New working paper

New working paper with Constantine Yannelis

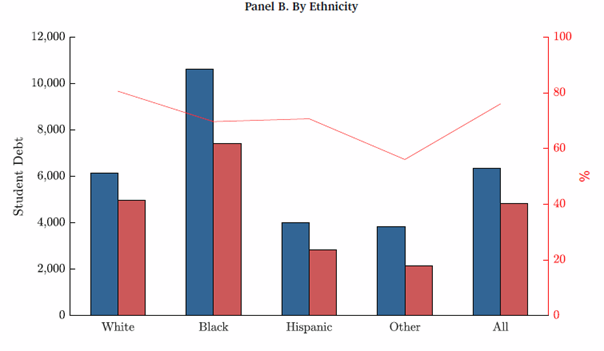

with Constantine YannelisWe study “The Distributional Effects of Student Loan Forgiveness”. We find forgiveness to be a highly regressive policy. Full cancellation would distribute $192 bn to the top 20% of earners, and only $29 bn to the bottom 20%. 1/15

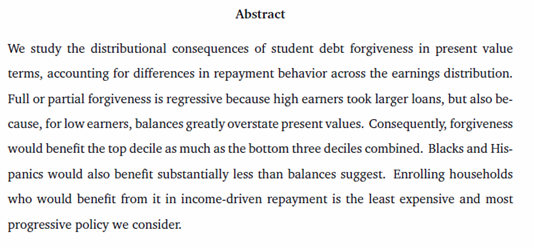

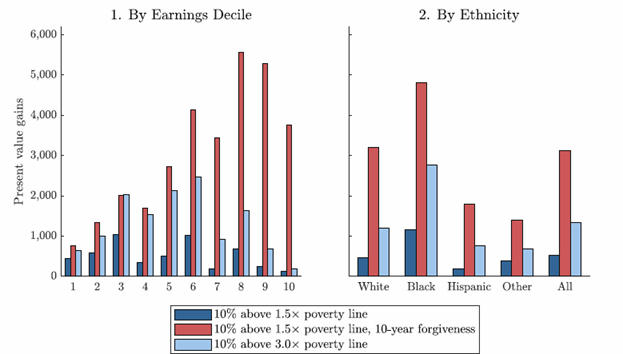

Our main graph shows that the average person in the bottom 10% would receive $3000 in balance forgiveness, which is only worth $1,100 in present value terms (in actual savings). Someone in the top three deciles would receive roughly $8,000 in present value terms. 2/15

Present values account for differences in payment behavior between low on high-income borrowers. In particular, borrowers with high balances and low earnings enrolled in income-driven repayment plans (IDR) pay much less than their balance suggests. 3/15

Borrowers in IDR pay at most 10% of their “discretionary income”: the share of their earnings above 1.5x the poverty line, which depends on their family size. After 20 years, their loan is forgiven. Consequently, many low earners will never fully repay their balance. 4/15

In short, balances greatly overstate how much low-income families would financially benefit from debt forgiveness. In fact, for some people in IDR, forgiving $10,000 would have no effect on their monthly payments. 5/15

We estimate that, for the bottom decile, $1 of balance is truly worth 37 cents. If their debts were securitized and offered to private markets, they would trade at that price. For the top decile, $1 of balance is worth 96 cents. 6/15

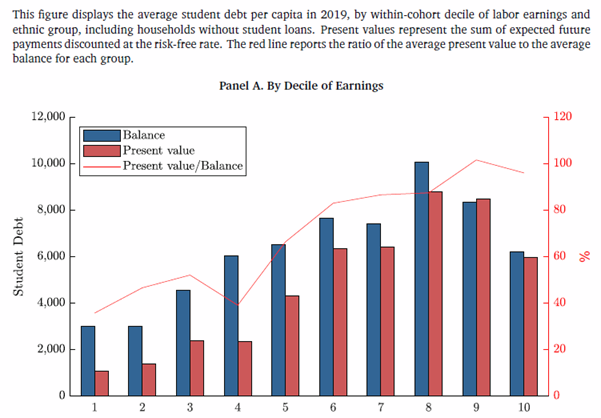

We also run these computations by ethnic group. Blacks have very large balances ($10,600 per person, $33,000 for those with debt), but, as they tend to earn less, the fair value of their debt ($7,400) is somewhat closer to Whites ($5,000). 7/15

We also look at policies forgiving $10K or $50K per person and observe similar patterns. Forgiving $10K is the policy that benefits Blacks the least, relative to other groups. They would only get 16% of the benefits, barely more than their share of the US population. 8/15

What’s the intuition? If, like the average Black borrower, you have a balance of 33K but expect to only reimburse 23K under current rules, then reducing your balance to 23K does not help much. It’s largely cancelling debt you would not have paid back. 9/15

In other words, reducing the balance of low earners acknowledges losses that already happened and that a good accountant would have already provisioned. Whereas reducing the balance of high earners is a real financial gift. 10/15

We also study an alternative policy: enrolling more borrowers in IDR. Many low earners leave money on the table by not enrolling. Enrolling them would distribute more dollars to the bottom 30% (26.2bn) than forgiving $10K of debt. 11/15

In one variation on this policy, we assume that earnings are only garnished above 3x the poverty line. This policy (light blue) mostly benefits the middle class. On the other hand, forgiving debt sooner (red) is very expensive and mostly benefits high earners. 12/15

Also, the cost to taxpayers of enrolling more people in IDR (68bn) is only a third of cancelling $10K (196bn). Why? Because high earners do not benefit. The top decile gets 2.3% of the benefits of enrolling more people in IDR, but 12% of the benefits of cancelling 10K. 13/15

Overall, the bottom 10% receives less than 10% of the benefits of all the policies we consider. Outstanding student debt is inversely correlated with economic hardship, so it is difficult to design a forgiveness policy that does not accentuate inequality. 14/15

Many more details in the paper: https://bfi.uchicago.edu/working-paper/2020-169/ 15/15

Read on Twitter

Read on Twitter