1/ I haven't done a thread like this in a while but seems like with the influx of new people, now is a great time to do a comprehensive data summary to look at recent growth in Bitcoin and Ethereum. Almost everything we track is reaching all-time highs. Let's dive in!

2/ Total on-chain volume, a proxy for economic throughput, saw a strong increase of 51.5%, to a new yearly high of $204 billion in November. Bitcoin’s on-chain volume was 2 times higher than Ethereum’s in November.

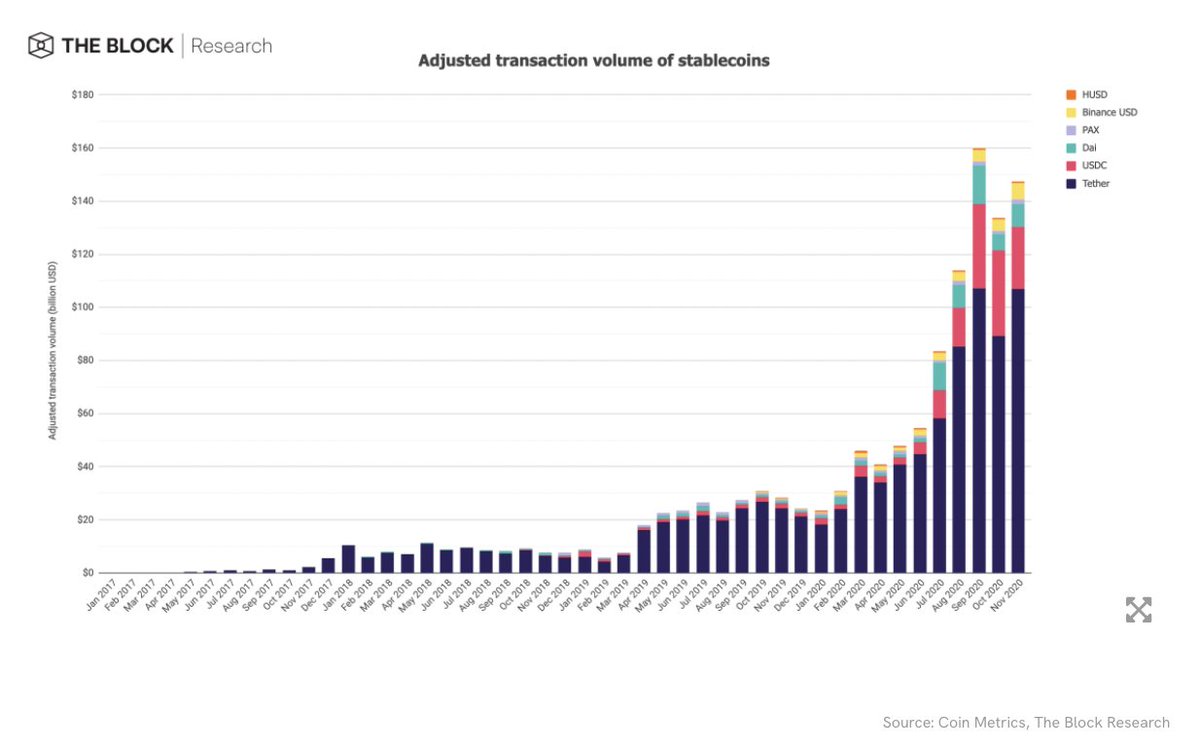

3/ Stablecoins have exploded in 2020. Since January, the total issued supply has grown by nearly 329%.

Main reasons:

• Miners repaying Tether debt against Bitcoin

• Popularity of Tether-collateralized derivatives exploded

• DeFi and the yield farming food token craze

Main reasons:

• Miners repaying Tether debt against Bitcoin

• Popularity of Tether-collateralized derivatives exploded

• DeFi and the yield farming food token craze

4/ The stablecoin on-chain volume, dominated by Tether, remains more than 6 times higher in November than in January 2020.

5/ Bitcoin miners generated $520 million in revenue in November, representing a significant month-over-month increase of 48%. This is the highest amount of revenues since February 2020, and higher than prior to the halving

