My latest research @TheBlockRes (open for everyone to read).

A proposal to do nothing with Uniswap liquidity incentives — where I make the case for not extending $UNI rewards to liquidity providers.

Read here & highlights in thread (1/x) https://www.theblockcrypto.com/post/86082/uniswap-liquidity-incentives-proposal

(1/x) https://www.theblockcrypto.com/post/86082/uniswap-liquidity-incentives-proposal

A proposal to do nothing with Uniswap liquidity incentives — where I make the case for not extending $UNI rewards to liquidity providers.

Read here & highlights in thread

(1/x) https://www.theblockcrypto.com/post/86082/uniswap-liquidity-incentives-proposal

(1/x) https://www.theblockcrypto.com/post/86082/uniswap-liquidity-incentives-proposal

In case you're not aware, Uniswap's liquidity mining rewards were 10M $UNI per month & ended on Nov 18th.

There's a proposal in the community to halve the rewards, but continue extending them.

At current market price, ~$18M per month subsidy to LPs. Still substantial.

(2/x)

There's a proposal in the community to halve the rewards, but continue extending them.

At current market price, ~$18M per month subsidy to LPs. Still substantial.

(2/x)

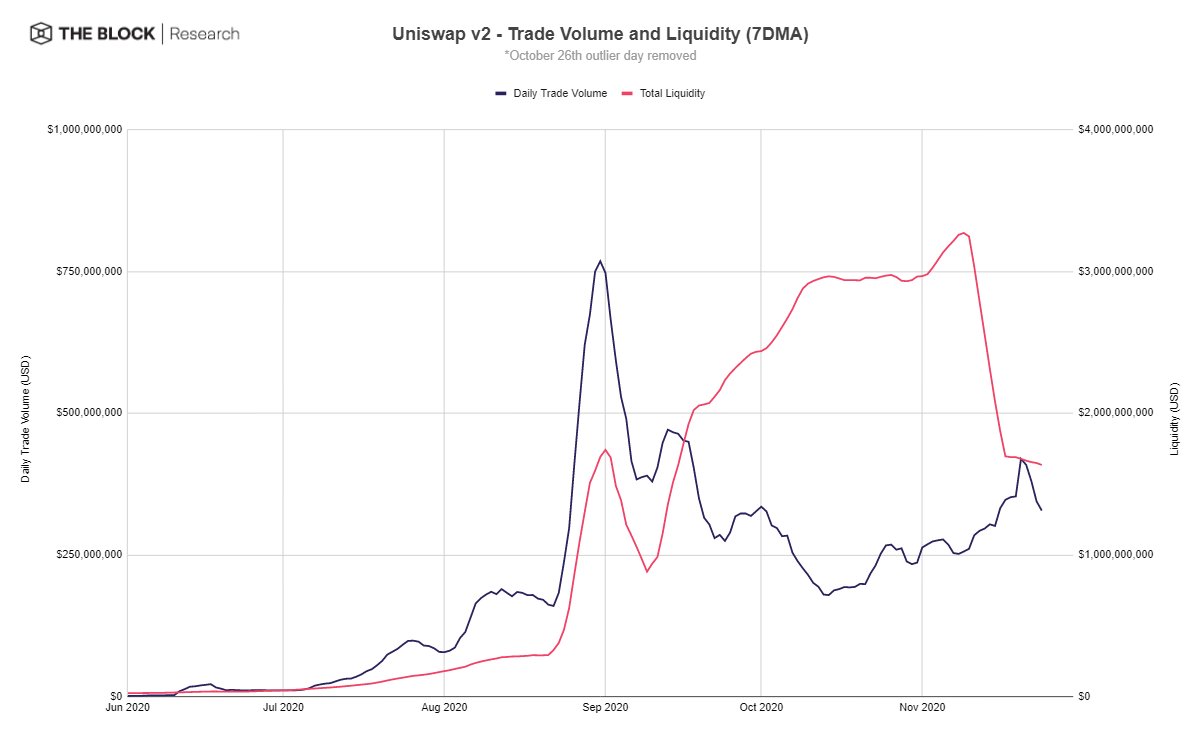

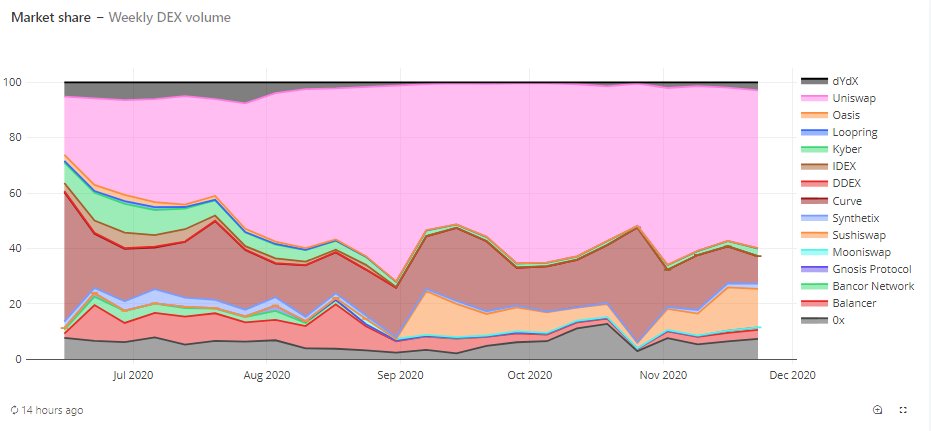

First, Uniswap's trade volume haven't been impacted by ~$36M per month $UNI rewards.

