1/ Over the last year and a half, I’ve earned ~1.2BTC with various yield generating services to earn an average of 5% on 30 BTC.

Here is my journey and how to guide

Here is my journey and how to guide

2/ Earning a yield enables you to stack more sats (what I’m doing), or reduce the temptation to sell your coin through earning an income.

The yield you earn comes with RISK!

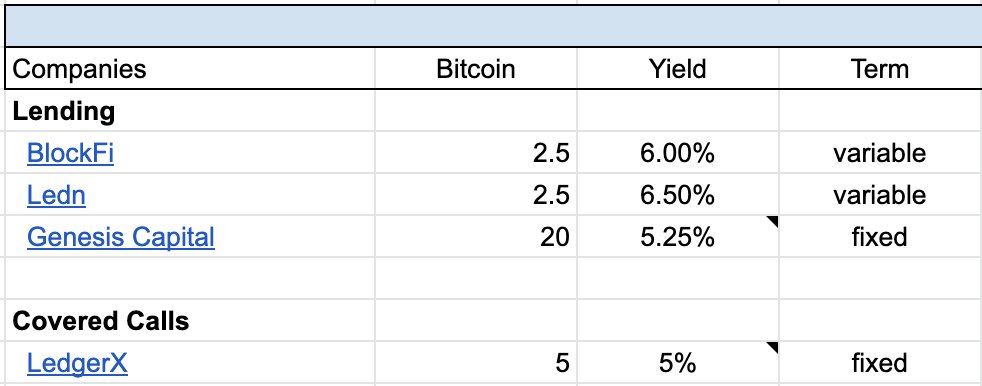

Below is my current allocation for November (I’ll be updating every month)

https://docs.google.com/spreadsheets/d/1ZoapTCl76wahFMeNISSx9UdC3QBx-zC_jY4Le1H5Sdg/edit?usp=sharing

The yield you earn comes with RISK!

Below is my current allocation for November (I’ll be updating every month)

https://docs.google.com/spreadsheets/d/1ZoapTCl76wahFMeNISSx9UdC3QBx-zC_jY4Le1H5Sdg/edit?usp=sharing

3/ Here are the ways you can earn yield:

Lending (Easiest/most popular)

Yield: 3-6%

- Ledn: https://rb.gy/3nfhvx

- BlockFi: https://rb.gy/4wzpri

Covered calls (Harder)

Yield: 1-80%

- Deribit: https://rb.gy/zbkrlu

- LedgerX: https://rb.gy/b6dl1n

Lending (Easiest/most popular)

Yield: 3-6%

- Ledn: https://rb.gy/3nfhvx

- BlockFi: https://rb.gy/4wzpri

Covered calls (Harder)

Yield: 1-80%

- Deribit: https://rb.gy/zbkrlu

- LedgerX: https://rb.gy/b6dl1n

4/ When I first started, I had 10 BTC in BlockFi.

BlockFi is a lending/borrowing platform where you can lend your Bitcoin out for ~6% interest. Much of this borrow is going to the GBTC arb trade, shorting, or the futures “cash and carry trade.” (for all lending platforms)

BlockFi is a lending/borrowing platform where you can lend your Bitcoin out for ~6% interest. Much of this borrow is going to the GBTC arb trade, shorting, or the futures “cash and carry trade.” (for all lending platforms)

5/ Risk assessment: When you lend your coins to Ledn, BlockFi, etc. you have to trust that they’ve evaluated counter party risk properly, which includes:

- Financials of borrower

- Collateral requirements (typically 30-110%)

- Trading strategy

- Financials of borrower

- Collateral requirements (typically 30-110%)

- Trading strategy

6/ As everyone knows, March was an insanely volatile month. Here’s how they operated through the volatility:

- Deposits, withdrawals, trades, etc. all processed normally (1-2 business days)

- “zero losses in the lending book”

- All of the products had near 100% uptime

- Deposits, withdrawals, trades, etc. all processed normally (1-2 business days)

- “zero losses in the lending book”

- All of the products had near 100% uptime

7/ Note: there may be no benefits to diversification as you do not know the counter party overlap between lenders (ex: BlockFi and Genesis).

