$LGVW to merge w/ @ButterflyNetInc -- a disruptor in ultrasound.

Learned about it a few days ago & had a chance to dig in.

A thread .

.

Learned about it a few days ago & had a chance to dig in.

A thread

.

.

The product: "Butterfly IQ+"

-Puts ultrasound on a semiconductor

-Ushers in era of hand-held ultrasound

-Linear, curvilinear & phased array ultrasound probe all in 1

-Connects hardware w/integrated software, AI & tele-guidance to drive faster, smarter, less costly medical imaging

-Puts ultrasound on a semiconductor

-Ushers in era of hand-held ultrasound

-Linear, curvilinear & phased array ultrasound probe all in 1

-Connects hardware w/integrated software, AI & tele-guidance to drive faster, smarter, less costly medical imaging

1. Notes from Dr. Jonathon Rothberg -- Founder & Chairman

The resume

-Pioneered a process to sequence genomes on a semiconductor

-Launched field of next-gen sequencing

-Won a Presidential Medal of Tech & innovation… casual

The resume

-Pioneered a process to sequence genomes on a semiconductor

-Launched field of next-gen sequencing

-Won a Presidential Medal of Tech & innovation… casual

Dr. Rothberg continued:

“I knew life had transformed when computing was put on a chip… I saw the power of Moore’s law & envisioned how it could be brought to DNA sequencing.”

“I knew life had transformed when computing was put on a chip… I saw the power of Moore’s law & envisioned how it could be brought to DNA sequencing.”

Dr. Rothberg continued:

“I discovered majority of had no access to medical imaging.”

had no access to medical imaging.”

What'd he do?

Put ultrasound on a chip.

“Today Butterfly IQ+ has the broadest FDA clearance for a single ultrasound probe ever... it's the world’s 1st & only full-body ultrasound system."

“I discovered majority of

had no access to medical imaging.”

had no access to medical imaging.”What'd he do?

Put ultrasound on a chip.

“Today Butterfly IQ+ has the broadest FDA clearance for a single ultrasound probe ever... it's the world’s 1st & only full-body ultrasound system."

2. Dr. John Martin -- CMO

“Ultrasound is the fastest growing medical imaging modality.”

“For 50 years, ultrasound used the same piezoelectric crystal tech driving complexity & cost higher."

Means patients "wait for imaging in dedicated centers or for carts to come bedside.”

Means patients "wait for imaging in dedicated centers or for carts to come bedside.”

“Ultrasound is the fastest growing medical imaging modality.”

“For 50 years, ultrasound used the same piezoelectric crystal tech driving complexity & cost higher."

Means patients "wait for imaging in dedicated centers or for carts to come bedside.”

Means patients "wait for imaging in dedicated centers or for carts to come bedside.”

3. Notes from Gioel Molinari -- President

IQ+'s 3-staged approach to value:

a) ultrasound on a chip -- replaces piezoelectric tech w/9000 micro-transducers (tiny drums emitting & receiving ultrasound)

--Frees ultrasound to be

---Scalable

---Portable

---Affordable

b&c)

IQ+'s 3-staged approach to value:

a) ultrasound on a chip -- replaces piezoelectric tech w/9000 micro-transducers (tiny drums emitting & receiving ultrasound)

--Frees ultrasound to be

---Scalable

---Portable

---Affordable

b&c)

b) Invested in software & AI tools to automate measurements & aid professionals in decision-making

c) Butterfly Enterprise: The IQ+ operating system (OS) for point of care ultrasound ensuring:

-quality control

-electronic medical record (EMR) integration

c) Butterfly Enterprise: The IQ+ operating system (OS) for point of care ultrasound ensuring:

-quality control

-electronic medical record (EMR) integration

Molinari continued:

