Did we just hit peak oil? Today I went deep on how the future of energy snuck up on us in 2020: 11 charts, 3500 words, 9 photos. You should really check it out, but I will try to distill it here 1/ https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

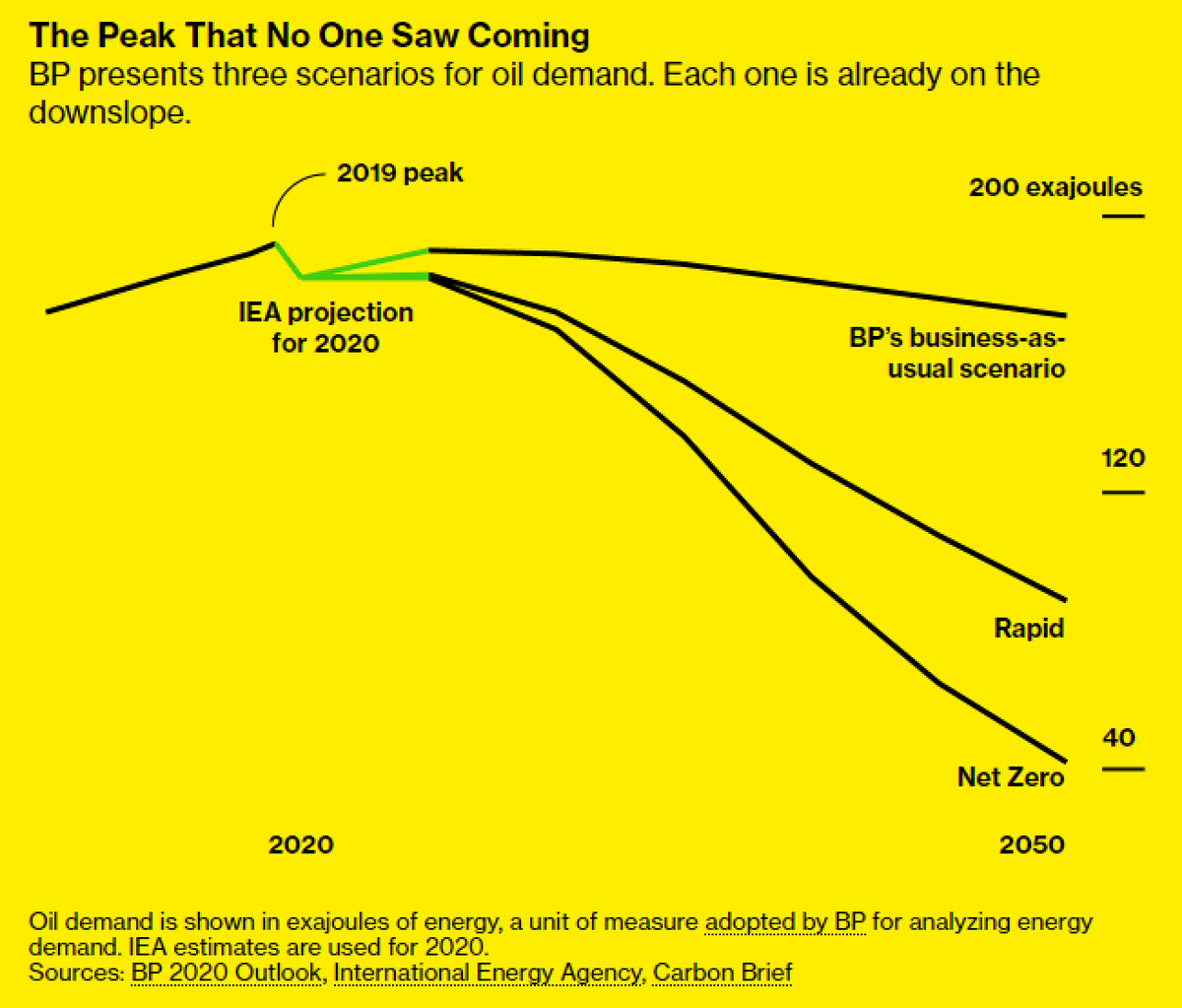

It starts with a forecast by one of the world’s biggest oil majors. This year BP made an extraordinary call—that oil energy demand may never again return to 2019 levels. That’s not some 2040 “Implausibly Green” scenario. It’s their business-as-usual 2/ https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

