[THREAD]

Let’s learn about Mr. Market’s latest AI IPO: C3 AI

C3 allows companies to develop, test and run full-scale, real-time enterprise AI applications.

The company’s led by one of the sharpest founders/CEOs in the game, Thomas Siebel.

Let's learn

https://macro-ops.com/c3-ai-mr-markets-latest-ai-ipo/

Let’s learn about Mr. Market’s latest AI IPO: C3 AI

C3 allows companies to develop, test and run full-scale, real-time enterprise AI applications.

The company’s led by one of the sharpest founders/CEOs in the game, Thomas Siebel.

Let's learn

https://macro-ops.com/c3-ai-mr-markets-latest-ai-ipo/

1/ Executive Leadership

C3 is led by Tom Siebel, one of the sharpest founders in this space.

His resume includes:

- Helping Oracle reach $1B in revenues

- Starting Siebel Systems which did $2B in revs in 6 years

Here's Siebel's reasons for starting C3 (hint, not about $)

C3 is led by Tom Siebel, one of the sharpest founders in this space.

His resume includes:

- Helping Oracle reach $1B in revenues

- Starting Siebel Systems which did $2B in revs in 6 years

Here's Siebel's reasons for starting C3 (hint, not about $)

2/ Culture Matters

C3 has one of the best Glassdoor ratings/reviews I've seen:

- 89% approve of CEO

- 92% would recommend co. to friends

- 4.6/5 stars w/ 338 reviews

Employees rave about three things:

- Meaningful work

- Tough challenges

- Great incentives (paid learning)

C3 has one of the best Glassdoor ratings/reviews I've seen:

- 89% approve of CEO

- 92% would recommend co. to friends

- 4.6/5 stars w/ 338 reviews

Employees rave about three things:

- Meaningful work

- Tough challenges

- Great incentives (paid learning)

3/ The Bull Thesis From a C3 Employee

I can’t write a C3 thread without mentioning this review from a current employee.

It’s one of the best bull pitches I’ve seen for the company.

When your employees know the thesis, you got something!

TL;DR: Make sure you provide value!

I can’t write a C3 thread without mentioning this review from a current employee.

It’s one of the best bull pitches I’ve seen for the company.

When your employees know the thesis, you got something!

TL;DR: Make sure you provide value!

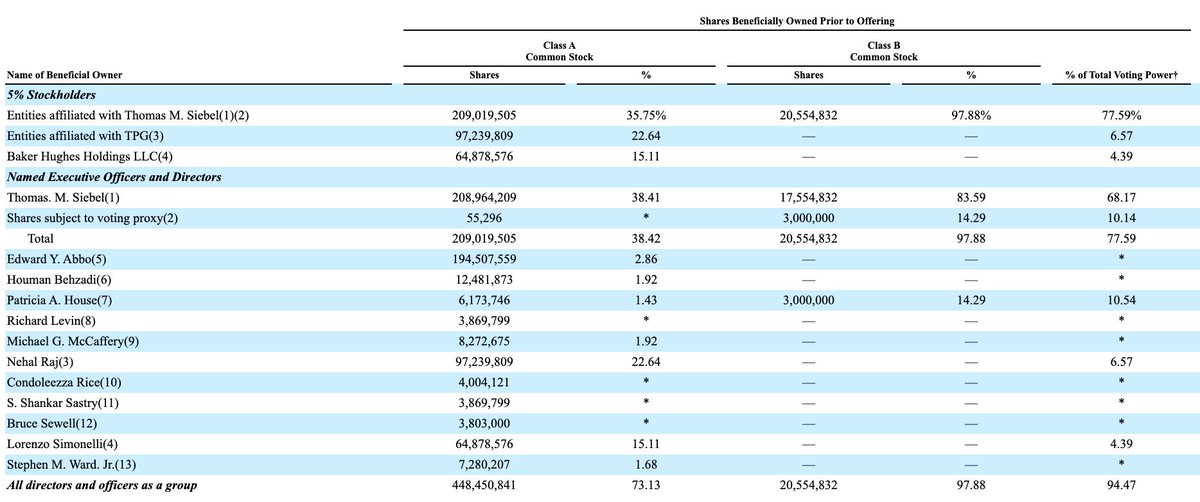

4/ Compensation & Skin In The Game

Siebel took a $5,700 salary in 2020 w/ $10M in options awards

He owns 38% of C3 and controls 78% of the voting power.