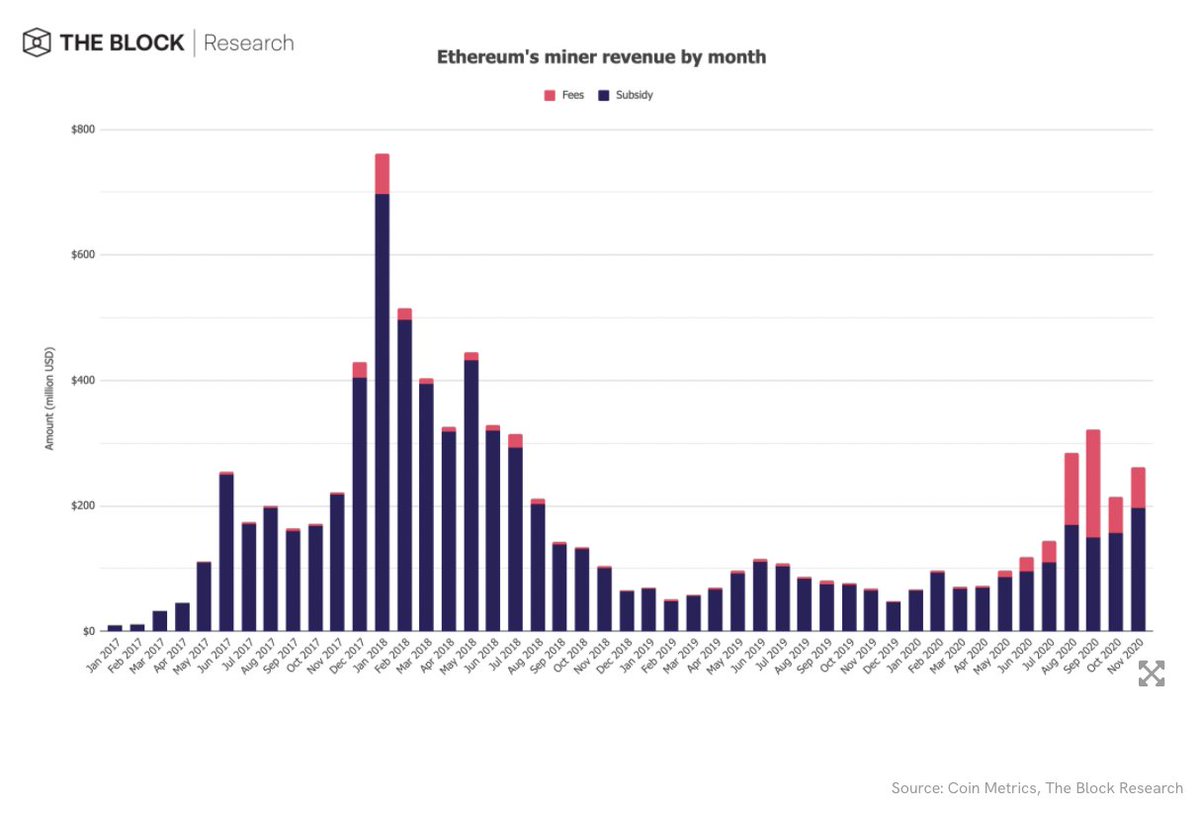

6/ Ethereum miners generated $262 million in revenue in November, representing a month-over-month increase of 22% — and a slight recovery from the steep decline in October.

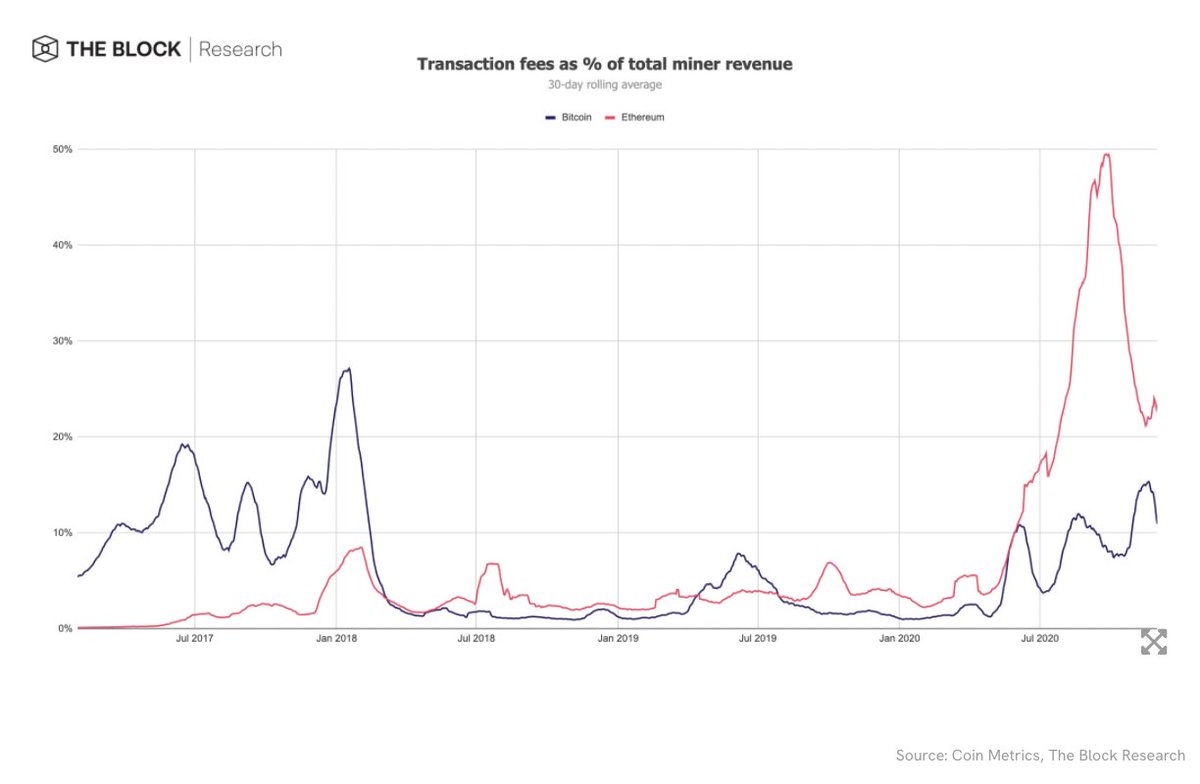

7/ Bitcoin miners made about 2 times more than Ethereum miners in November. Transaction fees on Ethereum slightly decreased to 23% of the total revenue. Bitcoin’s transaction fees as a share of total miner revenue also saw a slight decrease from 12% to 11%.

