The copper/gold ratio's broken with Treasury yields.

Here's what I think's going on.

A thread. https://www.bloomberg.com/news/articles/2020-12-01/gundlach-s-favored-metals-ratio-breaks-from-yields-in-new-normal?sref=qrmIOQ0q

Here's what I think's going on.

A thread. https://www.bloomberg.com/news/articles/2020-12-01/gundlach-s-favored-metals-ratio-breaks-from-yields-in-new-normal?sref=qrmIOQ0q

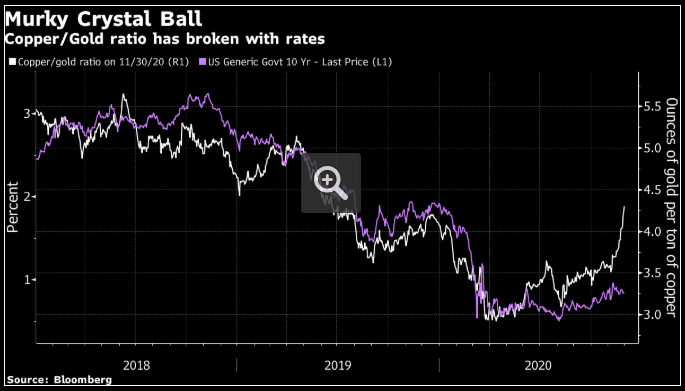

The ratio had an uncanny link to 10-year yield levels over the past five years, measured on a weekly basis over 5 years, and it's reportedly one of Jeffrey Gundlach's favorites.

2/

2/

But right now, it looks broken.

In recent weeks, copper has rallied hard while gold plunged, sending the ratio to levels that suggest 10-year yields should be about double -- even with today’s eight basis-point jump to 0.92%.

3/

In recent weeks, copper has rallied hard while gold plunged, sending the ratio to levels that suggest 10-year yields should be about double -- even with today’s eight basis-point jump to 0.92%.

3/

It appears to be going through a regime shift -- a statistical term that implies large and persistent change in the structure of a complex system like the global economy.

4/

4/

That doesn’t mean that copper, gold and Treasuries will no longer correlate -- merely that the level at which they correlate, or even their relative betas, might shift.

5/

5/

“Co-movement does not necessarily mean causality from one to the other. Nor does it mean there is always a long-term stable relation between the two," Harry Tchilinguirian at BNP Paribas told me.

6/

6/

The question is, why?

7/

7/

There are a number of reasons.

First, the central bank reaction function has changed.

It's pretty much established that for a given level of growth and inflation, they'll give us lower interest rates.

8/

First, the central bank reaction function has changed.

It's pretty much established that for a given level of growth and inflation, they'll give us lower interest rates.

8/

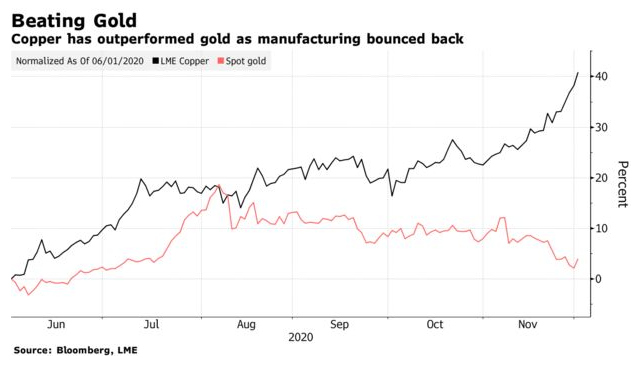

At the same time, there are regional differences in the pace of recovery from the virus. And manufacturing is bouncing back faster than services -- with a long term shift to greener economies also benefitting copper.

9/

9/

That doesn’t mean that copper, gold and Treasuries will no longer correlate -- merely that the level at which they correlate, or even their relative betas, might shift.

/ends

/ends

(Oh, also look out for cameo's by @Ole_S_Hansen and @SophieHH5)

Read on Twitter

Read on Twitter