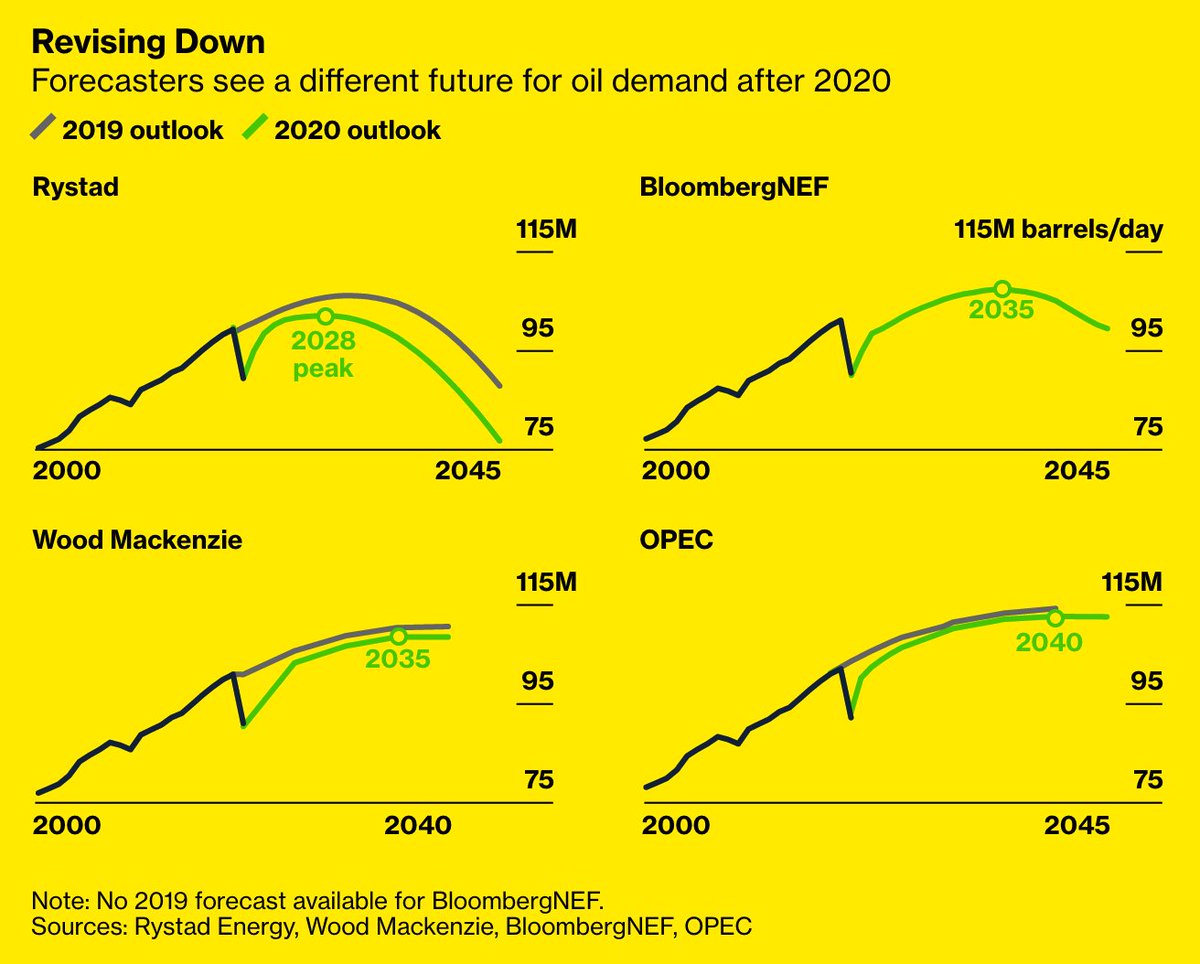

It’s not just BP. Before 2020, none of the major forecasters predicted peaking oil demand any time soon. Now look:

BP (2019)

Equinor (peaking 2027-2028)

Rystad (2028)

Total SA (2030)

McKinsey (2033)

BNEF (2035)

Wood Mackenzie (2035)

OPEC (2040)

3/ https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

BP (2019)

Equinor (peaking 2027-2028)

Rystad (2028)

Total SA (2030)

McKinsey (2033)

BNEF (2035)

Wood Mackenzie (2035)

OPEC (2040)