8/ After peaking in September, daily average gas price continued to decrease to around 57 gwei on a 30-day rolling average in November. This is mostly after the cooldown from the DeFi craze

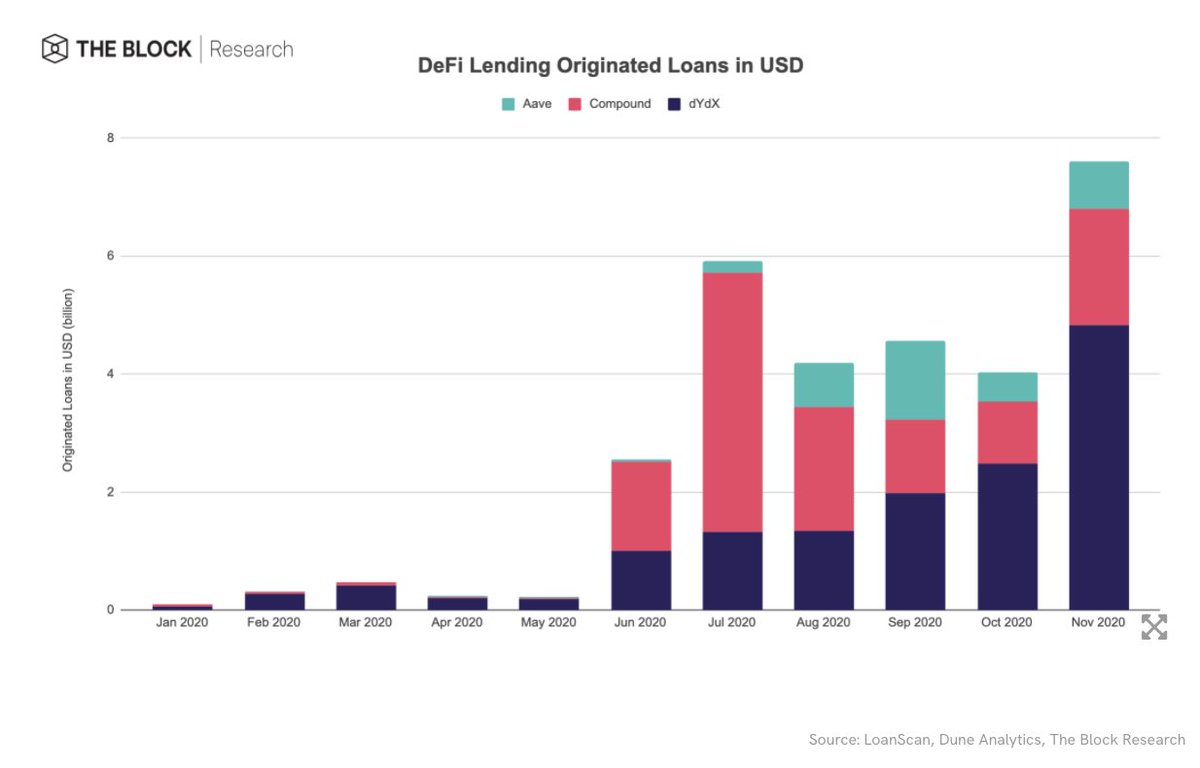

9/ When it comes to DeFi lending, dYdX, as well as Compound and Aave, hit a new all-time high with $7.6 billion in originated loans in November — representing a month-over-month increase of 88%.

