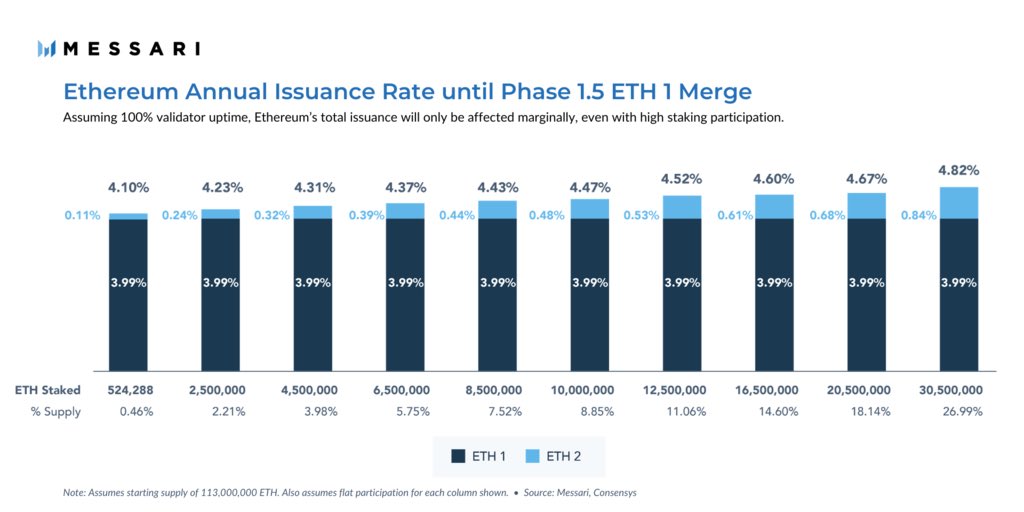

In the meantime, Ethereum’s annual issuance rate will actually increase because ETH 2 issuance will be incremental to ETH1.x before the merge.

Important to note though that this incremental issuance is both temporary minimal.

In the meantime, Ethereum’s annual issuance rate will actually increase because ETH 2 issuance will be incremental to ETH1.x before the merge.

Important to note though that this incremental issuance is both temporary minimal.

Many may still look at the above insurance schedule and be skeptical.

“Ethereum’s monetary policy seems too fluid and unstable”

And they’d be somewhat correct in that Ethereum’s monetary policy is not rigid.

But they’d also be missing what Ethereum’s monetary policy truly is.

“Ethereum’s monetary policy seems too fluid and unstable”

And they’d be somewhat correct in that Ethereum’s monetary policy is not rigid.

But they’d also be missing what Ethereum’s monetary policy truly is.

Ethereum’s monetary policy can be defined as “Minimum Necessary Issuance” - the minimum amount of issuance necessary to ensure Ethereum remains secure.

Although this may seem subjective, like any protocol parameter Ethereum’s monetary policy is enforced through social consensus

Although this may seem subjective, like any protocol parameter Ethereum’s monetary policy is enforced through social consensus

Ethereum’s monetary policy is optimized for security.

This is in opposition to Bitcoin’s monetary policy which optimizes for “monetary perfection” (fixed supply and deterministic issuance schedule).

The benefit is that Bitcoin’s monetary policy is 𝗺𝘂𝗰𝗵 easier to communicate

This is in opposition to Bitcoin’s monetary policy which optimizes for “monetary perfection” (fixed supply and deterministic issuance schedule).

The benefit is that Bitcoin’s monetary policy is 𝗺𝘂𝗰𝗵 easier to communicate

But the two approaches to monetary policy have their trade offs.

Ethereum’s monetary policy can be hard to quantify and communicate.

While Bitcoin’s monetary policy sets its security budget arbitrarily.

Ethereum’s monetary policy can be hard to quantify and communicate.

While Bitcoin’s monetary policy sets its security budget arbitrarily.

It will be exciting to see the consequences of each’s approach to monetary policy and how it will affect their properties as money.

Is security more important or is “monetary perfection” important?

It’s to be determined.

Is security more important or is “monetary perfection” important?

It’s to be determined.

But if it is the case that Ethereum becomes more scarce than Bitcoin, and it’s security model is more sustainable, both due to PoS, then what will that imply for ETH’s monetary properties vs Bitcoin’s?

Check out our full ETH 2.0 report here to learn more about Ethereum’s monetary policy and more and find an answer for yourself: http://bit.ly/2KXLKcj

Read on Twitter

Read on Twitter