1/15

So how hard will #BMN push this now revised Vanchem refurbishment? Here perhaps are some hints.

Yesterday's RNS ;

"The Company is in the process of drawing down funds under the PFA and has given notice to Orion to drawdown on the full amount of US$35 million."

So how hard will #BMN push this now revised Vanchem refurbishment? Here perhaps are some hints.

Yesterday's RNS ;

"The Company is in the process of drawing down funds under the PFA and has given notice to Orion to drawdown on the full amount of US$35 million."

2/

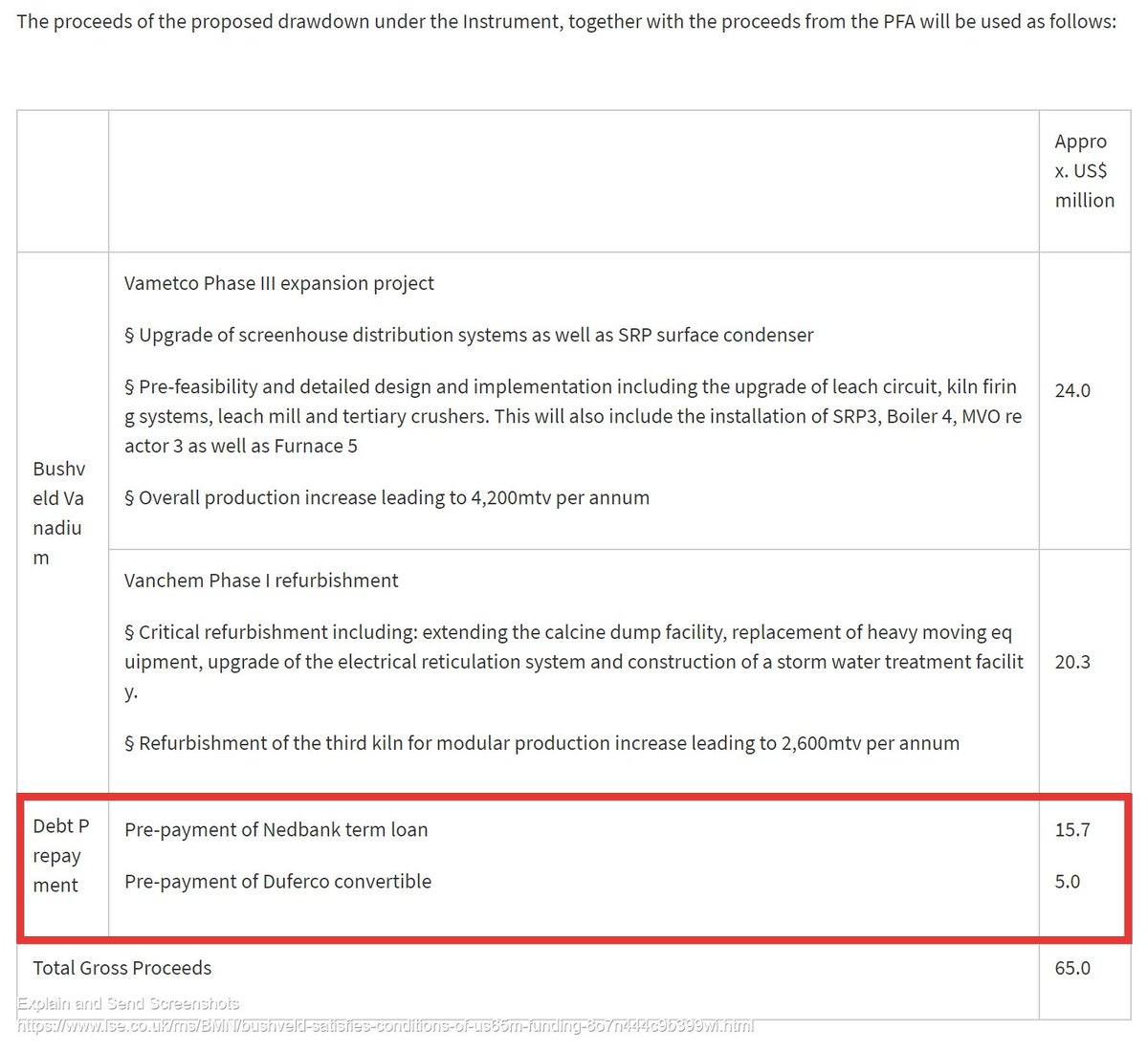

So minimum +$35m is being drawdown immediately.

BMN also already have +$20m in cash on hand.

There's $20.7m in immediate debt payments.

Vametco is still at feasibility stage and so long lead costs should be limited at this time & its a staged debottlenecking programme,

So minimum +$35m is being drawdown immediately.

BMN also already have +$20m in cash on hand.

There's $20.7m in immediate debt payments.

Vametco is still at feasibility stage and so long lead costs should be limited at this time & its a staged debottlenecking programme,

3/

which indicates limited expenditure over an extended period.

That therefore leaves Vanchem, which requires $20.3m to meet its regulatory requirements and deliver an additional 1,500mtV of production.

Again, one would expect that said expenditure (long lead items aside),

which indicates limited expenditure over an extended period.

That therefore leaves Vanchem, which requires $20.3m to meet its regulatory requirements and deliver an additional 1,500mtV of production.

Again, one would expect that said expenditure (long lead items aside),

4/

would extend over the next 12-18 month period.

So logic tells me, that at full drawdown on the notes + at least a part of the PFA also (interest bearing remember), there is clear intent here, to not only push the regulatory work but also that additional 1,500mtV.

would extend over the next 12-18 month period.

So logic tells me, that at full drawdown on the notes + at least a part of the PFA also (interest bearing remember), there is clear intent here, to not only push the regulatory work but also that additional 1,500mtV.