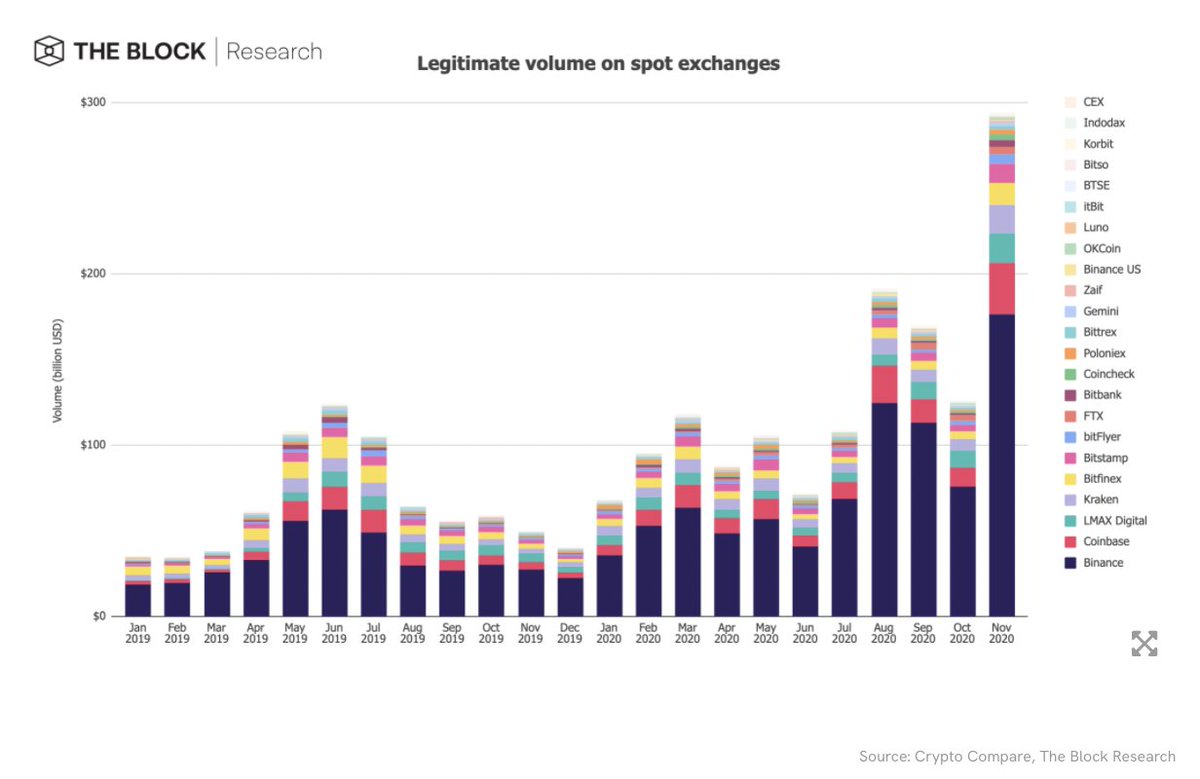

10/ Cryptocurrency spot trading volumes spiked by 134% in November. Some exchanges such as Binance reached volume all time highs.

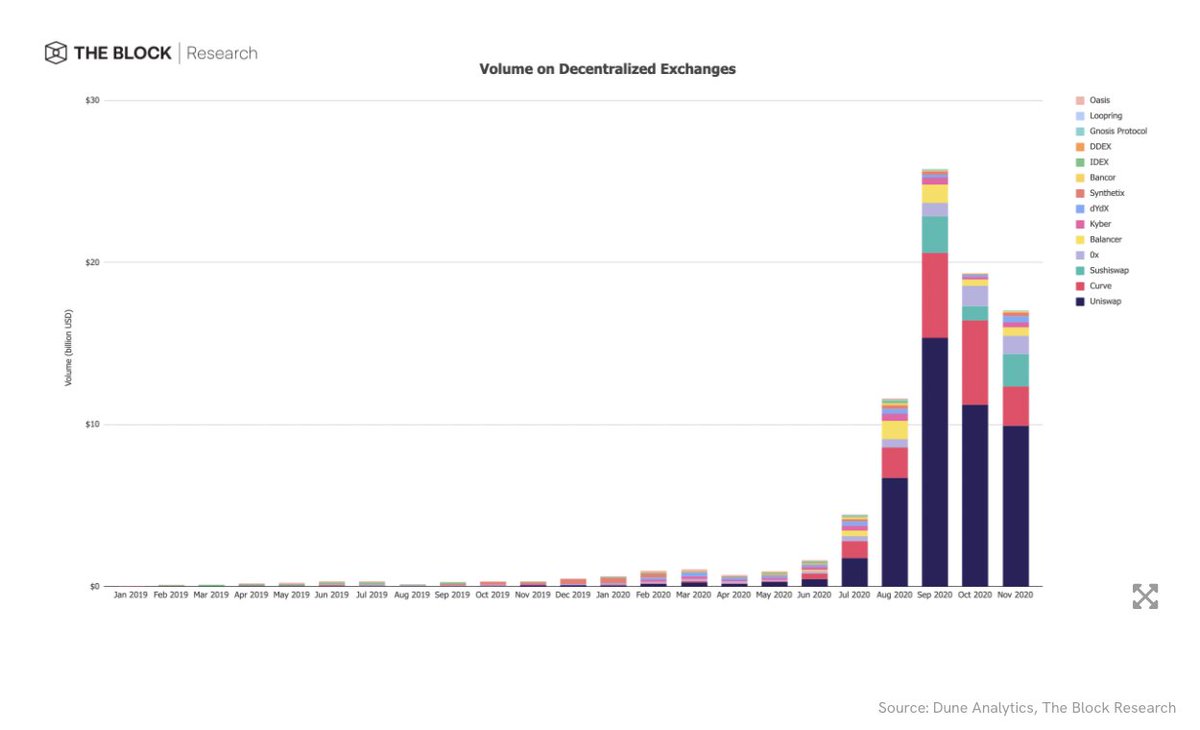

11/ Volumes on DEXs saw a m/m 12% decline to $17.1 billion. Still massively up since January's sub $1bn volume. Uniswap continues to dominate the DEX space with a market share of 58%, Curve's market share declined significantly to 14%, down from 27% in October.