3/ https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

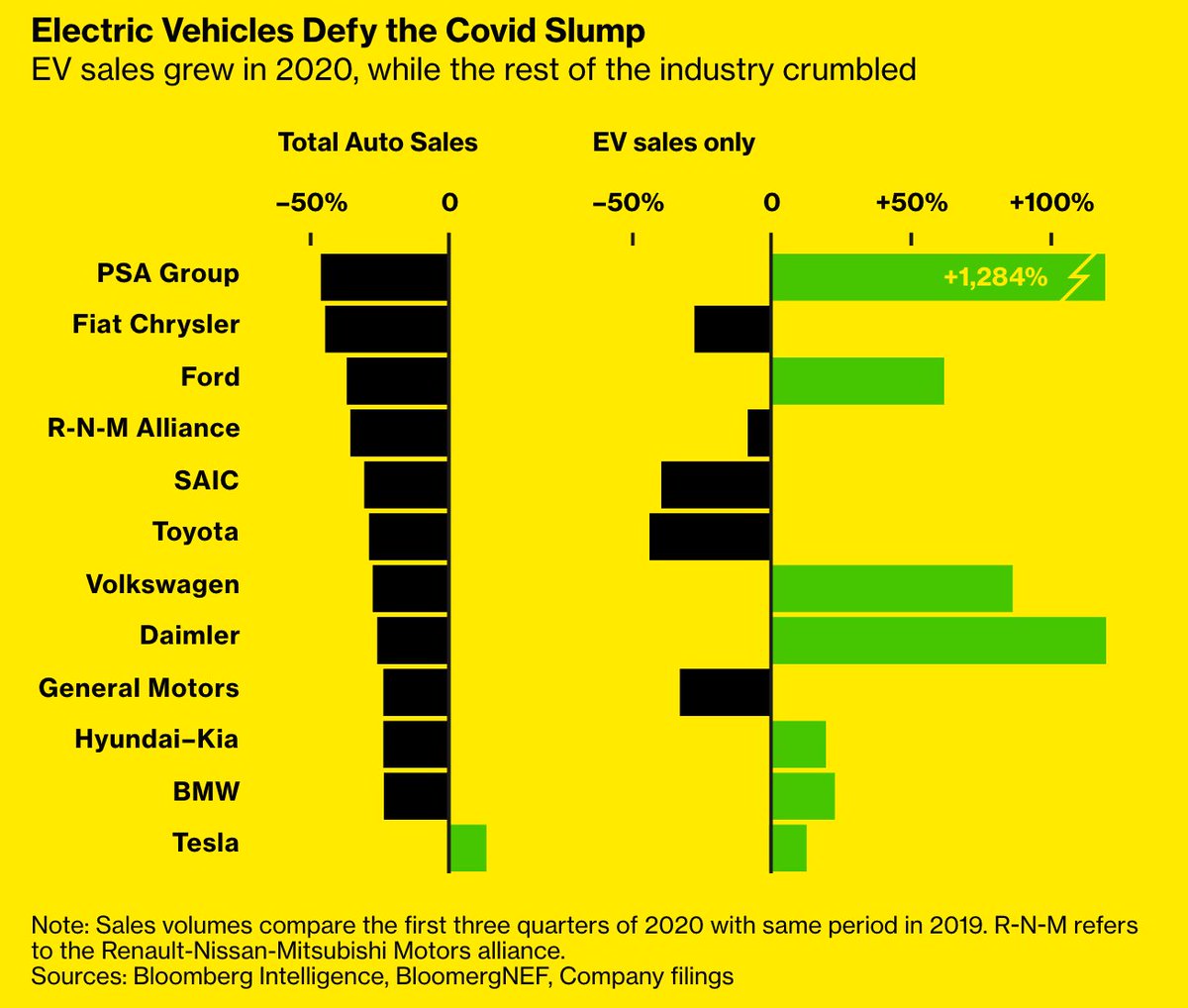

How did this happen? It started with a major blow to the global economy— but also an acceleration of trends already underway: working from home, less travel, more life online. But most importantly, electric cars didn’t brake for Covid 4/

https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

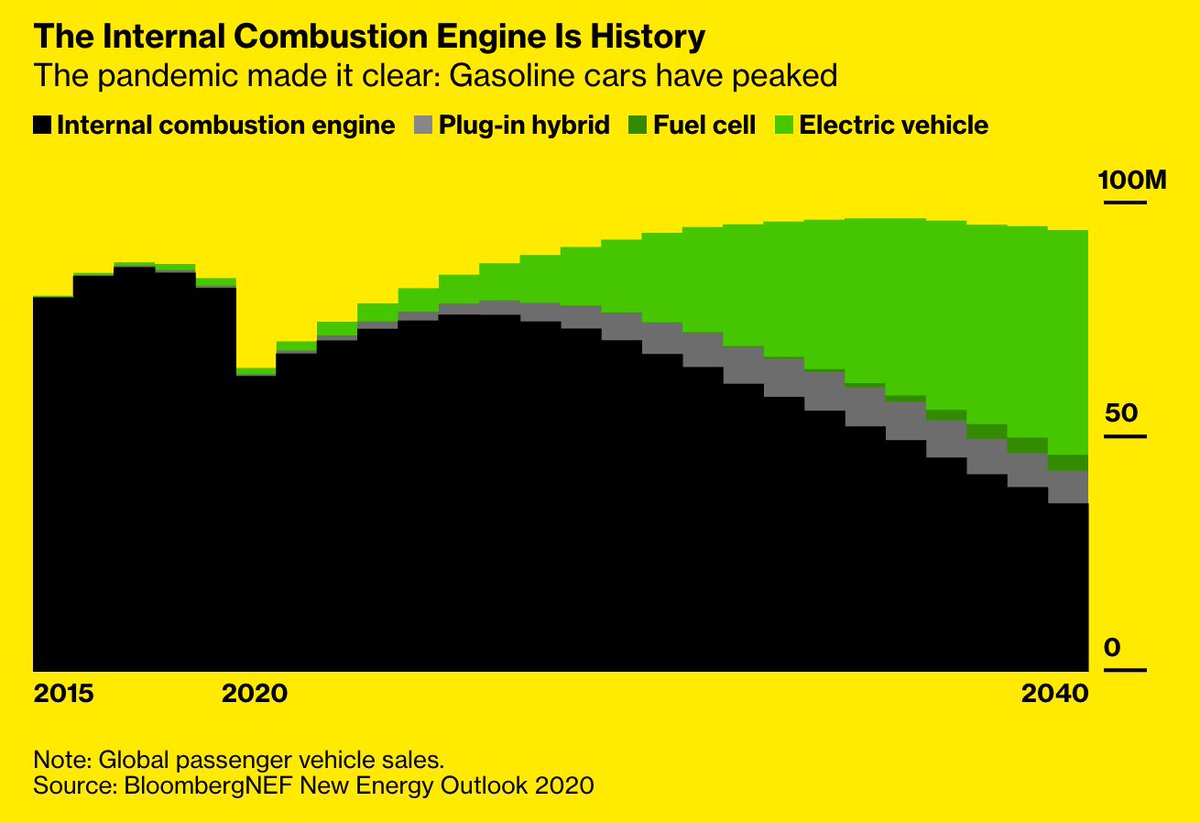

For the last two years, people started to wonder if gasoline-powered cars might have peaked in 2017. After that, EV sales kept growing, even amid an industry slump. But until now, peak combustion was just a theory. The pandemic made it real 5/