IQ+

a) offers 20 clinical sets ranging from shallow to deep imaging

--change depth setting w/phone app

--uses 1 probe; competition needs 2-3

b) performs a volumetric bladder scan

--gages if catheterization needed

--had been determined w/time intervals alone

IQ+

a) offers 20 clinical sets ranging from shallow to deep imaging

--change depth setting w/phone app

--uses 1 probe; competition needs 2-3

b) performs a volumetric bladder scan

--gages if catheterization needed

--had been determined w/time intervals alone

Molinari continued:

c) "Don’t need to listen to the heart with a stethoscope… can image the heart in real time"

d) Demonstrated uploading results into patient records

e) Hit on their "imaging virtuous cycle" -- IQ+ improves as more data boosts AI & tele-guide capabilities

c) "Don’t need to listen to the heart with a stethoscope… can image the heart in real time"

d) Demonstrated uploading results into patient records

e) Hit on their "imaging virtuous cycle" -- IQ+ improves as more data boosts AI & tele-guide capabilities

Final notes from Molinari:

“We hope to introduce a product to be used by patients to self-scan ultrasound in the home to send to doctors in real time.”

“We hope to continue miniaturizing our chip to enable wearable medical imaging… using our partnership with $TSM.”

“We hope to introduce a product to be used by patients to self-scan ultrasound in the home to send to doctors in real time.”

“We hope to continue miniaturizing our chip to enable wearable medical imaging… using our partnership with $TSM.”

4. Highlights from Laurent Faracci -- CEO

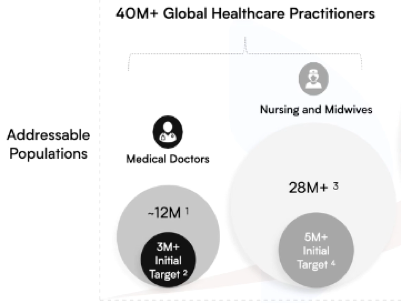

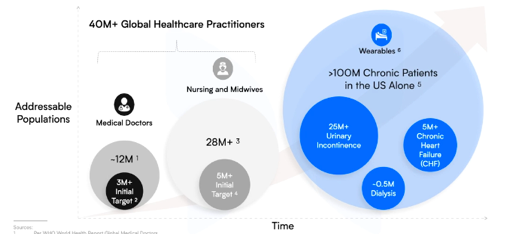

The market

-TAM of $8B & growing

-40M global HC workers to ultimately target; 8M initially

“By bringing imaging to the patient, we allow access beyond traditional imaging centers & broaden the settings for ultrasound”

The market

-TAM of $8B & growing

-40M global HC workers to ultimately target; 8M initially

“By bringing imaging to the patient, we allow access beyond traditional imaging centers & broaden the settings for ultrasound”

Faracci continued:

“Plan to update our hardware every 2 years and to push out monthly software update to enhance utility”

Recent examples:

-Launch of "Needle Viz" for confident, ultrasound-guided needle insertion

-“Fast 3D bladder rendering”

-“Many more soon to go”

“Plan to update our hardware every 2 years and to push out monthly software update to enhance utility”

Recent examples:

-Launch of "Needle Viz" for confident, ultrasound-guided needle insertion

-“Fast 3D bladder rendering”

-“Many more soon to go”

Faracci continued -- wearables

“In 2023 & subject to regulatory authorization… we plan to enter the wearables market representing 100M chronic patients in the USA alone”

"Our wearable patch will capitalize on momentum from higher-tier software & at-home monitoring trends”

“In 2023 & subject to regulatory authorization… we plan to enter the wearables market representing 100M chronic patients in the USA alone”

"Our wearable patch will capitalize on momentum from higher-tier software & at-home monitoring trends”

Final tidbit from Faracci:

“This year we launched a salesforce to scale adoption… many of whom are practitioners already using butterfly today.”

“This year we launched a salesforce to scale adoption… many of whom are practitioners already using butterfly today.”