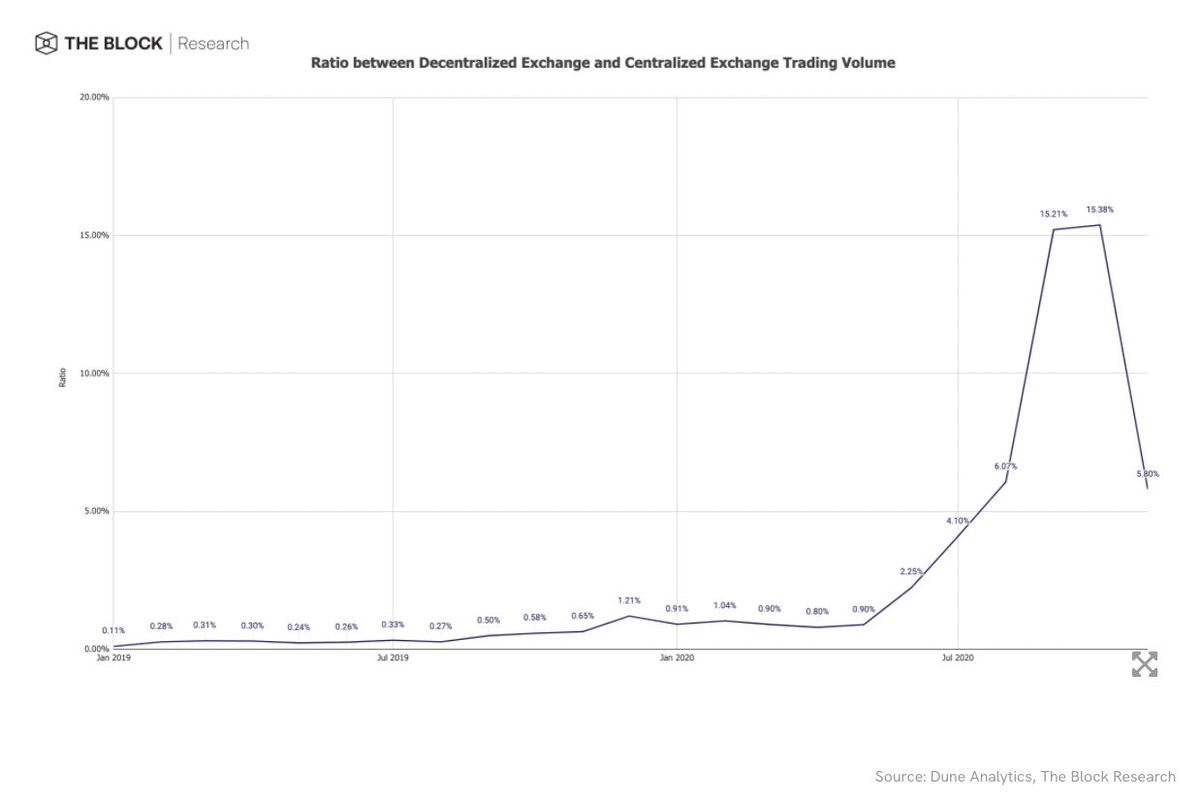

12/ The ratio between decentralized exchanges and centralized exchanges decreased significantly in November to 5.8%.

