The 2020 stock market recovery should not be surprising given the V-shaped recovery in corporate profits, which are now higher than they were at the end of 2019 (h/t @lhamtil).

Thread on what drove this, using sectoral balances & Levy-Kalecki

1/

Thread on what drove this, using sectoral balances & Levy-Kalecki

1/

Levy-Kalecki profit equation recap:

Corporate Profits =

Investment

+ Dividends

- Household Saving

- Government Saving

+ Current Account Surplus

Business investment & current account surpluses are profit sources.

Household & government savings subtract from profits.

2/

Corporate Profits =

Investment

+ Dividends

- Household Saving

- Government Saving

+ Current Account Surplus

Business investment & current account surpluses are profit sources.

Household & government savings subtract from profits.

2/

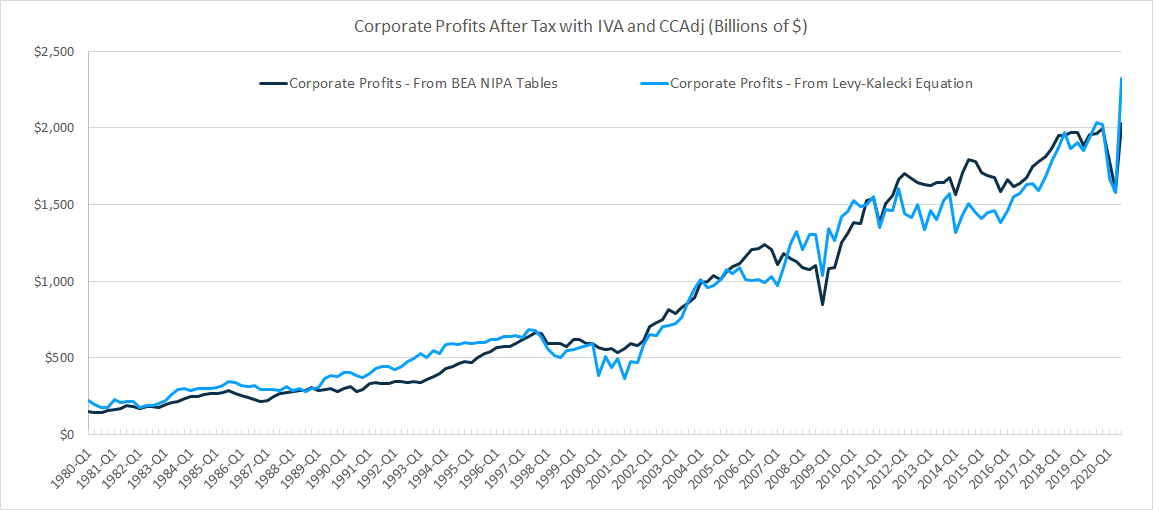

I used BEA's NIPA tables to compare corporate profits (collected directly) vs calculation using the profit equation.

Not a perfect match as the first chart shows.

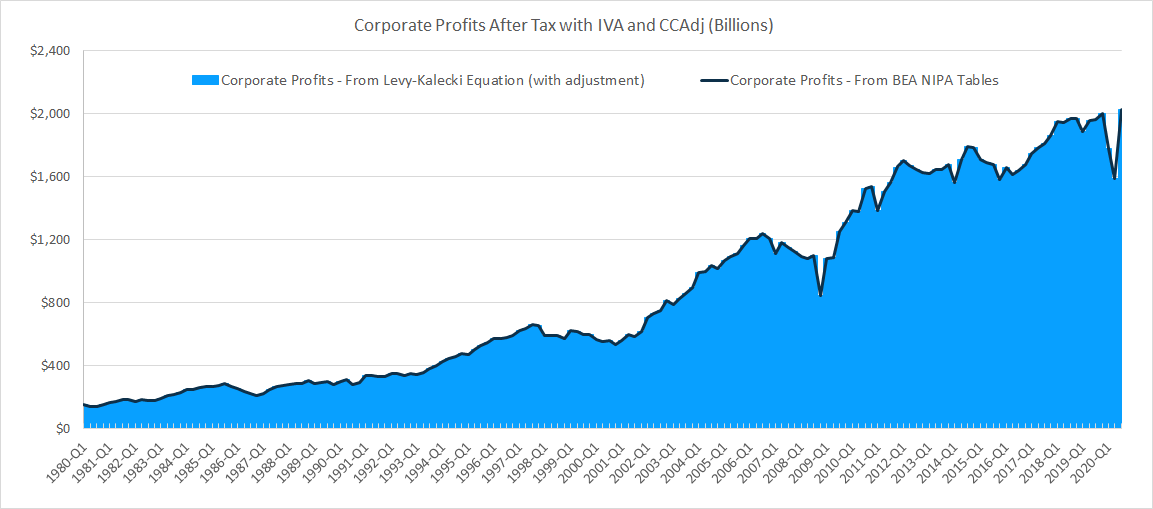

But you get an exact match by subtracting a discrepancy term (from BEA) to account for data collection errors.