8/ Note: I am not a fan of lending/borrowing services that have a token. There is no reason why you need a token as it introduces regulatory and structural risk.

Case in point: Cred blew up earlier this year.

https://cointelegraph.com/news/cred-customers-demand-answers-after-platform-files-for-bankruptcy

Case in point: Cred blew up earlier this year.

https://cointelegraph.com/news/cred-customers-demand-answers-after-platform-files-for-bankruptcy

9/ There are other ways to earn interest through lending, which include lending coins to exchange margin pools:

- Bitfinex: https://rb.gy/rdgbb4

What is beneficial about this method is you understand your counter party risk.

- Bitfinex: https://rb.gy/rdgbb4

What is beneficial about this method is you understand your counter party risk.

10/ Lending is by far the easiest way for a regular trader to earn yield and at size if you’ve got more coin (ex: call strategies suffer from poor liquidity).

Next I’ll dig into covered calls

Next I’ll dig into covered calls

11/ What are “covered calls?”

It’s an option trade which has the owner of the underlying asset (“covered”) sell their upside above a certain price (“strike”) in exchange for a payment (“premium”)

The more likely that event occurring, the higher the premium (very simplified)

It’s an option trade which has the owner of the underlying asset (“covered”) sell their upside above a certain price (“strike”) in exchange for a payment (“premium”)

The more likely that event occurring, the higher the premium (very simplified)

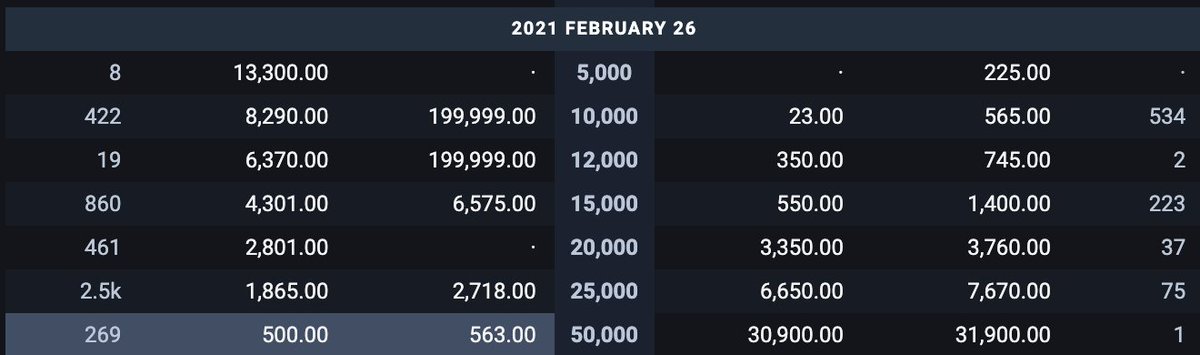

12/ So how does that look with some real numbers? (Pulled 12/1)

2/26/21 $50k strike = $500 premium (10% annualized) 2/26/21 $20k strike = $2,800 premium (60% annualized) Annualized is a bit of misnomer as you don’t know what the yield will be the next time you sell calls

2/26/21 $50k strike = $500 premium (10% annualized) 2/26/21 $20k strike = $2,800 premium (60% annualized) Annualized is a bit of misnomer as you don’t know what the yield will be the next time you sell calls