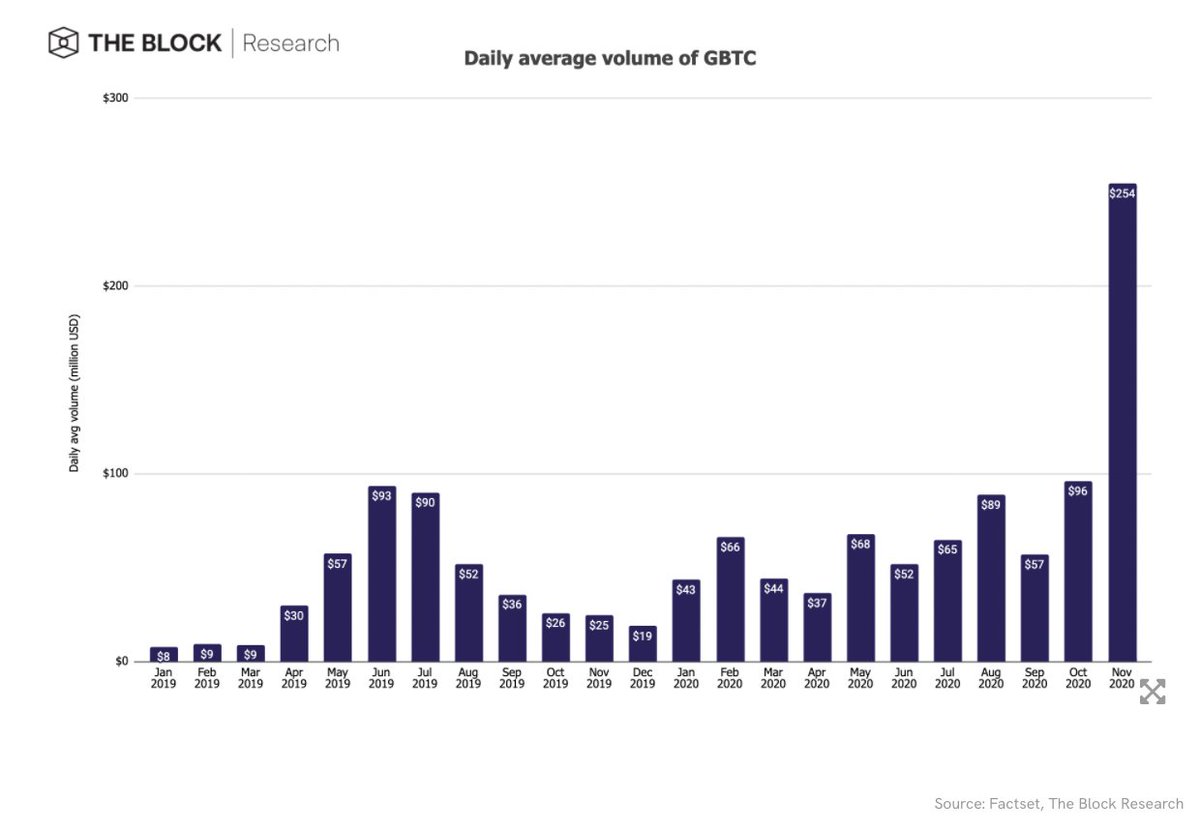

13/ The daily average volume of GBTC, a closed-end fund that invests exclusively in bitcoin, saw a significant increase of 165% to a two year high of $254.4 million in November. Bonkers month

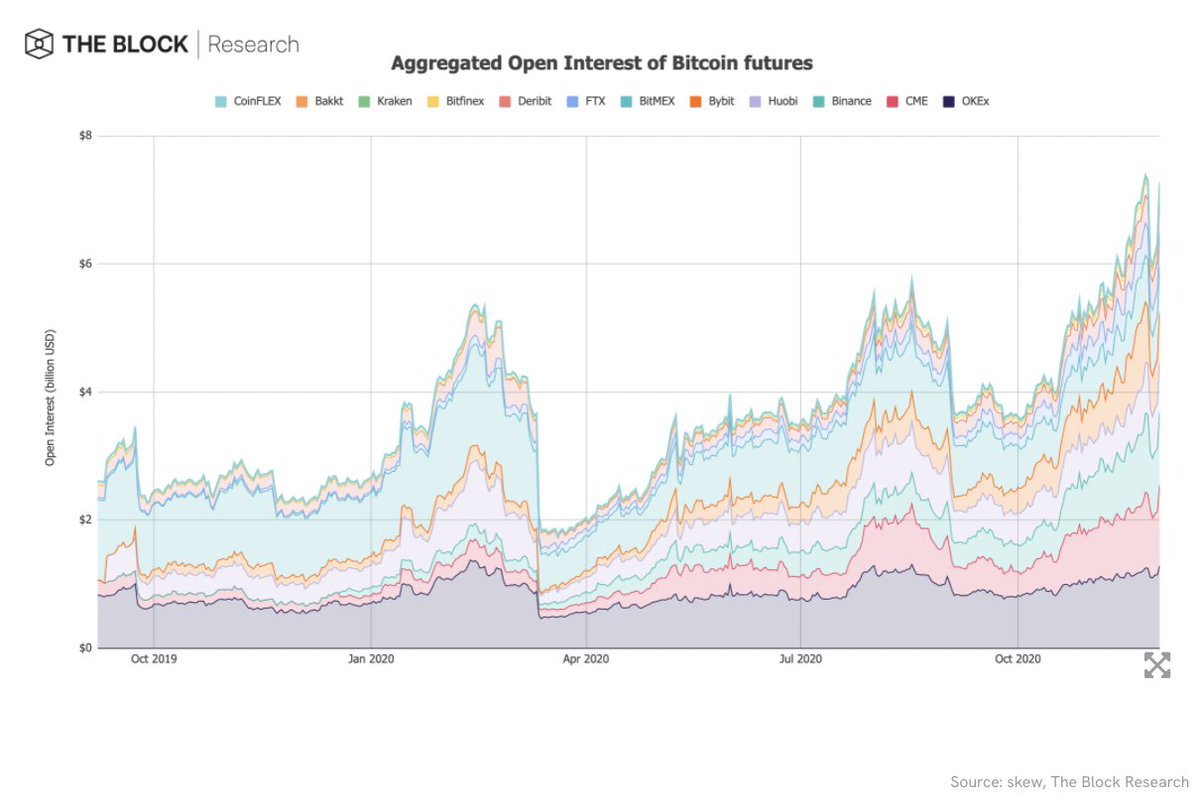

14/ The aggregated open interest of Bitcoin futures reached a new all-time high of $7.3 billion by the end of November, a 35% increase month-over-month.

