Technical Analysis MASTER-CLASS.

Part 1- 'How not to lose your money'

Please retweet. It might help a trader from losing it all.

A thread.

Part 1- 'How not to lose your money'

Please retweet. It might help a trader from losing it all.

A thread.

Fact- 90% of the traders lose money.

We will learn how to be in the top 10% by mastering Risk management in the next few threads. The most important but most ignored concept.

According to me, ALL of trading knowledge is futile if you don't follow Risk Management. Period

We will learn how to be in the top 10% by mastering Risk management in the next few threads. The most important but most ignored concept.

According to me, ALL of trading knowledge is futile if you don't follow Risk Management. Period

Since 90% of the traders lose money due to lack of risk management, we don't need to further discuss its importance.

If we don't manage risk mathematically, we WILL FOR SURE lose all the capital. FOR SURE.

In this thread, we will try to understand

'Optimum position sizing'

If we don't manage risk mathematically, we WILL FOR SURE lose all the capital. FOR SURE.

In this thread, we will try to understand

'Optimum position sizing'

The 5% Rule

NEVER risk more than 3-5% of your portfolio on a single trade.

3% is what I prefer, 5% is an aggressive approach.

This might sound bizarre, a waste of time but let's understand it further.

NEVER risk more than 3-5% of your portfolio on a single trade.

3% is what I prefer, 5% is an aggressive approach.

This might sound bizarre, a waste of time but let's understand it further.

Trading with only 5% of your capital doesn't mean your trade/position size is only 5% of your total capital.

What it means is that you're RISKING 5% of your equity in a single trade.

Whatever happens, you will not lose more than 5% of your equity on a single trade.

What it means is that you're RISKING 5% of your equity in a single trade.

Whatever happens, you will not lose more than 5% of your equity on a single trade.

Trade Size will be determined by the LEVERAGE on that 5% equity.

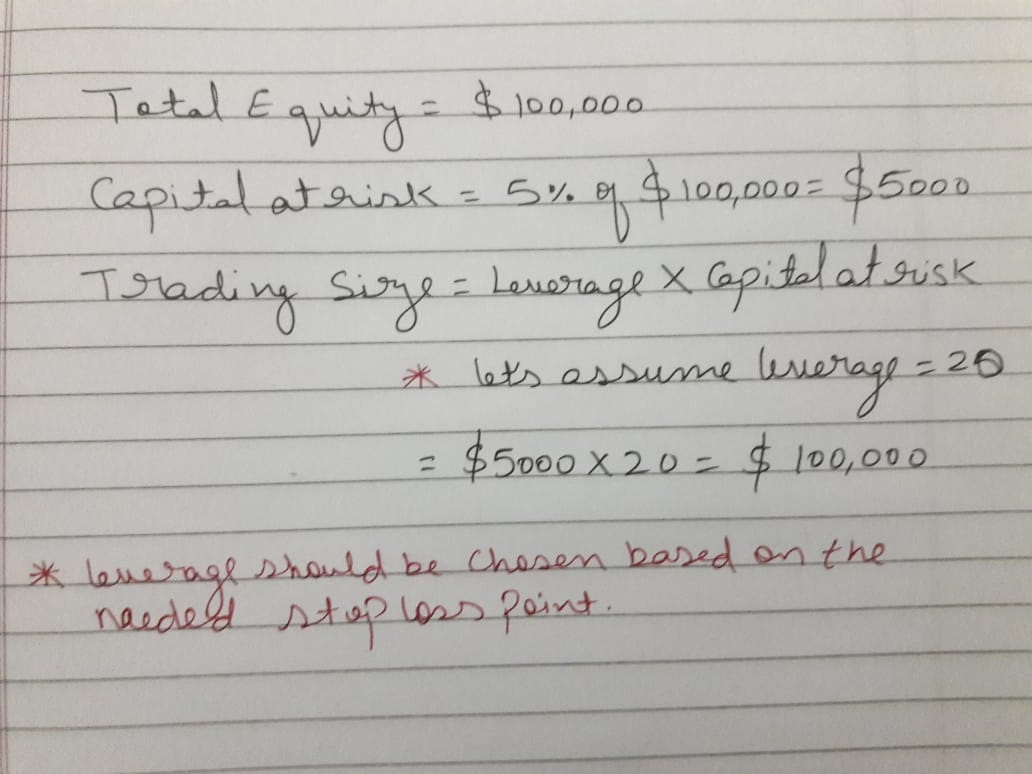

This is illustrated in the note below.

Notice how 5% equity at risk of $100,000 becomes a position size of $100,000 by risking just $5000

Caution- This is just an illustration,we will learn to use leverage later.

This is illustrated in the note below.

Notice how 5% equity at risk of $100,000 becomes a position size of $100,000 by risking just $5000

Caution- This is just an illustration,we will learn to use leverage later.

Leverage usage is a function dependent on the Stop loss determined based on TA.

I use only technical analysis to determine the stop loss and the leverage multiple shall be determined by it.

We will learn the application of leverage in the "Stop Loss" thread.

I use only technical analysis to determine the stop loss and the leverage multiple shall be determined by it.