https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

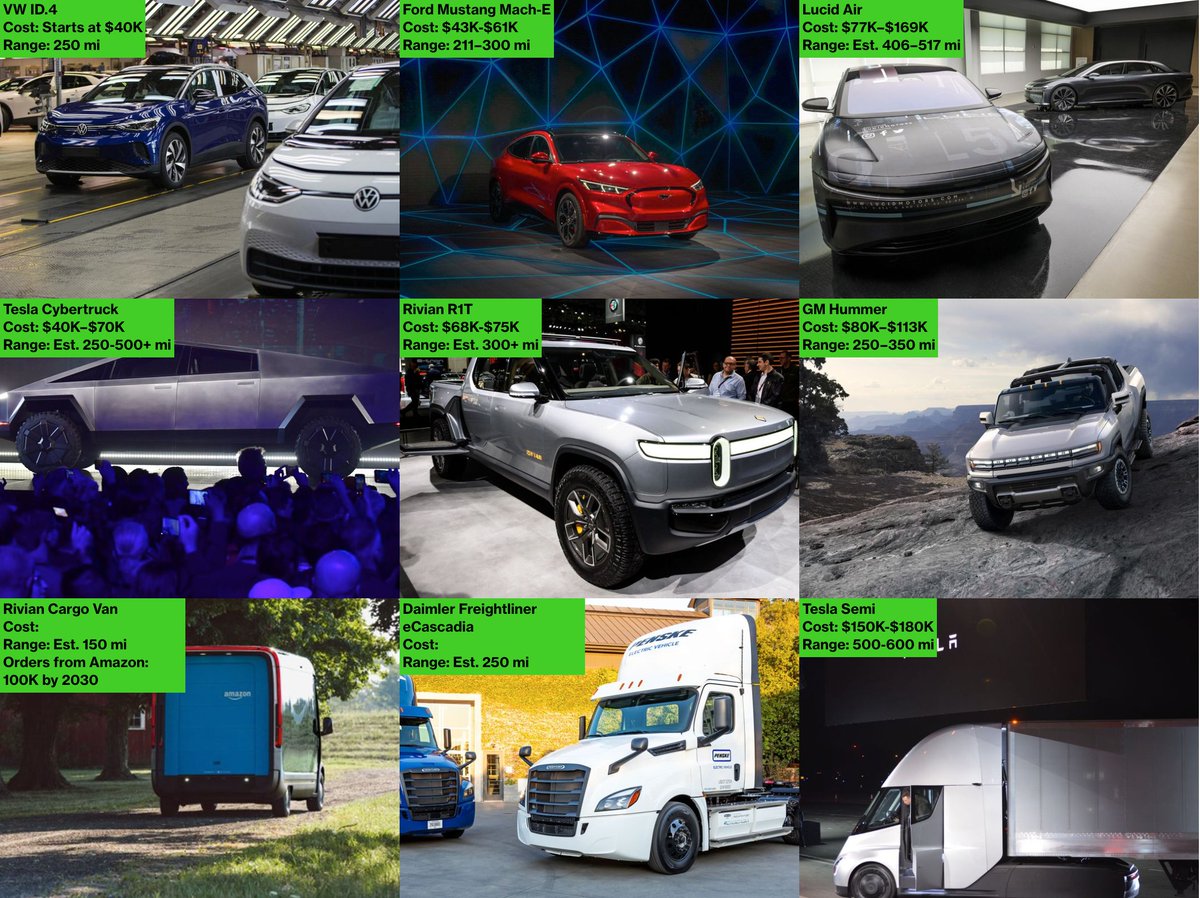

Automakers are working on at least 35 new all-electric vehicles for *next year*. I’ve always been wary of these counts after so many turn out to be mirages. But things are getting real. A taste of what’s coming in 2021: cars, pickups and freight 6/

