Many people on FinTwit incorrectly invoke Soros to justify buying TSLA or other trends at the highs. Soros preferred being early, having a trend, a misconception, a change of fundamentals and some early confirmation in price. Here are 7 examples I have on right now. A thread:

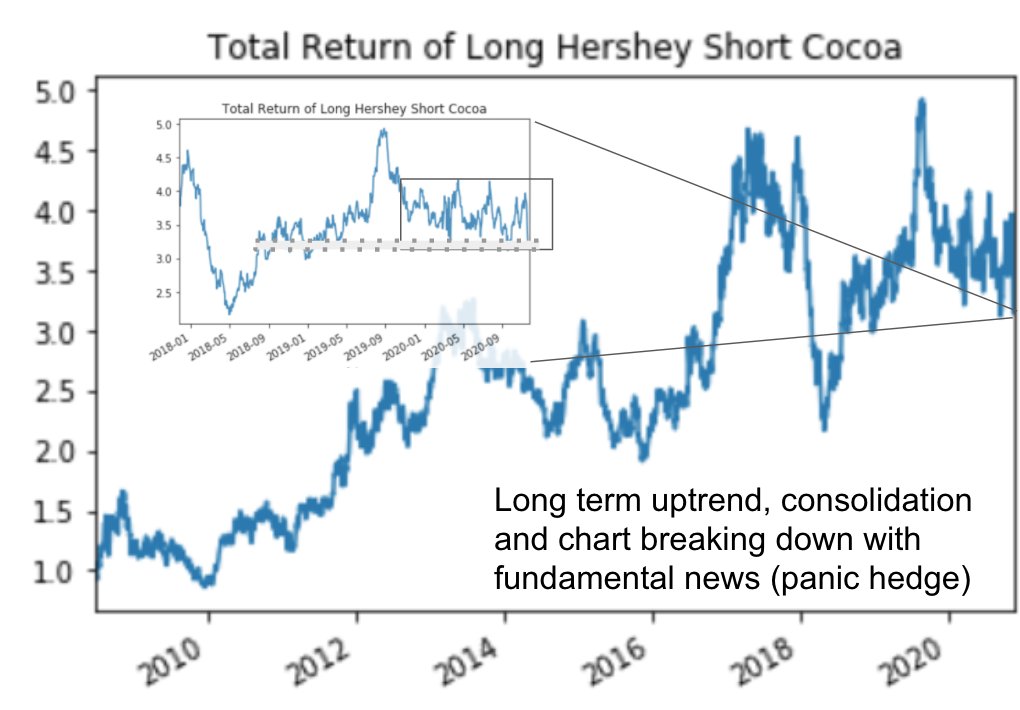

1/ The trend: climate change & growing Chinese wealth. The misconception: agriculture prices will always go down due to improved crop productivity. The Shock: Locust plague in Africa & water scarcity. The Trade: Long Cocoa Futures versus Hershey. The Confirmation:

