In our new paper @LHSummers and I argue that low interest rates present a challenge for monetary policy and financial stability but an opportunity for fiscal policy--if we choose to seize it. A thread summarizing the paper. https://www.piie.com/system/files/documents/furman-summers2020-12-01paper.pdf

We all know interest rates have fallen. Many theories for why, what matters is do they stay low. Market expectations going forward are stunning:

--72% FFR < 0.25 in 2025

--1.4% FFR expected in 2030

--2% ten-year Treasury rate in 2030

--72% FFR < 0.25 in 2025

--1.4% FFR expected in 2030

--2% ten-year Treasury rate in 2030

This raises 3 concerns:

1. Less scope for monetary policy in recessions

2. Increased financial stability risks (e.g., investors "reach for yield")

3. Maybe even demand shortfalls in normal times.

1. Less scope for monetary policy in recessions

2. Increased financial stability risks (e.g., investors "reach for yield")

3. Maybe even demand shortfalls in normal times.

And creates 3 opportunities:

1. More active use of fiscal policy in combatting recessions

2. More sustainable debt given low debt relative to present value of GDP and debt service relative to current GDP.

3. The scope and need for public investments has expanded.

1. More active use of fiscal policy in combatting recessions

2. More sustainable debt given low debt relative to present value of GDP and debt service relative to current GDP.

3. The scope and need for public investments has expanded.

I did a recent thread that focused on Opportunity #2 (more sustainable debt) as part of my @MarkusEconomist talk, you can find it here. https://twitter.com/jasonfurman/status/1329817571332337684?s=20