https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

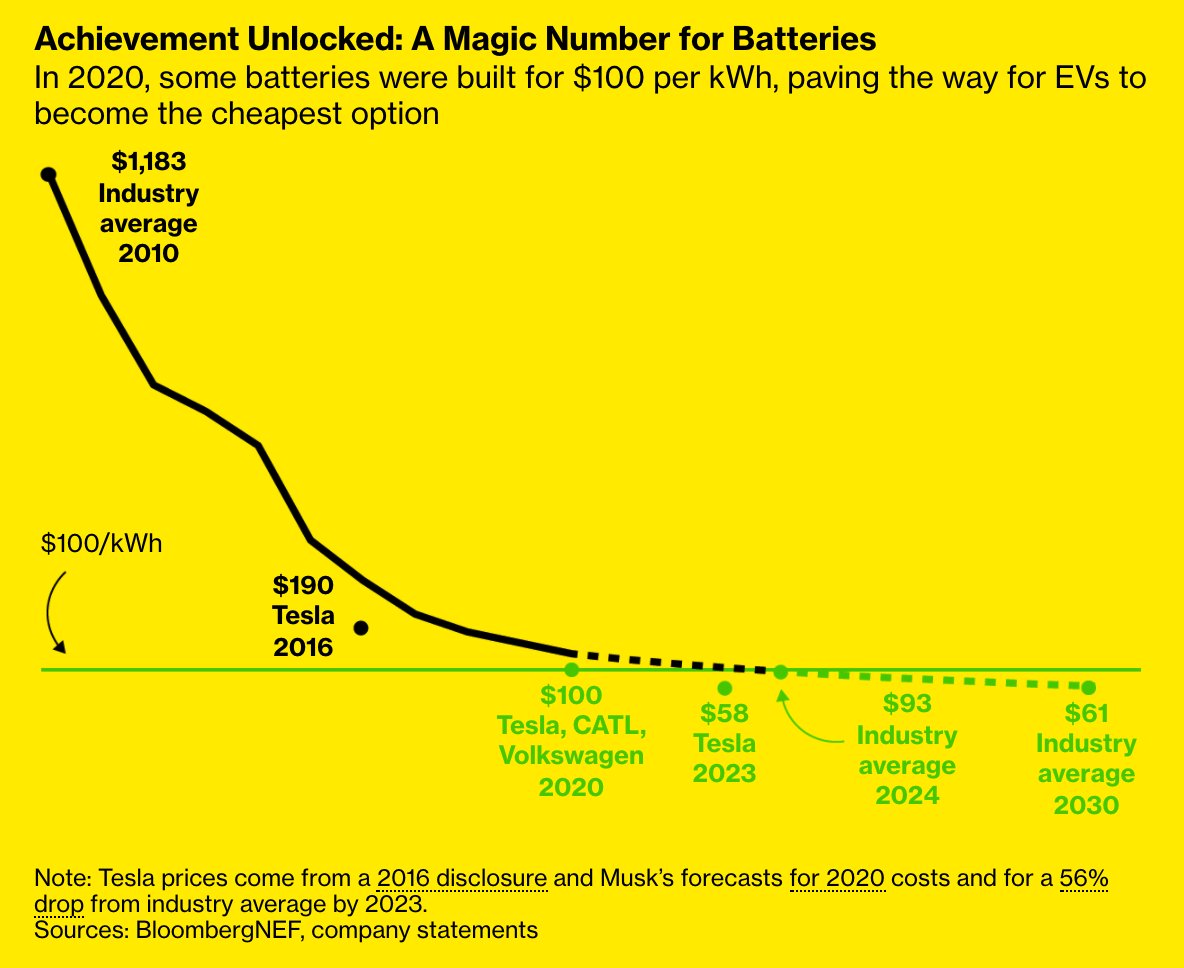

This is possible because we’re reaching a huge milestone in batteries. For the first time, some companies are reporting battery packs at $100/kWh. That’s the point at which EVs become cheaper to build than alternatives. It's only the beginning 7/