Together, management owns ~70% of the company.

Interests are aligned.

Siebel took a $5,700 salary in 2020 w/ $10M in options awards

He owns 38% of C3 and controls 78% of the voting power.

Together, management owns ~70% of the company.

Interests are aligned.

5/ C3’s Products: AI Suite Platform

C3 AI Suite is the only end-t2-end Platform (PaaS) designed to develop, test, and deploy enterprise AI applications at scale.

The Suite allows developers to create and customize their own applications using C3’s conceptual models.

C3 AI Suite is the only end-t2-end Platform (PaaS) designed to develop, test, and deploy enterprise AI applications at scale.

The Suite allows developers to create and customize their own applications using C3’s conceptual models.

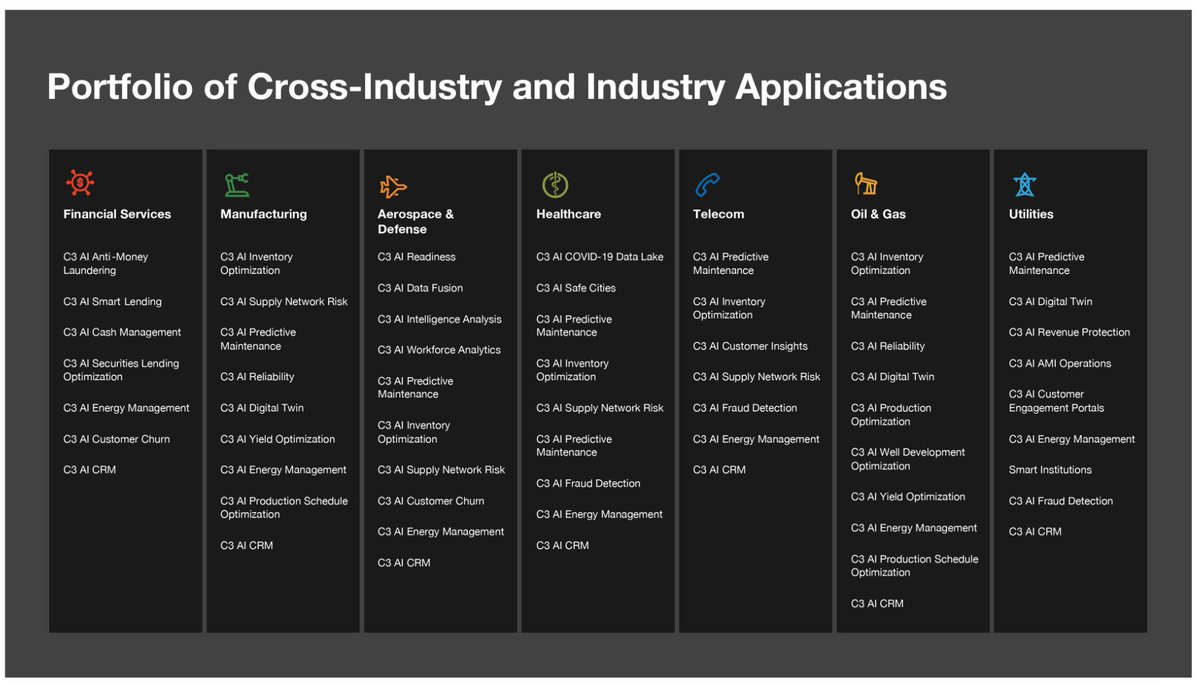

6/ C3’s AI Apps

C3 develops specific apps for its AI Suite Platform (like apps on an app store).

These apps are both cross-industry and industry-specific.