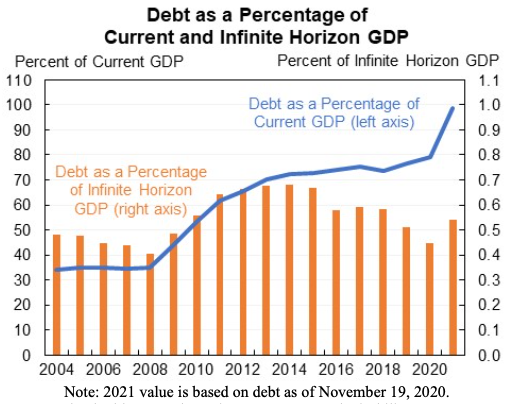

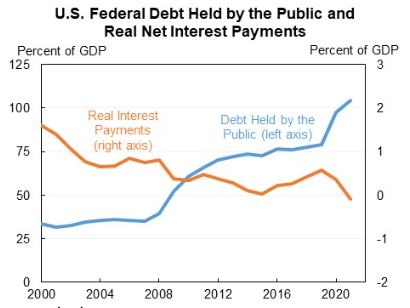

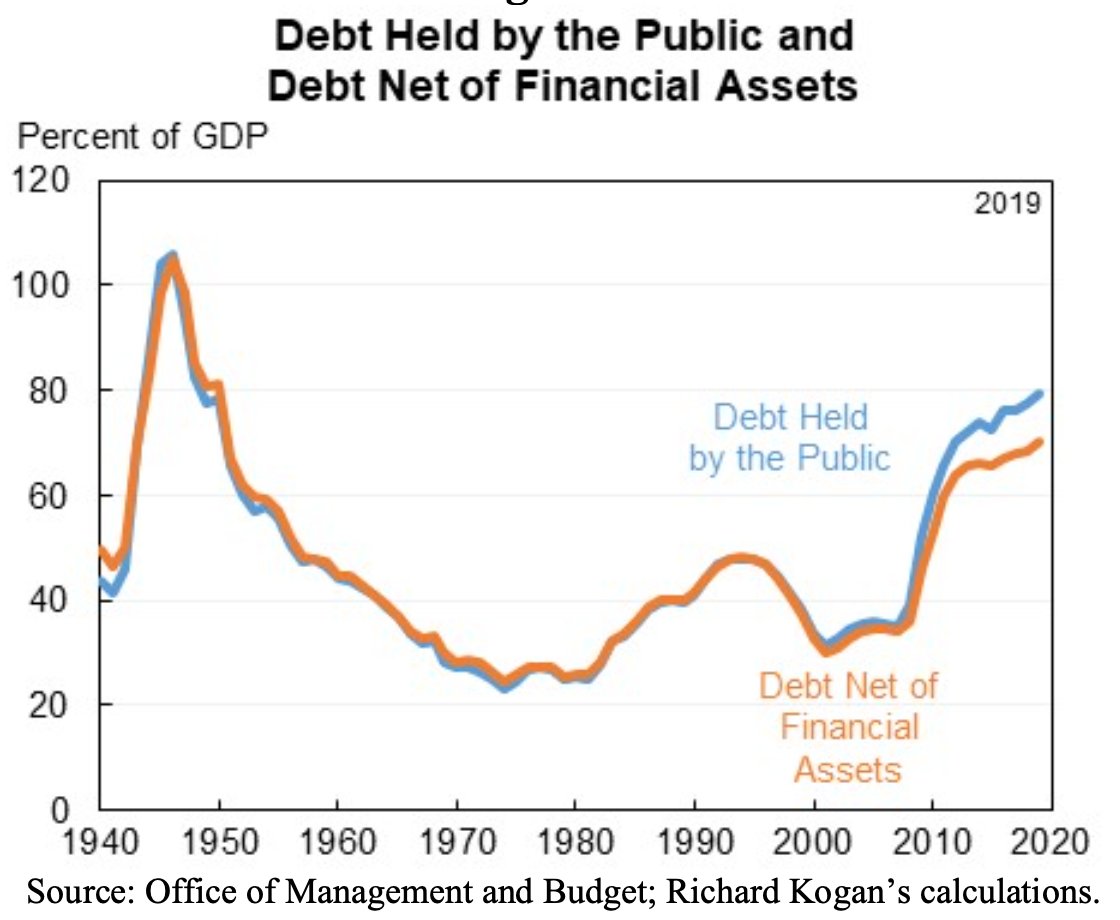

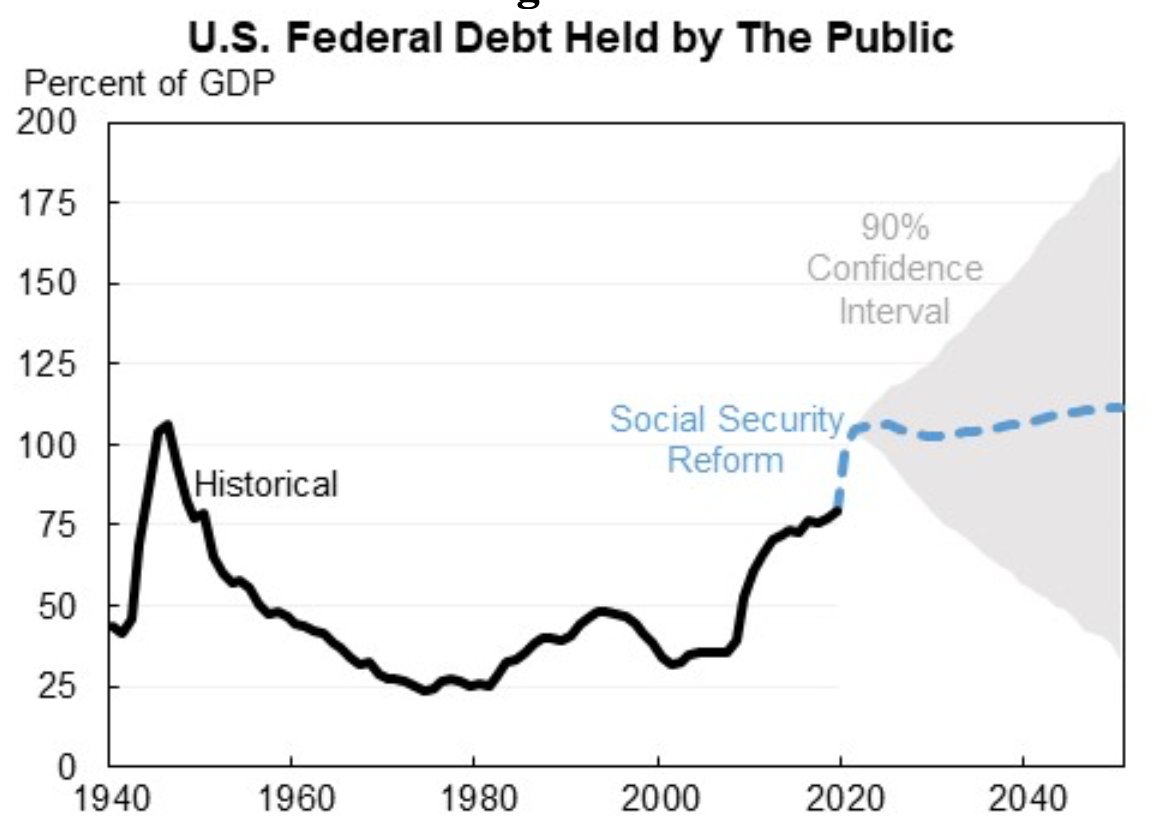

In brief, the debt-to-GDP has nearly tripled since 2000. But debt relative to the present value of future GDP has been stable/falling (because when interest rates down present value goes up). And real debt service has also fallen relative to GDP.

