Yesterday's @globeandmail article is bad and presents gross and incorrect speculation as informed analysis.

I'm getting tired of this. But, here is ANOTHER thread on TMX. Necessitated by reactions to this week's CER Energy Futures Report. https://www.theglobeandmail.com/opinion/article-the-trans-mountain-pipeline-could-soon-be-canadas-white-elephant/

I'm getting tired of this. But, here is ANOTHER thread on TMX. Necessitated by reactions to this week's CER Energy Futures Report. https://www.theglobeandmail.com/opinion/article-the-trans-mountain-pipeline-could-soon-be-canadas-white-elephant/

First off, the way that Global News handled this file is far more responsible than the above linked Globe and Mail article.

@ealini interviewed both me and @robynallan to get different analysis and opinion. https://globalnews.ca/news/7483307/canada-energy-regulator-trans-mountain/

@ealini interviewed both me and @robynallan to get different analysis and opinion. https://globalnews.ca/news/7483307/canada-energy-regulator-trans-mountain/

As an aside, I disagree with @robynallan's analysis here. But her reputation on this file has been earned by years of observation and analysis. I see no fault in a reporter approaching her for comment on this (particularly if they then get a second opinion from someone like me).

Back to the Globe's story.

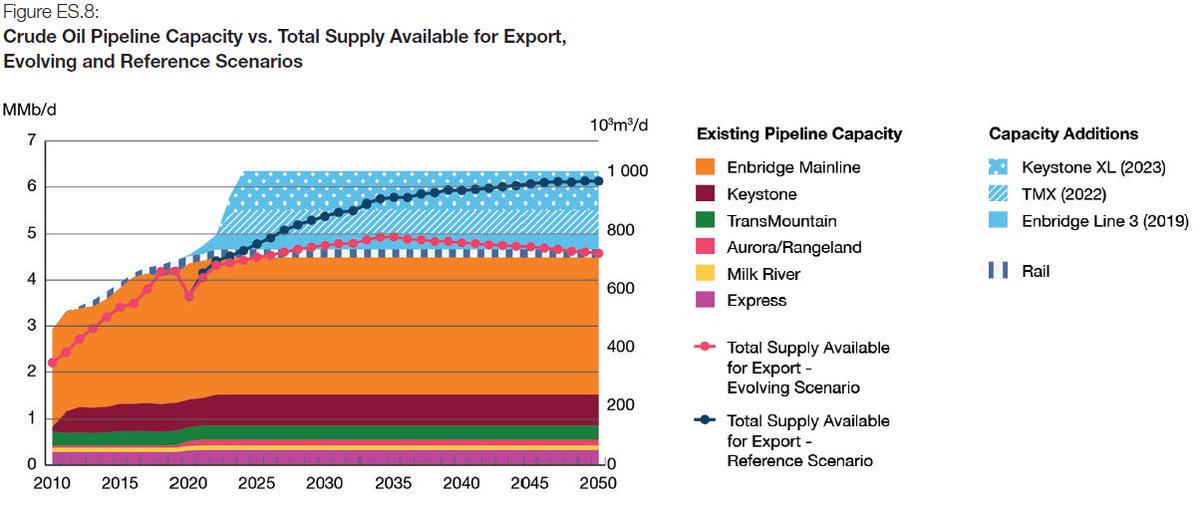

It, and a lot of the commentary on the CER report, seems to be based on a misinterpretation of this figure (from page 14 of the CER energy futures report: https://www.cer-rec.gc.ca/en/data-analysis/canada-energy-future/2020/canada-energy-futures-2020.pdf)

It, and a lot of the commentary on the CER report, seems to be based on a misinterpretation of this figure (from page 14 of the CER energy futures report: https://www.cer-rec.gc.ca/en/data-analysis/canada-energy-future/2020/canada-energy-futures-2020.pdf)

A very quick reading of that figure might lead to the conclusion that:

The red (evolving scenario) line doesn't go above the "Enbridge Line 3" Line

Ergo, we don't need TMX or KXL.

This is wrong for a few reasons.

The red (evolving scenario) line doesn't go above the "Enbridge Line 3" Line

Ergo, we don't need TMX or KXL.

This is wrong for a few reasons.

First, the transportation options near the top of the graph are stacked based on completion dates. That's fine, but, there is important context:

Rail tolls from Hardisty to the lower mainland (the TMX route) are 3 to 10 TIMES the pipeline toll.

Rail is SO much more expensive.

Rail tolls from Hardisty to the lower mainland (the TMX route) are 3 to 10 TIMES the pipeline toll.

Rail is SO much more expensive.

It's hard to know exactly how much more expensive rail is. But we know from evidence submitted to the BCUC that Trans-Mountain capacity (for refined products) was being sold in the re-sale market for up to 10X the regulated toll. You don't pay that much if rail is a better option

Second,

Pipelines don't have to be 100% full, all the time, to be a good investment.

It's a trivial example, but there is a good chance a small natural gas line enters your house or building. Consider that line is basically never running at 100% capacity.

Pipelines don't have to be 100% full, all the time, to be a good investment.

It's a trivial example, but there is a good chance a small natural gas line enters your house or building. Consider that line is basically never running at 100% capacity.

For a more practical example, the TransCanada Natural gas mainline saw its throughput drop dramatically in the 2000's, but the pipeline was still able to cover costs (due to having regulated tolls).

TMX tolls are going to be set a bit differently, but the pipeline already has long term commitments from shippers for 700,000 bpd of it's total 890,000 bpd capacity.

And there is a regulated upper limit on these long term commitments because the pipeline and CER need to ensure room for uncommitted shippers as well (those that want more option value on whether or not to ship).

Basically, the have set up their tolling agreements and shipper commitments to ensure the pipeline remains solvent.

In fact, if their throughput exceeds 85% of capacity in a given year, their agreement stipulates a revenue sharing agreement with their shippers.

In fact, if their throughput exceeds 85% of capacity in a given year, their agreement stipulates a revenue sharing agreement with their shippers.

It is also worth mentioning that this thing where we seem to implicitly expect (or desire) that all built pipelines are always full all the time is a weird (and wrong) new thing.

Prior to 2010 or so, we often had excess capacity on multiple pipelines BY DESIGN. Shipping demand on an individual pipeline fluctuates throughout the year due to season demand variation and across different pipeline routes due to variability in regional pricing and demand.

"These pipelines won't be full all the time" is good, and is not the same thing as: "there is not enough demand for these pipelines."

Finally (for now), remember that different pipelines serve different markets at different times. Excess capacity on any one line doesn't mean the industry wouldn't benefit from another line somewhere else.

See also @BlairKing_ca 's well informed thread on the subject: https://twitter.com/BlairKing_ca/status/1332173782828531713?s=20

Read on Twitter

Read on Twitter