5/

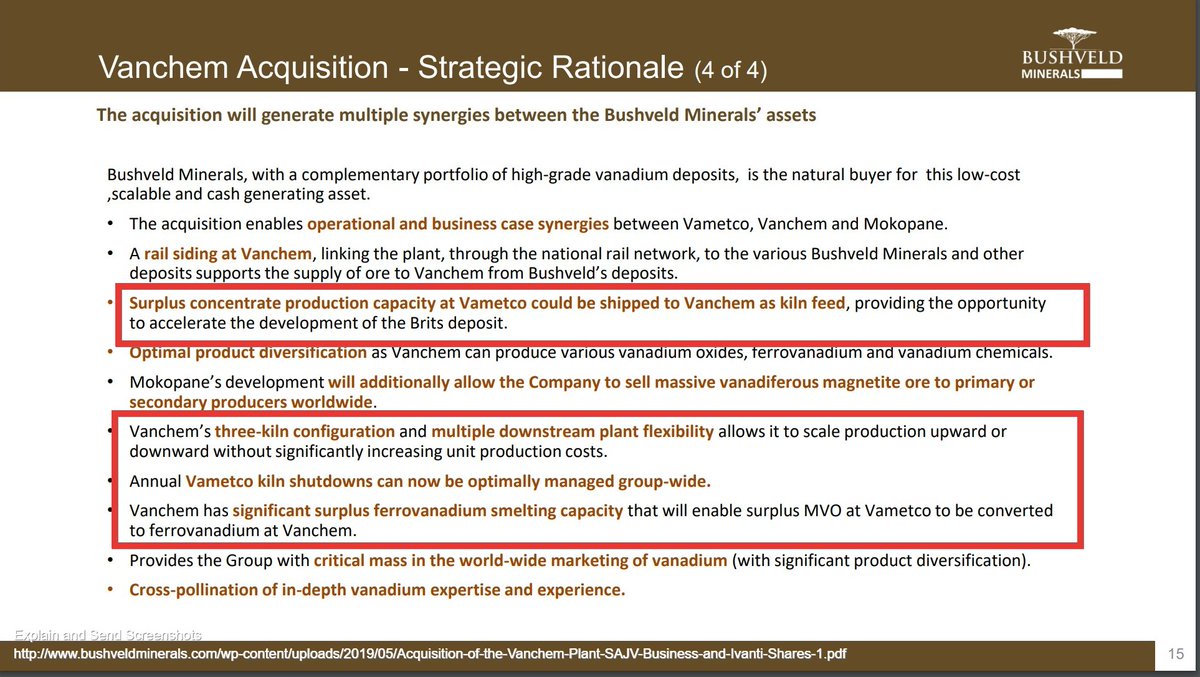

Why when V prices are so low?

Here's the presentation on the Vanchem acquisition, dated 1st May 2019.

http://www.bushveldminerals.com/wp-content/uploads/2019/05/Acquisition-of-the-Vanchem-Plant-SAJV-Business-and-Ivanti-Shares-1.pdf

Why when V prices are so low?

Here's the presentation on the Vanchem acquisition, dated 1st May 2019.

http://www.bushveldminerals.com/wp-content/uploads/2019/05/Acquisition-of-the-Vanchem-Plant-SAJV-Business-and-Ivanti-Shares-1.pdf

6/

The introduction of a 2nd kiln at Vanchem, not only delivers another 1,500mtV but also adds security to the existing 4,300mtV of production (not plant capacity remember), that BMN have yet to actually achieve.

e.g Eliminating lost production through planned maintenance.

The introduction of a 2nd kiln at Vanchem, not only delivers another 1,500mtV but also adds security to the existing 4,300mtV of production (not plant capacity remember), that BMN have yet to actually achieve.

e.g Eliminating lost production through planned maintenance.