3/

Not a perfect match as the first chart shows.

But you get an exact match by subtracting a discrepancy term (from BEA) to account for data collection errors.

3/

So here's cumulative growth of corporate profits & profit sources from 1993-2020 Q3.

You see big shifts, especially in household (blue) & government savings (orange) post-2008.

And 2020 Q2/Q3 are off the charts - more on this below.

4/

You see big shifts, especially in household (blue) & government savings (orange) post-2008.

And 2020 Q2/Q3 are off the charts - more on this below.

4/

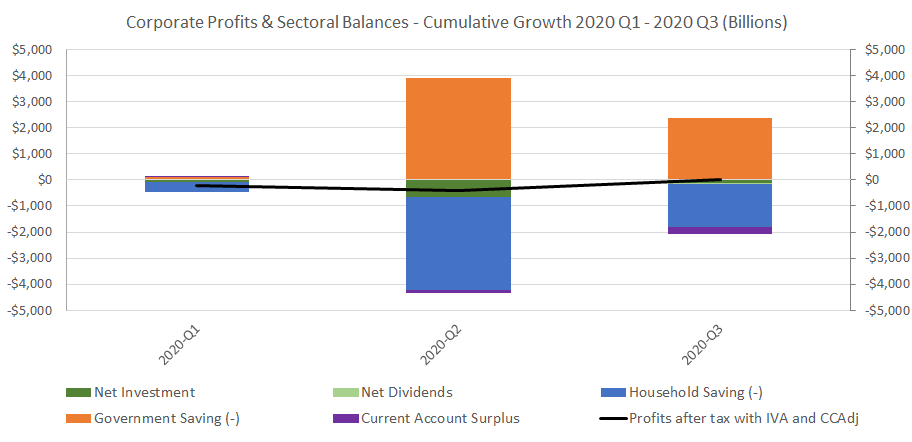

Focusing on 2020 Q1-Q3 cumulative growth.

We see huge increases in household savings (blue bars) & dropoff in investment spending (green) - both subtracting from profits.

But profits completely recovered (+$28B ytd) - thanks to negative govt savings i.e. deficits (orange).

5/

We see huge increases in household savings (blue bars) & dropoff in investment spending (green) - both subtracting from profits.

But profits completely recovered (+$28B ytd) - thanks to negative govt savings i.e. deficits (orange).

5/

Extending back a little further ...

Since 2016, profits are up $442B.

This is almost entirely on the back of fiscal deficits, which has made up for

- household deleveraging

- negligible investment

- higher current account deficits.

6/

Since 2016, profits are up $442B.

This is almost entirely on the back of fiscal deficits, which has made up for

- household deleveraging

- negligible investment

- higher current account deficits.

6/

Here's data from other sub-periods, including

2010-2015

2008-2009

2003-2007

2000-2002

1993-1999

(from a prior thread I did back in Feb)

https://twitter.com/sonusvarghese/status/1225158230642429961?s=20

7/

2010-2015

2008-2009

2003-2007

2000-2002

1993-1999

(from a prior thread I did back in Feb)

https://twitter.com/sonusvarghese/status/1225158230642429961?s=20

7/

Thread also has links to more info on Levy-Kalecki, incl

- primer from @RomanchukBrian

- a discussion between @DavidBeckworth & @teasri

- an old piece by @Jesse_Livermore

I highly recommend all

8/ https://twitter.com/sonusvarghese/status/1225158206915301378?s=20

- primer from @RomanchukBrian

- a discussion between @DavidBeckworth & @teasri

- an old piece by @Jesse_Livermore

I highly recommend all

8/ https://twitter.com/sonusvarghese/status/1225158206915301378?s=20

I do want to add a couple of more recent pieces.

Here @NathanTankus discusses "where profits come from" - definitely give it a read (& subscription)!

https://nathantankus.substack.com/p/where-do-profits-come-from

9/

Here @NathanTankus discusses "where profits come from" - definitely give it a read (& subscription)!

https://nathantankus.substack.com/p/where-do-profits-come-from

9/

For a deep dive, including the algebra & implications for markets, I highly recommend this mammoth piece by @Jesse_Livermore.

The 2020 profit scenarios don't look outlandish now!

As he noted, govt actions have quite literally changed the equation.

https://osam.com/Commentary/upside-down-markets

/end

The 2020 profit scenarios don't look outlandish now!

As he noted, govt actions have quite literally changed the equation.

https://osam.com/Commentary/upside-down-markets

/end

Read on Twitter

Read on Twitter