What are dividend yield funds?

A thread

Bonus: Comments on HDFC Dividend Yield Fund (NFO)

A thread

Bonus: Comments on HDFC Dividend Yield Fund (NFO)

1/ NFO: New Fund Offer is like an IPO of Mutual Fund Scheme. The scheme issues units to its subscribers at Face Value which is usually Rs. 10 per unit.

2/ The dividend yield is a financial metric that shows the amount paid by a company to its shareholders as a percentage of its stock price. Eg: A dividend of Rs. 10 on a stock of Rs. 200 would indicate a dividend yield of 5%.

3/ A dividend yield fund is a scheme that invests predominantly in companies having a track record of high dividend payouts along with occasional buybacks in order to return money to its shareholders.

4/ The fund bets on companies with stable cash flows along with predictable earnings. These are mature companies growing at a normal pace with lesser opportunities to reinvest their profits at a higher rate of return and hence chose to pay hefty dividends or consider buybacks.

5/ Companies in this category are mostly large-cap IT, FMCG, Energy, Utilities, etc. The focus of the scheme is to ensure the stability of returns over high growth on capital.

an important advantage of investing in such funds for large investors is tax arbitrage.

an important advantage of investing in such funds for large investors is tax arbitrage.

6/ Dividend in the hands of investors is taxed at the slab rates. This could be a cause of concern for large investors in high tax bracket. However, when they invest in mutual funds, there is no tax on dividends to the Mutual Fund house

7/ and the tax is incurred by investors only when they sell units in profit. These gains are taxed at 10% in the case of LTCG (holding period over 1 year) and 15% in the case of STCG (holding period of 1 year or less). This provides additional benefit on post-tax basis.

8/ The benchmark for such schemes is NIFTY Dividend Opportunities 50 Index. You can check the latest constituents here: https://bit.ly/3o4BrkV

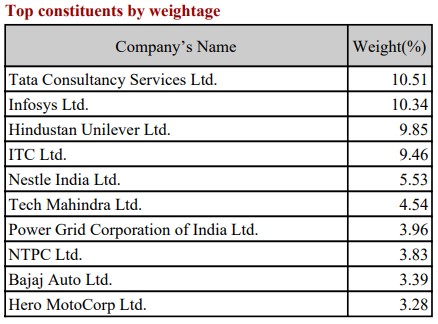

9/ Following is the weightage of stocks in NIFTY Dividend Opportunities 50 Index as of 30th October 2020:

10/ HDFC Dividend Yield Fund is a New Fund Offer in this particular category. I have tried to summarize the details put forth by various communications received from AMC with respect to these schemes:

- Scheme will invest a minimum of 65% of corpus in high dividend yield stocks.

- Scheme will invest a minimum of 65% of corpus in high dividend yield stocks.

11/

- Preference will be given to stocks with a consistent history of paying dividends.

- Stock having higher DY than the Nifty 50 index will be preferred. (Most PSU utility and energy companies qualify).

- Investing in low capital intensive business (Most IT companies).

- Preference will be given to stocks with a consistent history of paying dividends.

- Stock having higher DY than the Nifty 50 index will be preferred. (Most PSU utility and energy companies qualify).

- Investing in low capital intensive business (Most IT companies).

12/

- Ability to increase dividend payouts.

- Dividend yield at 1x - 2x of 10-year G-sec yield.

- It will be sector and market cap agnostic.

- Ability to increase dividend payouts.

- Dividend yield at 1x - 2x of 10-year G-sec yield.

- It will be sector and market cap agnostic.

13/

My take on this NFO:

- Most of the stocks in portfolio will be PSU utility & energy cos that have not performed well in terms of share price growth. In some cases, The dividend yield was fully offset by the decline in share price thereby yielding zero or negative returns.

My take on this NFO:

- Most of the stocks in portfolio will be PSU utility & energy cos that have not performed well in terms of share price growth. In some cases, The dividend yield was fully offset by the decline in share price thereby yielding zero or negative returns.

14/

- Valuation could be a cause of concern while investing in FMCG companies even when they have stable dividend payouts. Time correction in such companies may result in below-par returns for the scheme.

- Valuation could be a cause of concern while investing in FMCG companies even when they have stable dividend payouts. Time correction in such companies may result in below-par returns for the scheme.

15/

- IT companies have displayed stability in terms of dividends along with decent stock price growth and are trading at reasonable valuations. A higher weightage to these companies may result in good performance of the scheme.

- IT companies have displayed stability in terms of dividends along with decent stock price growth and are trading at reasonable valuations. A higher weightage to these companies may result in good performance of the scheme.

16/

- Median expense ratio of this category of funds is around 1.5%. This coupled with lower share price growth stocks could lead to below-par returns.

- Median expense ratio of this category of funds is around 1.5%. This coupled with lower share price growth stocks could lead to below-par returns.

17/

- The fund should have lower beta and volatility as compared to other broader indices like Nifty 50 due to its constituents. The fund manager can further reduce the volatility by higher allocation to low beta stocks. (We will have to wait and watch).

- The fund should have lower beta and volatility as compared to other broader indices like Nifty 50 due to its constituents. The fund manager can further reduce the volatility by higher allocation to low beta stocks. (We will have to wait and watch).

18/

- The dividend tax arbitrage won't make much sense in the case of investors in lower tax slabs.

- The dividend tax arbitrage won't make much sense in the case of investors in lower tax slabs.

19/

Conclusion: Investors looking for low volatility and stable returns can take a look at this fund. However, looking at past performance of this category, it can be seen that these funds have underperformed the funds in other equity-oriented categories (Eg: Multi cap).

End.

Conclusion: Investors looking for low volatility and stable returns can take a look at this fund. However, looking at past performance of this category, it can be seen that these funds have underperformed the funds in other equity-oriented categories (Eg: Multi cap).

End.

Read on Twitter

Read on Twitter