1/19

Dear ETH Friends,

If you are concerned about the outlandish claim that "ETH2.0 Staking is for sure a taxable event" then you'll want to read this thread

Dear ETH Friends,

If you are concerned about the outlandish claim that "ETH2.0 Staking is for sure a taxable event" then you'll want to read this thread

2/19

First, note that this isn't tax advice. There is no guidance on this specific case, so no one can be 100% sure, and state, federal and international treatment may differ.

But, we can take guidance from similar cases that we've seen in the past.

First, note that this isn't tax advice. There is no guidance on this specific case, so no one can be 100% sure, and state, federal and international treatment may differ.

But, we can take guidance from similar cases that we've seen in the past.

3/19

Second, make sure you consider the difference between natively depositing ETH into the ETH2 launchpad contract and running your own validator, vs depositing via an exchange.

Second, make sure you consider the difference between natively depositing ETH into the ETH2 launchpad contract and running your own validator, vs depositing via an exchange.

4/19

If you deposit via an exchange, it is a bit dicey on taxation. It ultimately depends on how the exchange represents that.

If they just show you that you have a locked stake balance? You're likely fine.

If you deposit via an exchange, it is a bit dicey on taxation. It ultimately depends on how the exchange represents that.

If they just show you that you have a locked stake balance? You're likely fine.

5/19

If they have a tradable market for that locked balance, but you can't withdraw some token. Then it's a grey area.

If its tokenized? It's quite possibly a taxable event. This is an open question and depends on how material different it behaves from actual ETH.

If they have a tradable market for that locked balance, but you can't withdraw some token. Then it's a grey area.

If its tokenized? It's quite possibly a taxable event. This is an open question and depends on how material different it behaves from actual ETH.

6/19

For example, swapping ETH<>wETH does not create a taxable event as they are materially the same.

Even though we have ETH/WETH markets with a small delta, they are mostly the same.

For example, swapping ETH<>wETH does not create a taxable event as they are materially the same.

Even though we have ETH/WETH markets with a small delta, they are mostly the same.

7/19

Another example is the swap from USD to USDT or USDC - it isn't taxable when swapping at a 1-1 rate.

However, if you traded it instead and received a profit (1 USDT for $0.99 USD) then the tax exists on the capital gain/loss of $0.01

Another example is the swap from USD to USDT or USDC - it isn't taxable when swapping at a 1-1 rate.

However, if you traded it instead and received a profit (1 USDT for $0.99 USD) then the tax exists on the capital gain/loss of $0.01

8/19

Now, if you deposit it yourself and run your own validator.

This is akin to an update or software migration.

The American Institute of CPAs (AICPA) had released a 2018 guidance on Virtual Currencies (notice 2014-21)

Now, if you deposit it yourself and run your own validator.

This is akin to an update or software migration.

The American Institute of CPAs (AICPA) had released a 2018 guidance on Virtual Currencies (notice 2014-21)

9/19

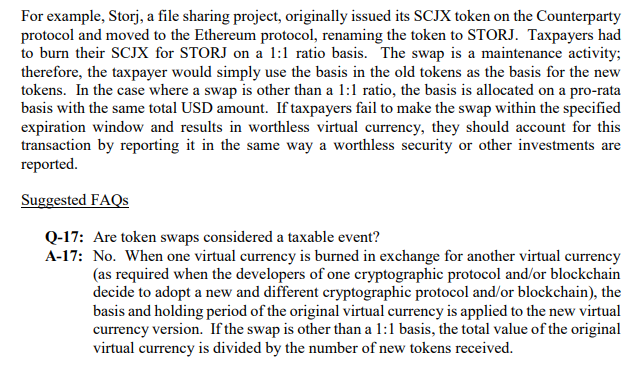

In section 6(d) of that guidance they noted that token swaps on a 1:1 ratio basis are not a taxable event.

Token swaps on a non-1:1 ratio didn't create a taxable event but would adjust one's cost basis for figuring out later capital gains/losses.

In section 6(d) of that guidance they noted that token swaps on a 1:1 ratio basis are not a taxable event.

Token swaps on a non-1:1 ratio didn't create a taxable event but would adjust one's cost basis for figuring out later capital gains/losses.

