Ethereum's Beacon Chain launched today with over $500M staked.

Here's what that actually means

Here's what that actually means

Side note: we'll be discussing this all in detail at tomorrow's event along with @BisonTrails and friends.

Don't miss it :) https://www.crowdcast.io/e/the-road-to-eth-2/register?utm_source=profile&utm_medium=profile_web&utm_campaign=profile

Don't miss it :) https://www.crowdcast.io/e/the-road-to-eth-2/register?utm_source=profile&utm_medium=profile_web&utm_campaign=profile

Ethereum 2.0 boils down to launching a new blockchain from scratch with a completely new consensus mechanism and architecture, all without disrupting Ethereum’s existing $100B+ cryptoeconomy.

The Beacon Chain is Ethereum's new blockchain.

Where Ethereum’s existing blockchain employs proof of work (PoW) consensus backed by a network of miners, the Beacon Chain employs proof of stake (PoS) consensus backed by a network of validators.

Where Ethereum’s existing blockchain employs proof of work (PoW) consensus backed by a network of miners, the Beacon Chain employs proof of stake (PoS) consensus backed by a network of validators.

Where proof of work miners help secure a network by running energy intensive, specialized hardware (ASICs), validators make an economic commitment in the form of 32 ETH and run software that validates new transactions.

If a validator performs adequately, mainly by remaining online and participating honestly in consensus, they are rewarded with newly issued ETH and eventually, transaction fees.

If they perform inadequately or maliciously, they receive reduced rewards and could even risk losing some or all of their stake via a slashing penalty.

Eventually, the Beacon Chain will serve as the central nervous system for the entire Ethereum network. However, upon launch the Beacon Chain’s primary purpose will just be to bootstrap the new PoS consensus mechanism.

In the meantime, Ethereum applications will continue to run uninterrupted on the original PoW chain.

Despite its limited functionality, the Beacon Chain comes with very real economic implications, as new ETH will be issued to PoS validators based on two variables.

Despite its limited functionality, the Beacon Chain comes with very real economic implications, as new ETH will be issued to PoS validators based on two variables.

1) a validator’s ability to remain online and active

2) the amount of ETH that’s locked in a special contract called the deposit contract.

2) the amount of ETH that’s locked in a special contract called the deposit contract.

What is the deposit contract?

It's a one-way bridge between Ethereum’s PoW chain and the Beacon Chain. Currently, there has been over 878,000 ETH (over $530M) staked from over 2,700 unique depositors who have opted to help bootstrap Ethereum’s proof of stake blockchain.

It's a one-way bridge between Ethereum’s PoW chain and the Beacon Chain. Currently, there has been over 878,000 ETH (over $530M) staked from over 2,700 unique depositors who have opted to help bootstrap Ethereum’s proof of stake blockchain.

When an aspiring staker makes a valid deposit of 32 ETH or greater, the Beacon Chain mints an equivalent amount of ETH on the new chain. Validators then start accruing ETH rewards in exchange for their services.

The main catch here is that the deposit contract is a one-way street. Once ETH is staked, that stake, along with the accrued rewards will be completely immobile until a later phase not anticipated until some time in 2022 (there are proposals that may move this timeline up)

As this lack of liquidity is undesirable for many, look for a host of protocols and service providers to introduce a variety of staking derivative solutions (i.e. loans collateralized by ETH locked in the deposit contract).

How much do validators make?

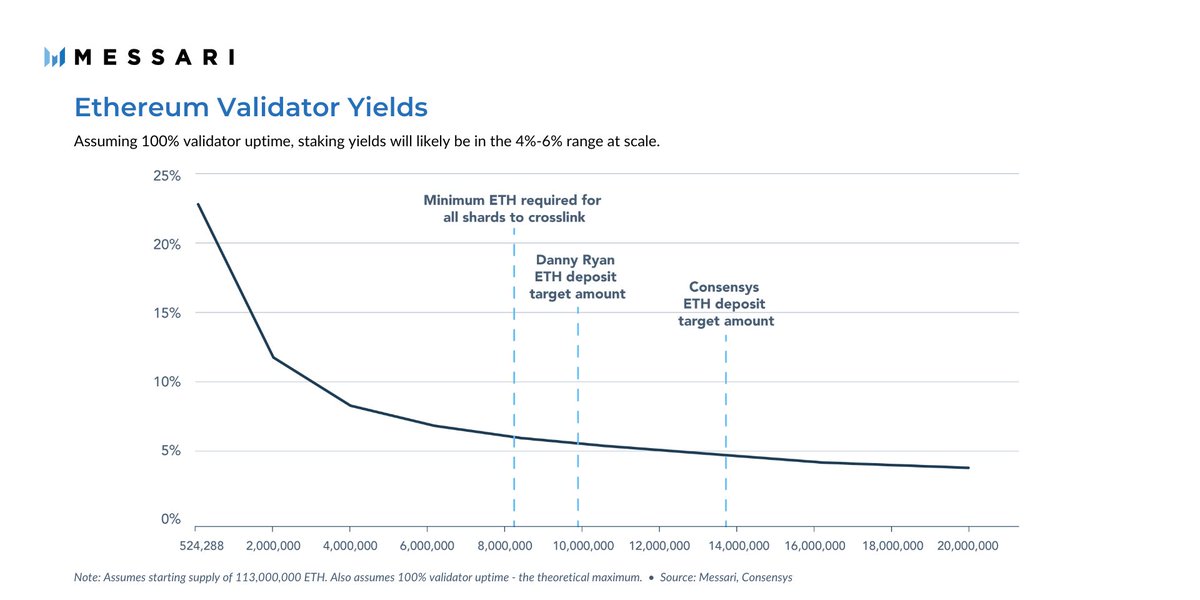

The amount of yield that individual validators receive will be based on the total amount of ETH staked. Basically, the rewards validators receive will go down as staking participation goes up.

The amount of yield that individual validators receive will be based on the total amount of ETH staked. Basically, the rewards validators receive will go down as staking participation goes up.

. @ConsenSys estimates that in order to match the current security of Ethereum’s PoW chain, just under 16 million ETH would need to be staked. At this point, validators would be earning a theoretical max of 4.4% per year (all of these figures assume 100% uptime).

More on what the introduction of PoS means for $ETH in the full report

Read it: http://bit.ly/3fTYJap

Read it: http://bit.ly/3fTYJap

Read on Twitter

Read on Twitter