#IvoryCoast just issued a EUR 1bn eurobond (annual coupon = 4.875%). Their 10th eurobond. Few thoughts thread. Key points: mkts open, was not all new/net debt & kudos to their active/ sophisticated approach to debt management

3rd African issuance (after #Egypt #Morocco) since pandemic hit ( #Gabon #Ghana came just before). Proceeds raised for combo of financing needs + debt repayment risk reduction / aka liquidity management.

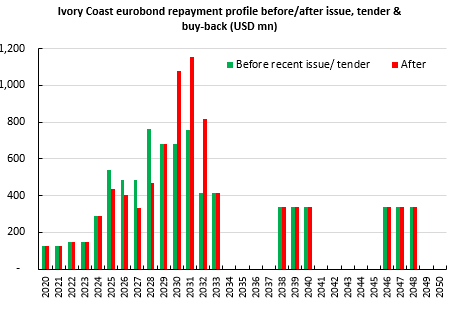

Having announced tender (on bonds due 2025 EUR, 28s + 32s USD, gov't accepted ~$497mn offers https://www.bourse.lu/issuer/CoteD-Ivoire/40022. So net debt = EUR1bn minus that so 58% ~EUR587mn. Plus appears some additional buyback $32s ~$158mn. In sum debt repayment risks reduced 2024-28 & placed 2030-32

Was Ivory Coasts 10th eurobond, have issued ~$11.5bn in $ & EUR with $8.5bn outstanding. Have paid back ~$3bn via tender/buy-back & scheduled amortisation. As economy expands over next decade can keep managing debt risks in this fashion. Will now need be careful about 2030 & 2031

Recent issuance mostly in EUR. Makes sense for country as regional currency pegged to euro. Although small downside is EUR paper not in main EM bond indexes. Also since 2018 been opting for eurobonds that mature over 3 years instead of in one hit, spreads repayment risk

Highlights how African/ frontier debt market access can be more sustainable if active approach to debt management. Having defaulted on Bradybonds, then tough start after 2010 eurobond debut (delayed coupons), #IvoryCoast 've established good macro/debt/growth record past 8 years

Read on Twitter

Read on Twitter