This story. Have to say the @WSJ has done a good job on covering the reality of life in America, especially on issues such as household debt. This one is about college loans & specifically the aspirational aspect of higher education that led many parents to borrow for their kids. https://twitter.com/ForsythJenn/status/1334231737912623104

There is a mantra in American society that the only way for upward mobility is through a college education. Many low income & middle class parents bought that & do whatever they can to give their children opportunities.

But the premise is flawed as not all colleges are equal.

But the premise is flawed as not all colleges are equal.

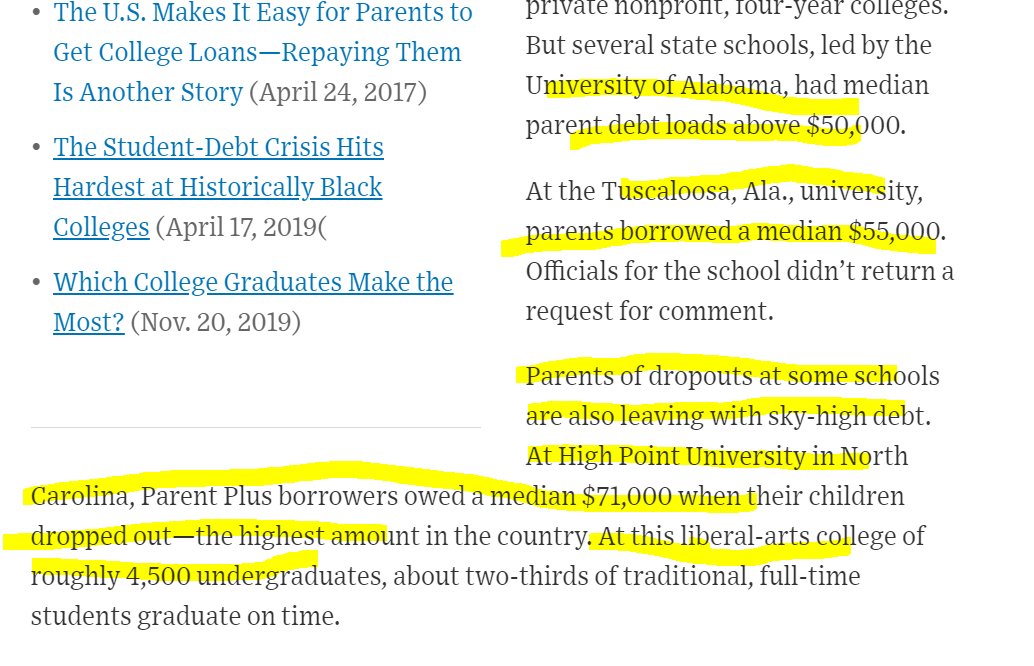

Parents in low-income & even middle class, with good intentions but may be ill informed, don't have people that advise them on how to maximize return (higher income for kids + opportunities to mingle w/ kids that will be good influences) on their investment, or debt. Look at this

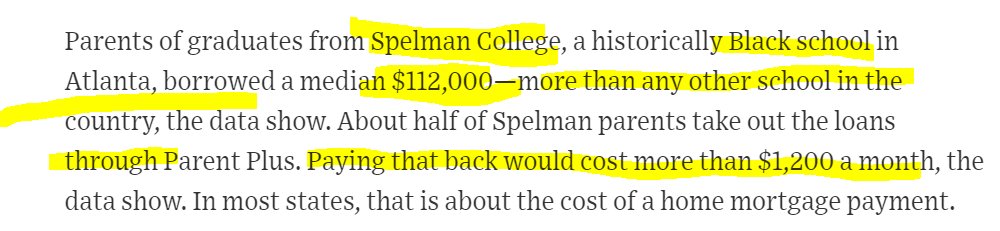

The college w/ the highest parent student loan debt is a black college called Spelman College where parents borrowed a median USD112k or 1200 monthly payment. Parent plus rates = 5.3%

Why don't they send their kids to public universities that are subsidized? Went to UCLA. Cheap.

Why don't they send their kids to public universities that are subsidized? Went to UCLA. Cheap.

