Buyback Analysis

How to deal with these Special Situation Events?

A Thread.

How to deal with these Special Situation Events?

A Thread.

1/n Before we start with our Buyback Calculation let’s understand some basic term to ease our understanding

2/n Buyback of shares is approved by two routes

1) Tender Route

2) Open Market Route

1) Tender Route

2) Open Market Route

3/n

1.Tender Route

Tender Route is the most common way for the buyback. In the tender route, the current shareholders have to make an application for the buyback of shares and based on the demand, the company buy back the shares on the pro-rata and quota allocation basis.

1.Tender Route

Tender Route is the most common way for the buyback. In the tender route, the current shareholders have to make an application for the buyback of shares and based on the demand, the company buy back the shares on the pro-rata and quota allocation basis.

4/n

2. Open Market Route

The open market is a simple and easy one. The company buyback the shares from the exchanges and complete the buyback process but due to such a heavy demand in the shares, the share price rises,

2. Open Market Route

The open market is a simple and easy one. The company buyback the shares from the exchanges and complete the buyback process but due to such a heavy demand in the shares, the share price rises,

If the company has a less free float than substantially it will lead to buying at a very high cost than expected and this make buyback process costly.

5/n what are Announcement Date, Record Date and Ex-Date?

Announcement Date= Date at which the company announced a buyback of shares.

Announcement Date= Date at which the company announced a buyback of shares.

6/n

Record Date= Date at which company records the shareholders who will be entitled to the buyback.

Ex-Date= After this Date nobody is entitled to participate in the buyback.

Record Date= Date at which company records the shareholders who will be entitled to the buyback.

Ex-Date= After this Date nobody is entitled to participate in the buyback.

7/n Example-Justdial

Just dial Board had approved the buyback on 30th April 2020, as per this date buyback was a lucrative bet, so let’s dig further to understand buyback.

Just dial Board had approved the buyback on 30th April 2020, as per this date buyback was a lucrative bet, so let’s dig further to understand buyback.

8/n

Step 1- Visit the BSE Website, check the corporate action, you will get Buyback details ( Announcement made by the company). ( Link shared below)

https://www.bseindia.com/xml-data/corpfiling/AttachHis/0a3e6650-6e66-4999-aac7-a798bfe8539e.pdf

Step 1- Visit the BSE Website, check the corporate action, you will get Buyback details ( Announcement made by the company). ( Link shared below)

https://www.bseindia.com/xml-data/corpfiling/AttachHis/0a3e6650-6e66-4999-aac7-a798bfe8539e.pdf

9/n

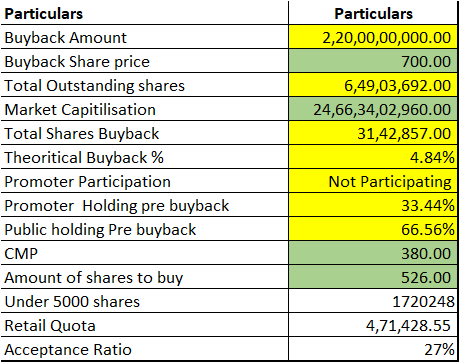

Step 2-

3 details to be fetched from the announcement.

1) Buyback Amount (Total amount of shares they are going buyback) = 22 Cars

2)Buyback Share price (share price for buyback) =700rs

3)Total shares buyback (No. of shares they are going to buyback)= 3142857

Step 2-

3 details to be fetched from the announcement.

1) Buyback Amount (Total amount of shares they are going buyback) = 22 Cars

2)Buyback Share price (share price for buyback) =700rs

3)Total shares buyback (No. of shares they are going to buyback)= 3142857

10/n Step 3

Get Theoretical Buyback Ratio(TBR)= Total shares for buyback/ total Number of shares Outstanding.

Which will be 3142857/64903692 =4.84%.

TBR Explains the total per cent of shares company will be engaged for buyback (This info. is available in the corporate action)

Get Theoretical Buyback Ratio(TBR)= Total shares for buyback/ total Number of shares Outstanding.

Which will be 3142857/64903692 =4.84%.