Customers use C3’s applications to develop and launch AI-based models and tests.

Think of apps as pre-built AI models.

C3 develops specific apps for its AI Suite Platform (like apps on an app store).

These apps are both cross-industry and industry-specific.

Customers use C3’s applications to develop and launch AI-based models and tests.

Think of apps as pre-built AI models.

7/ How C3 Makes Money

C3 charges a subscription fee for their platform and a monthly usage fee for run-time on apps/cloud storage (per CPU-hour consumption).

87% of their revs are recurring/contractual and average 3yrs per contract

14% of their revenue comes from pro. service

C3 charges a subscription fee for their platform and a monthly usage fee for run-time on apps/cloud storage (per CPU-hour consumption).

87% of their revs are recurring/contractual and average 3yrs per contract

14% of their revenue comes from pro. service

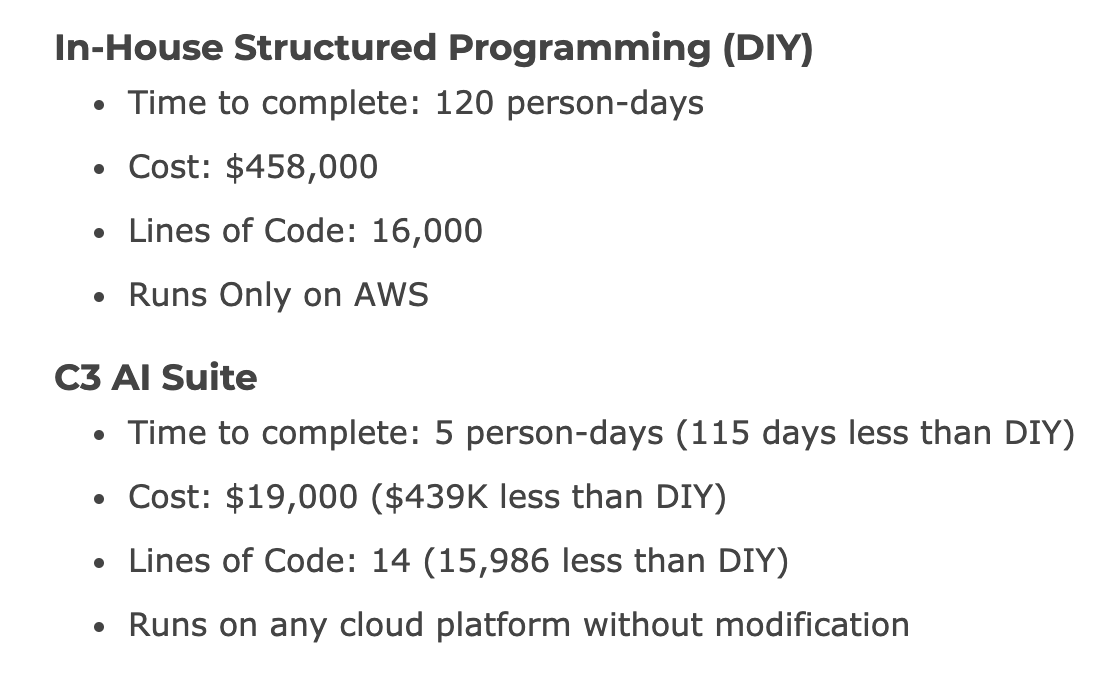

8/ How C3 Differentiates

There’s two major advantages using C3 vs. alternatives:

- Operability on any cloud platform on/off premise

- Massive time/money savings

In one example, C3 saved over $400K and wrote 15K< lines of code than competitor …

There’s two major advantages using C3 vs. alternatives:

- Operability on any cloud platform on/off premise

- Massive time/money savings

In one example, C3 saved over $400K and wrote 15K< lines of code than competitor …

