$BOX reports earnings today, and while everyone thinks they're undervalued and a potential acquisition target, I think they will continue struggling with churn in the next year or so. Here's why: (1/5)

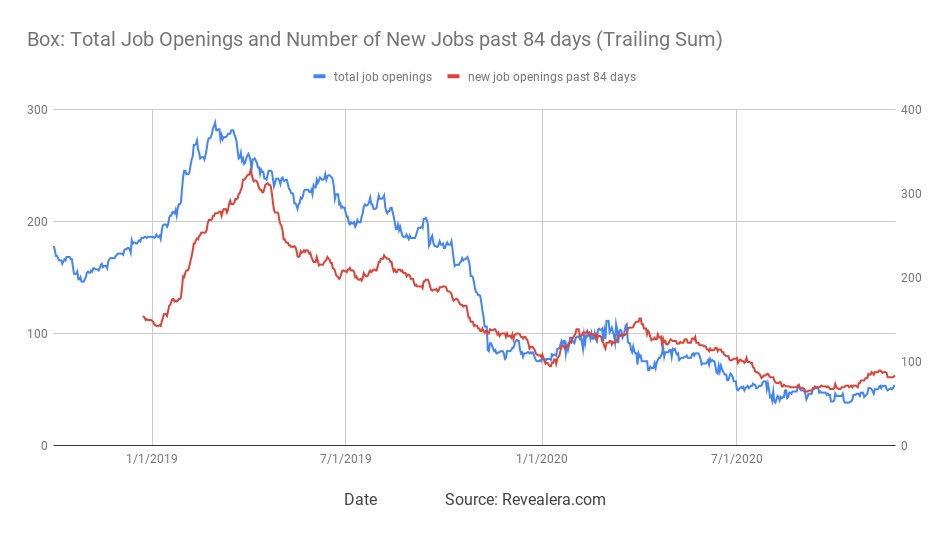

First, total job openings in $BOX are down 36% YoY and have been trending down all year. In fact, total job openings have been on a decline shortly after Starboard took a 7.5% stake in $BOX last fall. (2/5)

There was a CIO spending survey circulating around earlier this year. 10% of CIOs said they were planning to reduce spending by > 10% on $BOX this year. This was the 2nd worst among all technology vendors. Conversely, companies planned to spend more with $MSFT (3/5)

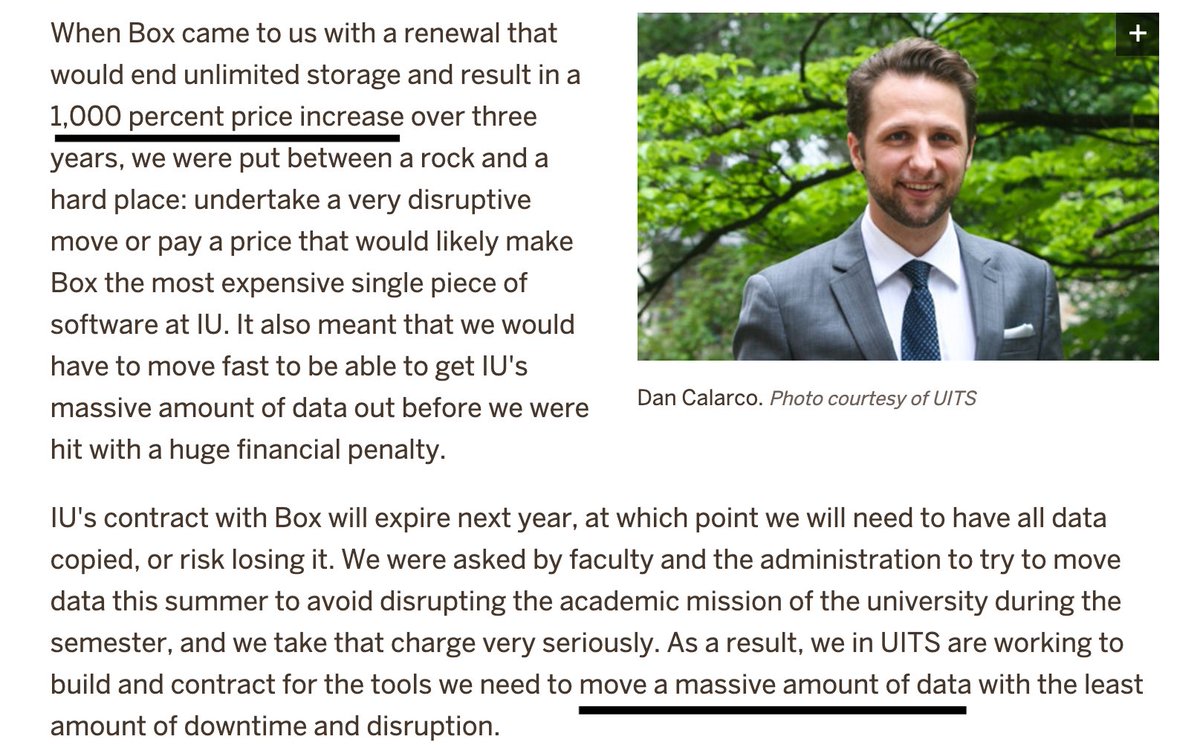

Why would companies want to spend less on $BOX? The reason is b/c $BOX is dramatically increasing their prices for some enterprises. Take a look at the notes sent out by these 2 universities on their plans to cancel Box. Note how $MSFT is mentioned as a replacement. (4/5)

In conclusion, I see many similarities between $BOX and $WORK. Though both are WFH tools, Covid has forced many companies to scrutinize their budget, and move to single platforms rather than 'best in class' tools to save money. (5/5)

Read on Twitter

Read on Twitter