IDFC First Bank Story:

-2 Flights that took off Mr. V Vaidyanathan

-IDFC and Capital First

-New Bank

-Setting targets and hitting them

-Fintech Partnership: Good and the Bad

-Performance so far

-2 Flights that took off Mr. V Vaidyanathan

-IDFC and Capital First

-New Bank

-Setting targets and hitting them

-Fintech Partnership: Good and the Bad

-Performance so far

1/ IDFC First Bank is a merged entity, formed by merging Capital First and IDFC in December 2018. So, it is the story of 3, Capital First, IDFC, and Mr. V Vaidyanathan.

2/ IDFC Limited was formed in 1997 to finance the projects and mobilize capital in private sector infrastructure ventures. A distinctive point about IDFC was its ability to tap both domestic and international resources to finance.

3/ Dr. Rajiv Lall joined IDFC in 2005 and he was responsible for diversifying the business by setting up AMC, Institutional Broking, and Infrastructure Debt Fund. IDFC received in-principle approval to set up a bank in 2014.Before joining IDFC he was a partner at *Warburg Pincus*

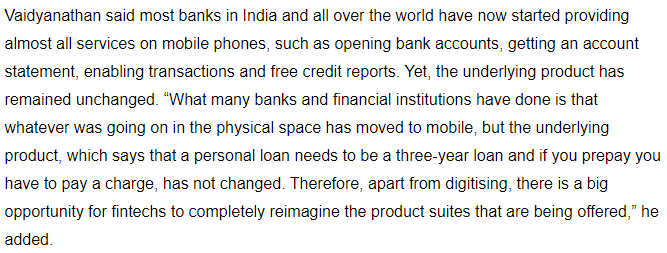

4/ In 2015, IDFC divested its financing-related assets and liabilities to the new set-up Bank. It gave out wholesale loans and was primarily wholesale funded. Top 20 companies formed 44% of IDFC’s disbursements.

5/ Company felt the drag due to increased risk in Infrastructure sector and low margins in corporate lending. It needed to diversify with both retail assets and liabilities, to reduce lumpiness and increase margins. After setting up Bank in started giving Home Loans & MicroLoans.

6/ Getting the banking license was not it. As of Sep’18, IDFC Bank’s retail assets constituted only 15%, [12% previous year] of the total book and its CASA stood at 13% [8.2% previous year]. Its NIM stood at 1.9%.

7/ It needed someone who had his hands tested on the retail side: Mr. V Vaidyanathan. He worked in consumer banking with CITI Bank for 10 years before joining ICICI Bank for building its retail book and diversify from project lending.

8/ He was also instrumental in setting up SME and Rural Banking within retail for ICICI Bank. He was also appointed to head ICICI Pru Life in 2009 as Managing Director. But a flight to Hyderabad ensured that he begin his entrepreneurial journey.

9/ In 2010, Mr. Vaidyanathan was on a one-hour flight to Hyderabad where he met Mr. Kishore Biyani. Mr. Biyani had indicated his desire to move out of this business and pitched him Future Capital Holdings.

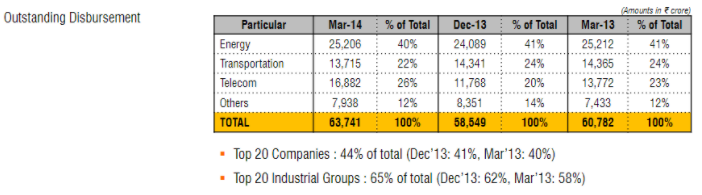

10/ Mr. Vaidyanathan was offered a 10% equity stake in the business. Future Capital Holding was primarily a real estate and wholesale lender and operated several arms like forex, brokerage, and wealth management.

11/ Its loan book at that time stood at Rs.935crs, with GNPA and NNPA of 5.28% and 3.78% respectively. Mr. Vaidyanathan then started giving out the retail small retail loans in the range of Rs.12000-Rs.30000 in a bid to build a prototype to present it to investors.

12/ He tried to woo several investors. Once even pitching to Arun Kumar of IFC while suffering from Dengue.

13/ 2nd Flight: On a Flight to Delhi, Mr. Vaidyanathan met Mr. Narendra Ostwal of Warburg Pincus. In that 2 hour journey, Mr. Vaidyanathan presented his passion and what he was able to achieve in 2 short years.

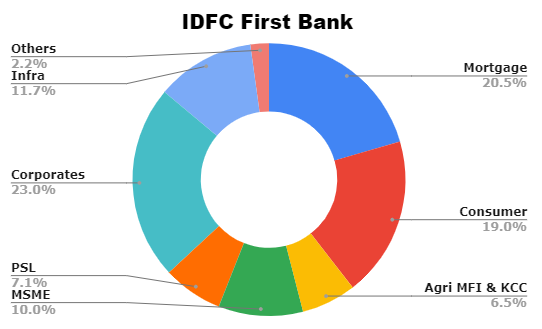

14/ Warburg Pincus for a background reference check went to Deepak Parekh, who termed Mr. Vaidyanathan as a “prudent lender”, “risk-averse” and “committed”. Mr. Vaidya successfully carried out a management buyout with Warburg Pincus backing with Rs.810crs.

