In light of @API3DAO's ongoing token distribution on @mesa_eth , I want to share my thoughts on why I think the project has serious potential in the oracle space

Actually, “oracle” might not even be the right word here as API3 doesn’t rly see itself as an oracle provider..

Actually, “oracle” might not even be the right word here as API3 doesn’t rly see itself as an oracle provider..

1/ What's an oracle?

Simply put, an oracle is a piece of software that takes information which lives outside of the blockchain and delivers it onto the blockchain

Effectively acting as a bridge between off-chain and on-chain worlds

Simply put, an oracle is a piece of software that takes information which lives outside of the blockchain and delivers it onto the blockchain

Effectively acting as a bridge between off-chain and on-chain worlds

2/ *First party oracles vs. Third party oracles*

First party oracles are operated by the owners/API providers themselves

For a price feed that could e.g be @kraken or @coinbase running an oracle on-chain

First party oracles are operated by the owners/API providers themselves

For a price feed that could e.g be @kraken or @coinbase running an oracle on-chain

3/ Third party oracles on the other hand, are operated by middlemen..

who get the data from one or multiple API providers and run a node to deliver that data on-chain

This can e.g be a @chainlink node

who get the data from one or multiple API providers and run a node to deliver that data on-chain

This can e.g be a @chainlink node

4/ Although, API providers could also operate third-party oracles THEMSELVES the reality is that:

- they’re not familiar with crypto tech

- maintenance of these oracles is resource-expensive

- they don’t want to deal with cryptocurrency payments ( gas costs in $ETH, API fees)

- they’re not familiar with crypto tech

- maintenance of these oracles is resource-expensive

- they don’t want to deal with cryptocurrency payments ( gas costs in $ETH, API fees)

5/ Oracles are crucial for DeFi to reach mass adoption.

It’s enough for a hacker to manipulate a price feed by a few percentages to exploit an entire protocol and get away with millions of dollars.

$24m dollars were stolen this way in Harvest https://twitter.com/harvest_finance/status/1320586738675388416?s=20

It’s enough for a hacker to manipulate a price feed by a few percentages to exploit an entire protocol and get away with millions of dollars.

$24m dollars were stolen this way in Harvest https://twitter.com/harvest_finance/status/1320586738675388416?s=20

6/ When a dev uses a price feed from a 3rd party oracle, the feed typically aggregates responses from multiple nodes

The price they each individually report is then averaged and normalized to clean the data

It’s easy to spot that this type of oracle design has several flaws

The price they each individually report is then averaged and normalized to clean the data

It’s easy to spot that this type of oracle design has several flaws

7/ Flaws:

1) Majority of nodes can collude to manipulate responses

2) One “identity” can create several nodes (a.k.a Sybil attack)

3) A central governing party decides which nodes “contribute” to a price feed (a.k.a curation)

1) Majority of nodes can collude to manipulate responses

2) One “identity” can create several nodes (a.k.a Sybil attack)

3) A central governing party decides which nodes “contribute” to a price feed (a.k.a curation)

8/

4) High costs: To incentivize nodes to act *honestly* they must be paid substantial fees ( essentially a tax on top of API fees )

5) Lack of transparency: devs don’t know what data goes into third-party oracles

4) High costs: To incentivize nodes to act *honestly* they must be paid substantial fees ( essentially a tax on top of API fees )

5) Lack of transparency: devs don’t know what data goes into third-party oracles

9/ To tackle these problems, API3 introduces Airnode, a node specially designed for first-party oracles.

Airnode essentially allows API providers to deploy an API gateway to Blockchains using their existing cloud infrastructure using only a few commands. https://twitter.com/API3DAO/status/1331905770343067648?s=20

Airnode essentially allows API providers to deploy an API gateway to Blockchains using their existing cloud infrastructure using only a few commands. https://twitter.com/API3DAO/status/1331905770343067648?s=20

11/ This last part is crucial

While in theory, API providers could also run third party oracles themselves, the hassle and maintenance required make it impractical in practice.

While in theory, API providers could also run third party oracles themselves, the hassle and maintenance required make it impractical in practice.

12/ The airnode integrates seamlessly with multiple of the existing cloud infrastructures that API providers are familiar with and are already maintaining.

