(1/10) What do we learn about profit shifting from the new country by country data? At least five important lessons!

My new paper from Tax Notes (Fed/Intl) is now publicly available on SSRN.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3736287

My new paper from Tax Notes (Fed/Intl) is now publicly available on SSRN.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3736287

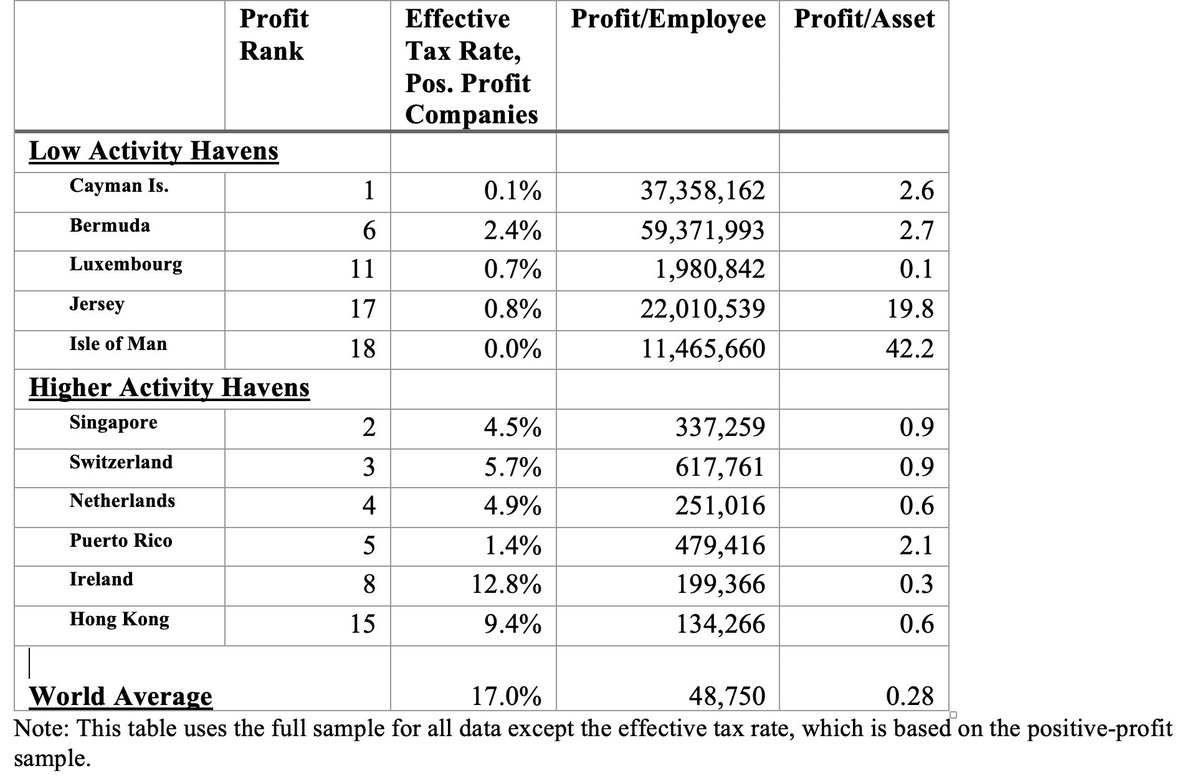

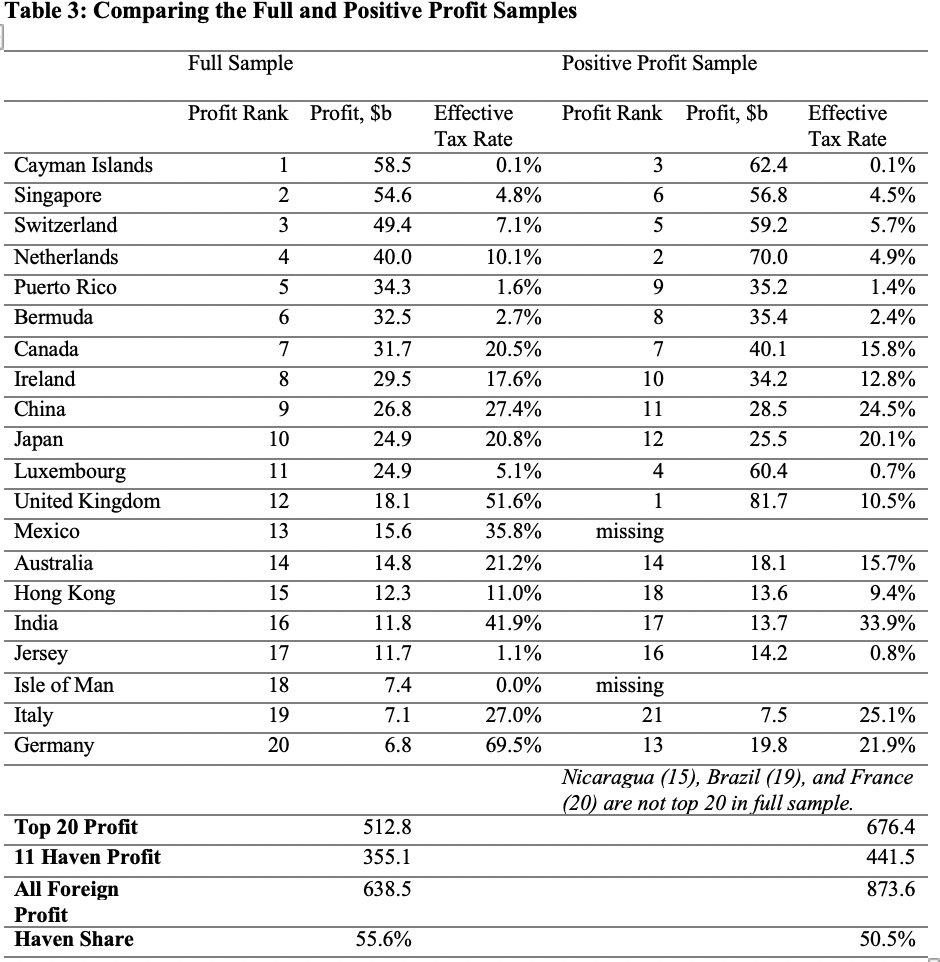

(2/10) Lesson 1. Havens are *the* story. Nearly all profit shifting is destined for just a handful of economies with rock-bottom taxes. Of $638b in foreign profit in 2017, $355b (56%) is in just 11 important havens. Data sets that miss haven income miss almost all of the story.