https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

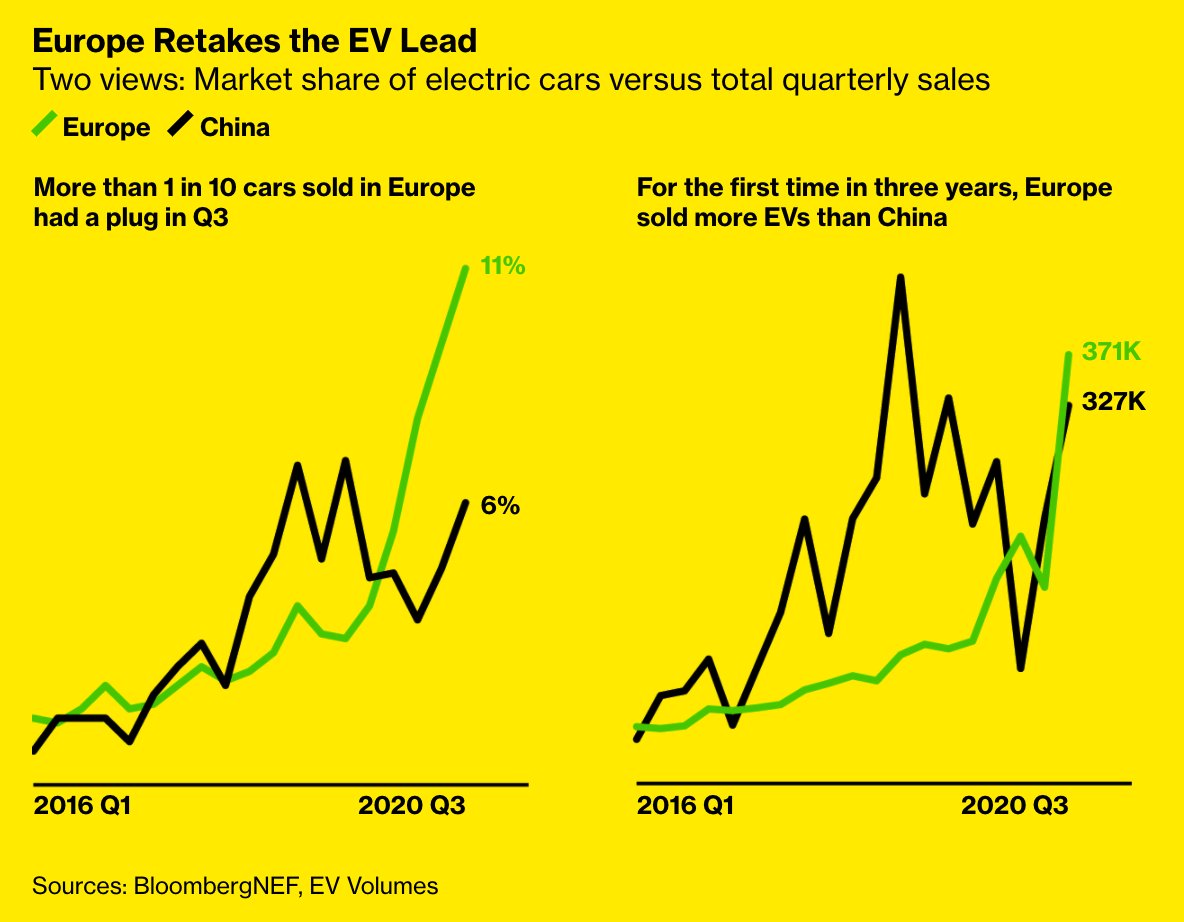

For the past three years China was the heavyweight champion of EVs. In 2020, Europe won back the belt. New EU efficiency rules kicked in, just before Covid. It was the push EVs needed. More than 1 in 10 cars sold in Europe had a plug in Q3

8/

https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

8/

https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

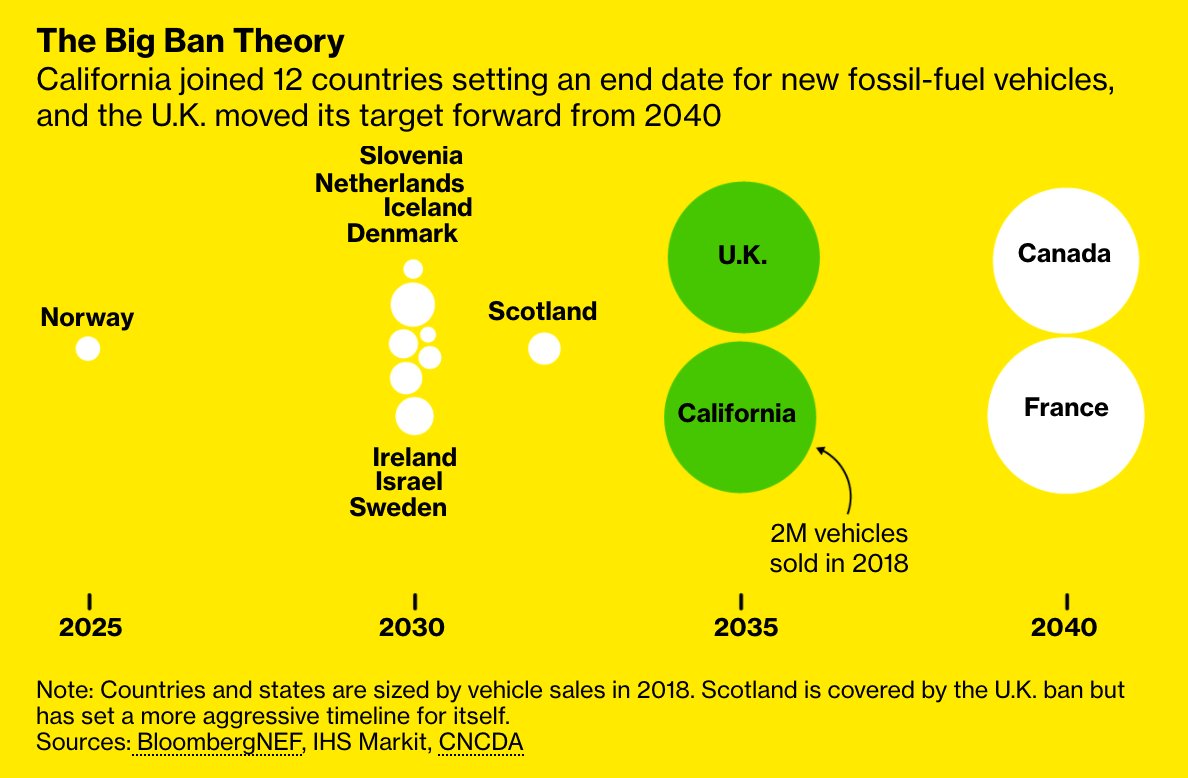

The economic crash could've been an excuse to backtrack on climate. Instead, China vowed to eliminate CO2 pollution by 2060. Japan and South Korea followed. California and U.K. banned gasoline cars in 2035. And in the U.S., we had an election 9/ https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