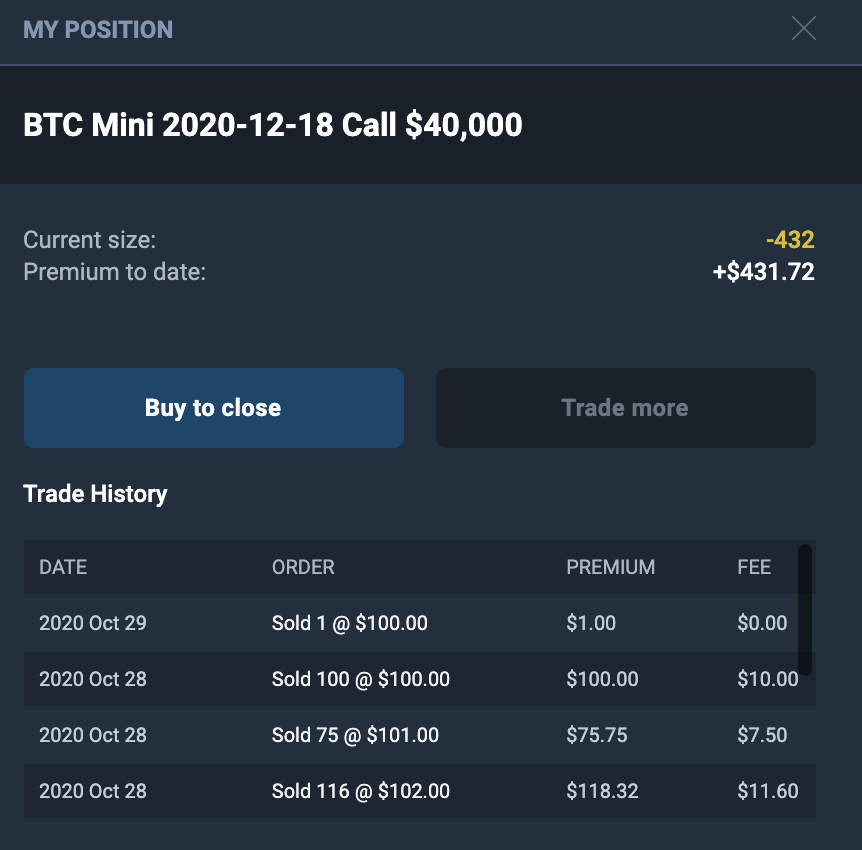

13/ I’ve been selling $40k/$50k strikes 2-3 months out an earning an average of 4-6%

An screenshot showing the premiums when I executed.

An screenshot showing the premiums when I executed.

14/ With covered calls you only have exchange custody risk, which is some of the lowest risk you can have.

One advantage of covered calls is that if you sell a 1yr+ duration call AND it gets assigned (price > strike) then your premium is taxed as long term cap gains (in the US)

One advantage of covered calls is that if you sell a 1yr+ duration call AND it gets assigned (price > strike) then your premium is taxed as long term cap gains (in the US)

15/ You can also earn a yield through trust minimized services like CoinJoins and providing lightning channel liquidity.

CoinJoins: (likely illegal)

Yield: ~0.5%

Get started: https://github.com/JoinMarket-Org/joinmarket/wiki/Running-a-Yield-Generator

Lightning Pool

Yield: TBD

Get started: https://lightning.engineering/pool/

CoinJoins: (likely illegal)

Yield: ~0.5%

Get started: https://github.com/JoinMarket-Org/joinmarket/wiki/Running-a-Yield-Generator

Lightning Pool

Yield: TBD

Get started: https://lightning.engineering/pool/

16/ Coinjoins allow for Bitcoiners to obfuscate their coin holdings through mixing them with other Bitcoiners. In order to create a market of individuals willing to mix, there are makers and takers. Makers post availability to mix, takers pay the makers for that convenience.

17/ Lightning Pool

Most simplistically, it is an order book for lightning liquidity (or a channel marketplace) done in a non-custodial manner (note: there is a coordinating server).

18/ Hope you enjoyed this thread! I fell down the yield rabbit hole and haven’t looked back :)

If you haven’t already, check out my Google sheet where I’ve got all of this information available to you to play around with. https://docs.google.com/spreadsheets/d/1ZoapTCl76wahFMeNISSx9UdC3QBx-zC_jY4Le1H5Sdg/edit?usp=sharing

If you haven’t already, check out my Google sheet where I’ve got all of this information available to you to play around with. https://docs.google.com/spreadsheets/d/1ZoapTCl76wahFMeNISSx9UdC3QBx-zC_jY4Le1H5Sdg/edit?usp=sharing

Read on Twitter

Read on Twitter