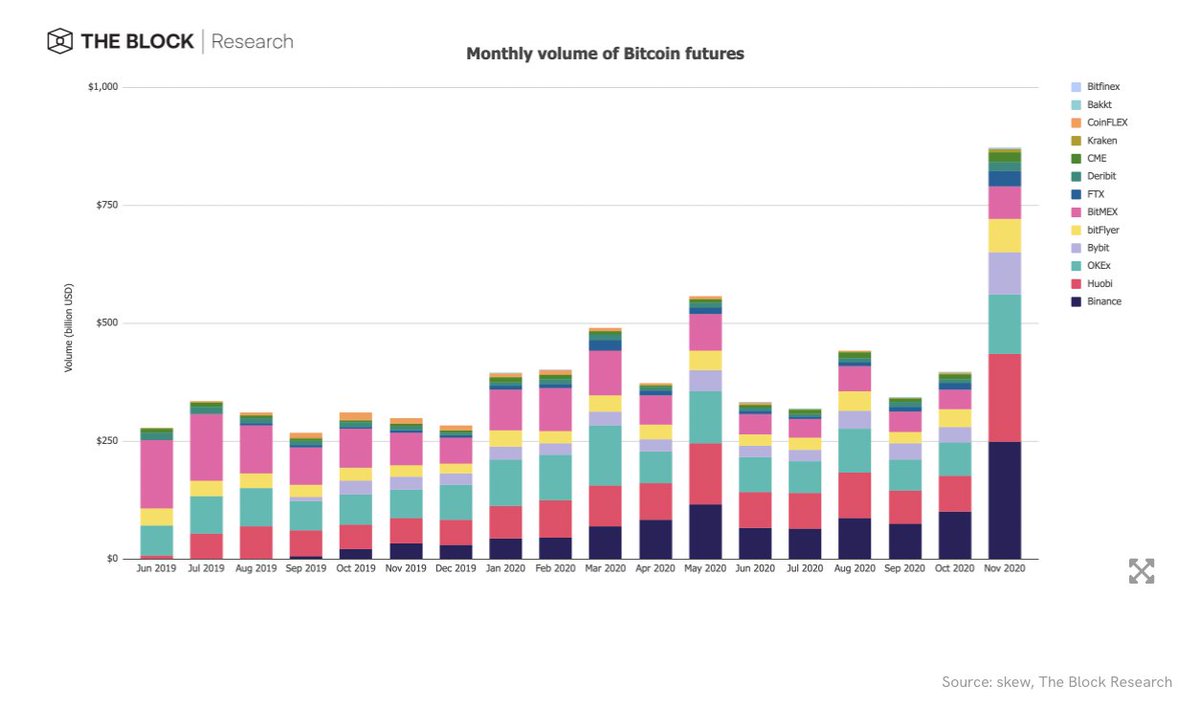

15/ The monthly volume of Bitcoin futures saw a massive increase of 120% in November, and hit a new all-time high of $872 billion.

16/ Moreover, on November 27, the daily volume of CME futures reached a new all-time high of $2.2 billion. The average daily volume hit a new all-time high in November.