7/

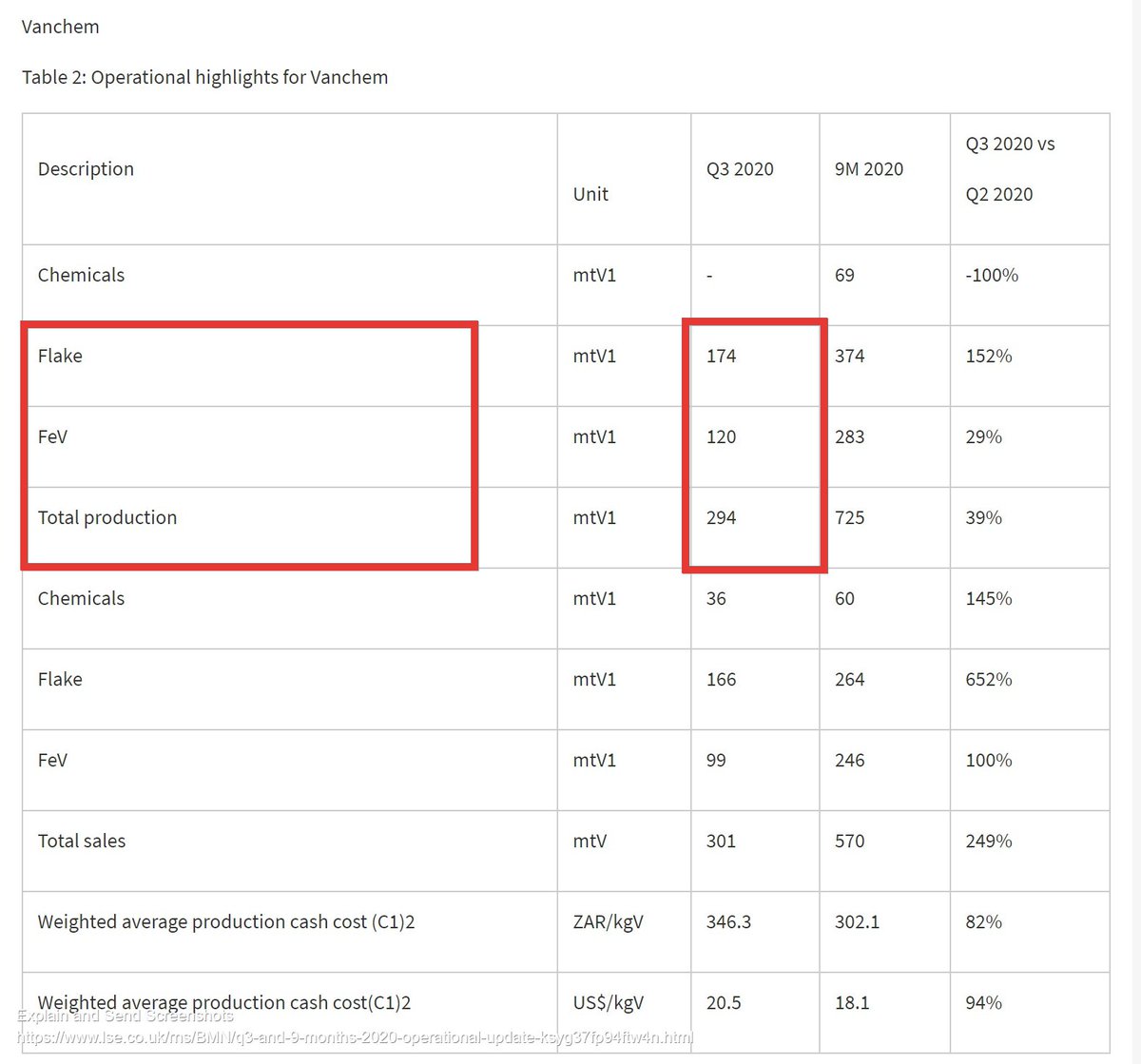

Furthermore, we have this "significant surplus ferrovanadium smelting capacity" at Vanchem.

Q3 update.

Vanchem top end guidance for 2020, pre Covid interruptions, was 1,100mtV and yet Q3 delivered 294mtV.

Furthermore, we have this "significant surplus ferrovanadium smelting capacity" at Vanchem.

Q3 update.

Vanchem top end guidance for 2020, pre Covid interruptions, was 1,100mtV and yet Q3 delivered 294mtV.

8/

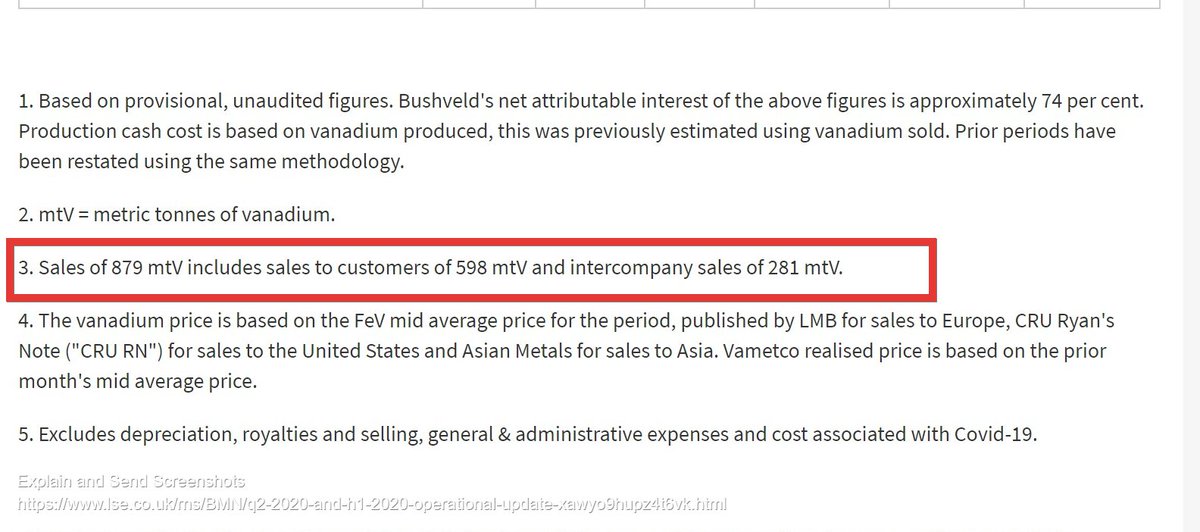

This was clearly assisted by the 281mtV of intercompany sales in Q2 (see Q2 update below).

So what happens in Q4, given that intercompany sales hit

446mtV in Q3?

Why does a Vanchem plant running at c. max 300mtV a quarter, need 446mtV in Q3?

This was clearly assisted by the 281mtV of intercompany sales in Q2 (see Q2 update below).

So what happens in Q4, given that intercompany sales hit

446mtV in Q3?

Why does a Vanchem plant running at c. max 300mtV a quarter, need 446mtV in Q3?

9/

Whether it is concentrate being sold or surplus MVO, doesn't matter, this is about demonstrating optionality.

A 2nd kiln only accelerates that, whilst driving down production costs, as Vametco output, that exists anyway, is fully utilised.

Whether it is concentrate being sold or surplus MVO, doesn't matter, this is about demonstrating optionality.

A 2nd kiln only accelerates that, whilst driving down production costs, as Vametco output, that exists anyway, is fully utilised.

