Did Exxon Mobil just capitulate to peak oil demand?

Looking at their writedown and reduced spending plans they announced Monday, it certainly looks that way:

https://www.bloomberg.com/opinion/articles/2020-12-01/exxon-mobil-capitulates-to-peak-oil-demand-with-huge-writedown #oott

Looking at their writedown and reduced spending plans they announced Monday, it certainly looks that way:

https://www.bloomberg.com/opinion/articles/2020-12-01/exxon-mobil-capitulates-to-peak-oil-demand-with-huge-writedown #oott

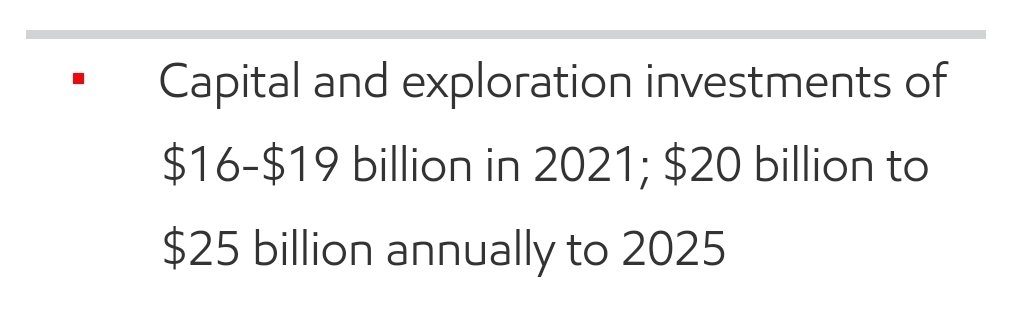

The key thing is their capital spending plans. These will by $16bn-$19bn in 2021, then $20bn-$25bn in each of the four years after.

https://corporate.exxonmobil.com/News/Newsroom/News-releases/2020/1130_ExxonMobil-to-prioritize-capital-investments-on-high-value-assets

https://corporate.exxonmobil.com/News/Newsroom/News-releases/2020/1130_ExxonMobil-to-prioritize-capital-investments-on-high-value-assets

That still sounds like a lot of money, but Exxon is a very big company and you need to also look at how fast its existing investments are wearing out.

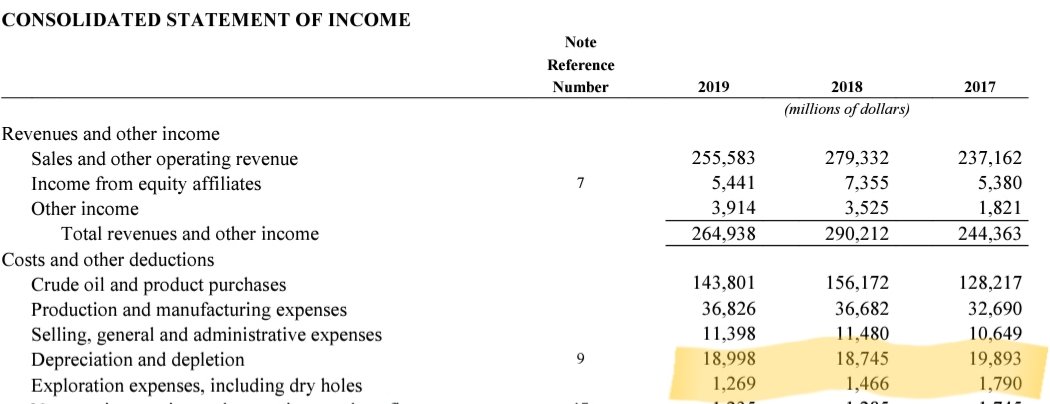

Depreciation, depletion, amortization and exploration spending of late is typically roughly $20bn, year in, year out.

Depreciation, depletion, amortization and exploration spending of late is typically roughly $20bn, year in, year out.

You need to spend that much just as maintenance capex to keep up with the decline of your existing assets.