5. Highlights from Stephanie Fielding -- CFO

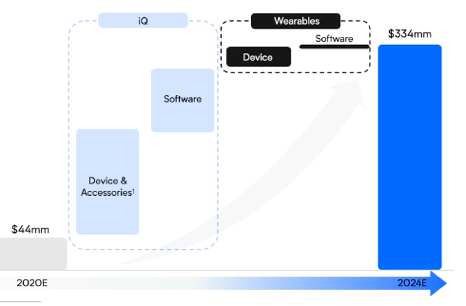

a) $44M in 2020 revs from “individual professionals & small groups"

b) Will scale adoption w/large enterprises starting in '21

c) Expect a 66% CAGR through 2024

--$334M in 2024 revs

--Includes little future wearables contribution

a) $44M in 2020 revs from “individual professionals & small groups"

b) Will scale adoption w/large enterprises starting in '21

c) Expect a 66% CAGR through 2024

--$334M in 2024 revs

--Includes little future wearables contribution

Fielding continued:

Profitability:

a) Gross profit margin (GPM) to inflect from negative to 40% in 2021 via moving from developmental fab manufacturer to $TSM

b) GPM target of 70%

c) Expect free cash by 2024

Wearables to conservatively contribute 10% to revs by 2024.

Profitability:

a) Gross profit margin (GPM) to inflect from negative to 40% in 2021 via moving from developmental fab manufacturer to $TSM

b) GPM target of 70%

c) Expect free cash by 2024

Wearables to conservatively contribute 10% to revs by 2024.

Fielding final notes:

“Capital from the transaction covers planned investments, supports planned transition to free cash & allows for additional capital allocation.”

“Software revenue is expected to reach 40-50% of total revenues by the back end of the decade”

“Capital from the transaction covers planned investments, supports planned transition to free cash & allows for additional capital allocation.”

“Software revenue is expected to reach 40-50% of total revenues by the back end of the decade”

6. Deal structure BASED ON $17/share

a) EV roughly $2.85B

b) $175M PIPE @ $10/share

-- $THC & Fidelity part of PIPE

c) 23.3M outstanding options

NOTE: valuation slide below is off... based on $10/share not current price -- now it's more like 18x 2022 EV/Revs not 10.6x

a) EV roughly $2.85B

b) $175M PIPE @ $10/share

-- $THC & Fidelity part of PIPE

c) 23.3M outstanding options

NOTE: valuation slide below is off... based on $10/share not current price -- now it's more like 18x 2022 EV/Revs not 10.6x

7. Competitive landscape -- thanks @Nick_HuynhMPLS

Some can come close to IQ+ on cost. None rival it on probe functionality.

IQ+ is the only all in 1 linear, curvilinear & phased array probe (AKA it can image @ various depths & so perform more tests) https://twitter.com/Nick_HuynhMPLS/status/1329951660182007809?s=20

Some can come close to IQ+ on cost. None rival it on probe functionality.

IQ+ is the only all in 1 linear, curvilinear & phased array probe (AKA it can image @ various depths & so perform more tests) https://twitter.com/Nick_HuynhMPLS/status/1329951660182007809?s=20

