1 of 8) CASE STUDY: $STNE StoneCo Ltd.

A stock I have believed in for two full years but got completely wrong due to a lack of #patience

It's been an up and down ride but I lacked #conviction

We all make mistakes, no matter how long we do this.

#MentalMistakes

A stock I have believed in for two full years but got completely wrong due to a lack of #patience

It's been an up and down ride but I lacked #conviction

We all make mistakes, no matter how long we do this.

#MentalMistakes

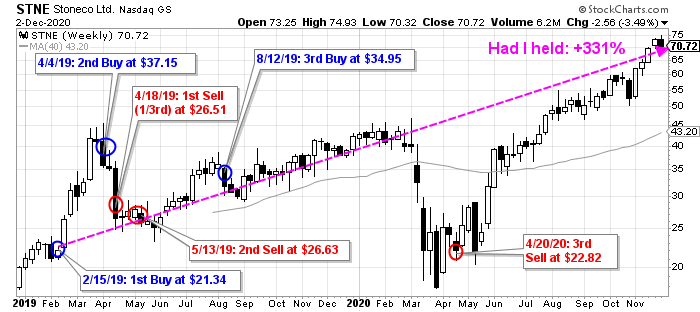

2) My first $STNE buy was excellent in early 2019 at $21.34.

Here's what I said in the tweet and the 2019 Stocks to Watch...

Here's what I said in the tweet and the 2019 Stocks to Watch...

3) I made a 2nd buy of $STNE 71% higher than my initial purchase as my conviction was growing.

It helped that Warren Buffett was a large shareholder.

It helped that Warren Buffett was a large shareholder.

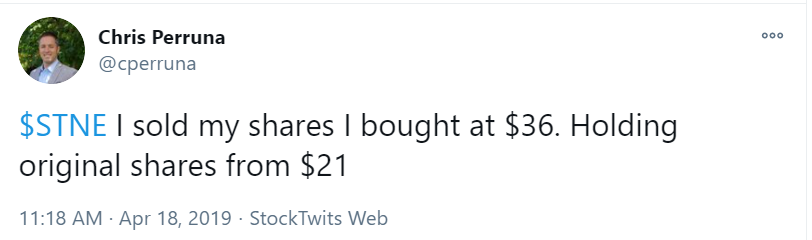

4) Following a less than stellar earnings, the stock started a quick 45% drawdown so I decided to sell the $STNE shares I bought in April.

5) With further downside pressure, I decided to sell the remaining $STNE position and take my gains before they turned into a loss.

In hindsight, I lost the conviction I wrote about in January.

Not enough patience - also a mistake in hindsight.

In hindsight, I lost the conviction I wrote about in January.

Not enough patience - also a mistake in hindsight.

6) The stock gathered itself over the next two months so I jumped back in, in August at $34.95, 31% higher than my previous sell.

I admitted that I made a mistake with $STNE and paid up to get back in. Don't stay wrong.

Lesson learned - or so I thought...

I admitted that I made a mistake with $STNE and paid up to get back in. Don't stay wrong.

Lesson learned - or so I thought...

7) $STNE slowly trended back up and traded above $45 on three occasions but struggled to go any higher, the same resistance it hit in March 2019.

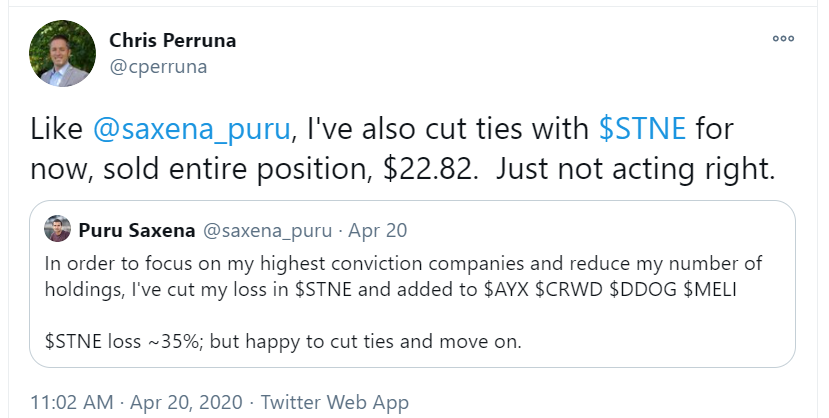

2020: COVID hits, market falls & Brazil cases start to mount so I sold it all, for a loss.

Looking back, not far from the low.

2020: COVID hits, market falls & Brazil cases start to mount so I sold it all, for a loss.

Looking back, not far from the low.

Read on Twitter

Read on Twitter