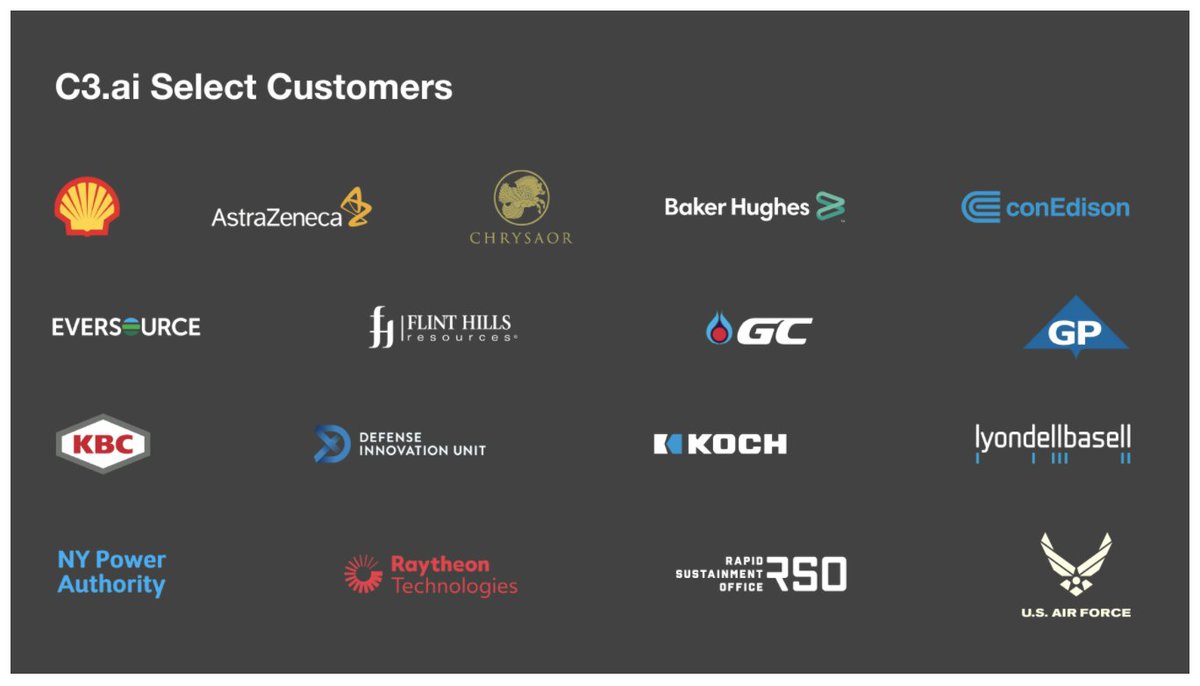

9/ C3’s Go-To-Market Strategy

C3’s go-to-market strategy is simple:

- Make best and biggest companies your customer

- Do great work

- Use them as an example to gain market share down the funnel

This helps C3 naturally bleed to lower-end markets + validates their product

C3’s go-to-market strategy is simple:

- Make best and biggest companies your customer

- Do great work

- Use them as an example to gain market share down the funnel

This helps C3 naturally bleed to lower-end markets + validates their product

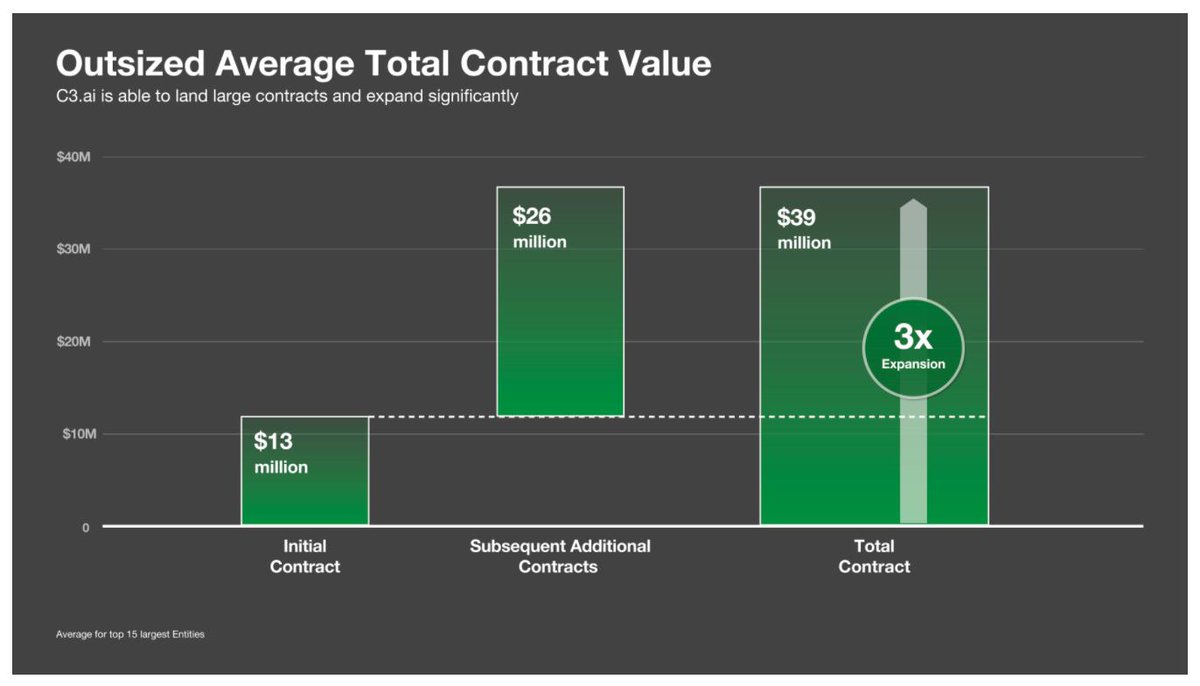

10/ Land & Expand Revenue Model

C3 customers spend 3x their initial contract value after joining.

That’s a great sign.

It means customers see the value and increase how much they use it in their org.

This translates to higher recurring revenues and strong cash-generation.

C3 customers spend 3x their initial contract value after joining.

That’s a great sign.

It means customers see the value and increase how much they use it in their org.

This translates to higher recurring revenues and strong cash-generation.