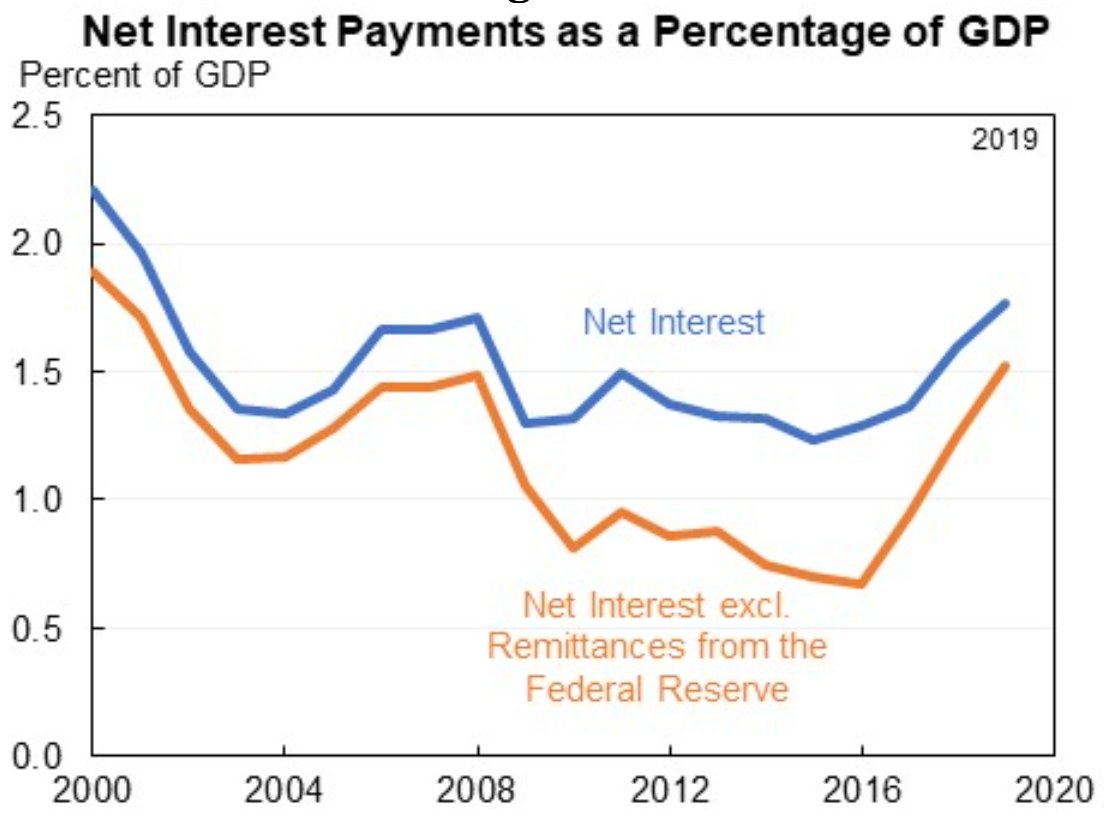

Also, I can't help myself but make a technical aside: the standard debt/interest measures themselves overstate the issue because debt should exclude the government's growing financial assets and interest should exclude the fed's increased remittances.

And lots and lots and lots of uncertainty around this. We could end up with among the lowest postwar debt or nearly 200% of GDP. Uncertainty is symmetric and cost of waiting to respond appropriately relatively small (plus some cost of premature, irreversible responses).

Going forward the salient context is that interest rates are dangerously low, debt is projected to be stable, real debt service is projected to be low. More fiscal expansion needed now and in the future for growth and financial stability.

@LHSummers and I call for a new guidepost for fiscal policy: ensuring that real debt service is not projected to rise rapidly or exceed a number that is about 2 percent of GDP over the next decade.

We also propose three guidelines consistent with this objective and guidepost:

1. Emergency spending should not be paid for, defined broadly.

2. Long-term spending should be paid for, with broad exceptions.

3. The composition of government should improve.

1. Emergency spending should not be paid for, defined broadly.

2. Long-term spending should be paid for, with broad exceptions.

3. The composition of government should improve.

You can tune in to the Hutchins Center and @PIIE event from 3-5pm ET today (and presumably this link will take you to a recording if you get this after the event is done). https://www.piie.com/events/fiscal-policy-advice-joe-biden-and-congress

Read on Twitter

Read on Twitter