15/ From Rs.935crs loan book in 2010 with retail loans of only 10%, Capital First grew the loan book to Rs.32000crs in 2018, with Retail Loans forming 91% of the total loan book.

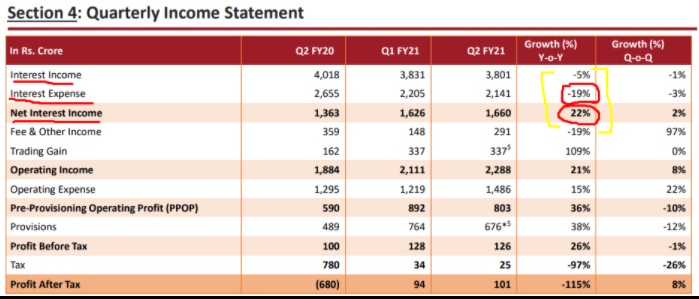

16/ Capital First ticket size:

Rs.15k - Rs.1 lac - Micro business loans, 2-wheelers, office needs

Rs.1 lac - Rs.10 lac - Working Capital needs

Rs. 10 lac - Rs.2crs - SME Financing

Rs.15k - Rs.1 lac - Micro business loans, 2-wheelers, office needs

Rs.1 lac - Rs.10 lac - Working Capital needs

Rs. 10 lac - Rs.2crs - SME Financing

17/ During this time its GNPA stayed in the range of 1.5-1.75% range and NNPA hovered around the 1% mark. As the loss-making company turned profitable, the RoEs too started to improve to 14.5% as of Sep’2018.

18/ At the time of MBO in 2012, it was valued at Rs.740crs which rose to Rs.8000crs market capitalization in 2018 January.

19/ Both IDFC and Capital First was primarily funded by wholesale assets. Mr. Vaidyanathan had successfully turned around Capital First as well as set up a retail franchisee for ICICI. This was going to be his 3rd time building retail book

20/ From the merger, IDFC gets retail assets helping it diversify its loan book and Capital First gets a banking license and access to retail stable funds in form of CASA deposits.

21/ At the merger, the 5-year target was set:

-Grow Retail Book from Rs.36000crs to Rs.1lac crs

-Reduce Wholesale book from Rs.56kcrs to Rs.40kcrs

-Retail Mix Target- 70%

-Yield Expansion- 13.5%

-CASA- 30%

-NIMs- 5-5.5%

-Cost-to-income - 50-55% Range

-RoA -1.4-1.6% | RoE-13-15%

-Grow Retail Book from Rs.36000crs to Rs.1lac crs

-Reduce Wholesale book from Rs.56kcrs to Rs.40kcrs

-Retail Mix Target- 70%

-Yield Expansion- 13.5%

-CASA- 30%

-NIMs- 5-5.5%

-Cost-to-income - 50-55% Range

-RoA -1.4-1.6% | RoE-13-15%

22/ As of Q2FY21, IDFC First has grown its Retail Loan book to Rs.60000crs which at the merger was Rs.36000crs. Retail now constitutes 56% of the total book [+6% for PSL Buyouts]. An interesting thing to note here is that IDFC First has not been growing its overall book.

23/ It is winding down its infra related and wholesale book and substituting it with Retail loans. Infra book down from Rs.22,000crs at merger to Rs.12,000crs. Wholesale loans down from Rs.56809crs Dec’18 to Rs.37,000 crs.

24/ Concentration of loan book is also reducing with exposure to Top 10 borrowers in a downtrend and book moving towards more granular lending.

Exposure to Top-10 borrowers:

Dec’18 - 21.81%

Dec’19 - 7.38%

Sep’20 - 7%

Exposure to Top-10 borrowers:

Dec’18 - 21.81%

Dec’19 - 7.38%

Sep’20 - 7%

25/ IDFC First has aggressively grown its CASA book as well. In Dec’18, the CASA% stood at 8.7% amounting to Rs.5274crs. In Sep’20, the book has grown to Rs.30181crs [CASA% - 40.37%]. A major reason behind this is the 7% interest offering on Savings Account deposits.

26/ In a low-interest rate regime,7% in a scheduled commercial bank sounds like a very good proposition. Some feel that the interest rate is too high.Well, compared to others, it is definitely high, but if looked at cost of funds for IDFC[8.9%] and CapF[8.5%],7% does look cheaper

27/ While it is getting Retail funds [CASA + TD], it is not using the same for expanding its assets, as seen above is has remained stable for several quarters now. Instead, the bank is using these funds to retire CD and wholesale borrowings.