10/

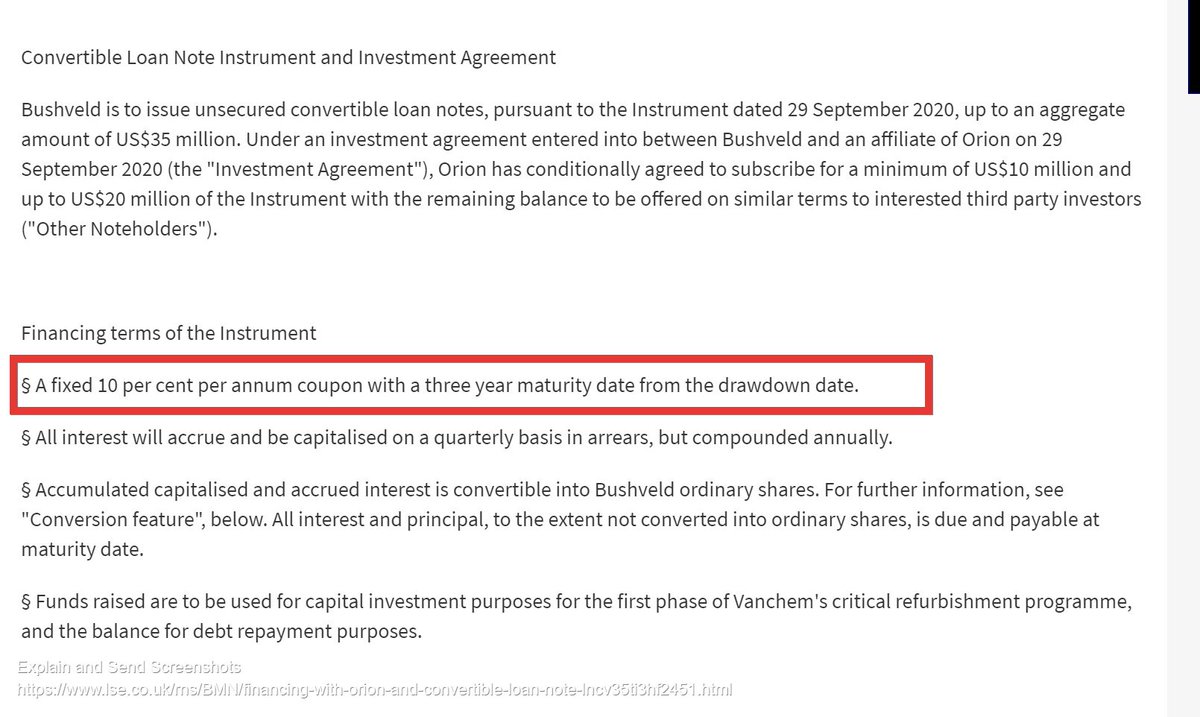

So yet more support for accelerating that 2nd kiln at Vanchem.

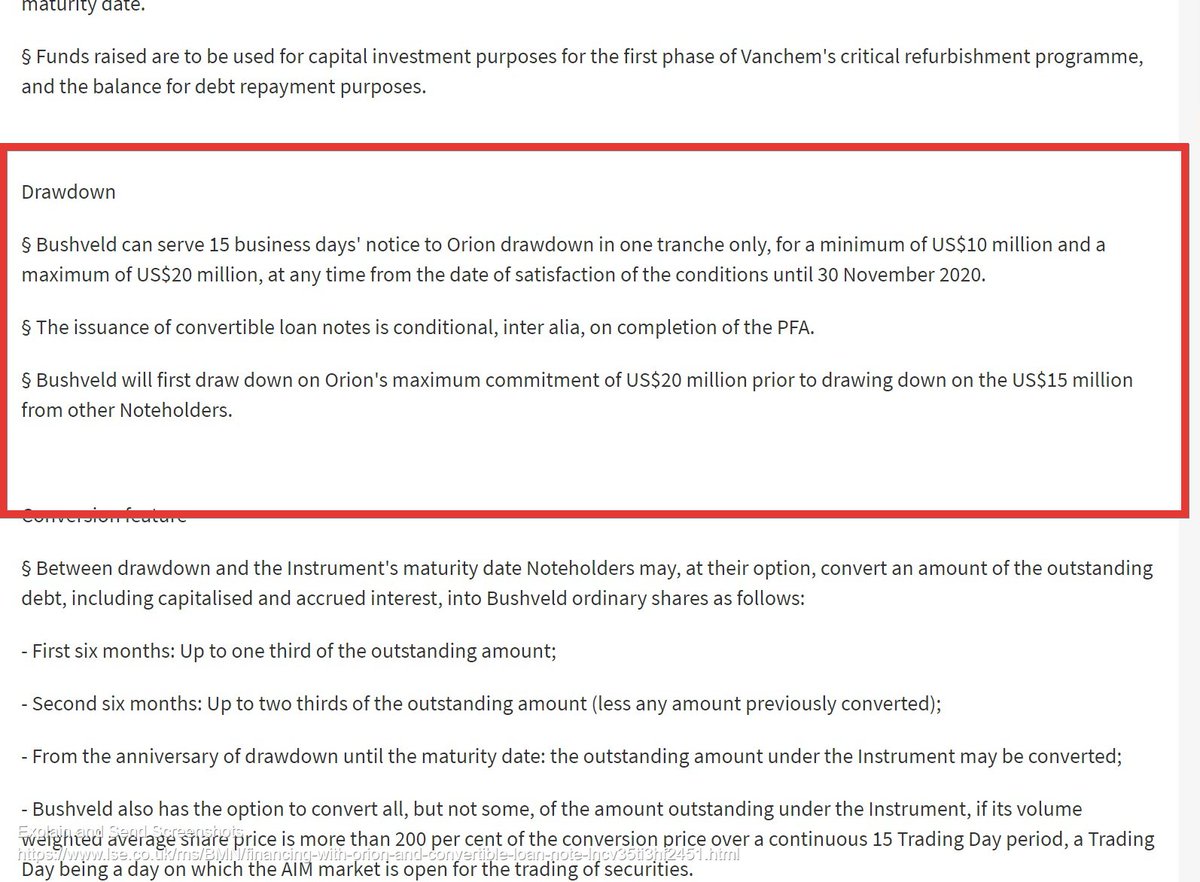

Just to be clear here, there's nothing in the existing RNSs, that says BMN must draw down all of the notes in one go.

It says "minimum of $10m."

At 10% per annum + 3 year term, its not cheap either.

So yet more support for accelerating that 2nd kiln at Vanchem.

Just to be clear here, there's nothing in the existing RNSs, that says BMN must draw down all of the notes in one go.

It says "minimum of $10m."

At 10% per annum + 3 year term, its not cheap either.

11/

If we then add in the expedited transaction period, "just 2 months," an achievement that BMN keeps on delivering, in what is supposed to be a slow regulatory landscape, then for me, we are seeing clear signs, that BMN mean business on this next stage of Vanchem development.