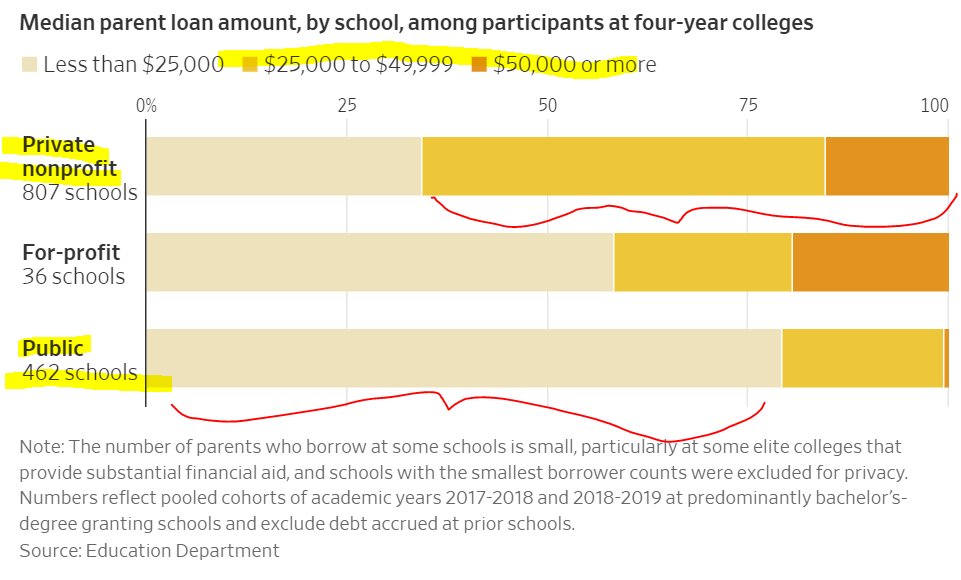

Here are the statistics for different colleges. If you are from a poor family, you should go to public universities or a private one that GIVES YOU A SCHOLARSHIP. Don't attend a 4-yr education w/ 6-figure student loans, either via parents or kids.

Most public schools cheap.

Most public schools cheap.

Why shouldn't u go to a school that makes you take out a 6-figure loan if not a professional degree? Because it means you are funding the school vs the school funds u because u are so bright. Public schools have mandates to help low income people through grants etc.

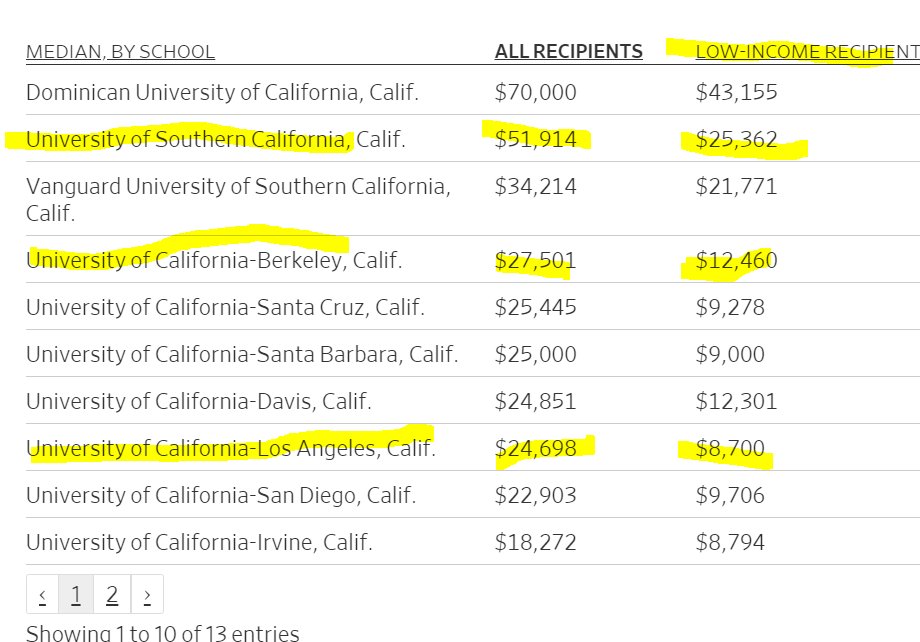

UCs below.