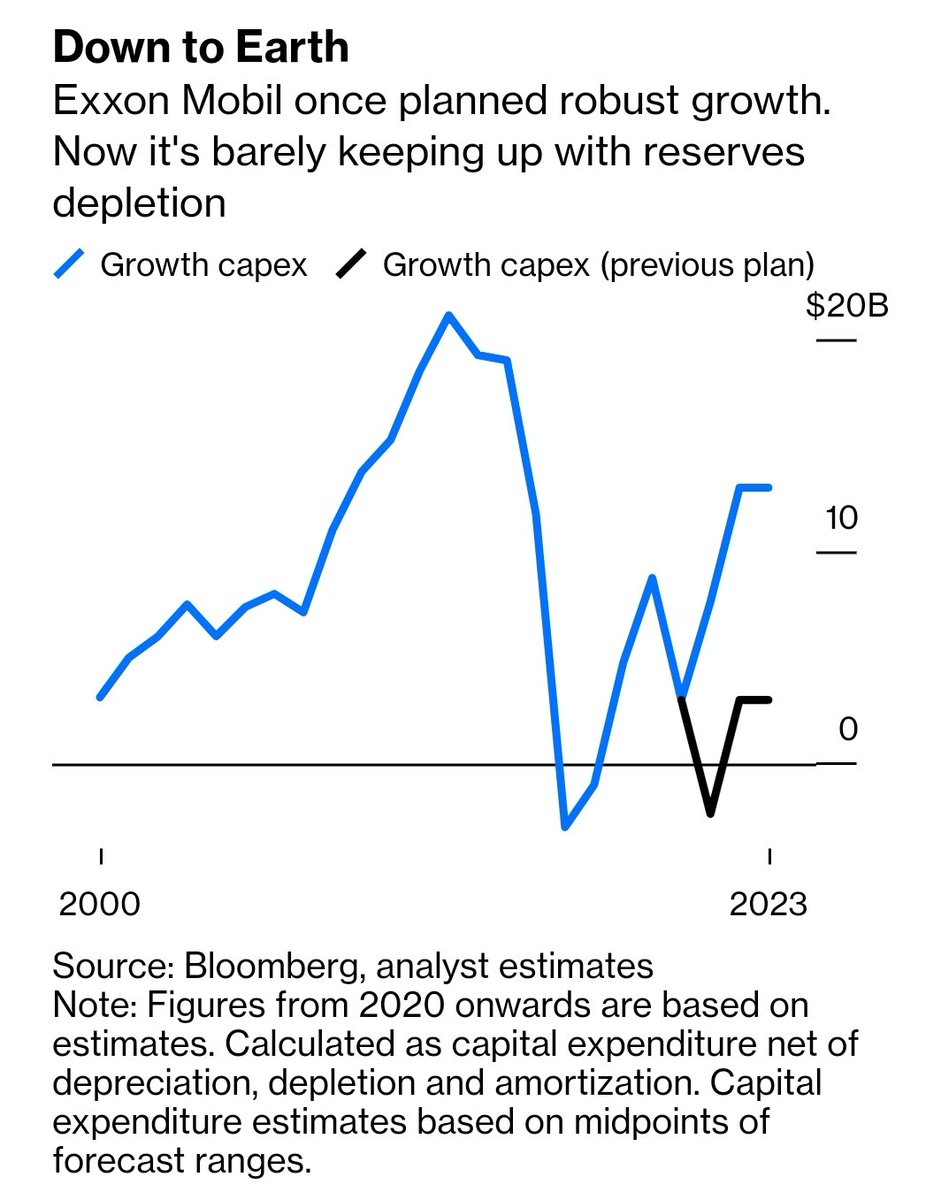

So Exxon's growth capex — its bet on rising oil demand, essentially — is, up to 2025, at most $5bn a year. At least, it's nada.

So Exxon's growth capex — its bet on rising oil demand, essentially — is, up to 2025, at most $5bn a year. At least, it's nada.