If we then add in the expedited transaction period, "just 2 months," an achievement that BMN keeps on delivering, in what is supposed to be a slow regulatory landscape, then for me, we are seeing clear signs, that BMN mean business on this next stage of Vanchem development.

12/

BMN are not only now financially secure for min. next 2 years, allowing V prices to recover and VRFB growth to further influence prices further...

but also have a clear route to +6,000mtV within those 2 years, which the evidence says, is very much being driven as we speak.

BMN are not only now financially secure for min. next 2 years, allowing V prices to recover and VRFB growth to further influence prices further...

but also have a clear route to +6,000mtV within those 2 years, which the evidence says, is very much being driven as we speak.

13/

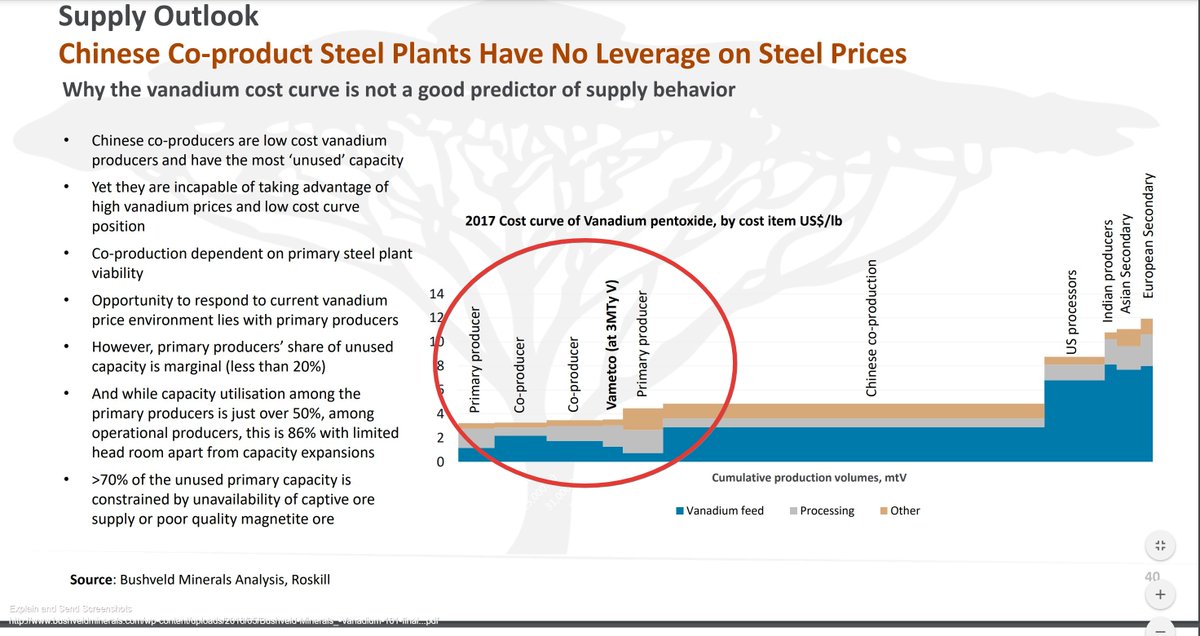

Meaning that BMN, may well become the world's lowest cost vanadium producer.

Here's slide 40 from the Vanadium 101 webinar, dated May 2018 and so pre-Vanchem.

http://www.bushveldminerals.com/wp-content/uploads/2018/05/Bushveld-Minerals_-Vanadium-101-final...pdf

Meaning that BMN, may well become the world's lowest cost vanadium producer.

Here's slide 40 from the Vanadium 101 webinar, dated May 2018 and so pre-Vanchem.

http://www.bushveldminerals.com/wp-content/uploads/2018/05/Bushveld-Minerals_-Vanadium-101-final...pdf

14/

Accepted it is based on the 2017 cost curve, so pre-Largo expansions but still, take a look at where Vametco sat on that cost curve, when producing at just 3,000mtV.

Current actual capacity is 3,200mtV.

Now consider the combined operations and the ability to...

Accepted it is based on the 2017 cost curve, so pre-Largo expansions but still, take a look at where Vametco sat on that cost curve, when producing at just 3,000mtV.

Current actual capacity is 3,200mtV.

Now consider the combined operations and the ability to...

15/

...employ 2 Vanchem kilns, to alleviate maintenance shutdowns and employ excess outputs, that previously had no home.

All of this spans from the finance deal closed out yesterday.

Plenty of news flow still to come but the biggest one, has actually already happened.

...employ 2 Vanchem kilns, to alleviate maintenance shutdowns and employ excess outputs, that previously had no home.

All of this spans from the finance deal closed out yesterday.

Plenty of news flow still to come but the biggest one, has actually already happened.

15A

#BMN's Fortune Mojapelo on 30th Nov ;

"the current vanadium price environment requires us to re-evaluate our thesis for the vanadium market, for our assets and for our strategy. And having done that, if our convictions are strengthened, as they are today,"

#BMN's Fortune Mojapelo on 30th Nov ;

"the current vanadium price environment requires us to re-evaluate our thesis for the vanadium market, for our assets and for our strategy. And having done that, if our convictions are strengthened, as they are today,"

15B

"we must add to that conviction courage (even if mixed with some pragmatism) to follow through with our strategy."

"Courage" when V prices are low, means as a minimum, Vanchem to 2,600mtV, is going to happen as soon as it is feasible to do so.

The momentum is building.

"we must add to that conviction courage (even if mixed with some pragmatism) to follow through with our strategy."

"Courage" when V prices are low, means as a minimum, Vanchem to 2,600mtV, is going to happen as soon as it is feasible to do so.

The momentum is building.