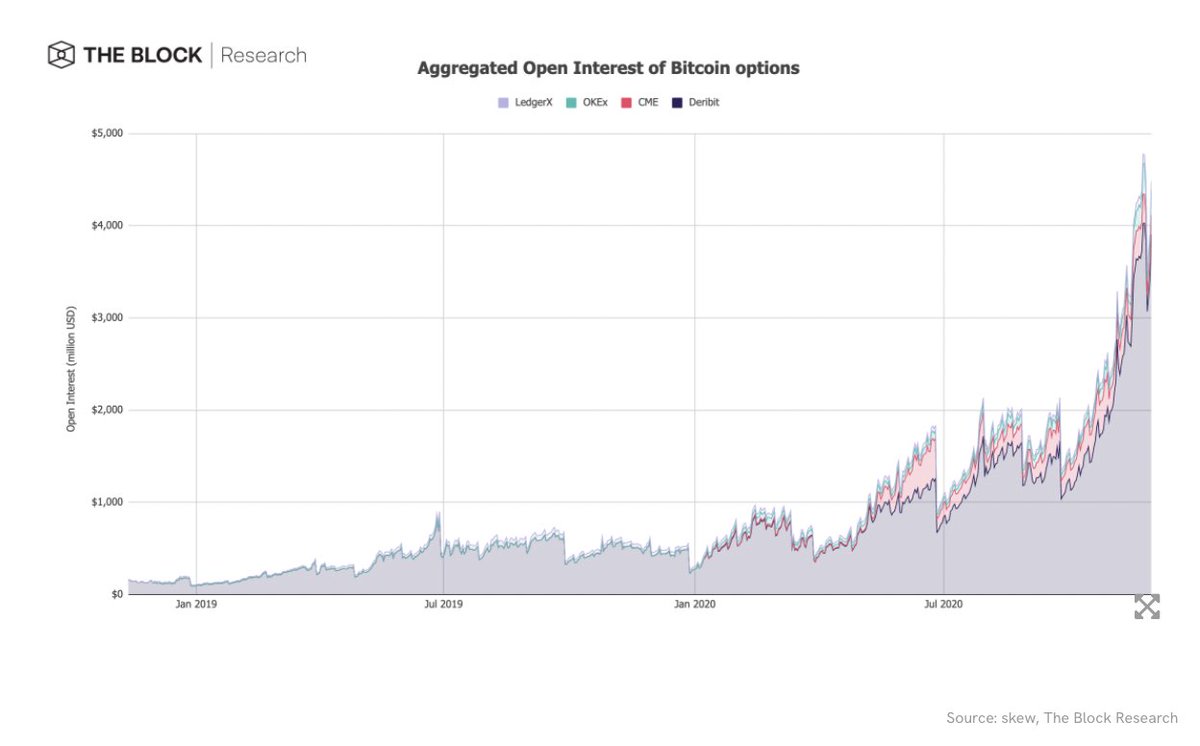

17/ The aggregated open interest of Bitcoin options reached a new all-time high of $4.49 billion by the end of November, which represents a strong month-over-month increase of 86%.

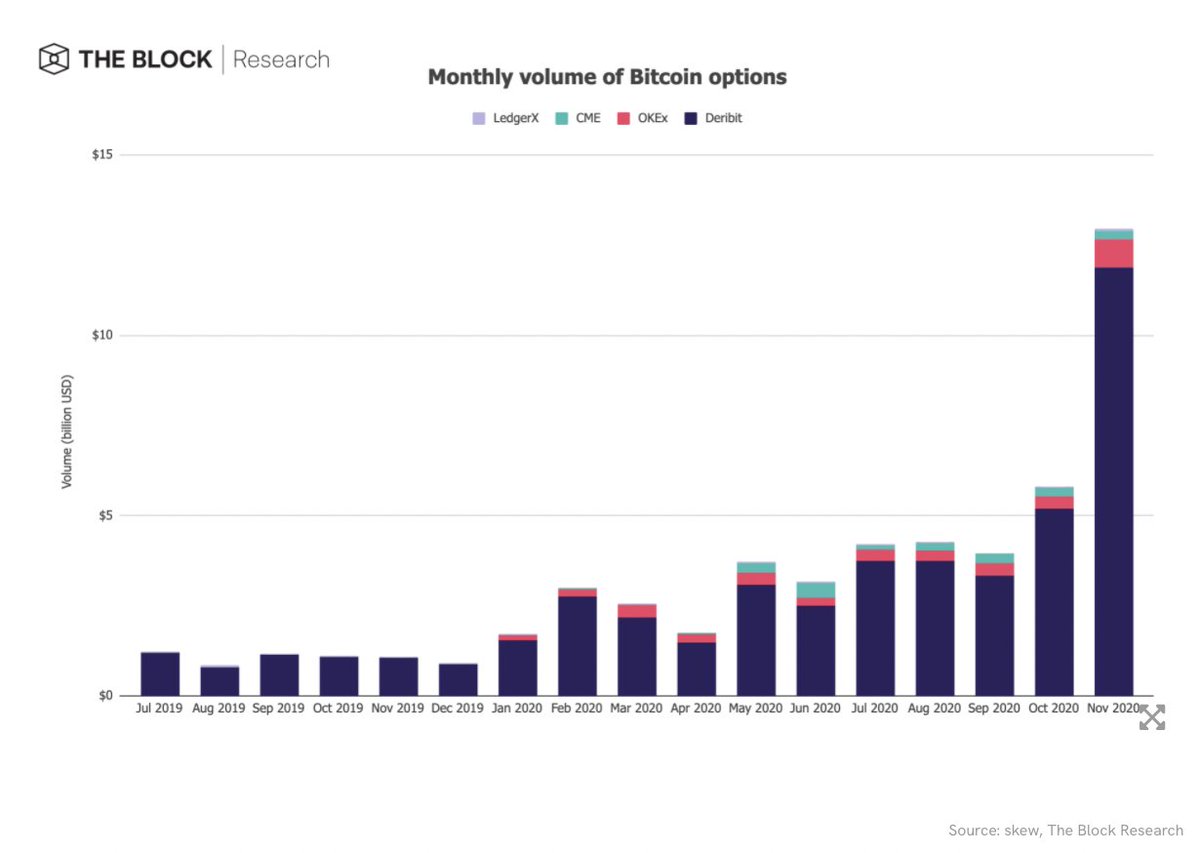

18/ The monthly volume of Bitcoin options reached a new all-time high by nearly 2x the previous ATH.

19/ Follow @lars_hl and @TheBlockRes for more data like this. The Block Research members get this data every month. If you want to check the full write up, check here: https://www.theblockcrypto.com/genesis/86371/november-by-the-numbers

Same thread, only two tweets, same conclusion. https://twitter.com/CryptoCobain/status/1334125056637739011

Read on Twitter

Read on Twitter