Consider that in the context of Exxon Mobil's usual rhetoric and you see how significant it is.

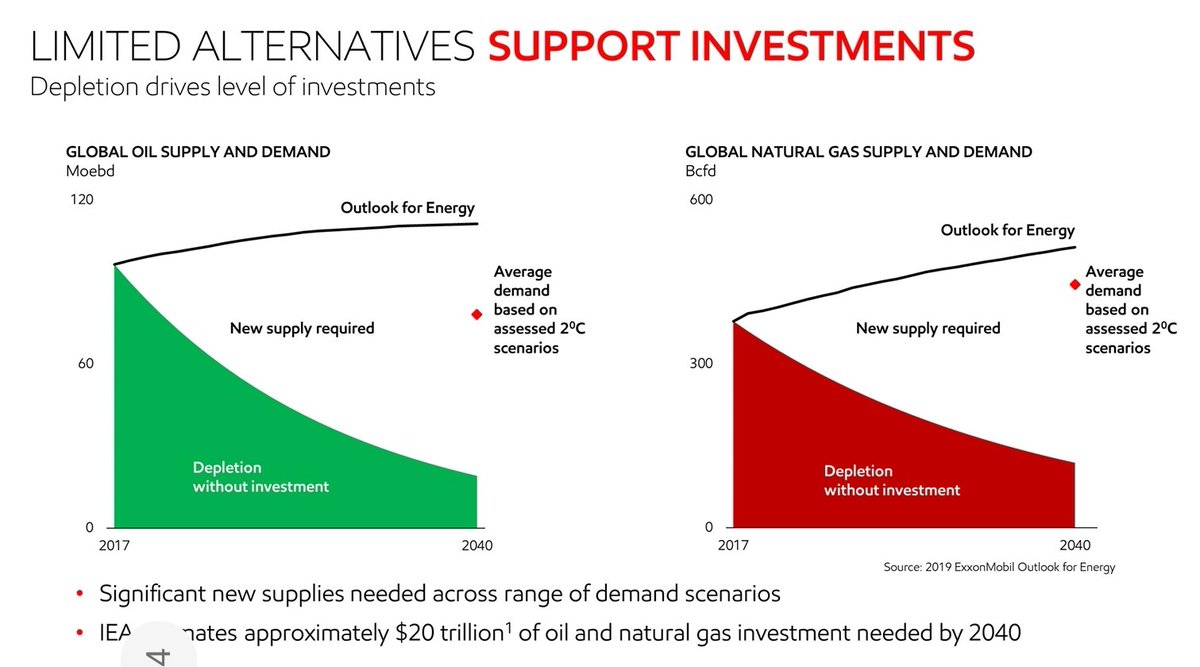

New oil supplies need to grow by 8% and gas by 6% a year to keep up with demand, CEO Darren Woods said in March. The world needs supply growth!

New oil supplies need to grow by 8% and gas by 6% a year to keep up with demand, CEO Darren Woods said in March. The world needs supply growth!

If other companies aren't investing at the pace needed to achieve that, then Exxon Mobil's job is to spend when others are cutting back and win the future by investing counter-cyclically.

Or at least, that's how Woods puts it.

Or at least, that's how Woods puts it.

By cutting $10bn a year from its capex plans, Exxon Mobil is either committing to a declining oil market share or admitting that demand out to 2025 has peaked.