15C

Now here's the @CruxInvestor #BMN transcript of last week's interview.

https://articles.cruxinvestor.com/bushveld-minerals-bmn-vanadium-producers-with-eyes-on-the-future-transcript

"Or is this actually the time, when you've rechecked your investment thesis, when you've rechecked that your business case holds up,"

Now here's the @CruxInvestor #BMN transcript of last week's interview.

https://articles.cruxinvestor.com/bushveld-minerals-bmn-vanadium-producers-with-eyes-on-the-future-transcript

"Or is this actually the time, when you've rechecked your investment thesis, when you've rechecked that your business case holds up,"

15D

"that you should have the courage of your convictions to ensure that when the upturn comes you are ready? We are of that viewpoint as a company, which is why we raised USD$65M."

"that you should have the courage of your convictions to ensure that when the upturn comes you are ready? We are of that viewpoint as a company, which is why we raised USD$65M."

15E

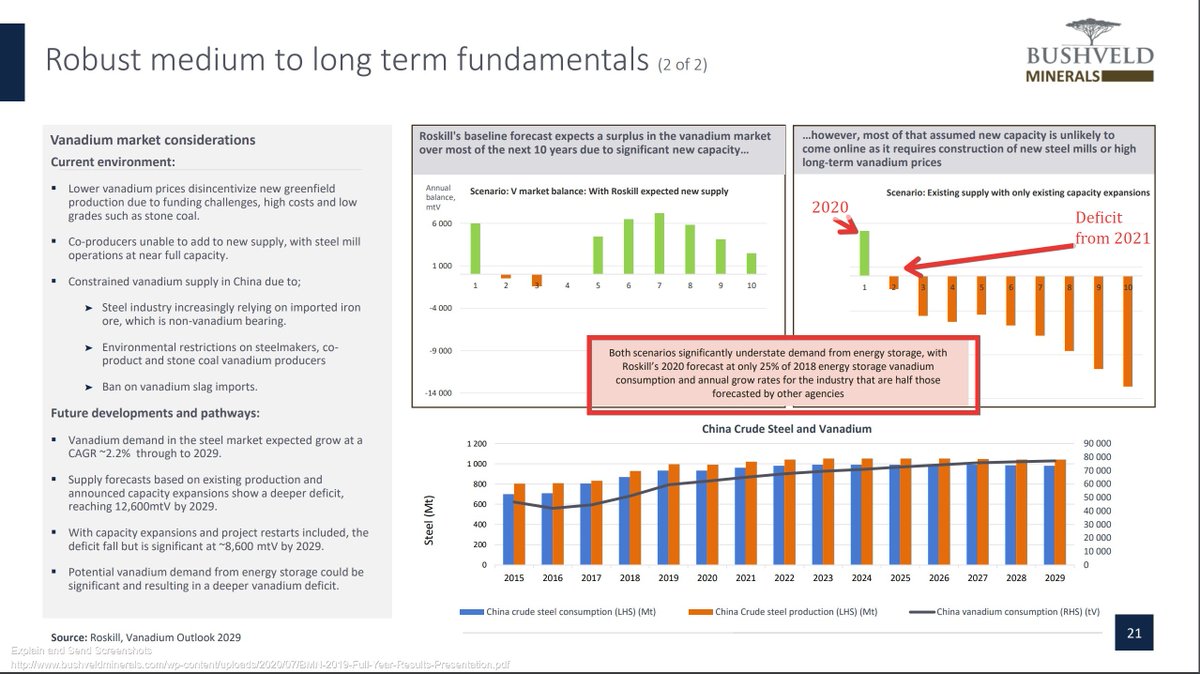

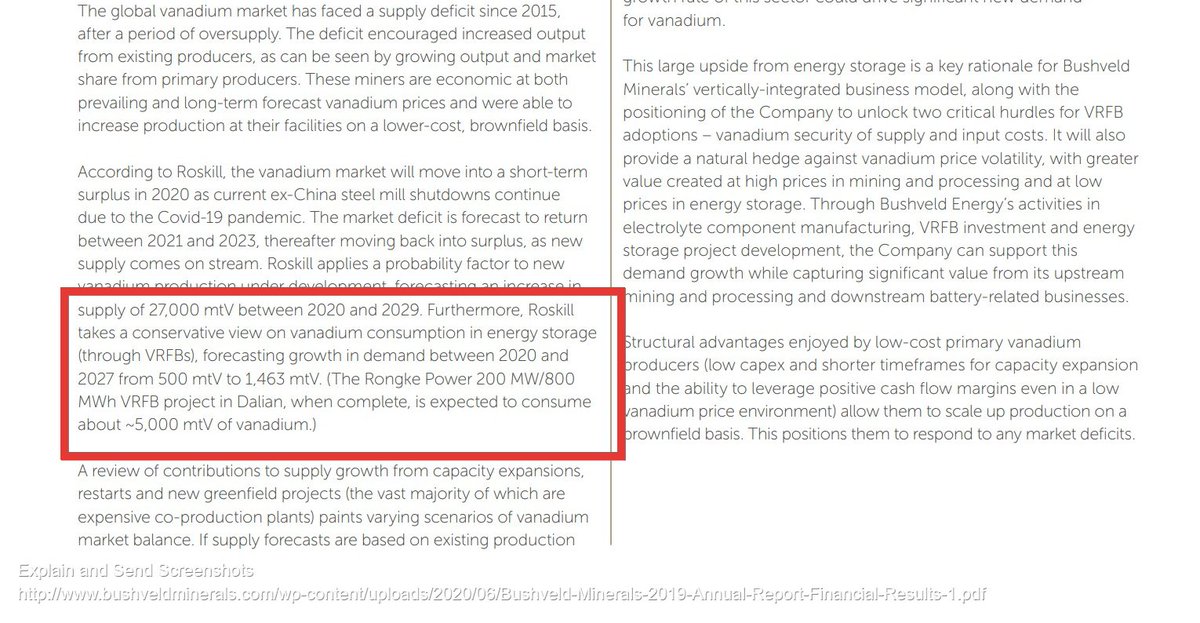

Here is what they are betting on.

Roskill predicting c. 775mtV of vanadium demand from VRFBs by start of 2023.

