2) Income from the massive increase in aggregate wealth hasn't changed: you're much less rich with £1m when rates are 1% (the recent norm) than when they're 5% (early 2000s norm)

So stocks of wealth aren’t necessarily a consistent guide to the living standards of their owners

So stocks of wealth aren’t necessarily a consistent guide to the living standards of their owners

3) Owners of assets driven up by interest rates can only achieve a higher standard of living by liquidating and consuming the proceeds at some stage in their life.

That suggests it might be fairer to tax them only when they do so rather than on their paper holdings

That suggests it might be fairer to tax them only when they do so rather than on their paper holdings

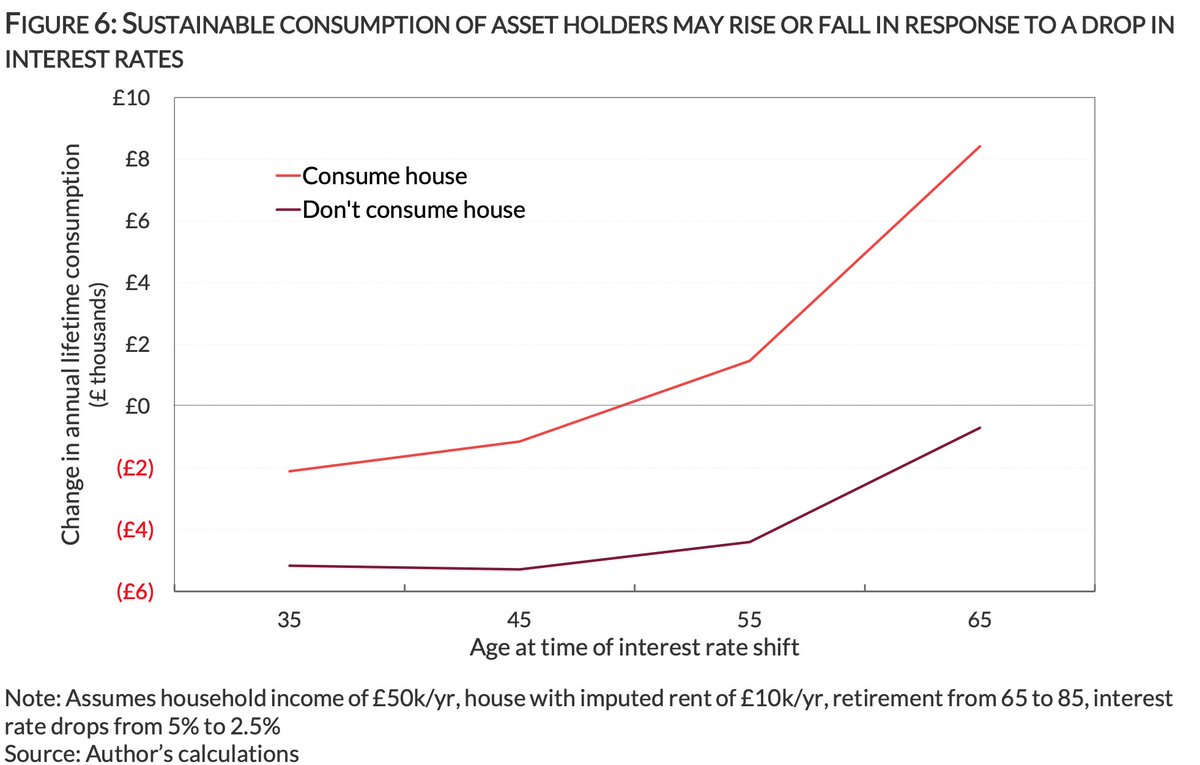

4) Falling rates magnify future consumption costs too: someone whose house jumps in value may actually be worse off over their lifetime if low rates mean they now need to save much more in a pension.

Net wealth isn't always a reliable guide to how 'rich' different people are

Net wealth isn't always a reliable guide to how 'rich' different people are

Lots more in the full paper, which you can read here. This only scratches the surface of a profoundly important set of trends that could be accelerated by the pandemic. We should talk about it more https://www.wealthandpolicy.com/wp/BP122_Sources.pdf

I'd recommend all the evidence papers for the commission, but on this topic the paper by @arunadvaniecon @GeorgeBangham @jackhleslie is particularly good. Do have a read here https://www.wealthandpolicy.com/wp/101.html

Read on Twitter

Read on Twitter