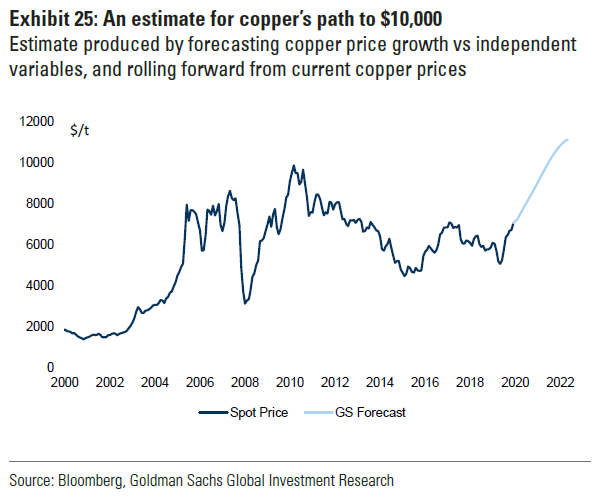

GS revises their 12m #Copper forecast from $7500 to $9500. $OCO $SLS

“The bull market for copper is now fully underway with prices up 50% from the 2020 lows, reaching their highest level since 2017.

“The bull market for copper is now fully underway with prices up 50% from the 2020 lows, reaching their highest level since 2017.

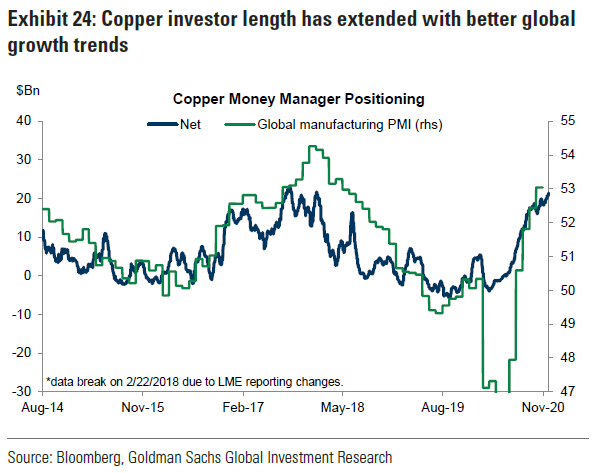

This current price strength is not an irrational aberration, rather we view it as the first leg of a structural bull market in copper. Going into 2021, the copper market will face the tightest market conditions in a decade owing to a substantial deficit (327kt).

Nor should there be comfort in what follows after that, with a continuation in tight copper markets now anticipated in both 2022 (153kt deficit) and 2023 (35kt surplus).

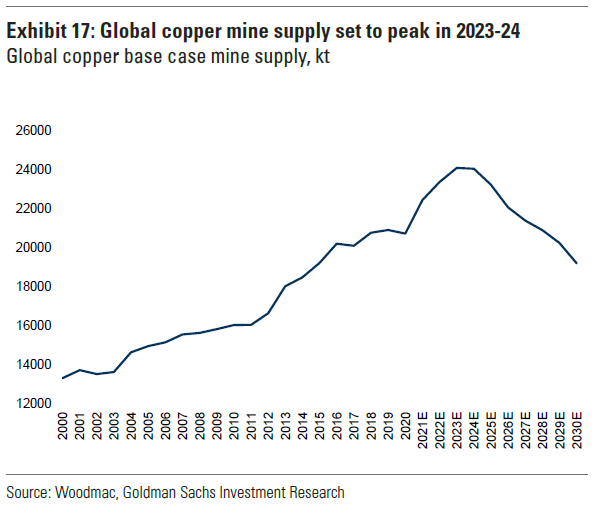

We expect this period to be framed by a robust cyclical and policy driven demand environment set against already low inventories, a fast-approaching peak of base case mine supply and a falling dollar"