10/19

Since 2017 we've had a number of migrations/swaps including:

EOS

KIN (3x)

BNB

SAI -> DAI

DAI-CSAI

SJCX->STORJ

Shadow Cash - Particl

And in that time the AICPA has held their stance on the matter of swaps not being a taxable event.

Since 2017 we've had a number of migrations/swaps including:

EOS

KIN (3x)

BNB

SAI -> DAI

DAI-CSAI

SJCX->STORJ

Shadow Cash - Particl

And in that time the AICPA has held their stance on the matter of swaps not being a taxable event.

11/19

Also in that time, there has been no contrary guidance from the IRS.

And that brings us to the most important point about taxes:

It's not illegal to get your taxes wrong.

It's only illegal if you get it wrong on purpose.

Also in that time, there has been no contrary guidance from the IRS.

And that brings us to the most important point about taxes:

It's not illegal to get your taxes wrong.

It's only illegal if you get it wrong on purpose.

12/19

Taxes are confusing and guidance is unclear.

You should consult a local tax professional who has knowledge of crypto. The AICPA has volumes of books on the topic and can likely direct you.

Taxes are confusing and guidance is unclear.

You should consult a local tax professional who has knowledge of crypto. The AICPA has volumes of books on the topic and can likely direct you.

13/19

But, if you use the best knowledge at the time, document things, consult professionals and the conclusion is that it *isn't* a taxable event - then if in the future the IRS gives clear guidance that it *IS* taxable there isn't a criminal penalty. You just pay the tax.

But, if you use the best knowledge at the time, document things, consult professionals and the conclusion is that it *isn't* a taxable event - then if in the future the IRS gives clear guidance that it *IS* taxable there isn't a criminal penalty. You just pay the tax.

14/19

Not to mention with crypto, the IRS does not apply the "Wash Sale Rules" so tax lost harvesting is a possibility.

What does that mean?

Not to mention with crypto, the IRS does not apply the "Wash Sale Rules" so tax lost harvesting is a possibility.

What does that mean?

15/19

If ETH2 were to trigger a taxable event and have tradable markets, you would be within legal rights to optimize your taxes through taking a capital loss& buying it back right after the tax season

Its why US crypto markets have large volume but not high vol late dec

If ETH2 were to trigger a taxable event and have tradable markets, you would be within legal rights to optimize your taxes through taking a capital loss& buying it back right after the tax season

Its why US crypto markets have large volume but not high vol late dec

16/19

Of course speak to a tax accountant if you plan to do something like that. Remember:

Tax optimization = legal.

Tax avoidance =/= legal.

It can be a fine line.

Of course speak to a tax accountant if you plan to do something like that. Remember:

Tax optimization = legal.

Tax avoidance =/= legal.

It can be a fine line.

17/19

But, the fear mongering, mostly from maxi's is unfounded.

(Why would anyone think BTC holders are experts on tokens anyway, how many swaps have they been through?)

But, the fear mongering, mostly from maxi's is unfounded.

(Why would anyone think BTC holders are experts on tokens anyway, how many swaps have they been through?)

18/19

All you need to do is follow the best guidance you can find at the time and make honest best efforts in your reporting.

Talk to a local tax expert.

It's likely direct staking is fine.

It's possible exchange assets may need tax loss harvesting to optimize.

All you need to do is follow the best guidance you can find at the time and make honest best efforts in your reporting.

Talk to a local tax expert.

It's likely direct staking is fine.

It's possible exchange assets may need tax loss harvesting to optimize.

19/19

But, in the end, even if you did create a taxable event, you'd be paying capital gains on the profit between ETH and ETH2.

ETH2 likely won't be at a premium.

So that taxable event, if it exists, is possible a capital loss, or tax on a few dollars.

But, in the end, even if you did create a taxable event, you'd be paying capital gains on the profit between ETH and ETH2.

ETH2 likely won't be at a premium.

So that taxable event, if it exists, is possible a capital loss, or tax on a few dollars.

ps - not financial, legal or tax advice.

Just a recap of existing measures and guidance.

Consult a professional.

Just a recap of existing measures and guidance.

Consult a professional.

Read on Twitter

Read on Twitter