Very important development - new legal proposal in US to ensure that bigtechs moving into banking space are treated with the proper regulatory approach.

Essentially the US moving to slightly adapted e-money/MICA approach for stablecoins. https://twitter.com/rohangrey/status/1334258771204325378

Essentially the US moving to slightly adapted e-money/MICA approach for stablecoins. https://twitter.com/rohangrey/status/1334258771204325378

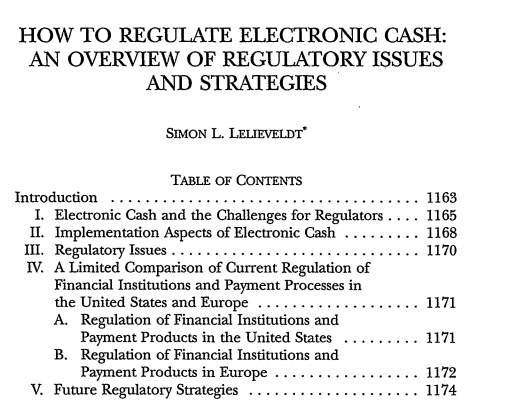

As a background to this news, it might be useful to understand that for a long time the US had all kinds of state payment laws, while Europe did not. See the overview article I wrote in 1997 on regulation of e-cash, or stablecoin as we would call it now.

https://digitalcommons.wcl.american.edu/cgi/viewcontent.cgi?article=1390&context=aulr

https://digitalcommons.wcl.american.edu/cgi/viewcontent.cgi?article=1390&context=aulr

When faced with Internet cash in Europe, we could not use or adapt payment legislative frameworks to capture the new technology. So the EMI/ECB moved to claim that all e-money issuers needed to be banks. This was not met with enthousiasm at the Ministries of Economic Affairs.

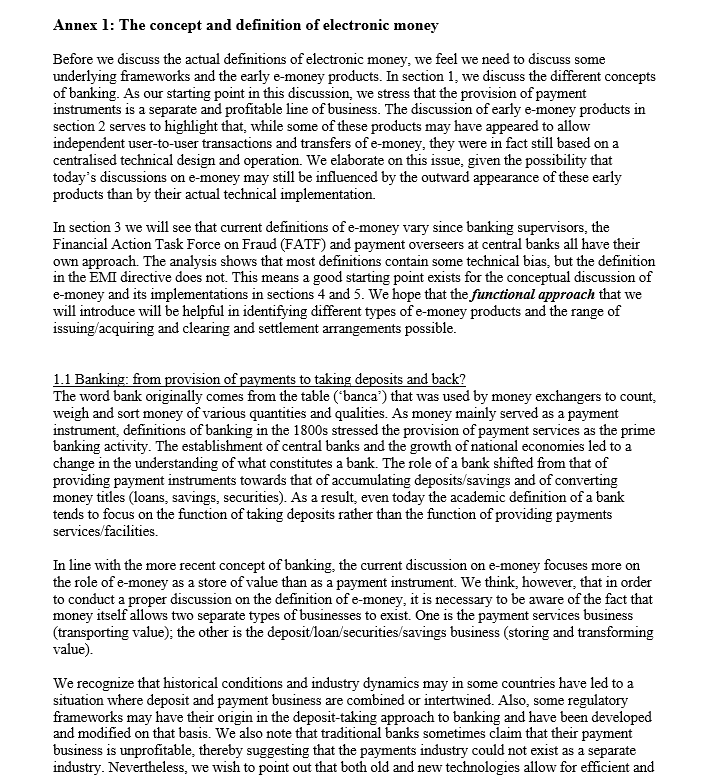

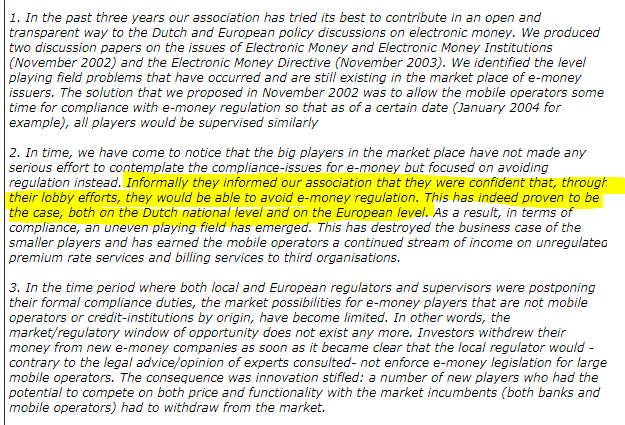

For a broader history as to the emergence of the e-money directive, have a look at this position paper of the now defunct industry association http://11a2.nl in particular Annex 1.