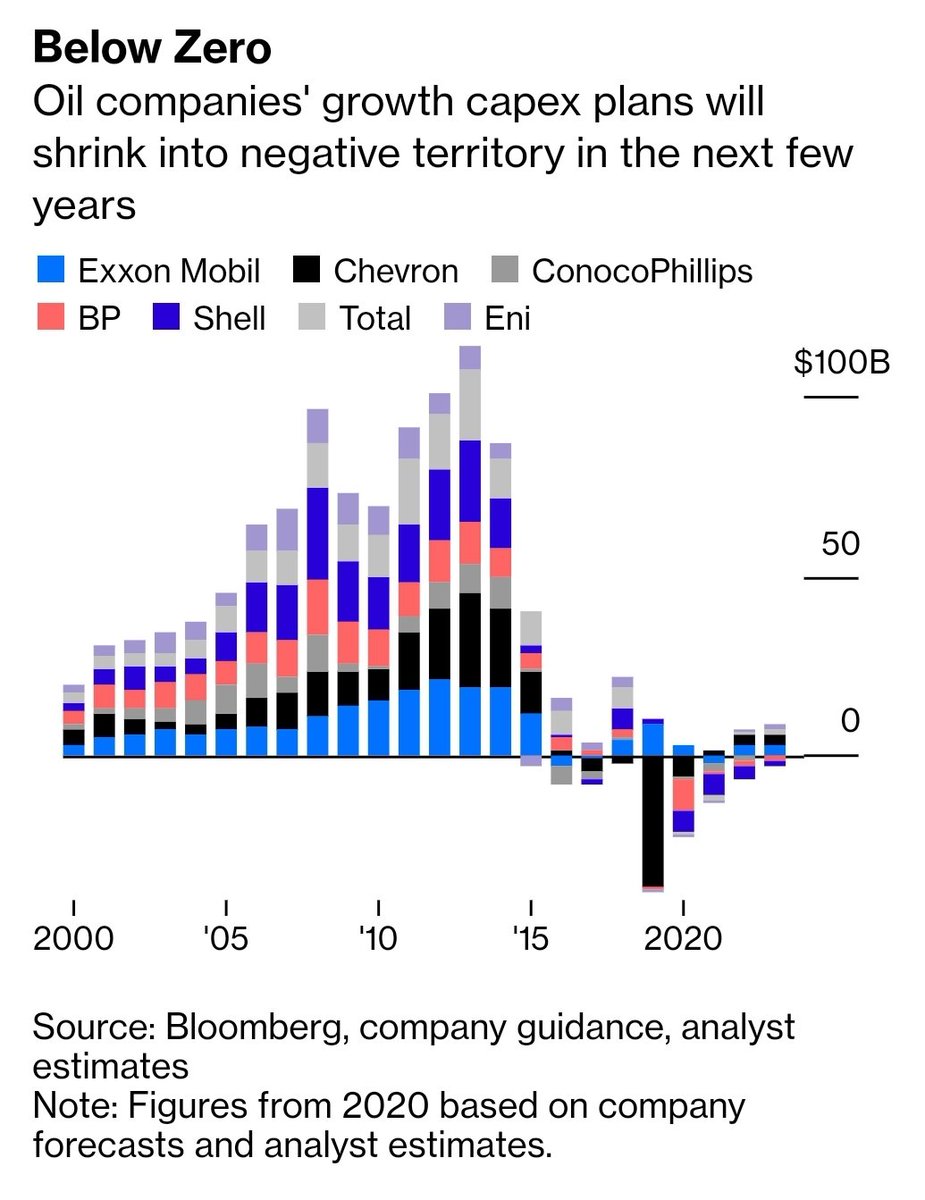

In that, it's just joining the rest of the industry. Look at the growth capex of the other oil majors: all of them have basically stopped investing in excess of maintaining their existing business.

