Once the most valuable DeFi token, MKR has now dropped to #4

One reason is a structural issue that @DegenSpartan has discussed- its 3-body governance problem

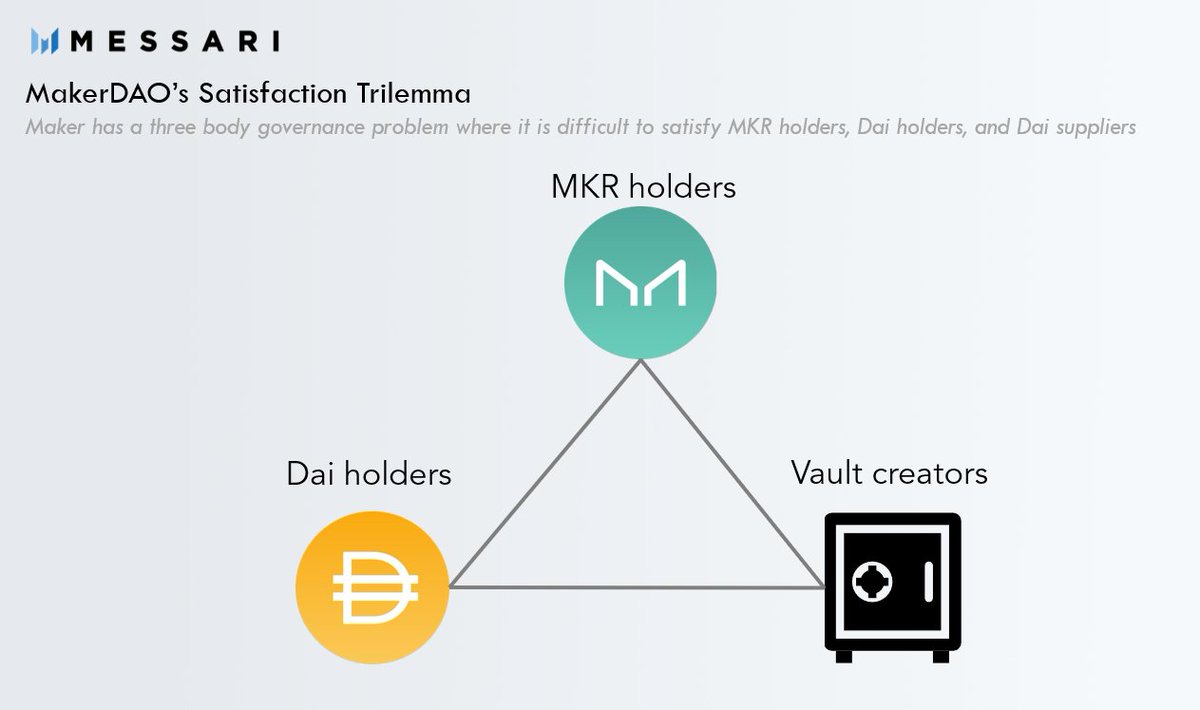

To put another way, there’s a “Satisfaction Trilemma” where it’s impossible to keep all stakeholder groups happy

1/

One reason is a structural issue that @DegenSpartan has discussed- its 3-body governance problem

To put another way, there’s a “Satisfaction Trilemma” where it’s impossible to keep all stakeholder groups happy

1/

To start there is the Dai user

Their main priority is that the value of their Dai remains pegged at $1

If the price rises they want more collateral types, higher debt ceilings, and higher stability fees to restore the peg

The same vice versa. https://messari.io/chart/dai-peg--43BCC4FB

Their main priority is that the value of their Dai remains pegged at $1

If the price rises they want more collateral types, higher debt ceilings, and higher stability fees to restore the peg

The same vice versa. https://messari.io/chart/dai-peg--43BCC4FB

Then there is the Dai borrower (vault creator)

They are the vehicles of credit creation. They have assets and they want credit

Their chief concern is that the price of their credit (aka stability fee) doesn’t get too high

They are the vehicles of credit creation. They have assets and they want credit

Their chief concern is that the price of their credit (aka stability fee) doesn’t get too high

Finally there’s the MKR holder

They are the equity holders that govern and backstop the system, and ideally benefit from the protocol’s growth

They want to maximize fees paid (through loan growth and stability fees) while minimizing the possibility of dilution

They are the equity holders that govern and backstop the system, and ideally benefit from the protocol’s growth

They want to maximize fees paid (through loan growth and stability fees) while minimizing the possibility of dilution

All three of these groups play pivotal roles

Without 1 you have worthless dai

Without 2 you have no dai

Without 3 you have a stagnant protocol

Without 1 you have worthless dai

Without 2 you have no dai

Without 3 you have a stagnant protocol

The issue is you can’t satisfy all 3 groups

If you want Dai to scale, you can lower SF to incentivize debt creation

But eventually, MKR holders will want compensation

If they raise SF to juice fees then it might cause Dai to break north of the peg

If you want Dai to scale, you can lower SF to incentivize debt creation

But eventually, MKR holders will want compensation

If they raise SF to juice fees then it might cause Dai to break north of the peg

This dynamic exists across a multitude of parameter decisions

It results in a persistent tension that inhibits Dai from staying at $1, Dai from scaling further, and MKR from accruing value simultaneously

It results in a persistent tension that inhibits Dai from staying at $1, Dai from scaling further, and MKR from accruing value simultaneously

This isn’t to say Maker can’t succeed

Reaching $1b is nothing short of a monumental achievement

We’ve even written at length about a path forward

cc: @RyanWatkins_ https://messari.io/article/an-opportunity-for-maker

Reaching $1b is nothing short of a monumental achievement

We’ve even written at length about a path forward

cc: @RyanWatkins_ https://messari.io/article/an-opportunity-for-maker

But carefully balancing the needs of all three stakeholders will be pivotal going forward

Failing to satisfy any one group could put the whole system at risk

And crypto loves looking at problems through three-sided infographics

Failing to satisfy any one group could put the whole system at risk

And crypto loves looking at problems through three-sided infographics

Read on Twitter

Read on Twitter