TBR Explains the total per cent of shares company will be engaged for buyback (This info. is available in the corporate action)

11/n

Step 4 – Let’s consider a scenario for retail investors for the time being.

(Retail quota is a quota mandated by SEBI for companies to set aside 15% of the total buyback size for retail investors,

Step 4 – Let’s consider a scenario for retail investors for the time being.

(Retail quota is a quota mandated by SEBI for companies to set aside 15% of the total buyback size for retail investors,

these investors are those who are holding shares worth up to INR 2 lakh on the record date of the buyback process i.e. you can maximum buy 526 shares at CMP of 380). We have 15% of the Quota reserved for the retail shareholders.

12/n So let's calculate.

We can see that 471428 Shares are applicable for the buyback for the retail Shareholders (15% of 3142857 which is 471428)

We can see that 471428 Shares are applicable for the buyback for the retail Shareholders (15% of 3142857 which is 471428)

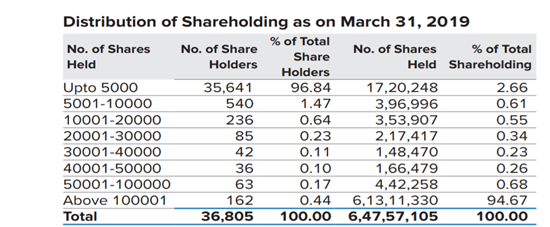

13/n Now how do you know how many shareholders are falling into minority shareholders who can apply for retail Quota?

Here is the catch you get a shareholding pattern in the annual report which shows how many shares are under 1-5000 Category, 50000-100000 Category and so on.

Here is the catch you get a shareholding pattern in the annual report which shows how many shares are under 1-5000 Category, 50000-100000 Category and so on.

14/n Check the below image which shows 1720248 Shares are under 1-5000 Category i.e these shareholders may apply for the buyback for retail quota. (You can Download annual report form BSE Website or Company's website)

15/n Step 5- Now let’s find the acceptance ratio which leads to what per cent the company will accept the shares in the buyback

Acceptance Ratio(AR) = Total Shares are available for retail Quota/ Total No of shares held under minority category

which is =471428/1720248 = 27%

Acceptance Ratio(AR) = Total Shares are available for retail Quota/ Total No of shares held under minority category

which is =471428/1720248 = 27%

27% is the minimum AR by the company for the buyback of the shares.

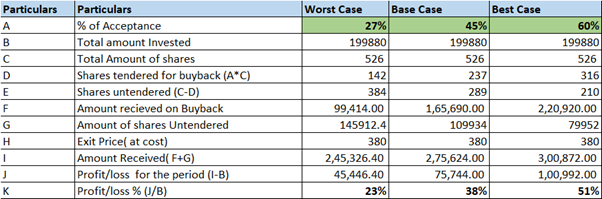

17/n

Worst Case= Only 27%( As per Acceptance Ratio) Shares can be Tender for the buyback and 73% shares remain untendered which we will exit at cost.

Worst Case= Only 27%( As per Acceptance Ratio) Shares can be Tender for the buyback and 73% shares remain untendered which we will exit at cost.

So, we invested 1,99,880rs for the buyback. Now we have only 27% as the acceptance Ratio that leads to 142 out of 526 shares can accept in the buyback and 384 remains untendered.

18/n 142 shares are sold at 700rs per share (Buyback price decided by the company) and remaining we will sell at the cost (the price we bought).

We earn a good amount of money i.e 45,446 Profit in the invested amount of 1,99,880 (~23%)

( As stated in the image below)

We earn a good amount of money i.e 45,446 Profit in the invested amount of 1,99,880 (~23%)

( As stated in the image below)

18/n Let us calculate the

A. Worst-case scenario,

B. Base-case Scenario

C. Best-case Scenario

A. Worst-case scenario,

B. Base-case Scenario

C. Best-case Scenario

19/n Base Case= Only 45% (Assumed) shares tendered for the buyback and 55% shares remain Untendered which will be exiting at cost.

20/n Why base case and best-case scenario?