Gives a nice flavour of the time and issues we dealt with.

http://www.11a2.nl/docs/empp1511.doc

Gives a nice flavour of the time and issues we dealt with.

http://www.11a2.nl/docs/empp1511.doc

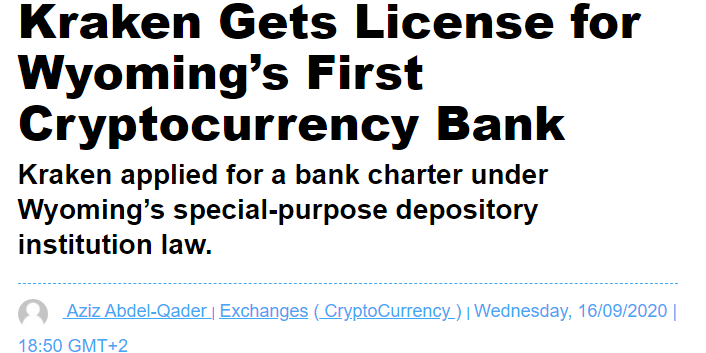

What happened is that the EU struck a deal between Finance/Economics interests to draft a special purpose bank charter for e-money issers, which pretty much resembles the Wyoming special purpose bank law idea, used by Kraken.

https://www.financemagnates.com/cryptocurrency/exchange/kraken-gets-license-for-wyomings-first-cryptocurrency-bank/

https://www.financemagnates.com/cryptocurrency/exchange/kraken-gets-license-for-wyomings-first-cryptocurrency-bank/

The beauty of the early e-money legislation in Europe was that e-money issuers could also hook into the settlement systems of central banks. This was taken out in a later version of the law, when e-money institutions became more a payment service provider-like vehicle.

Although the general impression for scholars was that E-money directive #1 was not succesfull we could also say it was too succesfull. All mobile phone money would also need to be regulated, which prompted a defensive move by them to steer clear. See http://11a2.nl

So the EU Commission narrative was.. well yeah, the first E-money directive didn't really work for the market, but I challenged that opinion. It allowed for Paypal to start as e-money in the EU and move on towards a full banking regime.

http://moneyandpayments.simonl.org/2007/05/paypal-upgrades-from-e-money-issuer-to.html

http://moneyandpayments.simonl.org/2007/05/paypal-upgrades-from-e-money-issuer-to.html

Also, in 2007 we could see Google moving in with an e-money license as they experimented with finding their strategic angle as to integrating payments into their business.

http://moneyandpayments.simonl.org/2007/03/google-moving-in-with-e-money-license.html

http://moneyandpayments.simonl.org/2007/03/google-moving-in-with-e-money-license.html

And when looking at Google's current license structure I would say that they have an Irish license for payment scheme activities and a UK and Lithuanian license for e-money payments.

https://moneyandpayments.simonl.org/2019/01/so-whats-up-with-google-licenses.html

In terms of licenses they are well positioned and experienced now.

https://moneyandpayments.simonl.org/2019/01/so-whats-up-with-google-licenses.html

In terms of licenses they are well positioned and experienced now.

For Facebook the play officially started in 2016 with their e-money license in the EU. My hunch was they were not there to displace banks (due to regulatory burden and image positioning) and would move slowly

https://moneyandpayments.simonl.org/2016/11/facebook-obtained-its-e-money-license.html

https://moneyandpayments.simonl.org/2016/11/facebook-obtained-its-e-money-license.html

Then we saw the Libra/Calibra play in June 2019 and this would clearly not work due to the amateur design (when looking at the relevant EU rules that they were stacking) although in market coverage it was a real threat.