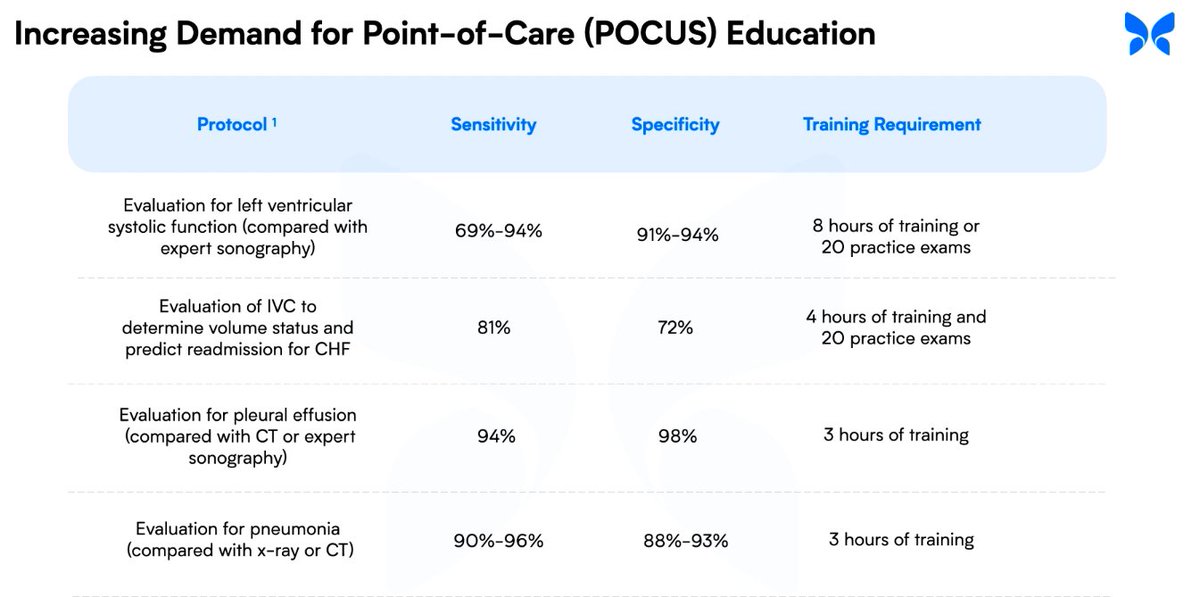

IQ+ user on-boarding:

-Complex procedures take a few hours & a handful of exams to master

-Per The Journal of Family Medicine: A Lung exam w/IQ+ takes hours to learn

-For trained users, Butterfly built a learning management system to provide scalable education

-Complex procedures take a few hours & a handful of exams to master

-Per The Journal of Family Medicine: A Lung exam w/IQ+ takes hours to learn

-For trained users, Butterfly built a learning management system to provide scalable education

8. @Glassdoor reviews are limited & fine but not amazing:

https://www.glassdoor.com/Reviews/Butterfly-Network-Reviews-E1191843.htm

All private shareholders (including Baillie Gifford & the Gates Foundation) are rolling their equity into the public company.

https://www.glassdoor.com/Reviews/Butterfly-Network-Reviews-E1191843.htm

All private shareholders (including Baillie Gifford & the Gates Foundation) are rolling their equity into the public company.

1 more concern:

Image quality.

Chip-based ultrasound was released by @HitachiGlobal in 2009.

It struggled w/quality & offered just 1 depth.

Butterfly offers many depths but some worry all chip-based ultrasound will struggle w/image quality.

@ButterflyNetInc disagrees.

Image quality.

Chip-based ultrasound was released by @HitachiGlobal in 2009.

It struggled w/quality & offered just 1 depth.

Butterfly offers many depths but some worry all chip-based ultrasound will struggle w/image quality.

@ButterflyNetInc disagrees.

Summary:

-Strong IQ+ value-prop

-IQ+ is cleared

-Integrated, high-margin software business built in

-Leadership impressive

-Wearables = larger pursuit not factored into guidance

-High risk, high reward name

VERY small position -- .5% of holdings

Long $LGVW

-Strong IQ+ value-prop

-IQ+ is cleared

-Integrated, high-margin software business built in

-Leadership impressive

-Wearables = larger pursuit not factored into guidance

-High risk, high reward name

VERY small position -- .5% of holdings

Long $LGVW

Sources & a link to all investor materials:

https://omdia.tech.informa.com/OM005239/The-future-of-ultrasound-is-on-a-chip

https://www.prnewswire.com/news-releases/butterfly-network-a-global-leader-in-democratizing-medical-imaging-to-be-listed-on-nyse-through-a-merger-with-longview-acquisition-corp-301177892.html https://www.butterflynetwork.com/investors

https://omdia.tech.informa.com/OM005239/The-future-of-ultrasound-is-on-a-chip

https://www.prnewswire.com/news-releases/butterfly-network-a-global-leader-in-democratizing-medical-imaging-to-be-listed-on-nyse-through-a-merger-with-longview-acquisition-corp-301177892.html https://www.butterflynetwork.com/investors

Read on Twitter

Read on Twitter