UCs below.

UCLA & Berkeley are consistently top schools in the US but they have pretty low loans on average for low-income and average for in-state people. Compare the loan to USC, comparable school in quality.

If u can't get in, go to states. Cheap. Why pay max price for random colleges?

If u can't get in, go to states. Cheap. Why pay max price for random colleges?

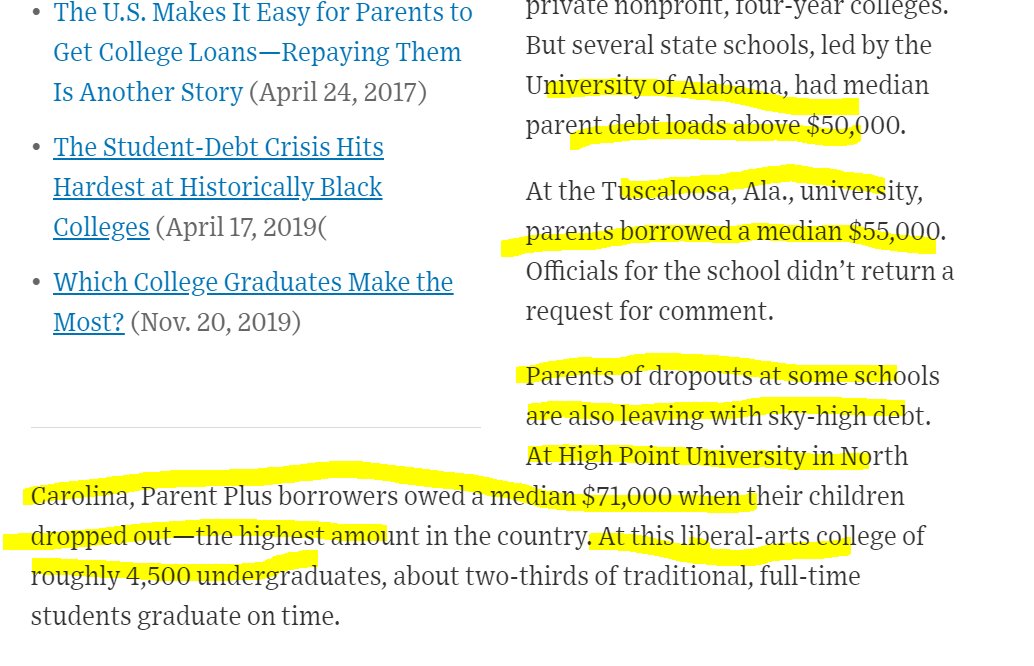

Sad part about the economics of student loans in the US is that it is pretty predatory on the aspirational desire of parents to help kids. Easy to get debt but hard to erase. U can't declare bankruptcy. If ur kids don't have what it takes, should u pay ur way? No. Let life teach.

When children are ill prepared to go to college but PUSHED by aspirational parents or society that tells them that college is all about partying but not training grounds for the labor market, they FAIL & drop out. And guess what? The DEBT STAYS.

Why not community college?

Why not community college?

Many of my best friends, even those from wealthy parents, went to community colleges (practically free) & lived at home for free room and board & then transfer to UCs like Berkeley or UCLA or SD & end up w/ little or no debt. Community colleges are the best thing about the US.

Tuition in the Community College system is $46 per unit, so a student taking a full-time load of 12 credits per semester would have to pay $1,104 if they did not get any aid. At CSU, tuition runs $5,742/yr for CA resident attending full-time. W/ grants, they're practically free!

The US is unique amongst many countries in that it has pathways for people to RE-ENTER the labor force via community college. You can drop out of HS or come from a foreign country & if u do the units & pass, u can transfer to a 4-yr. Why do poor parents not send their kids there?

A state public school tuition in CA is only $7,852 per yr for residents. That's dirt cheap. And guess what? If you are low-income, likely to get grants to make that literally free.

Stop sending your kids to expensive schools that yield negative return. Makes no economic sense.

Stop sending your kids to expensive schools that yield negative return. Makes no economic sense.

Read on Twitter

Read on Twitter