A light thread on insurance and the missed part of this very 2 sided coin.

The current narrative that I have noticed in the DeFi space with respect to insurance is a focus on 2 things;

- TVL

- Total Cover Purchased

While these are 2 fundamentals any investor needs to be highly considerate of, the truth is they are only the investors side of the story.

- TVL

- Total Cover Purchased

While these are 2 fundamentals any investor needs to be highly considerate of, the truth is they are only the investors side of the story.

In the difference between the current money markets we are used to seeing in DeFi ,with insurance specifically, it needs to appeal to the purchasing party for the growth of the platform.

I mean no purchasing of cover, no fees right?

I mean no purchasing of cover, no fees right?

So why would someone want to purchase cover in the first place?

Simple - to be paid out in the instance something were to happen.

So as investors look for returns based on the probability of risk of an event, the purchaser wants a price the meets a probability of payout.

Simple - to be paid out in the instance something were to happen.

So as investors look for returns based on the probability of risk of an event, the purchaser wants a price the meets a probability of payout.

Which brings me to the all important missing piece of the DeFi insurance puzzle.

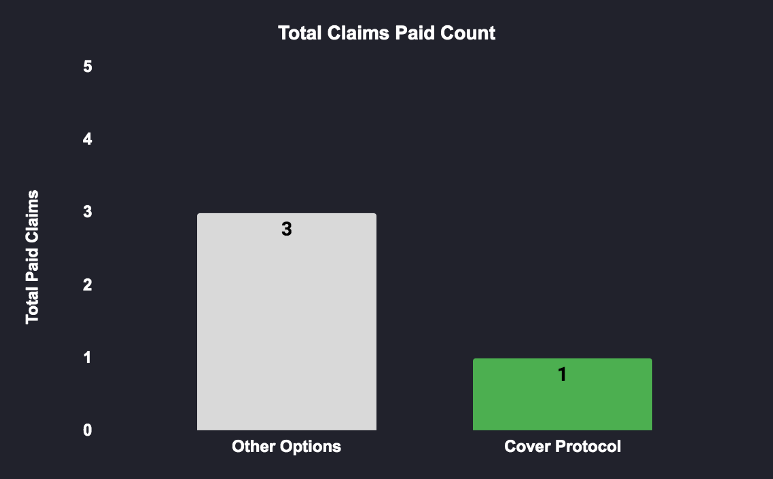

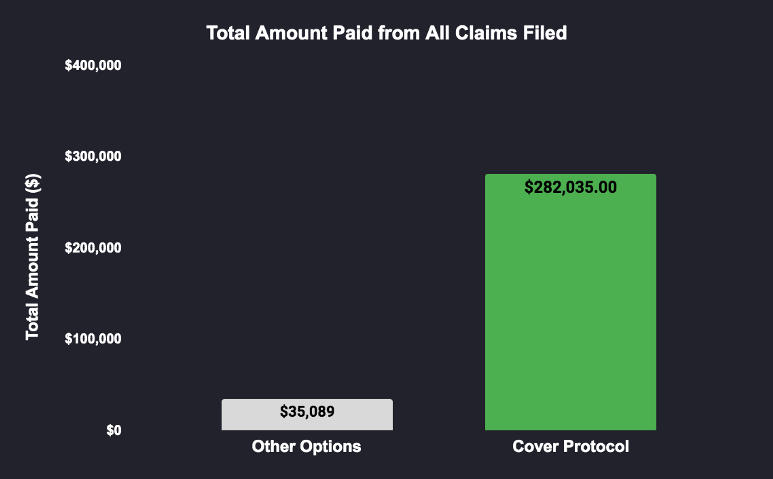

The claims process and the ability to pay.

Important to any current traditional insurance product the claims and payouts process is generally the markets judge of value and pricing.

The claims process and the ability to pay.

Important to any current traditional insurance product the claims and payouts process is generally the markets judge of value and pricing.

So while these numbers as below are nice that TVL is at near $100 million in Nexus and the MCR being at 101%, these are really irrelevant for some reasons I will point out. https://twitter.com/ZeMariaMacedo/status/1332393347927912450?s=20

If there is sufficiently priced coverage elsewhere with a proven history of payouts on claims, then purchasers will be happy to pay a premium to know that they are protected.

If Nexus cannot start to improve the claims process, cover purchase may go elsewhere.

If Nexus cannot start to improve the claims process, cover purchase may go elsewhere.

MCR% will actually rise in this instance as the MCR needed becomes less with less coverage purchased and actually have a further downward spiral on the price. Also allowing more $ETH to leave the Mutual. https://twitter.com/DegenSpartan/status/1323330703589662720?s=20

Will we see this happen? I don't know yet but Nexus do have a strong community and I am sure they are looking at how to provide a more robust and transparent claims process for their coverage holders. to meet competition in the market.

In insurance if you work when building with a view on the end purchaser you can achieve the same results in reverse, PMF with claims and payouts - leads to more purchasing of cover and more fees - more TVL from investor participants and a value return to token holders.

The next few months will see this space heat up and I look forward to the innovation coming out from all protocols as we all tackle the protection of users in the DeFi space.

Read on Twitter

Read on Twitter