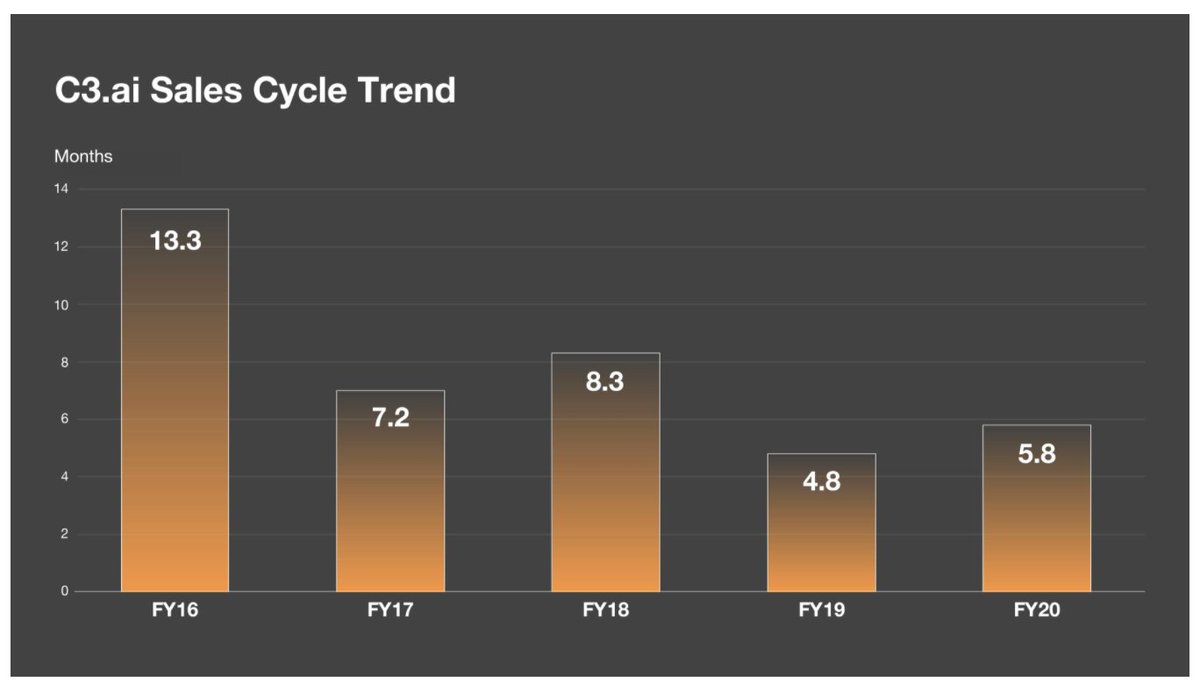

11/ Decreasing Sales Cycles

Another engine in C3s rev growth is their decreased sales cycle:

- 13 months in 2017 to 4.8 months in 2020

This makes sense as more companies see the value in AI and are quick to adopt C3’s tech and C3 captures smaller markets

Another engine in C3s rev growth is their decreased sales cycle:

- 13 months in 2017 to 4.8 months in 2020

This makes sense as more companies see the value in AI and are quick to adopt C3’s tech and C3 captures smaller markets

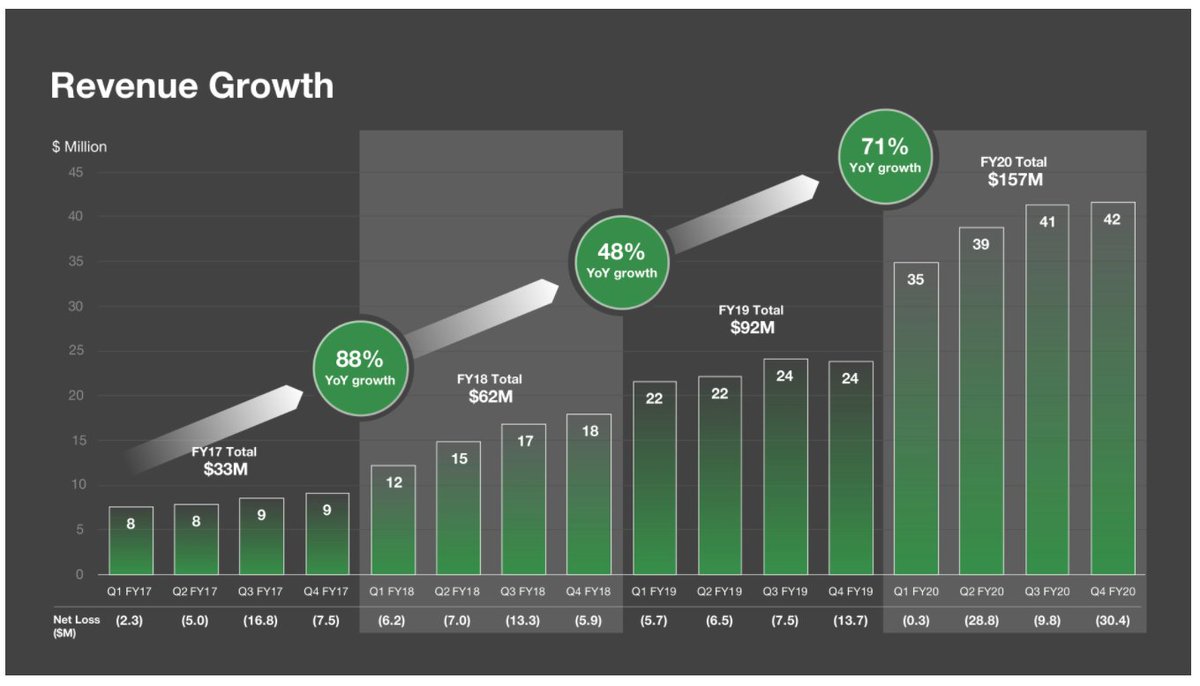

12/ Rapid Revenue Growth

C3’s grown revenues from $33M in ‘17 to $157M in ‘20.