They also have an incentive to deploy an airnode as it unlocks new revenue streams without costing them much effort.

They also have an incentive to deploy an airnode as it unlocks new revenue streams without costing them much effort.

13/ The fact that nodes are run by companies with an EXISTING API business

AND real-world reputation makes them more trustworthy than third-party oracles

Because they have their off-chain reputations at stake!

AND real-world reputation makes them more trustworthy than third-party oracles

Because they have their off-chain reputations at stake!

14/ Moreover, it removes the need for a lot of computational *clutter* that only exists in third-party oracle systems to prevent collusion etc.

Hence, API3 oracles are much less expensive in terms of gas and can be called more frequently, making dApps more robust

Hence, API3 oracles are much less expensive in terms of gas and can be called more frequently, making dApps more robust

15/ Besides, unlike third-party oracles, API providers have a financial incentive to deliver high quality data as they can monetize it directly.

The same way they monetize their APIs off-chain.

The same way they monetize their APIs off-chain.

16/ Third party oracles have an incentive to deliver cheap, freemium data as there’s no real transparency around which data they’re using.

But.. data source & quality matter

But.. data source & quality matter

17/ Price data is a good example: different providers do different things (e.g. query different sets of exchanges, filter for volume inflation, etc)

A particularly inspiring example is @CoinMarketCap's volume inflation detection algorithm. https://blog.coinmarketcap.com/2020/05/13/ongoing-improvements-to-combat-volume-inflation/

A particularly inspiring example is @CoinMarketCap's volume inflation detection algorithm. https://blog.coinmarketcap.com/2020/05/13/ongoing-improvements-to-combat-volume-inflation/

18/ *API3 DAO*

The API3 DAO aims to decentralize the protocol from the outset

Without compromising on the agility and development speed that a centralized governance structure brings to the table. https://medium.com/api3/on-daos-decentralized-autonomous-organizations-84c00abb89bc

The API3 DAO aims to decentralize the protocol from the outset

Without compromising on the agility and development speed that a centralized governance structure brings to the table. https://medium.com/api3/on-daos-decentralized-autonomous-organizations-84c00abb89bc

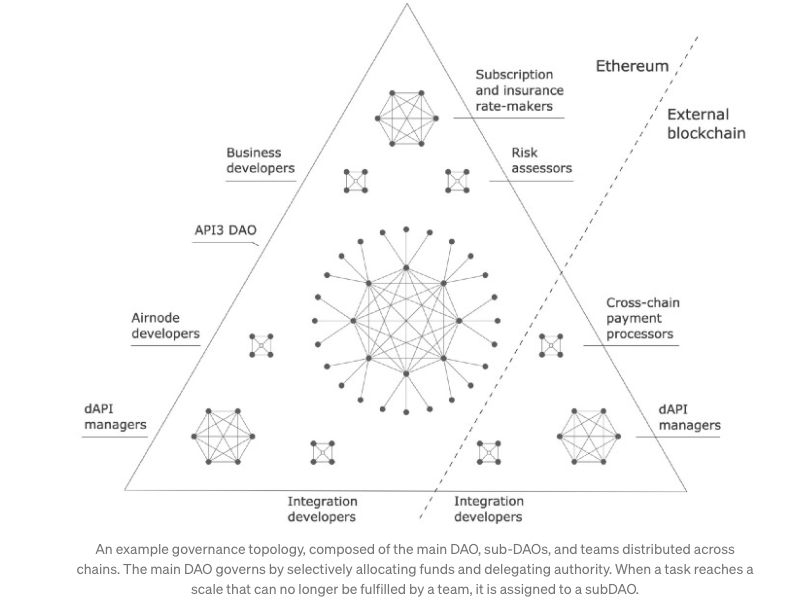

19/ The scope of the main DAO is narrowly defined (mainly handing out grants & setting important protocol parameters)

More mundane tasks are passed on to specialized sub-DAOs.

More mundane tasks are passed on to specialized sub-DAOs.

20/ With the API3 DAO, the construction of new data feeds becomes an entirely open process.

Each new data feed implementation is preceded with a proposal.