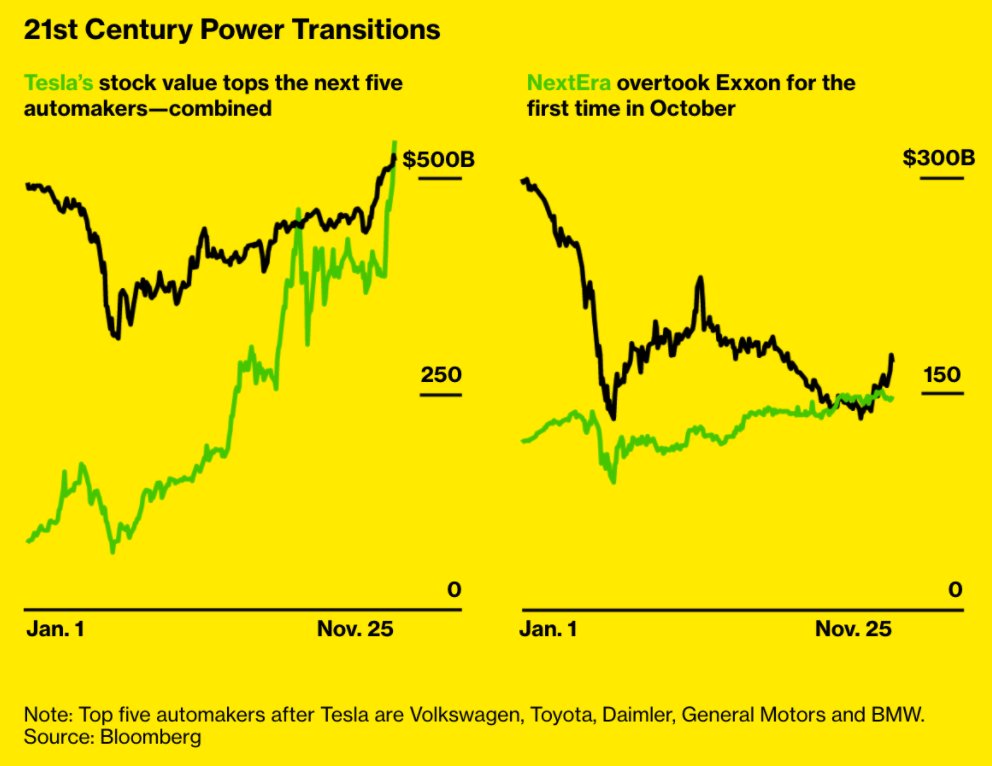

Tesla’s stock value now tops the next five automakers combined. NextEra, a mega-utility that focuses on wind and solar, overtook Exxon for the first time in October. When it comes to the future of oil demand, the market is speaking very clearly 10/ https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?srnd=premium&sref=Z0b6TmHW

