If you own a basket of #uranium stocks you probably own a bunch of garbage in the hope of catching a cycle. Most of what's out there will not be needed for at least a decade. https://twitter.com/808sandU3O8/status/1333737323612286976

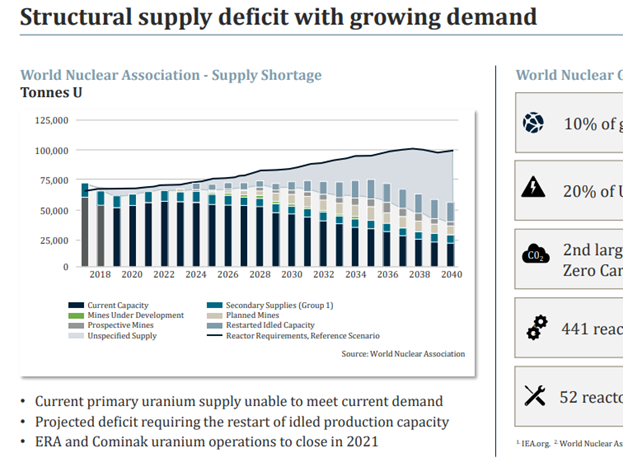

Lets take Paladin's own slides to demonstrate. Based on the uber-popular WNA slide I calculate there is a need for about 75mm lbs per annum of new mines to be built by 2030, excluding restarts. 75mm lbs sure sounds like a lot! Buy uranium stocks! Not so fast...

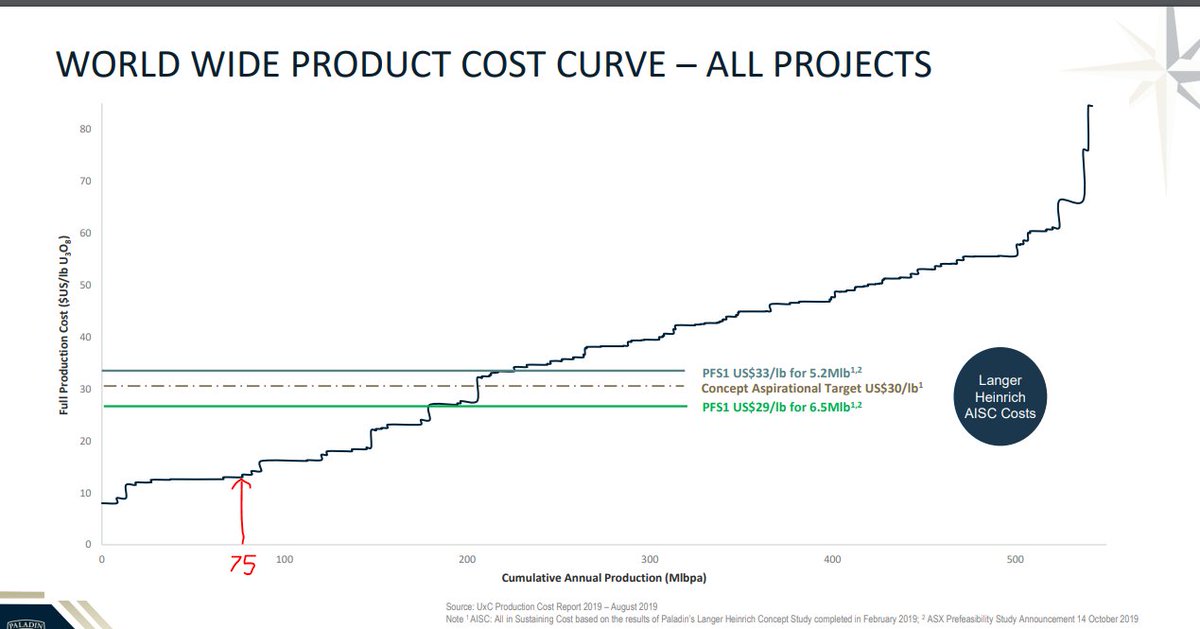

Now lets take another Paladin slide from last year (14 October 2019). This shows the cost curve of all projects identified by UXC, a cumulative capacity of 500 mm lbs per annum of projects are out there! That is a veritable crapload of projects. Uranium is not scarce.

75/500 means only 15% of known projects are needed this decade. Now where is breakeven for the cheapest 75mm lbs? Looks to be approx $15/lb AISC. Ergo if your project doesn't have $15/lb or lower AISC it is not competitive this decade.

Low cost projects are held by $KAP, $NXE, $DML, $BRK, $BRK. If you own a high cost asset you are not investing in what the world needs. I hope you all do very well trading out on a cycle and leaving someone else holding that bag.

Read on Twitter

Read on Twitter