4 key drivers

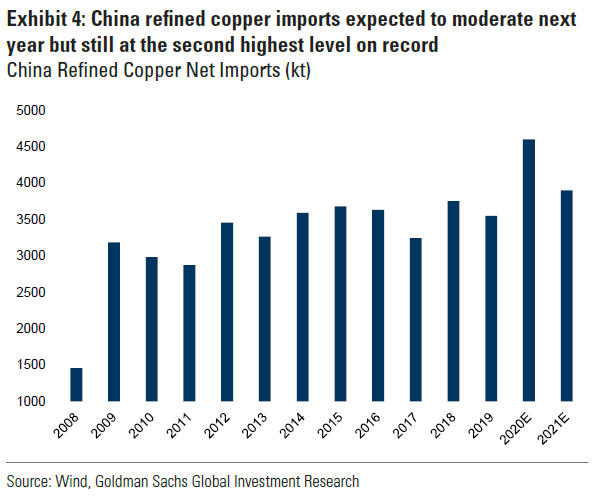

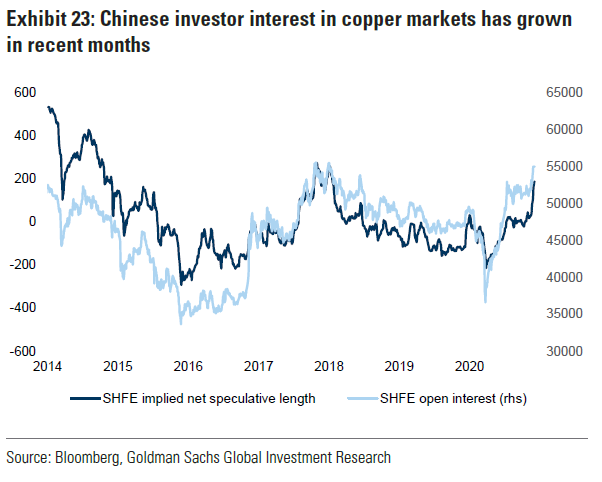

1. China's onshore market has tightened faster than previous expectations

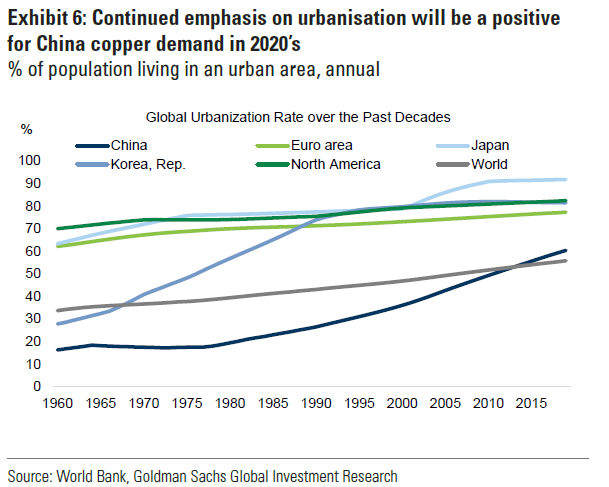

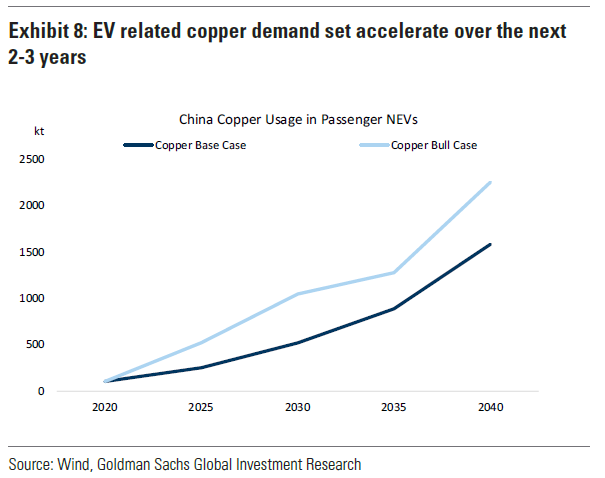

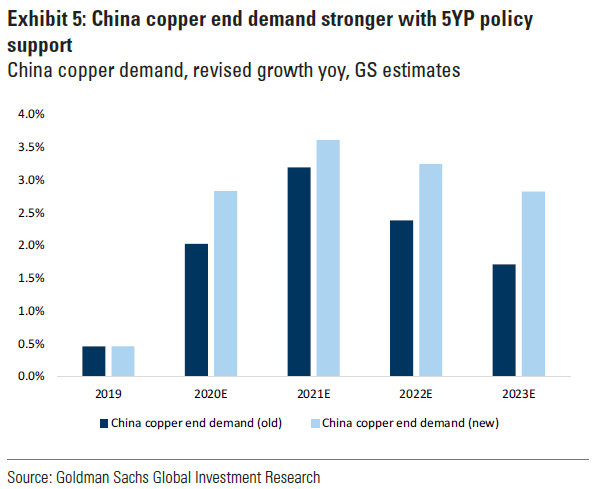

2. China's policy related to 14th 5y plan raised demand for a number of key copper consuming sectors

3. The concentrate market remains very tight

1. China's onshore market has tightened faster than previous expectations

2. China's policy related to 14th 5y plan raised demand for a number of key copper consuming sectors

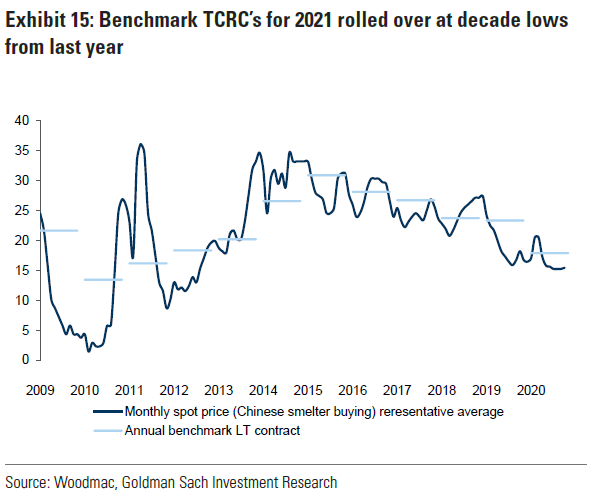

3. The concentrate market remains very tight

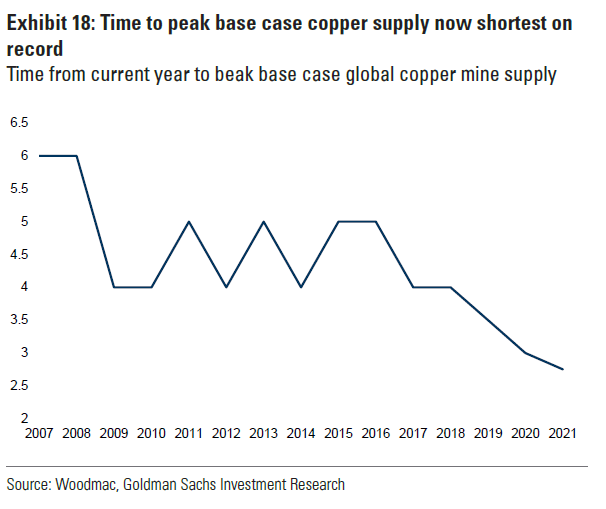

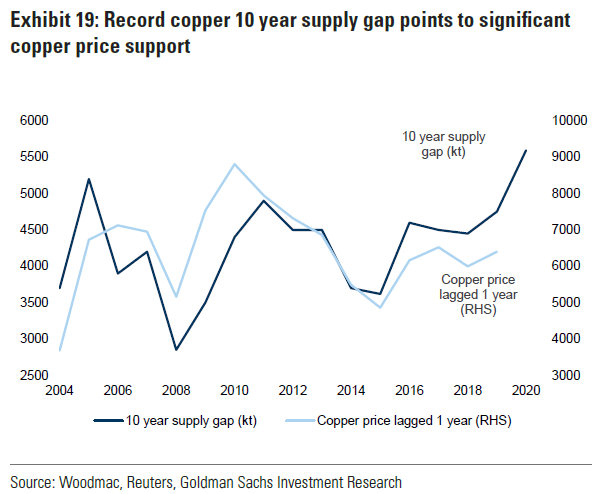

4. Peak base case copper mine supply is fast approaching on the horizon (end of 2023) and is now closer than at any point in the last 20 years. This means the 10-year supply shortfall is now at a record level for #copper

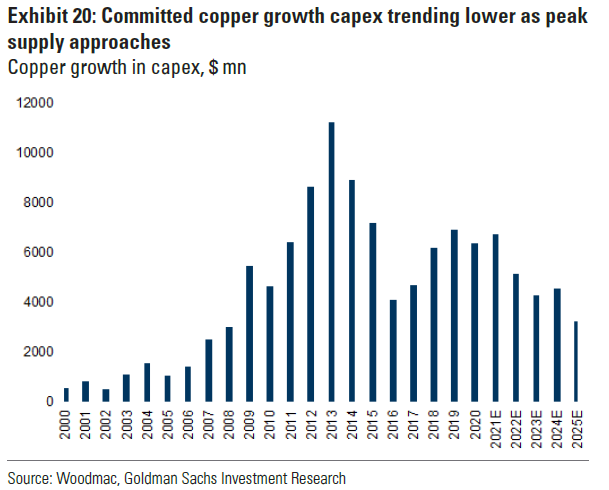