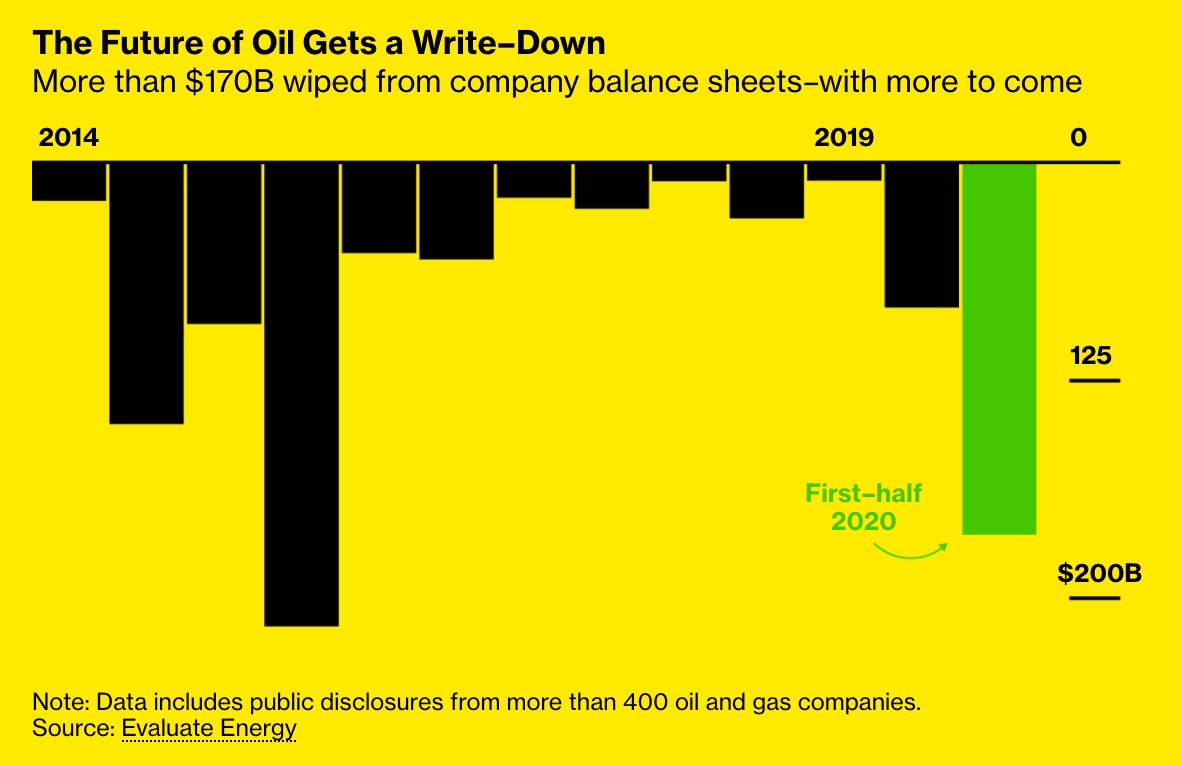

The oil industry wrote down more than $170B by July. For U.S. companies, it was equivalent to 18% of proven reserves—money wiped from books because they no longer believed in the value of their oil. And plenty more coming—Exxon just logged another $20B 11/

https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/

https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/

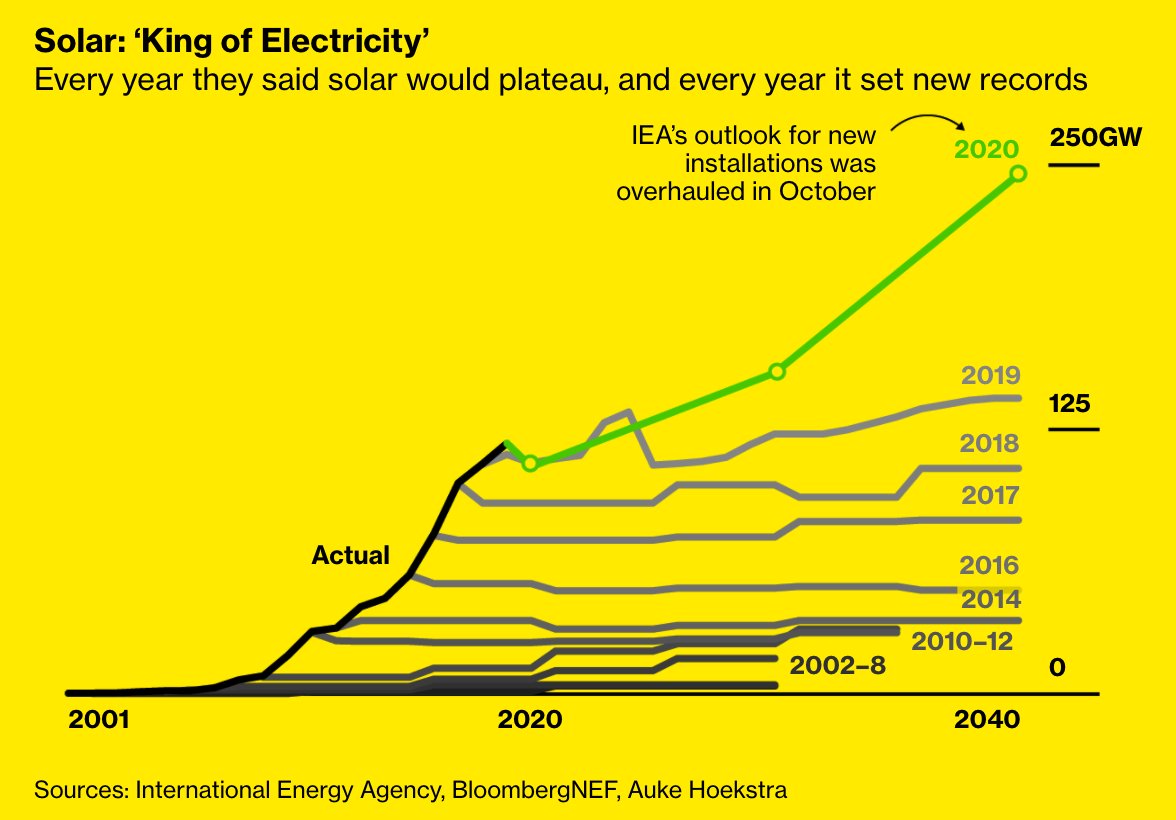

For the last century power and transport were distinct industries. Drillers vs miners, petrostates vs utilities. Oil majors watched what was happening to coal and insisted they were different. With EVs, oil is supplanted by the cheapest energy—solar 12/ https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/

IEA outlooks consistently underestimated solar. Every year, they expected installers to stop hiring. Every year, they didn’t. That's over. It now says “new king of electricity” will set records every year ahead (just as it did every year before 2020) 13/ https://www.bloomberg.com/graphics/2020-peak-oil-era-is-suddenly-upon-us/?sref=Z0b6TmHW

This is in some ways a follow up to one I did five years ago about how peak oil demand would cause the next oil crisis. It started a short video series I made called “Sooner Than You Think"—later made into an annual tech conference & Businessweek issue 14/ https://www.bloomberg.com/features/2016-ev-oil-crisis/

For that piece, I started by developing my own (very crude) model for oil displacement, because most oil folks wouldn’t even entertain that EVs could have a material impact on demand. It’s amazing how quickly the thinking has changed 15/ https://www.bloomberg.com/news/videos/2016-02-24/the-peak-oil-myth-and-the-rise-of-the-electric-car

Read on Twitter

Read on Twitter