(3/10) The new country by country data (first full data set released by US in Dec. 2019) show far improved country coverage, including important havens that were missing from prior data. The paper describes these new data, a signature achievement of OECD/G20 BEPS process.

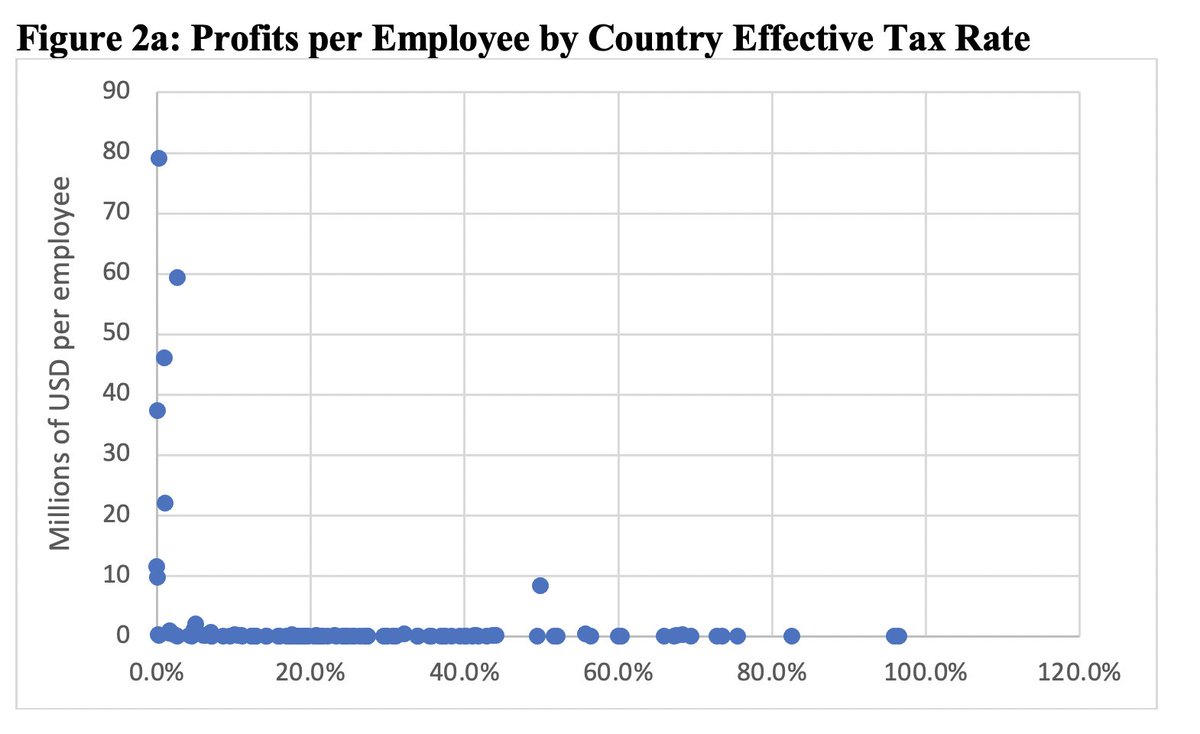

(4/10) Lesson 2. Activity is far less tax sensitive than profits. There are 2 types of havens; those w/o substantial jobs/investment, where profits per employee reach tens of $millions, and those with some economic activity, w/ profits/em. only ~10 times world average.

(5/10) There is a highly non-linear relationship between profit rates and tax rates. Zeroing in on those economies with profits per employee below $1 million, the nonlinearity persists. In short, most all profit shifting is destined for havens.