The company’s growth plan includes:

- Capturing more SMB customers

- Adding new AI Suite applications/products

- increasing use-cases with existing customers

That's some @saxena_puru growth here!

C3’s grown revenues from $33M in ‘17 to $157M in ‘20.

The company’s growth plan includes:

- Capturing more SMB customers

- Adding new AI Suite applications/products

- increasing use-cases with existing customers

That's some @saxena_puru growth here!

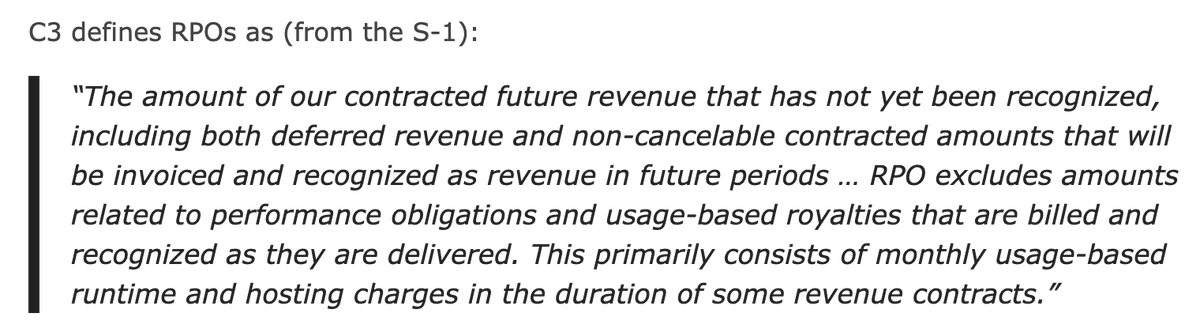

13/ How To Gauge C3’s Performance

The best way to think about C3s performance is through “Remaining Performance Obligations”, or RPOs.

RPO shows how much outstanding revenue C3 has to collect from deferred / non-cancelable contracts.

As of Oct. 2020 C3 had $267M in RPOs

The best way to think about C3s performance is through “Remaining Performance Obligations”, or RPOs.

RPO shows how much outstanding revenue C3 has to collect from deferred / non-cancelable contracts.

As of Oct. 2020 C3 had $267M in RPOs

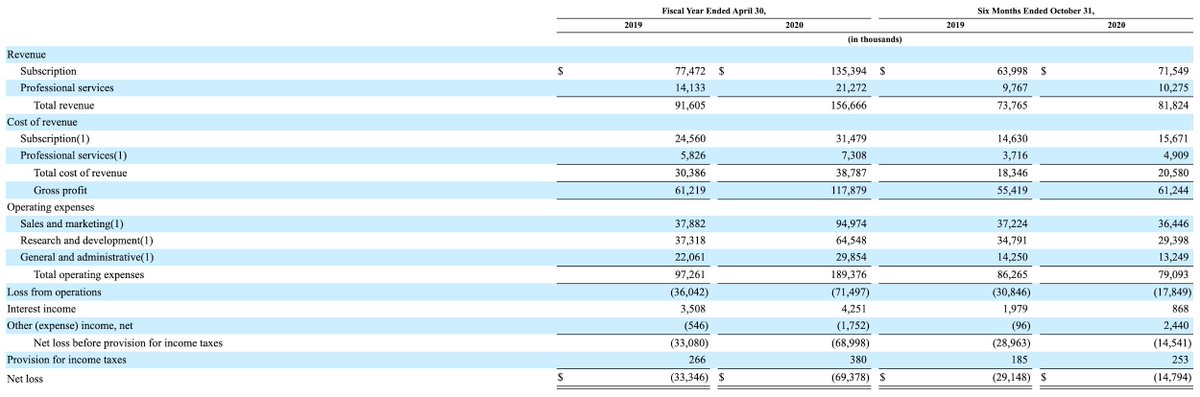

14/ C3 Financials

C3 had -$70M OI on $157M in revenues

This makes sense as they spent 60% of revs on sales & marketing. Then another 40% on R&D.