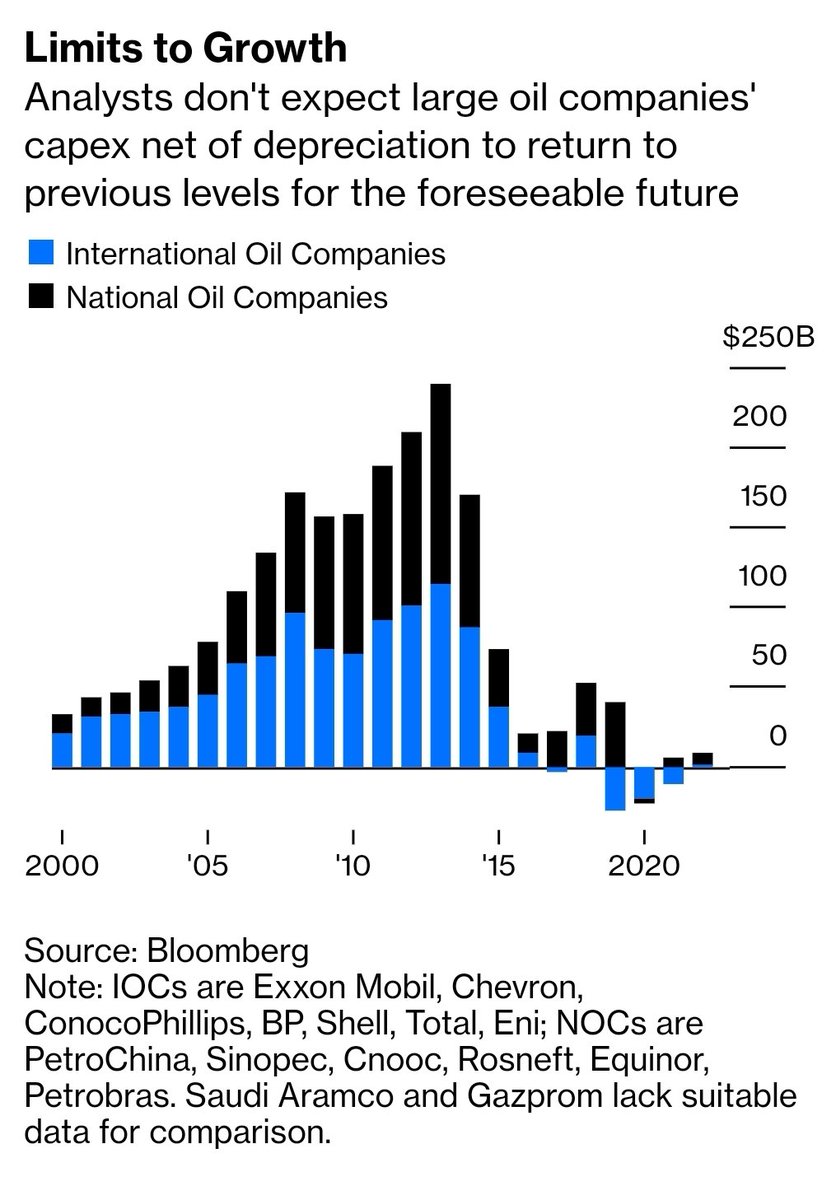

Even if you add in some of the big national oil companies which produce comparable data you end up with the same picture.

Growth investment ground to a halt around 2016 and is now gradually turning into a running down of existing investments.

Growth investment ground to a halt around 2016 and is now gradually turning into a running down of existing investments.

The @iea reckons that if oil investment keeps running at 2020 levels, by 2020 you're 9 million barrels a day below their central scenario -- equivalent to 10% of the current oil market. A very fast decline.

That's probably not going to happen. A supply shortfall on anything like that scale would cause sharply higher prices that should finally induce more petroleum capex. As long as everyone in the industry holds off, an investment drought is sorta OK for oil companies.

But if you have any expectation of oil demand growth right now, your animal spirits should be encouraging you to invest.

Bond market borrowing costs for investment-grade oil companies are the lowest since 2014.

Oil services are super-cheap because your rivals aren't spending.

Bond market borrowing costs for investment-grade oil companies are the lowest since 2014.

Oil services are super-cheap because your rivals aren't spending.

Exxon Mobil used to argue that such a counter-cyclical strategy was exactly what it was doing. Now it's going for a more cautious approach.

To me, that suggests the world's most reliable oil demand bull is capitulating to peak demand. (ends)

To me, that suggests the world's most reliable oil demand bull is capitulating to peak demand. (ends)

Read on Twitter

Read on Twitter