Check the libra/calibra blogseries

https://moneyandpayments.simonl.org/2019/10/perspectives-on-ca-libra-2-on-libra.html

Check the libra/calibra blogseries

https://moneyandpayments.simonl.org/2019/10/perspectives-on-ca-libra-2-on-libra.html

The Libra/Calibra efforts sparked a big backlash and central banks and regulators understood and countered the threat immediately. Legal proposals lead to the MICA-regulation proposal here in the EU, which I like to call the emergency brake for libra.

And in the mean time I noticed Facebook getting a limited network exemption for use of some form of Facebucks inside games..... this struck me as odd.... Facebook - a limited network under EU law ?

https://moneyandpayments.simonl.org/2020/09/facebook-limited-network-exemption-in.html

https://moneyandpayments.simonl.org/2020/09/facebook-limited-network-exemption-in.html

So to do a step back: the broader picture is that banks are being suffocated by hefty regulations on payments, allowing retailers/big tech a move into their payments business while they are tied with hands to the back.

With tokens at the heart.

2014-> https://moneyandpayments.simonl.org/2014/11/where-and-how-to-look-for-innovation-in.html

With tokens at the heart.

2014-> https://moneyandpayments.simonl.org/2014/11/where-and-how-to-look-for-innovation-in.html

Since 2014 we have indeed seen retailers and large big tech moving further ahead in the payment space. With a serious Chinese threat emerging.

https://wup.digital/blog/tech-giants-banking-amazon-in-banking/

https://wup.digital/blog/tech-giants-banking-amazon-in-banking/

I share witnessing the above developments with good friends such as @dgwbirch and @iang (both since the 1990s).

Actually Dave Birch wrote this very clarifying book: Currency Cold war, outlining market/regulatory developments. https://thecurrencycoldwar.com/

Actually Dave Birch wrote this very clarifying book: Currency Cold war, outlining market/regulatory developments. https://thecurrencycoldwar.com/

We are indeed witnessing a war between bigtech and banks on payments. Due to the shortsightedness of the EU Commission, the EU players are disadvantaged as they were forced to open up their systems and need to comply with stark competition rules.

https://moneyandpayments.simonl.org/2018/03/ec-gives-open-banking-to-bigtech-via.html

https://moneyandpayments.simonl.org/2018/03/ec-gives-open-banking-to-bigtech-via.html

In the meantime bigtech players use all kind of exemptions and loopholes (agents clause) of EU regulation to not have to apply consumer protection rules in payments and to hide their acquiring activities in payments as all-in service fees of 30-50%.

But we may have woken up...

But we may have woken up...

Not only is the proposed EU MICA-regulation the emergency brake for significant e-money schemes (aka Facebook and such) but the European Commission clearly seeks to align with the US on harnessing big tech threats.

Digital tax, privacy and breakup talks

https://ec.europa.eu/commission/presscorner/detail/en/ip_20_2279

Digital tax, privacy and breakup talks

https://ec.europa.eu/commission/presscorner/detail/en/ip_20_2279

But the realisation of the bigtech threat and unlevel playing field has also gained traction/attention of the competition regulators.

Take this december-2020 report of the Dutch competition authority as an example: https://www.acm.nl/en/publications/big-tech-and-dutch-payment-market-tightening-rules-needed-maintain-level-playing-field

Take this december-2020 report of the Dutch competition authority as an example: https://www.acm.nl/en/publications/big-tech-and-dutch-payment-market-tightening-rules-needed-maintain-level-playing-field

Which brings us back to square 1; the US draft bill on Stablecoins, seeking to ensure that when it comes to payments, bigtech needs to play according to the same rules...

https://twitter.com/rohangrey/status/1334258771204325378

All arrows clearly point in the same direction.

https://twitter.com/rohangrey/status/1334258771204325378

All arrows clearly point in the same direction.

unroll @threadreaderapp

PS. You start seeing it when you see it... (dutch proverb) https://in.reuters.com/article/tech-antitrust-facebook/u-s-states-plan-to-sue-facebook-next-week-sources-idINKBN28D0I1?il=0

Read on Twitter

Read on Twitter