Some thoughts on Public Debt Sustainability...

In light of this week’s OBR public finances update, and the appalling public discourse that followed, the sensible narrative has turned to the matter of what rules should govern public finances from now...

In light of this week’s OBR public finances update, and the appalling public discourse that followed, the sensible narrative has turned to the matter of what rules should govern public finances from now...

Such was the focus of @ChrisGiles_ in the FT today... https://www.ft.com/content/9539451d-0529-4e17-bde6-ae79685b734f

… channellings the work of @jasonfurman in the US, whose critique of the DSA framework, including the focus on the stock of debt to the flow of GDP, and the fact that it is backward-looking.... https://www.dropbox.com/s/lb2btgbadotwxcf/20201119%20Princeton%20Debt.pdf?dl=0

This is indeed true, though I think there is a way of updating out analytical framework to make it forward-looking and offering some insight into how we should indeed think about sustainability when i<g.

Indeed, there is a missing piece in the theoretical puzzle that has been bothering me for some time—as blogged last month. Perhaps tweeting about a couple of theoretical results relating to debt sustainability can sooth the soul?

First off, why debt to GDP? In fact, the traditional framework, when i>g, equates the stock of debt to GDP with the net present value of future primary surpluses. So, it’s the backward-looking stock that is equal to the future flow of resources devoted to serving the this.

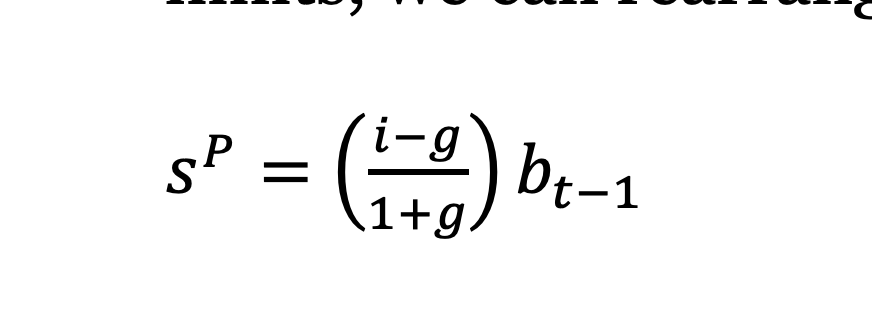

This also happens to be consistent with stabilizing the stock, but this equates a flow (primary surplus) with another flow (the interest-growth differential multiplied by the stock.)

So, the stock matters, but only insofar as it informs the flows which deliver forward-looking sustainability based on backward-looking debt (t minus 1).

Now, as @oblanchard1, @JZettelmeyer and @AlvaroISLM have pointed out, once i<g the growth of GDP dominates interest payments, and the backward-looking debt is of less pertinence.

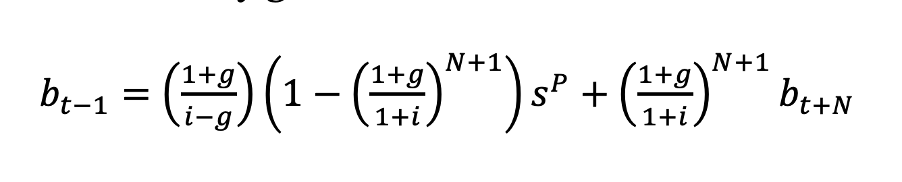

But where next? Well, we can still iterate forward the government budget constraint for a finite period when i<g, only there is no No Ponzi Condition. But if secular stagnation for some unknown period N will hopefully give way to “normalization”...

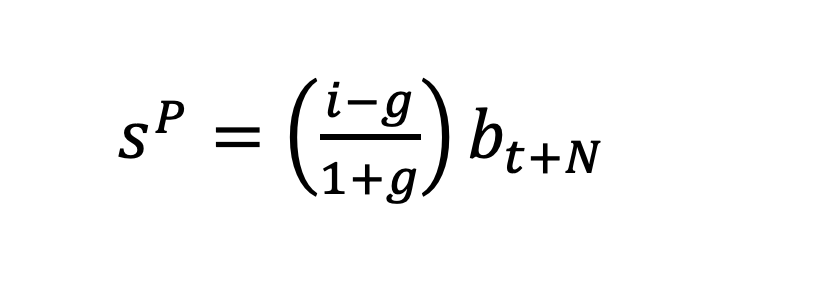

Crucially, under reasonable conditions, this can be rearranged and approximated by a forward-looking corollary of the standard sustainability condition to relate the primary balance today to the debt stock at the end of secular stagnation (t plus N):

So, allowing i<g indeed alters our sustainability condition, but subtly by making it entirely forward looking. This reasonably asks what the sustainable debt stock will be once secular stagnation comes to an end—what terminal debt stock can the community carry thereafter?