These % should decline over time, showing operating leverage.

They also have $114M in cash vs. $121M in liabilities on BS.

C3 had -$70M OI on $157M in revenues

This makes sense as they spent 60% of revs on sales & marketing. Then another 40% on R&D.

These % should decline over time, showing operating leverage.

They also have $114M in cash vs. $121M in liabilities on BS.

15/ IPO Potential Pricing

C3s offering 15.5M shares at $31-$34/share. That brings total shares to ~97.4M.

At $31-$34/share you’re looking at an estimated market cap of $3B – $3.3B and ~$2.9B EV ($109M net cash).

Or 19x sales … Welcome to 2020

But let's think 5-10 years out.

C3s offering 15.5M shares at $31-$34/share. That brings total shares to ~97.4M.

At $31-$34/share you’re looking at an estimated market cap of $3B – $3.3B and ~$2.9B EV ($109M net cash).

Or 19x sales … Welcome to 2020

But let's think 5-10 years out.

16/ What Does C3 Look Like In 2025?

The company’s grown revenues at a 94% CAGR since 2017.

If we assume the company grows revenue at a 50% CAGR for the next five years we get $1.4B in revenues by 2025.

Will it get there? Who knows.

The company’s grown revenues at a 94% CAGR since 2017.

If we assume the company grows revenue at a 50% CAGR for the next five years we get $1.4B in revenues by 2025.

Will it get there? Who knows.

17/ Thinking About Valuation

At $1.4B that’s ~2.15x EV/Sales for the following:

- Fast-growing

- First-mover

- High switching cost business

- Led by one of the sharpest founders in the game.

Given some SaaS valuation, a 5-7x multiple on sales seems cheap. Yet thats $7-$10B

At $1.4B that’s ~2.15x EV/Sales for the following:

- Fast-growing

- First-mover

- High switching cost business

- Led by one of the sharpest founders in the game.

Given some SaaS valuation, a 5-7x multiple on sales seems cheap. Yet thats $7-$10B

18/ Risks

There’s a few main risks:

- Execution risk from Siebel (voting power)

- Customer concentration (should reduce over time)

- No brand recognition (vs. AMZN or MSFT offerings)

- CIOs developing in-house versions of platform (more expensive/time consuming)

There’s a few main risks:

- Execution risk from Siebel (voting power)

- Customer concentration (should reduce over time)

- No brand recognition (vs. AMZN or MSFT offerings)

- CIOs developing in-house versions of platform (more expensive/time consuming)

19/ Concluding Thoughts

C3 has everything we want in a high conviction bet:

- A+ Founder/CEO with ample skin in the game

- Fantastic culture

- Dedicated Employees

- High switching cost product

- Pick-and-shovel business for a massive digital transformation

Thanks for reading!

C3 has everything we want in a high conviction bet:

- A+ Founder/CEO with ample skin in the game

- Fantastic culture

- Dedicated Employees

- High switching cost product

- Pick-and-shovel business for a massive digital transformation

Thanks for reading!

20/ While you're at it, give @TomSiebel a follow and let him know I want to get him on my podcast :)

Read on Twitter

Read on Twitter![[THREAD]Let’s learn about Mr. Market’s latest AI IPO: C3 AIC3 allows companies to develop, test and run full-scale, real-time enterprise AI applications.The company’s led by one of the sharpest founders/CEOs in the game, Thomas Siebel.Let's learn https://macro-ops.com/c3-ai-mr-markets-latest-ai-ipo/ [THREAD]Let’s learn about Mr. Market’s latest AI IPO: C3 AIC3 allows companies to develop, test and run full-scale, real-time enterprise AI applications.The company’s led by one of the sharpest founders/CEOs in the game, Thomas Siebel.Let's learn https://macro-ops.com/c3-ai-mr-markets-latest-ai-ipo/](https://pbs.twimg.com/media/EoP9FghW8AE-Wcd.png)