Only a very strong copper price signal can reverse the growth capex restraint that predominates the mining sector currently, to then defer peak supply and reduce the long-term supply shortfall

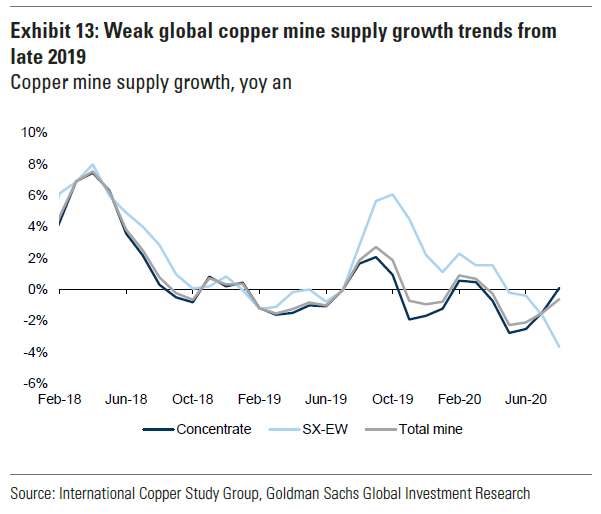

Global copper mine supply is on track to fall just under 2% y/y in 2020. This means that over the 3-year period up to and including 2020, global copper mine output has risen on average just 0.7% y/y, the lowest mine supply growth rate on a 3-year rolling basis since 2006-08

The other key supportive aspect to copper mine supply-side dynamics relates to the medium term outlook. Our current forecasts point to the prospect of base case mine supply peaking in 2023 before an open-ended contraction from 2024-25

On these base case numbers global mine supply would rise to 24Mt in 2023 but then fall to 22Mt by 2026 and 19Mt by 2030. To put this in context, we are currently closer to peak mine supply (3 years) than at any point in the previous 20 years

Read on Twitter

Read on Twitter