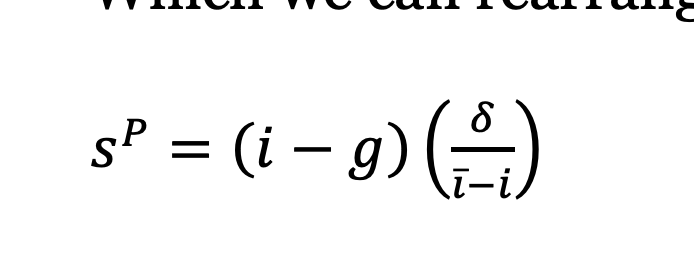

In this case, it’s possible to show that the primary surplus today should be proportional to the ratio of change in primary balance possible from secular stagnation to normalization (delta) and the change in interest on public debt during normalization:

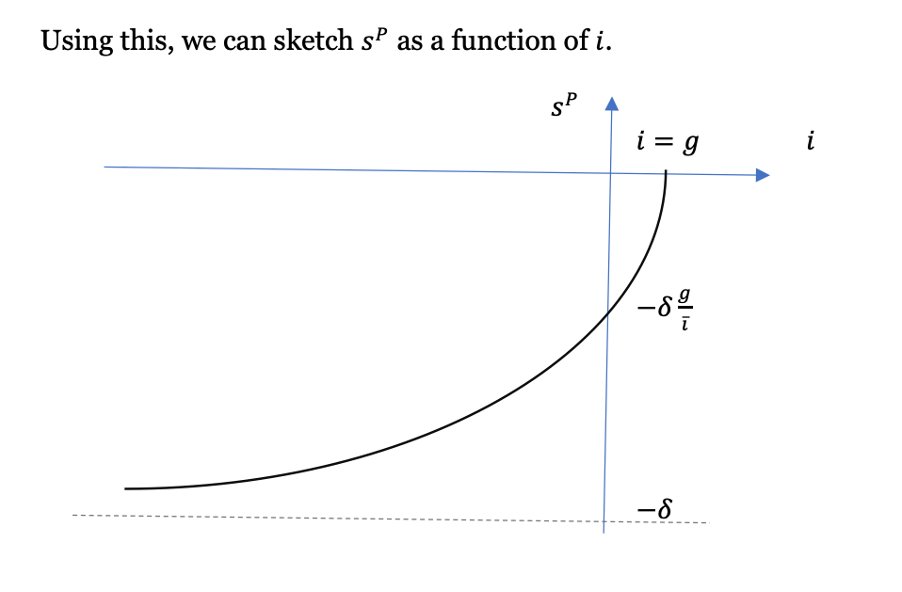

When i<g a primary deficit is entirely sustainable, is larger in proportion to adjustment possible during normalization. In fact, because the average interest on public debt today appears in the numerator and denominator, we can plot the relation between the primary balance and i

Interestingly, this an increasing function of i and is non-linear. As the interest rate today dips marginally below the growth rate, the primary balance should move quickly into deficit. So, it implies a rapid move into deficit is perfectly sustainable immediately when i<g.

This contrasts to euroarea governments which have used per-COVID low interest rates and growth to increase primary surpluses, despite the fact that they are perfecty sustainable.

So, the conventional theory can be modified to confirm with Furman’s intuition.

So, the conventional theory can be modified to confirm with Furman’s intuition.

It has policy implications, of course. Focus should be on ensuring policies that can be adjusted in the future to promote primary adjustment. So, no indexing etc. Moreover, it should help frame the discourse.

The OBR told the press conference on their latest UK projections that the interest sensitivity of debt increasing is important because the interest on debt can increase faster than the debt can fall.

This is silly—or should I say irresponsible from the Office for Budget Responsibility, @OBR_UK. The change in the stock is not important. The change in the primary balance that meets the increase in interest on the debt is.

There is no need to bring the stock into it. And this also matters since an increase in the average interest on government debt is only going to be happen if there is an acceleration in private activity, due to investment or consumption boom.

For the UK, that is.

In this case, the economic recovery will carry tax receipts higher to larger adjust the primary balance.

In this case, the economic recovery will carry tax receipts higher to larger adjust the primary balance.

In other words, automatic stabilizers when the economy is in the ascendant could largely deliver “sustainability” without any discretionary action—though discretionary action might be useful as an overall debt strategy.

In any case, the debate on public debt sustainability has indeed moved forward, as @ChrisGiles_ rightly notes. The key is for careful and considered analysis not to be crowded out by fear and bullshit.

Anyway, here’s my theoretical note on Public Debt Sustainability Under Secular Stagnation, which is blissfully short:

https://thegeneraltheorist.com/2020/11/03/a-note-on-public-debt-sustainability-under-secular-stagnation/

END.

https://thegeneraltheorist.com/2020/11/03/a-note-on-public-debt-sustainability-under-secular-stagnation/

END.

Read on Twitter

Read on Twitter