I've studied most methods in Technical Analysis, started with indicators, thoroughly studied Elliott Wave, read a lot about P&F charting, learned candlestick patterns... in the end I landed on the starting point, trend line and price chart with classical chart patterns.

Not that one method is better than the other. I went through a massive simplification stage in my life. I cut out so many material and non material things.

I realized that if you can't explain what you are doing to a 6 year-old, then you haven't simplified it enough.

I realized that if you can't explain what you are doing to a 6 year-old, then you haven't simplified it enough.

If you are depending on several computer screens, software updates, extremely fast internet connections, or several 3rd party service providers, you have complicated things.

Too many moving parts and one failure can mess up things.

Keep it simple. Start building simple.

Too many moving parts and one failure can mess up things.

Keep it simple. Start building simple.

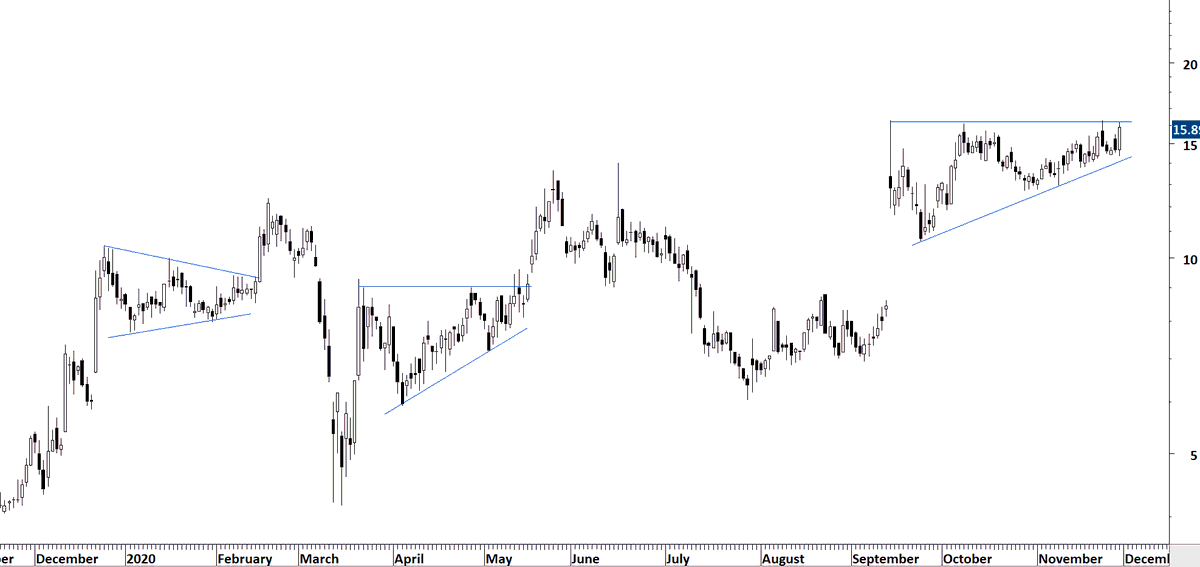

This method of identifying well-defined consolidations, focusing on mainly breakouts from horizontal setups and being able to understand the dynamics behind classical chart patterns helped me a lot.

Price chart + trend lines + some cadlestick pattern knowledge.

Price chart + trend lines + some cadlestick pattern knowledge.

Along the road, I made peace with myself that, the method I'm using will not capture every opportunity out there.

I also understood that there will be times when the method will perform well and times it will not be that effective.

I promised myself not to abandon the method.

I also understood that there will be times when the method will perform well and times it will not be that effective.

I promised myself not to abandon the method.

Style drift is the most dangerous. It is basically changing the method, parameters etc. when one method is not working (or if you think it is not working). You start searching for the new holy grail. It doesn't exist. Try not to depend on optimization.

Read on Twitter

Read on Twitter