Why start of 2023? Because that's when I believe BMN will be ramping up beyond 6,000mtV.

Here is what they are betting on.

Roskill predicting c. 775mtV of vanadium demand from VRFBs by start of 2023.

Why start of 2023? Because that's when I believe BMN will be ramping up beyond 6,000mtV.

15F

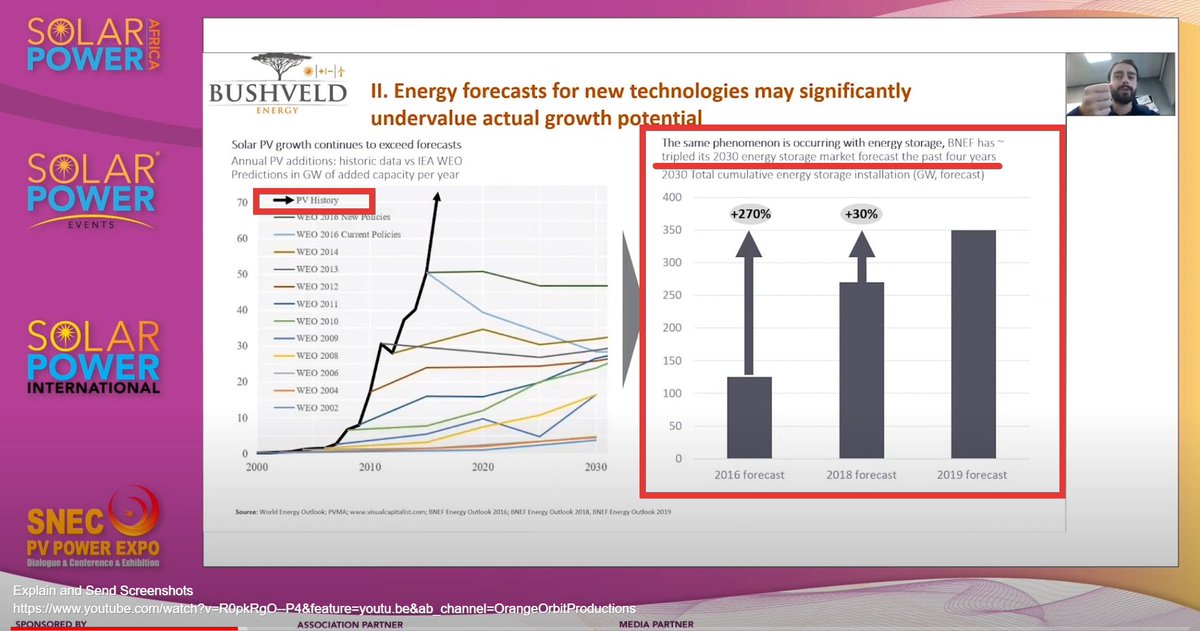

Note said predictions are against growth rates, that are just "half of those forecasted by other agencies."

These are the same agencies that understandably got solar woefully wrong and are repeating that now, with energy storage.

Note said predictions are against growth rates, that are just "half of those forecasted by other agencies."

These are the same agencies that understandably got solar woefully wrong and are repeating that now, with energy storage.

15G

The well respected BNEF "has tripled its 2030 energy storage market forecast, the past 4 years."

To be clear, said expanding deficit, also only takes into account "existing supply with only existing capacity expansions," i.e. the likes of BMN, who are planning the largest.

The well respected BNEF "has tripled its 2030 energy storage market forecast, the past 4 years."

To be clear, said expanding deficit, also only takes into account "existing supply with only existing capacity expansions," i.e. the likes of BMN, who are planning the largest.

15H

"With capacity expansions and project restarts included, the deficit fall but is significant at ~8,600 mtV by 2029."

So prices go up.

and ;

"Co-producers unable to add to new supply, with steel mill operations at near full capacity."

So then it becomes about new mines.

"With capacity expansions and project restarts included, the deficit fall but is significant at ~8,600 mtV by 2029."

So prices go up.

and ;

"Co-producers unable to add to new supply, with steel mill operations at near full capacity."

So then it becomes about new mines.

15I

If said mines are co-production, then they face significant financial hurdles, to get into production.

If they are pure play mines, such as AVL, they have a better chance, but are hindered by a volatile V price, which makes finance more difficult to secure.

If said mines are co-production, then they face significant financial hurdles, to get into production.

If they are pure play mines, such as AVL, they have a better chance, but are hindered by a volatile V price, which makes finance more difficult to secure.

15J

Whilst all of this is going on, BMN, the holder of the largest high grade vanadium deposits in the world and now $65m in finance, can expand and keep expanding, to fill that deficit.

Even most advanced greenfield mines, can't get significant new production into production,

Whilst all of this is going on, BMN, the holder of the largest high grade vanadium deposits in the world and now $65m in finance, can expand and keep expanding, to fill that deficit.

Even most advanced greenfield mines, can't get significant new production into production,

15K

faster than a BMN, that is financed and fully permitted.

Note - Vanchem refurb is just that, not a new mine with all the risk that comes with it, to get it into production.

Furthermore, as one of the lowest cost producers in the world, if BMN isn't making really good money,

faster than a BMN, that is financed and fully permitted.

Note - Vanchem refurb is just that, not a new mine with all the risk that comes with it, to get it into production.

Furthermore, as one of the lowest cost producers in the world, if BMN isn't making really good money,

15L

then new mines aren't getting built because they need high prices, to complete their finance and make the payments on it and before they even arrive, BMN is already starting to fill the gap because it costs far less and is ready to go.

6,000mtV to 8,400mtV and so on.

then new mines aren't getting built because they need high prices, to complete their finance and make the payments on it and before they even arrive, BMN is already starting to fill the gap because it costs far less and is ready to go.

6,000mtV to 8,400mtV and so on.

15M

So as far as I see it, no new mines are coming on line by 2023, unless vanadium prices move sig. north and if they do, BMN will make a lot of money and will expand quicker because they'll be using profits from sales and not someone else's capital and so control their destiny.