We considered the category of under 5000, Even in this category there will be very fewer shareholders who hold less than 500 shares which fall under retail quota, we have already been conservative in terms of a worst-case scenario

We considered the category of under 5000, Even in this category there will be very fewer shareholders who hold less than 500 shares which fall under retail quota, we have already been conservative in terms of a worst-case scenario

21/n Best Case=Only 60% (Assumed) shares tendered for the buyback and 40% shares untendered which we will exit at cost.

As per our analysis, in worst case Scenario we are earning ~23% in the buyback Period( which is mostly 2-3 months of duration)

As per our analysis, in worst case Scenario we are earning ~23% in the buyback Period( which is mostly 2-3 months of duration)

In the Best Case Scenario, we are earning ~51% profit for the buyback period.

22/n Unpopular fact:

We calculated the buyback for the share price prevailing on the announcement date and made consideration for our different scenario but you should know that the company records shareholders name on the record date

We calculated the buyback for the share price prevailing on the announcement date and made consideration for our different scenario but you should know that the company records shareholders name on the record date

we don’t know what price will be prevailing due to volatility.

If your value will be more than 2 lac then you are no more applicable for the retail category and you will be considered in HNI( High Net worth Individuals) category. For simplification buy shares of 1.5 -1.75 lac

If your value will be more than 2 lac then you are no more applicable for the retail category and you will be considered in HNI( High Net worth Individuals) category. For simplification buy shares of 1.5 -1.75 lac

23/n

Let take one more Example

Thomas Cook.

Let's See how much Viable it was.

Let take one more Example

Thomas Cook.

Let's See how much Viable it was.

26/n We can analyse in the worst-case scenario, we can just make 3.14% of the profit, while in the best-case scenario we can make 3.8% profit. Due to low acceptability and due to high opportunity cost, we will try not to participate in such a buyback Scenario.

27/n

Conclusion Note

Don't participate in the buyback which looks lucrative on the price basis, in Thomas cook buyback prices are lucrative i.e 57.5 compare at CMP (49.35) but the acceptance ratio is way too bad and so retail investors can make a minor loss( Due to volatility)

Conclusion Note

Don't participate in the buyback which looks lucrative on the price basis, in Thomas cook buyback prices are lucrative i.e 57.5 compare at CMP (49.35) but the acceptance ratio is way too bad and so retail investors can make a minor loss( Due to volatility)

28/n

When you apply for the buyback, go with the above steps provided, so that you can play a safe bet and earn a lot of money in an example of JUST DIAL and capital can be protected while investing in a better outcome

When you apply for the buyback, go with the above steps provided, so that you can play a safe bet and earn a lot of money in an example of JUST DIAL and capital can be protected while investing in a better outcome

29/n

We have to assure that the buyback is a good opportunity or not. In Just dial, it is 1 in a Million scenario where we can make a massive amount of money. While before applying for the buyback, follow these steps provided to value the buyback process

We have to assure that the buyback is a good opportunity or not. In Just dial, it is 1 in a Million scenario where we can make a massive amount of money. While before applying for the buyback, follow these steps provided to value the buyback process

30/n

One of my favourite twitter handler @tycoonmindset05 had made analysis on NTPC buyback. Just check is it worth of investment.

https://thetycoonmindset.com/special-situation/ntpc-buyback-case-study/#:~:text=The%20buyback%20amount%20of%20NTPC,the%20increase%20in%20share%20price).

One of my favourite twitter handler @tycoonmindset05 had made analysis on NTPC buyback. Just check is it worth of investment.

https://thetycoonmindset.com/special-situation/ntpc-buyback-case-study/#:~:text=The%20buyback%20amount%20of%20NTPC,the%20increase%20in%20share%20price).

31n

If you are still with me, you have great potential and eagerness to learn.

Stay Investing!!

If you are still with me, you have great potential and eagerness to learn.

Stay Investing!!

I'm tagging you not for the follower count, rather to educate innocent and ignorant Individuals

@ms89_meet @dmuthuk @deepakvenkatesh @shyamsek @adi2five @FincademyIn @FI_InvestIndia @iRadhikaGupta @Prashanth_Krish

@ms89_meet @dmuthuk @deepakvenkatesh @shyamsek @adi2five @FincademyIn @FI_InvestIndia @iRadhikaGupta @Prashanth_Krish

Read on Twitter

Read on Twitter