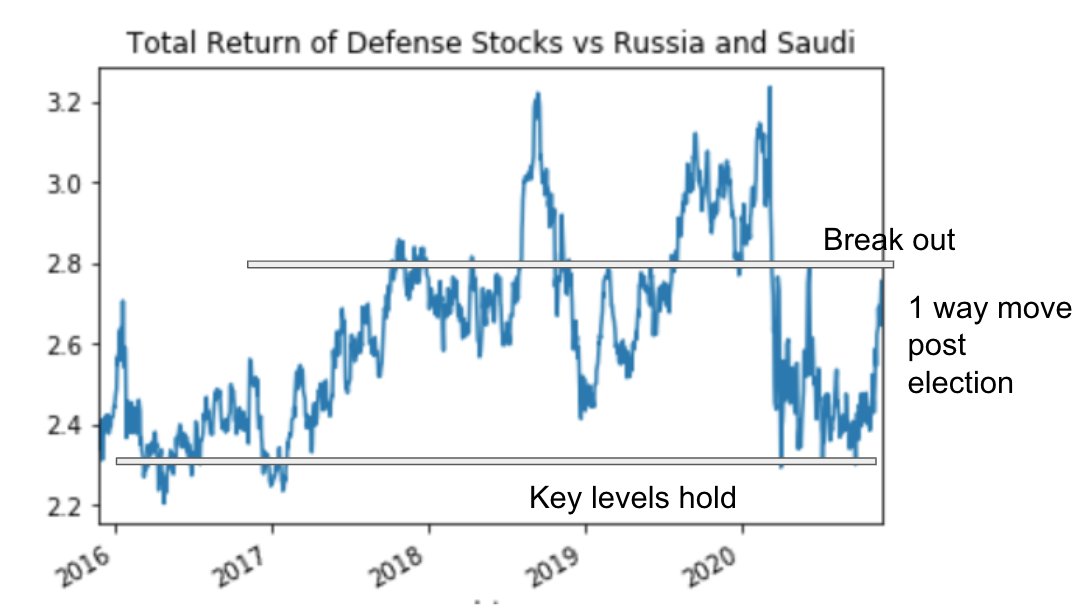

2/ The trend: nationalism and Realpolitik. The misconception: ESG investing will halt investment in defense stocks. The Middle East is calming. The shock: Biden engaging with Taiwan. Kamala saying Assad needs to go. The trade: Defense stocks vs Russia and Saudi. The confirmation:

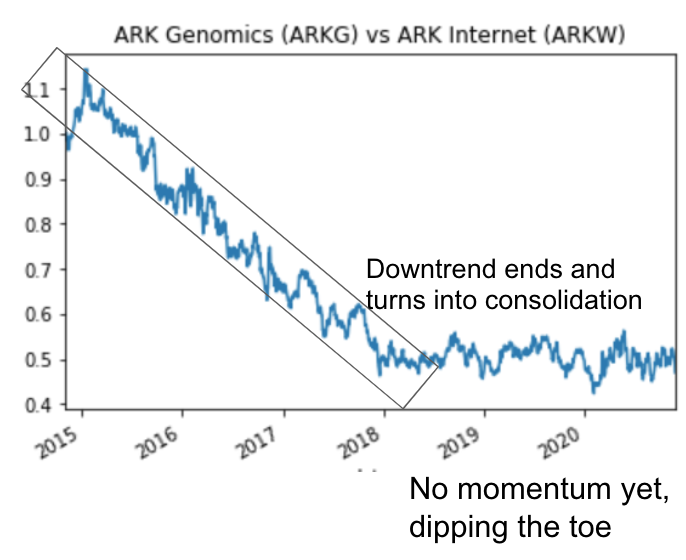

3/ The trend: state run markets. The misconception: the government will flex its muscles to benefit cloud, internet, and social media more than the genome sector. The shock: Moderna and Pfizer solving a $5 trillion+ problem with gene editing. The trade: ARKG vs ARKW. The chart:

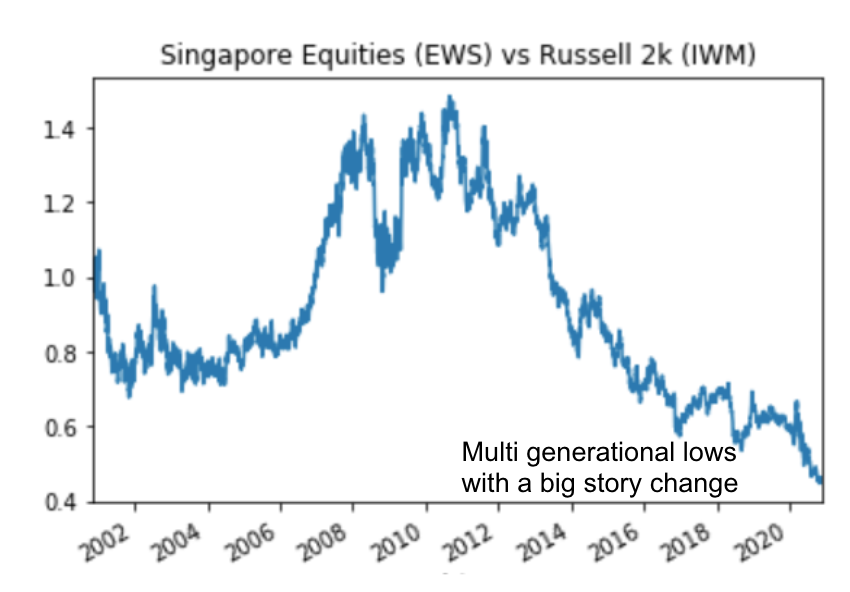

4/ The trend: collapse in US soft power, business friendly dynamics. The misconception: capital will stay in the US instead of moving internationally. The shock: RCEP signed without the US - free trade zone in Southeast Asia. The trade: long Singapore (EWS) short R2K. Chart:

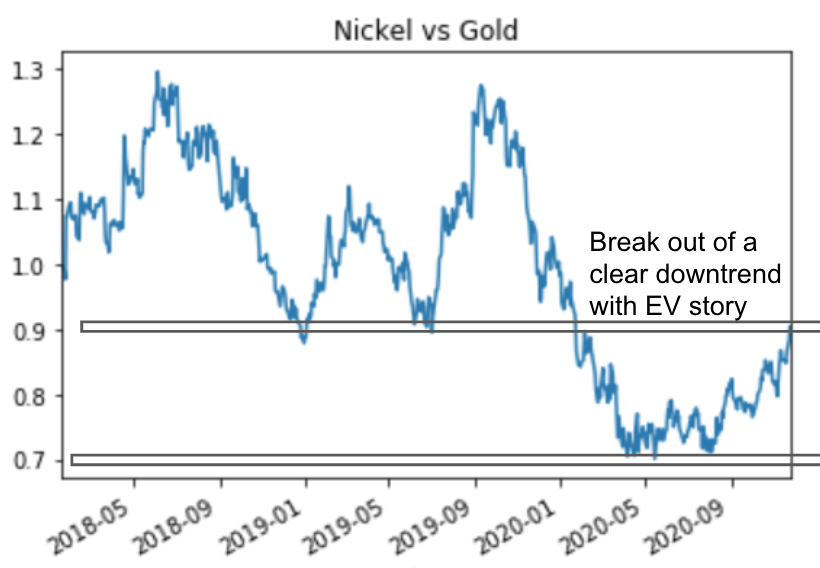

5/ The trend: obscene monetary debasement/fiscal expansion. The misconception: gold is the best expression. EM central banks have $ to buy more gold. The shock: electric vehicles driving nickel shortage. AstraZ failure = bad for EM. The trade: long Nickel hedged with gold.

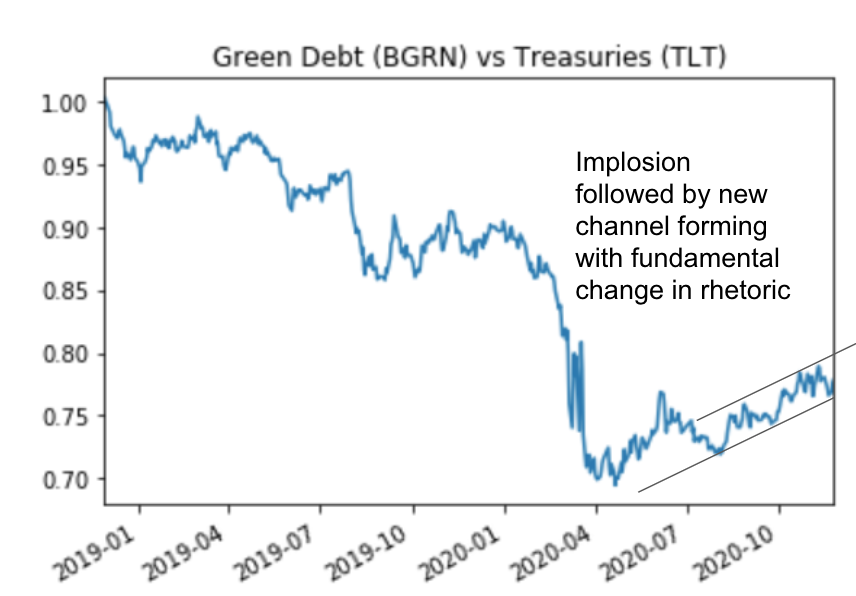

6/ The trend: politicization of central banking. The misconceptions: central banks can endlessly absorb 30 year issuance. central banks can't buy whatever bonds they want. The shock: stimulus checks & green ECB statement. The trade: green short term debt vs US long term debt.

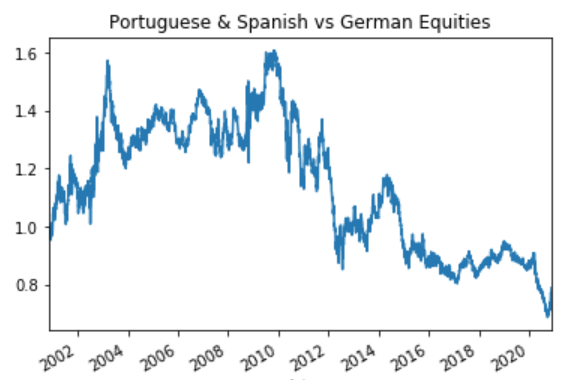

7/ The trend: true monetary unification of the Euro. The misconception: the Germans will profit from the ECB's climate shift and effective bailouts of the peripherals. The shock: massive peripheral debt purchases, discussion of Jubilee. The trade: Spain & Portugal vs Germany

8/ All trades have fundamentals, data, and a constant stream of news flow I can monitor 24/7. Most are in very liquid markets so I can get out fast. I'm constantly looking to be wrong. Soros said at his Google lecture that his most prized ability was changing his mind quickly.

Read on Twitter

Read on Twitter