So as far as I see it, no new mines are coming on line by 2023, unless vanadium prices move sig. north and if they do, BMN will make a lot of money and will expand quicker because they'll be using profits from sales and not someone else's capital and so control their destiny.

15M

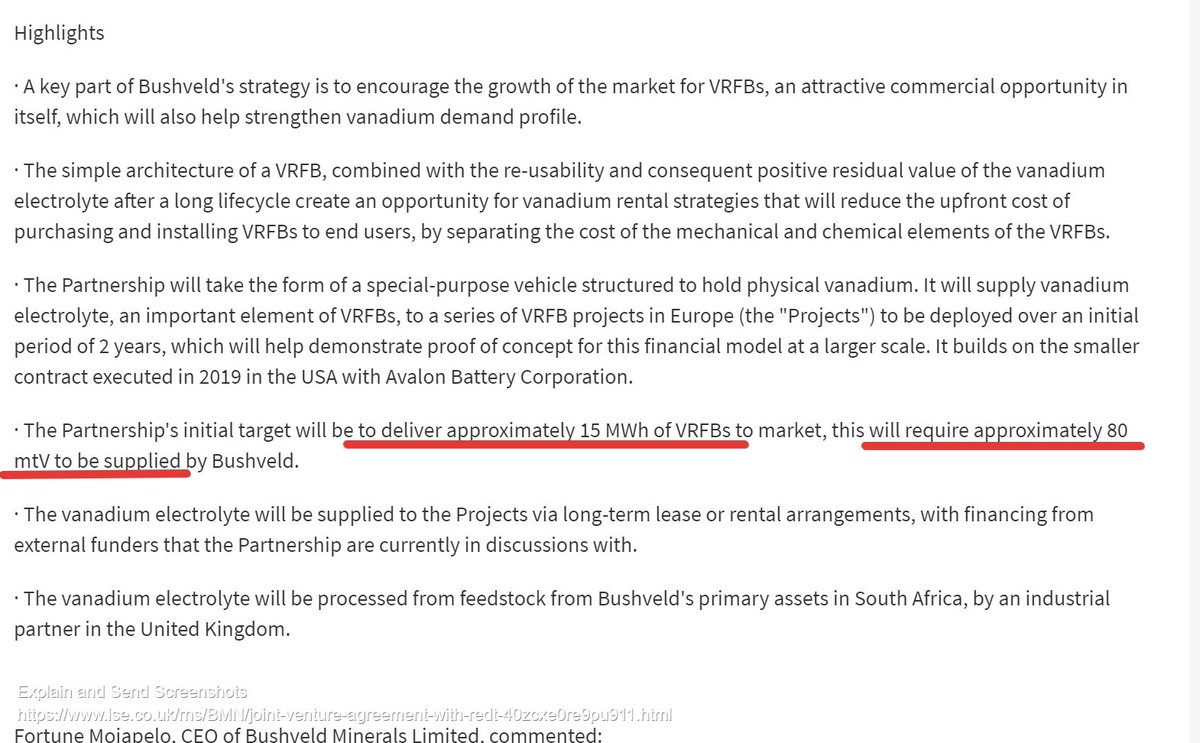

The last big question is VRFBs ability to capture enough of the market.

Lets revisit that Roskill 775mtV fig. in 2023.

In March 2020 BMN announced a deal with Redt (now Avalon) for vanadium rental (not even going to go there on its worth for demand through to 2023),

The last big question is VRFBs ability to capture enough of the market.

Lets revisit that Roskill 775mtV fig. in 2023.

In March 2020 BMN announced a deal with Redt (now Avalon) for vanadium rental (not even going to go there on its worth for demand through to 2023),

15N

15MWh requires "approximately " 80mtV.

So to hit that 775mtV target, we need VRFBs to capture just 145MWh of work, by the start of 2023.

Avalon alone already has 22.6MWh of known projects being delivered in 2021 and they are seedling projects with major energy suppliers,

15MWh requires "approximately " 80mtV.

So to hit that 775mtV target, we need VRFBs to capture just 145MWh of work, by the start of 2023.

Avalon alone already has 22.6MWh of known projects being delivered in 2021 and they are seedling projects with major energy suppliers,

15O

that are clearly going to lead to larger project roll outs.

So by close of play 2022, they could min. be delivering at least half of that 145MWh figure, with more to come.

They are just one VRFB company and we haven't even touched upon China, who could make this whole...

that are clearly going to lead to larger project roll outs.

So by close of play 2022, they could min. be delivering at least half of that 145MWh figure, with more to come.

They are just one VRFB company and we haven't even touched upon China, who could make this whole...

15P

..debate worthless, by delivering just one 50MW project (200MWh) per annum and send Roskill back to the drawing board, just like BNEF did.

So its fairly easy to see why BMN feel this courage is required right now because it sets them on a path, that keeps them ahead...

..debate worthless, by delivering just one 50MW project (200MWh) per annum and send Roskill back to the drawing board, just like BNEF did.

So its fairly easy to see why BMN feel this courage is required right now because it sets them on a path, that keeps them ahead...

15Q

...of the following pack and will be rewarded, even when VRFBs, only make a minimal global impact.

With the blue sky reward being VRFBs making a truly significant impact and BMN being front and centre, ready to exploit it, because they made the move towards it today.

...of the following pack and will be rewarded, even when VRFBs, only make a minimal global impact.

With the blue sky reward being VRFBs making a truly significant impact and BMN being front and centre, ready to exploit it, because they made the move towards it today.

15R

All of which says the deficit that Roskill are seeing, 2021 and beyond, is looking like a strong reality and one that will continue, as demand outstrips supply.

Deficit = good pricing = good profits = more capacity = BMN

and that's without any full value chain exposure.

All of which says the deficit that Roskill are seeing, 2021 and beyond, is looking like a strong reality and one that will continue, as demand outstrips supply.

Deficit = good pricing = good profits = more capacity = BMN

and that's without any full value chain exposure.

Read on Twitter

Read on Twitter