The DAO then crowdsources and assigns expert teams to assess API providers (and their accuracy, trustworthiness, etc).

Each new data feed implementation is preceded with a proposal.

The DAO then crowdsources and assigns expert teams to assess API providers (and their accuracy, trustworthiness, etc).

21/ This removes a large point of failure present in oracle systems..

where a SINGLE centralized governing body can simply switch data sources in and out.

where a SINGLE centralized governing body can simply switch data sources in and out.

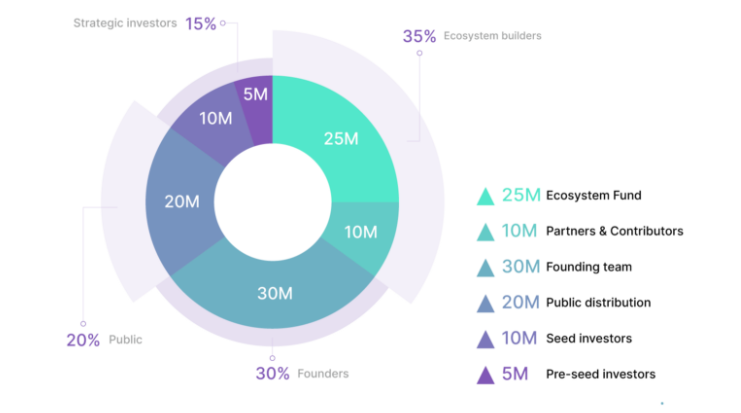

22/ *API 3 TOKENOMICS*

Total Supply: 100M

Founder, partners % investor’s allocation is vesting over 2 years (some with 6-month cliff)

This means at launch there is only the 20m supply from the public sale

This means at launch there is only the 20m supply from the public sale

Total Supply: 100M

Founder, partners % investor’s allocation is vesting over 2 years (some with 6-month cliff)

This means at launch there is only the 20m supply from the public sale

This means at launch there is only the 20m supply from the public sale

23/ To earn additional API tokens, users need to stake in the API3 pool.

The pool acts as an insurance in case of an airnode malfunction:

DApp developers have confidence in the protocol

DApp developers have confidence in the protocol

API3 holders have an incentive to apply stringent quality checks on the providers.

API3 holders have an incentive to apply stringent quality checks on the providers.

The pool acts as an insurance in case of an airnode malfunction:

DApp developers have confidence in the protocol

DApp developers have confidence in the protocol API3 holders have an incentive to apply stringent quality checks on the providers.

API3 holders have an incentive to apply stringent quality checks on the providers.

24/ The insurance fund gives a quantitative measure - a lower bound - on the amount a dAPI can safely secure and thus how much a user can trust it.

Arbitration of these error cases is conducted by @Kleros_io, an on-chain dispute resolution protocol https://bit.ly/2JzNzLO

Arbitration of these error cases is conducted by @Kleros_io, an on-chain dispute resolution protocol https://bit.ly/2JzNzLO

25/ In addition, the protocol burns the income it receives in form of API3 tokens

This ensures a smooth distribution to stakeholders instead of having revenue distribution events every month or quarter, causing price instability.

This ensures a smooth distribution to stakeholders instead of having revenue distribution events every month or quarter, causing price instability.

26/ As revenue kicks in and price goes up, the DAO can reduce inflationary rewards while keeping the total staked amount at the desired level.

All in all it’s a super interesting project that brings a lot of fresh ideas to the table.

All in all it’s a super interesting project that brings a lot of fresh ideas to the table.

27/ The core team behind has a lot of experience in the oracle space.

In fact, they were running major Chainlink nodes before they got the idea to launch API3.

The investors behind ( @placeholder, @DCGco et. al ) are top-notch and their network should help fast-track adoption.

In fact, they were running major Chainlink nodes before they got the idea to launch API3.

The investors behind ( @placeholder, @DCGco et. al ) are top-notch and their network should help fast-track adoption.

28/ Disclosure:

I am helping the team with Marketing & Comms and bought a small amount of tokens during the distribution event

I hope the thread helps to understand the project

I am helping the team with Marketing & Comms and bought a small amount of tokens during the distribution event

I hope the thread helps to understand the project

Read on Twitter

Read on Twitter