We will learn the application of leverage in the "Stop Loss" thread.

But Why risk so little capital?

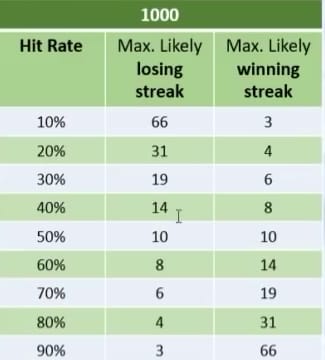

Per math, even if you have a very high strike rate (ratio of winning trades) eg 70%, there will come a time when you will have 6 consecutive losing trades.

High equity risk trades are historically proven to deplete all capital as explained below.

Per math, even if you have a very high strike rate (ratio of winning trades) eg 70%, there will come a time when you will have 6 consecutive losing trades.

High equity risk trades are historically proven to deplete all capital as explained below.

The chart below shows the consecutive losses a trader will DEFINETELY face over a period of time with the given hit rate.

Now imagine if someone with a respectable hit rate of 70% risked 40% of his capital in each of the 6 losing trades. REKT.

Now imagine if someone with a respectable hit rate of 70% risked 40% of his capital in each of the 6 losing trades. REKT.

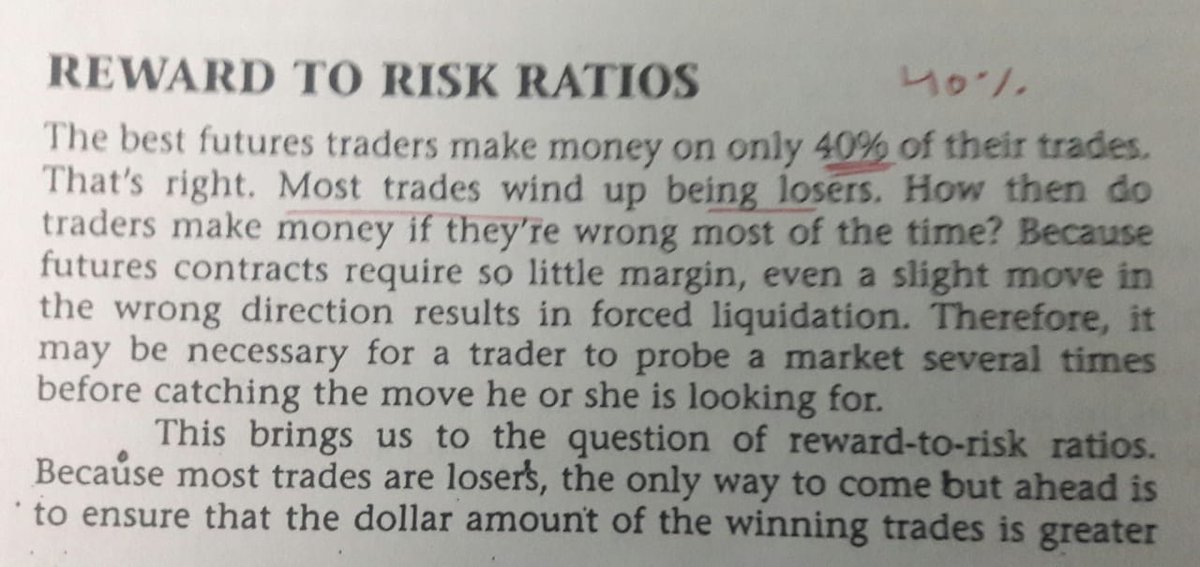

It might come as a surprise that the most successful and long term traders have a strike rate of around 40%.

The best traders that I know personally and even myself don't have that high of a hit rate.

Then how does such low strike rate lead to profits in the long run?.....

The best traders that I know personally and even myself don't have that high of a hit rate.

Then how does such low strike rate lead to profits in the long run?.....

The profitability is gained from obtaining a good R:R (Risk to reward) ratio over a period of time.

R:R, Stop Loss placements and the use of leverage will be explained in the next threads.

R:R, Stop Loss placements and the use of leverage will be explained in the next threads.

101.

-Don't risk more than 3-5% equity on a single trade.

-Position size matters, not leverage.

-Your position size can be as big as needed while risking only 5% of your equity.

-Leverage needs to be determined keeping the stop loss in mind.

DON'T RISK MORE THAN 5% ON ONE TRADE.

-Don't risk more than 3-5% equity on a single trade.

-Position size matters, not leverage.

-Your position size can be as big as needed while risking only 5% of your equity.

-Leverage needs to be determined keeping the stop loss in mind.

DON'T RISK MORE THAN 5% ON ONE TRADE.

This concludes part 1 of Risk management,

"Optimum Position sizing"

It might be boring but is THE MOST IMPORTANT part of trading.

Read it several times.

Next part of Risk Management to release soon.

Please share the thread to help a fellow trader.

Love,

EmperorBTC

"Optimum Position sizing"

It might be boring but is THE MOST IMPORTANT part of trading.

Read it several times.

Next part of Risk Management to release soon.

Please share the thread to help a fellow trader.

Love,

EmperorBTC

Read on Twitter

Read on Twitter