(6/10) Lesson 3. Country by country data allow us to separate profitable companies. Most other data sets combine companies with profits/losses, providing a biased picture of intl. tax avoidance, since effective tax rates are distorted upwards when losses are in the denominator.

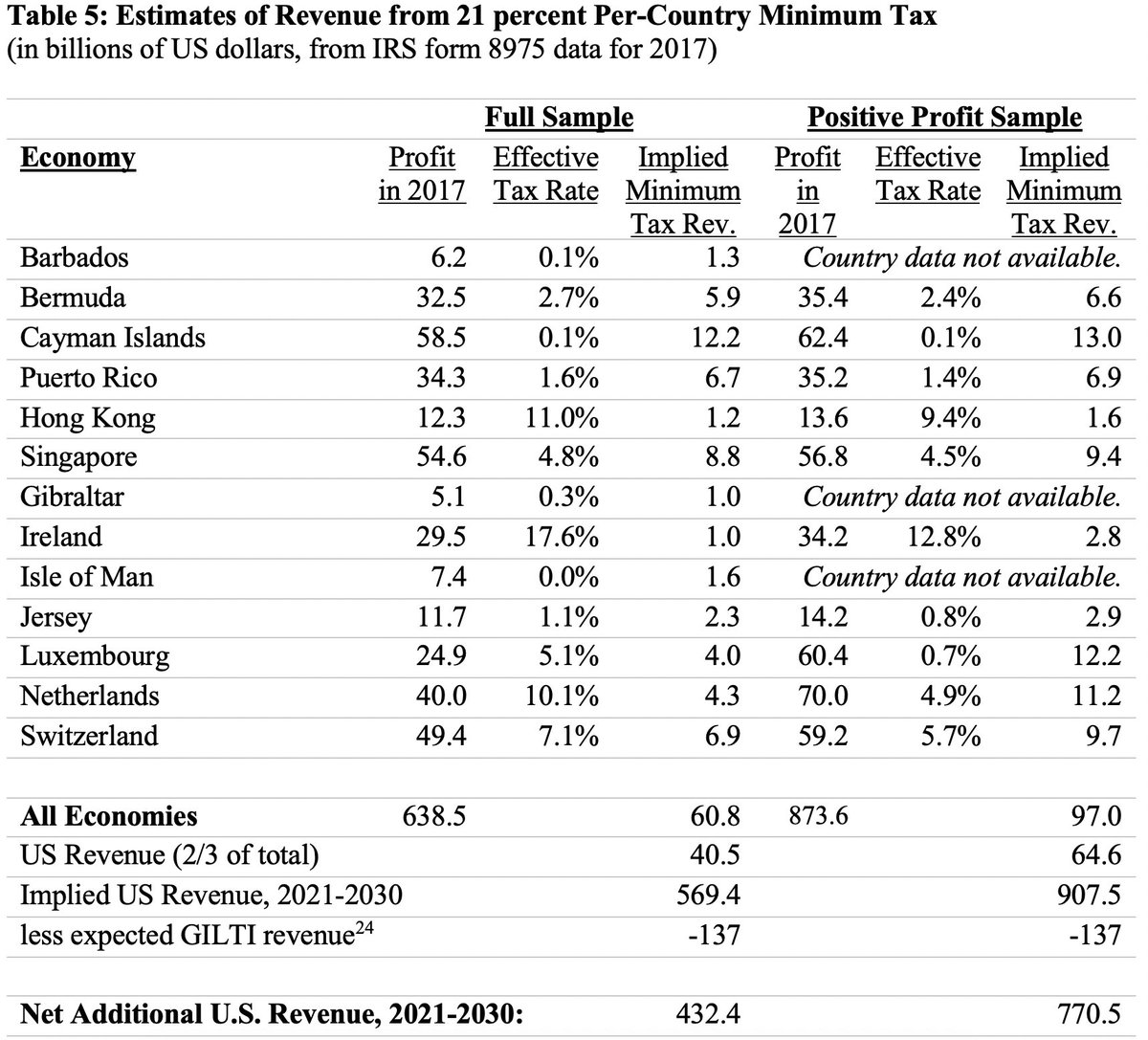

(7/10) Lesson 4. These new data, like all agg. data sources, show that profit shifting is an enormous problem, costing the US govt ~$100b by 2017. See my forthcoming NTJ paper to compare these estimates to those from other data.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3274827

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3274827

(8/10) Lesson 5. These new data show that strong (distinguish GILTI) minimum taxes can raise serious amounts of revenue. My preferred estimate is about $530 billion over 10yrs, beyond the revenues from the current minimum tax regime. This is similar to TPC and AEI estimates.

(9/10) Finally, there is a strong policy argument for public release of these data. (In a simple format.) This can harness reputation-based motives and provide policy-makers with much needed political will.

(10/10) Read the paper for details. As I argue in my book Open (now in paperback!), globalization comes with enormous benefits, but it poses policy challenges. One key challenge is modernizing our tax system to respond to the global mobility of capital. https://www.amazon.com/Open-Progressive-Immigration-Global-Capital/dp/0674919335

Read on Twitter

Read on Twitter