Uniswap's market share has stayed constant both before & after.

(3/x)

Uniswap's market share has stayed constant both before & after.

(3/x)

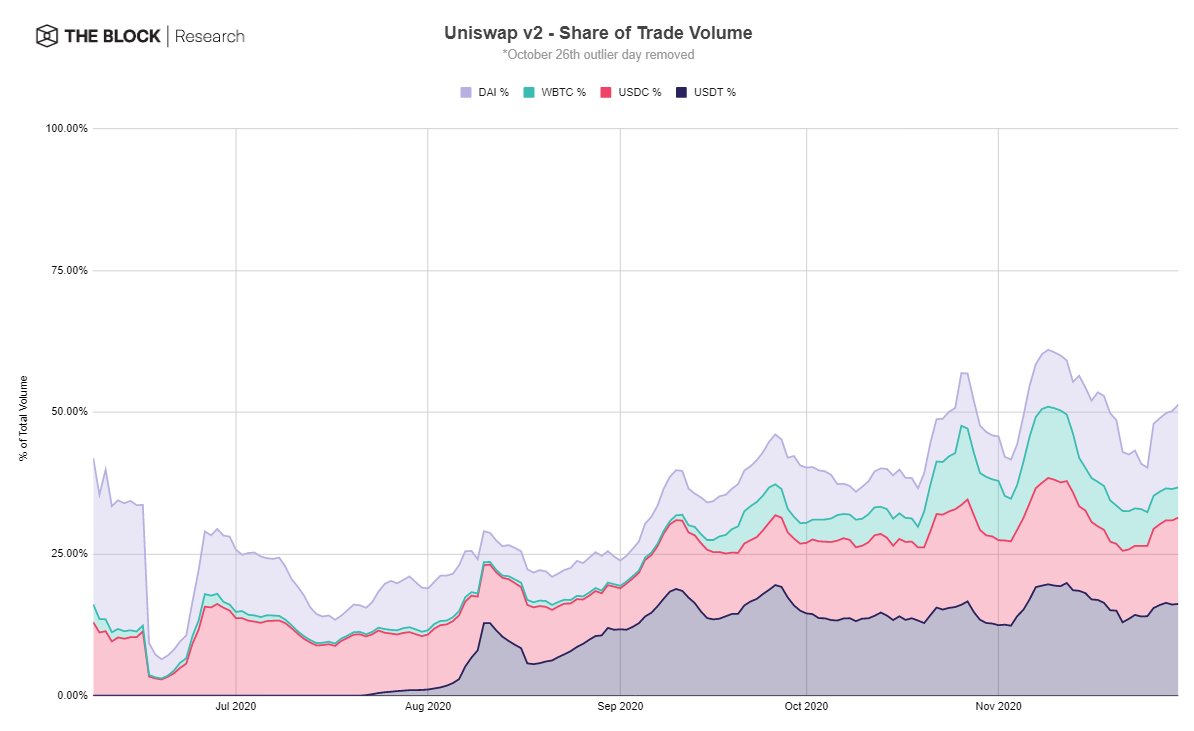

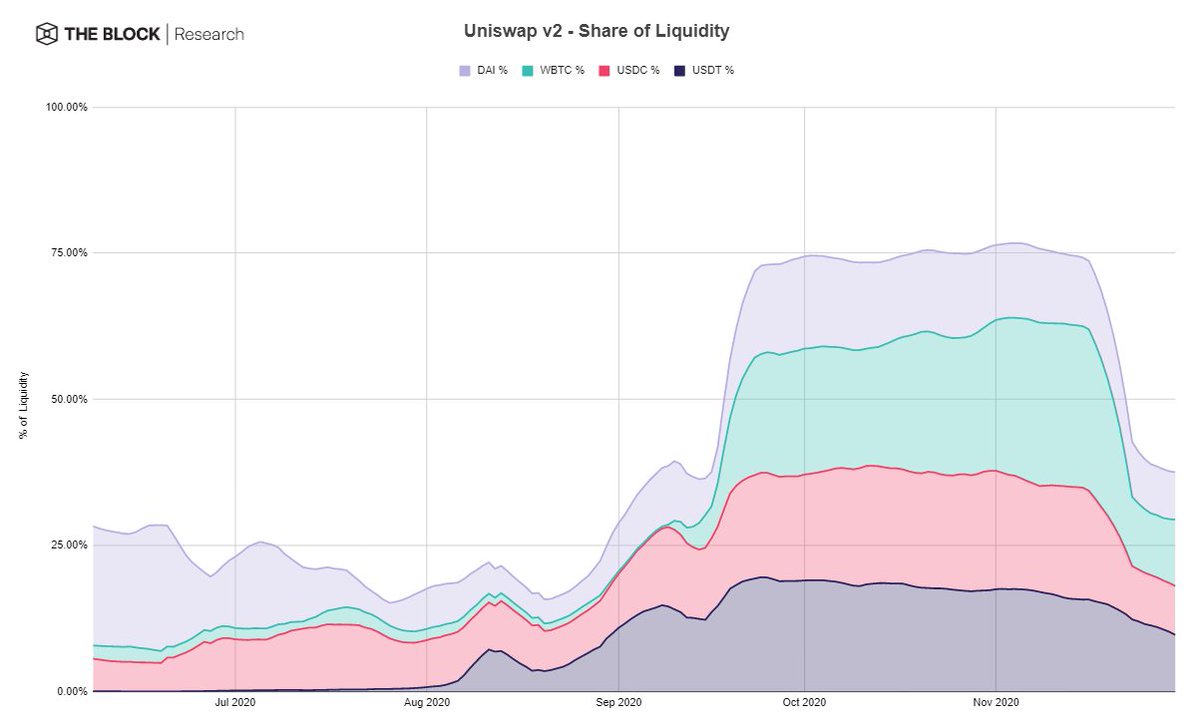

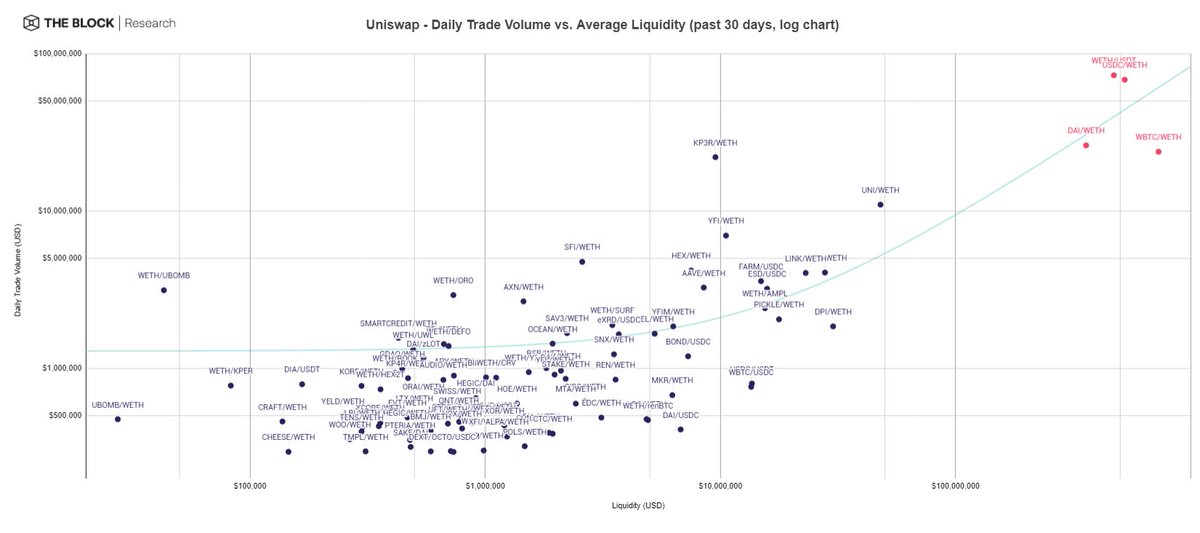

Lots of more data like this in the piece but e.g.:

Share Uniswap's of trade volume from subsidized pairs grew only slightly. However, liquidity on those pair obviously increased massively.

== A minor reward for a massive subsidy.

(4/x)

Share Uniswap's of trade volume from subsidized pairs grew only slightly. However, liquidity on those pair obviously increased massively.

== A minor reward for a massive subsidy.

(4/x)

More importantly, rewards don't produce defensible NFX.

Uniswap treasury could pay out $1M per month in grants & spending would still be cut down by >90%.

Additionally, we don't even know what the protocol will look like when v3 launches.

(5/x)

Uniswap treasury could pay out $1M per month in grants & spending would still be cut down by >90%.

Additionally, we don't even know what the protocol will look like when v3 launches.

(5/x)

Counterargument is that $UNI rewards decentralizes the protocol by distributing to users.

==> DeFi community is extremely small group of enthusiasts. Even this goal is better served waiting for more mainstream adoption.

(6/x)

==> DeFi community is extremely small group of enthusiasts. Even this goal is better served waiting for more mainstream adoption.

(6/x)

Read on Twitter

Read on Twitter