The earliest point in which the average Ethereum user will interact with ETH 2.0 is at least a year away.

So what's Ethereum's near term outlook?

So what's Ethereum's near term outlook?

The below is just a taste of what's in our ETH 2.0 report.

Get the full enchilada here: http://bit.ly/3qiLkgF

Look for insights from eth2 infrastructure provider @BisonTrails!

Get the full enchilada here: http://bit.ly/3qiLkgF

Look for insights from eth2 infrastructure provider @BisonTrails!

The launch of the Beacon Chain only signals the beginning of a multi-year journey towards scalability. Phase 0 is for staking and little else and at present, the Beacon Chain’s functionality is practically non-existent.

With basic transaction functionality 1-2 years away, ETH 2.0 can’t be a near term scaling solution for the current network.

This puts Ethereum in a precarious position following this summer’s DeFi bull market where network congestion created an unpredictable and oftentimes unforgiving fee market for users and developers.

Meanwhile, nearly every high profile Ethereum competitor has launched or will launch by the end of 2020. The gap between now and a user ready stage of ETH 2.0 leaves an opportunity for other low-fee, low-latency competitors to eat into Ethereum’s monopoly

Most new Layer-1s, whether it be @cosmos, @Polkadot, or @solana, have built their platforms partially based on the premise that developers and new retail users will grow tired of Ethereum’s unrelentingly high costs. Their strategy is not wrong.

Those snake-bitten by rising fees will inevitably explore alternative platforms with better transaction throughput and lower fees if they haven’t already.

It’s easy to write off these new networks, as they are miles behind Ethereum in terms of developer firepower, financial middleware, and tradable tokens. But the competition is just getting started.

Several networks are nearing completion on bridges to Ethereum that will allow value on Ethereum to interoperate with applications on competing chains:

+ @NEARProtocol's Rainbow Bridge

+ @cosmos' Peggy

+ @solana's Wormhole

+ @NEARProtocol's Rainbow Bridge

+ @cosmos' Peggy

+ @solana's Wormhole

Others are building chains compatible with Ethereum’s virtual machine (EVM) that will offer familiar environments for Ethereum developers with minimal switching costs:

+ @avalancheavax's Athereum

+ @Polkadot’s Moonbeam

+ @avalancheavax's Athereum

+ @Polkadot’s Moonbeam

In the near term, however, Layer-1’s aren’t competing with Ethereum 2.0. They’re in a much tighter race against viable Layer-2 solutions on Ethereum’s existing PoW chain. In particular, a solution known as “rollups”.

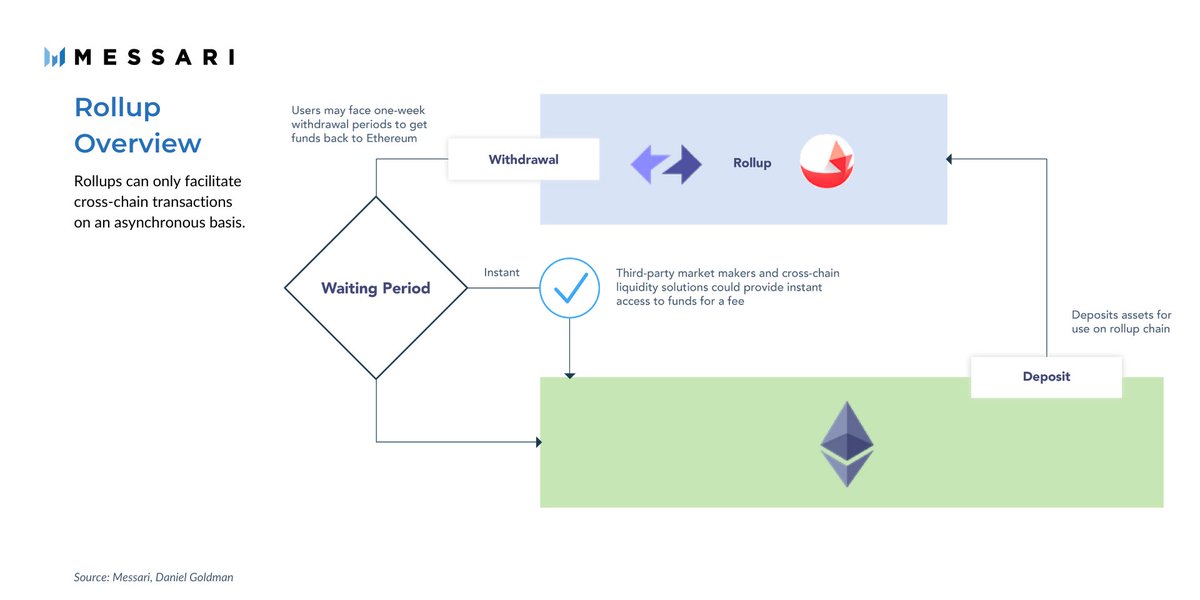

In general, layer-2 scaling solutions facilitate transactions through off-chain means before bundling and submitting them as a single transaction to the base layer.

Layer-2 solutions can significantly improve the number of transactions a Layer-1 can process without bogging down the underlying network with excess data and computing requests.

Rollups have quickly become the go-to scaling solution for Ethereum’s PoW chain due to their ability to run smart contracts off-chain. Rollups are essentially new blockchains that process transactions independently of Ethereum before settling batch transactions to the main chain

While rollups are still a few months away from being production-ready, there’s already a burgeoning ecosystem forming around various rollup flavors.

These include:

+ @optimismPBC's Optimistic Ethereum

+ @the_matter_labs’ zkSync

+ @OffchainLabs’ Arbitrum

+ @optimismPBC's Optimistic Ethereum

+ @the_matter_labs’ zkSync

+ @OffchainLabs’ Arbitrum

DeFi darling @synthetix_io has already deployed the first application on Optimism’s public testnet, and some suspect @UniswapProtocol will follow suit.

Combined with PoS and sharding, roll-ups would allow Ethereum to support a theoretical max of ~100,000 transactions per second, or a ~10,000x improvement over the current network capacity.

It could also negate the need for the final phase of Ethereum 2.0, allowing Ethereum to reach its desired scalability by the end of 2022.

It is likely that big name DeFi apps won’t stray too far from Ethereum and will end up on some version of a rollup, if they move from the base layer at all.

While Ethereum competitors will offer similar technical advantages, Ethereum’s strong community will continue to serve as its biggest moat.

There’s still ample opportunity outside of Ethereum, and new Layer-1s can stand out by targeting niche sectors (like Flow and gaming) and bringing radically different designs to the table (like the unparalleled flexibility afforded on Polkadot and Cosmos).

As for which approach will prevail, only time will tell. But if rollups pan out, Ethereum should be able to maintain its virtual monopoly on DeFi applications while ETH 2.0 remains in its incubation stage.

Read on Twitter

Read on Twitter