Mini-thread on this story about pawnshops, the idea for which was born when someone in the industry mentioned to me off-hand how pawn was really struggling during the pandemic, and I was like ... what. https://www.vox.com/the-goods/21611583/pawn-shop-covid-19-economy

Pawnshops are a loan business more than they are sales — despite what you see in the movies — and in the spring, loans fell as much as 40%. Thanks to the CARES Act and a drop in discretionary spending, people didn't need to pawn their stuff and were able to pay off pawn loans.

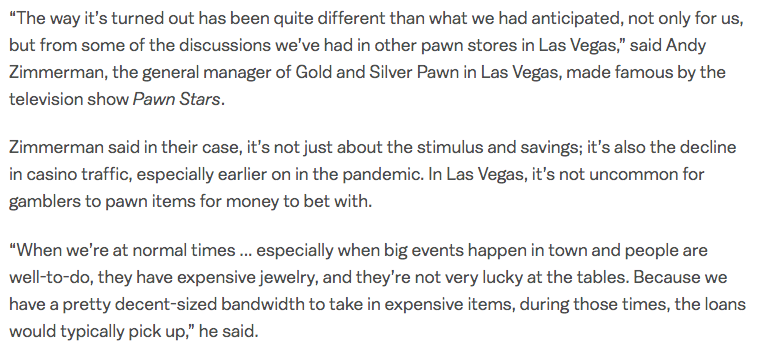

High-end and low-end pawnbrokers experienced the same thing, described people finally paying off loans they'd had out for years. Even the Pawn Stars guys had a hard time.

At the same time, pawnbrokers saw people buying up a ton of their inventory — electronics for at-home entertainment and education, guitars, tools. They also sold a ton of guns and gold, which people tend to buy when they panic. One broker said his gun sales were up 500%.

But as the pandemic continues and many in the economy continue to struggle, pawnbrokers say people are starting to come back in to pawn their stuff once again because they need to borrow money.

For people with bad credit or without access to a bank, there aren't a ton of good credit options. Worst-case scenario with a pawnbroker, you lose your ring — nobody dings your credit. Financially underserved consumers lose billions in fees and interest every year.

Pawnshops are an outgrowth of capitalism. If people had more money, they might not exist. One broker described a woman in her 70s who comes in every month to pawn a piece of jewelry to get her to her next Social Security check. Is it the best option? No. But who's to blame here?

Anyway, my full story on pawn in the pandemic and how the industry serves as an under-the-radar microcosm of what's going on in the economy: https://www.vox.com/the-goods/21611583/pawn-shop-covid-19-economy

Read on Twitter

Read on Twitter