1/ Quick take: $DMTK

Industry: Genetic diagnostics

Market cap: $250m

Platform: Less invasive and lower-cost detection of melanoma from suspicious moles and skin lesions.

A lot of chatter about this being a hidden gem stock. I might disagree.

Industry: Genetic diagnostics

Market cap: $250m

Platform: Less invasive and lower-cost detection of melanoma from suspicious moles and skin lesions.

A lot of chatter about this being a hidden gem stock. I might disagree.

2/ $DMTK is developing genetic diagnostics to detect melanoma. Typically, dermatologists take a biopsy of suspicious skin, then a pathologist assesses microscopic features. That can miss melanoma or risk taking too many biopsies.

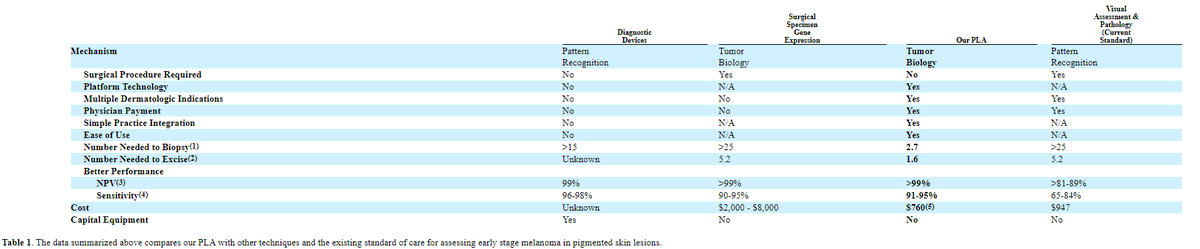

3/ $DMTK offers the pigmented lesion assay (PLA), which removes a layer of skin with adhesive tape (less invasive). The sample is assessed for malignant genetic markers. If melanoma is detected, then the Nevome test takes a deeper look at specific mutations from the same sample.

4/ The PLA is certainly a better approach to detecting melanoma. More accurate, less prone to human error, and *potentially* lower cost.

I've had a close call with melanoma (and the scars to go with it), so I can appreciate the tech-driven approach. $DMTK

I've had a close call with melanoma (and the scars to go with it), so I can appreciate the tech-driven approach. $DMTK

5/ Here's where investors need to be careful: $DMTK is pretty far away from achieving commercial success or market traction.

The PLA launched in Q2 2018. In the first nine months of 2020, the business recorded $2.7m in product revenue. Pretty lousy. What's going on?

The PLA launched in Q2 2018. In the first nine months of 2020, the business recorded $2.7m in product revenue. Pretty lousy. What's going on?

6/ $DMTK products aren't covered by many major insurance payors. Company expects these decisions between May 2022 and May 2023. That's a long time to wait -- and a big risk for investors. It can't actually price the PLA until payors agree. The product portfolio is also changing.

7/ $DMTK is seeking approval for a new product called PLA plus, which will replace the Nevome test. It adds TERT promoter detection, removes BRAF and NRAS genes. This shakes up regulatory, insurance payor coverage, and competitive timelines and risks.

8/ This is important:

There is nothing stopping competitors with significant resources and lab throughput from providing genetic Dx for melanoma. $MYGN (already has one actually), $NVTA, $EXAS, and so on. In fact, these companies could just copy $DMTK. Really.

There is nothing stopping competitors with significant resources and lab throughput from providing genetic Dx for melanoma. $MYGN (already has one actually), $NVTA, $EXAS, and so on. In fact, these companies could just copy $DMTK. Really.

9/ Patents covering diagnostic method claims, especially those tied to specific genes, are weak or ineligible for protection. In 2010, the U.S. NIH recommended exempting parties for liability for infringement of such patents. As far as I can tell, that covers most $DMTK IP.

10/ Do $DMTK products advance dermatopathology? Absolutely. I'd love to use a genetic Dx for my annual check ups. My last biopsy was negative -- actually the lowest risk category. And it's one of my biggest scars.

Is there anything to differentiate or protect the tech? Nope.

Is there anything to differentiate or protect the tech? Nope.

11/ Two tough but important lessons for investors:

-great technology doesn't guarantee a great business

-digital publications value volume over accuracy and domain competence. You should value real research, not 500 word articles engineered to tickle algorithms.

-great technology doesn't guarantee a great business

-digital publications value volume over accuracy and domain competence. You should value real research, not 500 word articles engineered to tickle algorithms.

12/ If everything goes right for $DMTK, then it might be able to earn a higher market valuation. But lackluster product revenue for 2+ years, a lack of insurance coverage, and no barriers for competitors are big risks. There are better genetic Dx stocks.

Read on Twitter

Read on Twitter