28/ The effect of this can be seen in interest expended as well. Without loan growth, interest income would grow only marginally due to the shift towards retail loans. But retiring of costlier borrowings gives an extra boost to the NII.

29/ With an increase in retail deposits [CASA + TD], the concentration among depositors too has decreased.

Top 20 Depositors Concentration:

Dec’18 - 40%

Sep’20 - 12.4%

Top 20 Depositors Concentration:

Dec’18 - 40%

Sep’20 - 12.4%

30/ Shift towards higher-yielding retail loans, retiring of costlier wholesale deposits, and substituting it with more stable retail deposits has resulted in improvement in Net Interest Margins,

IDFC NIM [SEP’18]: 1.56%

NIM at Merger: 2.89%

NIM [Q2FY21]: 4.57%

IDFC NIM [SEP’18]: 1.56%

NIM at Merger: 2.89%

NIM [Q2FY21]: 4.57%

31/ Capital Adequacy is satisfactory but is at the lower end compared to other private lenders with CRAR at 14.73%. Especially with the effect of the moratorium to be seen around Q4FY21. According to management, current NPA numbers are understated and might see a spike in 2021.

32/ IDFC First has also done some provision shuffling. It had created a 50% provision on Idea-Vodafone exposure for Rs.1622crs. It released 50% of this provision and diverted it towards Covid related provisions.

33/ It has been posting losses due to the provisions it has been making in a bid to clean its book. It had also provided for exposure to DHFL exposure. It sold these loans for a loss and adjusted it with trading gains in the Q2FY20 quarter and released provisions of Rs.460crs

34/ A lot depends on Mr. Vaidyanathan. He has successfully built 2 retail franchisees and is on his path to build a third. Significant branch expansion is likely to keep costs higher and provisions might keep eating the profits for a few quarters as well.

35/ Here is what is expected from management in the banking business. While the past record is no guarantee to similar performance in the future, the track record of Mr. Vaidyanathan does give some comfort. https://twitter.com/sneh_kagrana/status/1330807946503094277?s=20

36/ Here is what Vishal Mahadevia, MD Warburg Pincus had to say about him- “Vaidyanathan transformed what was just a platform [Future Capital] into a retail lending organization.” “He had integrity, professionalism, and entrepreneurial spirit.”

37/ IDFC First has also been partnering with fintech start-ups and looks agile in that sense. It has partnered with Niyo, to provide banking services to its customers. Niyo provides the front end while IDFC First provides back-end, i.e, it accepts the deposits

38/ While it helps in sourcing saving deposits, it also somewhat restricts IDFC First’s chances of cross-selling to those customers. It would be Niyo who would be providing the customer with forex and wealth management services.

39/ IDFC First also has a partnership with OneCard, which a metal credit card. Here is an excerpt from Global Fintech Fest 2020.

A lot remains to see, how the bank and management performs and if Mr. Vaidyanathan can play his charm for the third time in building a Retail Franchisee. /end

Please have a look @SwarnashishC @adi2five @Dinesh_Sairam @AnishA_Moonka @Rahul_J_Mathur @deepakvenkatesh

Read on Twitter

Read on Twitter

![22/ As of Q2FY21, IDFC First has grown its Retail Loan book to Rs.60000crs which at the merger was Rs.36000crs. Retail now constitutes 56% of the total book [+6% for PSL Buyouts]. An interesting thing to note here is that IDFC First has not been growing its overall book. 22/ As of Q2FY21, IDFC First has grown its Retail Loan book to Rs.60000crs which at the merger was Rs.36000crs. Retail now constitutes 56% of the total book [+6% for PSL Buyouts]. An interesting thing to note here is that IDFC First has not been growing its overall book.](https://pbs.twimg.com/media/EoFZX5WVEAEYtOf.png)

![26/ In a low-interest rate regime,7% in a scheduled commercial bank sounds like a very good proposition. Some feel that the interest rate is too high.Well, compared to others, it is definitely high, but if looked at cost of funds for IDFC[8.9%] and CapF[8.5%],7% does look cheaper 26/ In a low-interest rate regime,7% in a scheduled commercial bank sounds like a very good proposition. Some feel that the interest rate is too high.Well, compared to others, it is definitely high, but if looked at cost of funds for IDFC[8.9%] and CapF[8.5%],7% does look cheaper](https://pbs.twimg.com/media/EoFcBA1VcAAC7g3.png)

![27/ While it is getting Retail funds [CASA + TD], it is not using the same for expanding its assets, as seen above is has remained stable for several quarters now. Instead, the bank is using these funds to retire CD and wholesale borrowings. 27/ While it is getting Retail funds [CASA + TD], it is not using the same for expanding its assets, as seen above is has remained stable for several quarters now. Instead, the bank is using these funds to retire CD and wholesale borrowings.](https://pbs.twimg.com/media/EoFcHbBVQAAB2TL.png)