About Unrealized and Realized Gains: A Thread For Ignorant Normies Who Annoy Me With Shitty Takes.

1/23

1/23

Not investment advice. But you stay ignorant and go on eating up those bulltard tweets, you poor fuck. Here's an icecream.  Yeah, you like that icecream don't you? STOP.

Yeah, you like that icecream don't you? STOP.

Do you want to bulltard or do you want to make money?

LISTEN UP NORMIE.

2/23

Yeah, you like that icecream don't you? STOP.

Yeah, you like that icecream don't you? STOP.Do you want to bulltard or do you want to make money?

LISTEN UP NORMIE.

2/23

Let's say you buy 1 share of RUG for $100. It's going good, and now that share is worth $200.

"You haven't made any profit until you sell."

STOP.

3/23

"You haven't made any profit until you sell."

STOP.

3/23

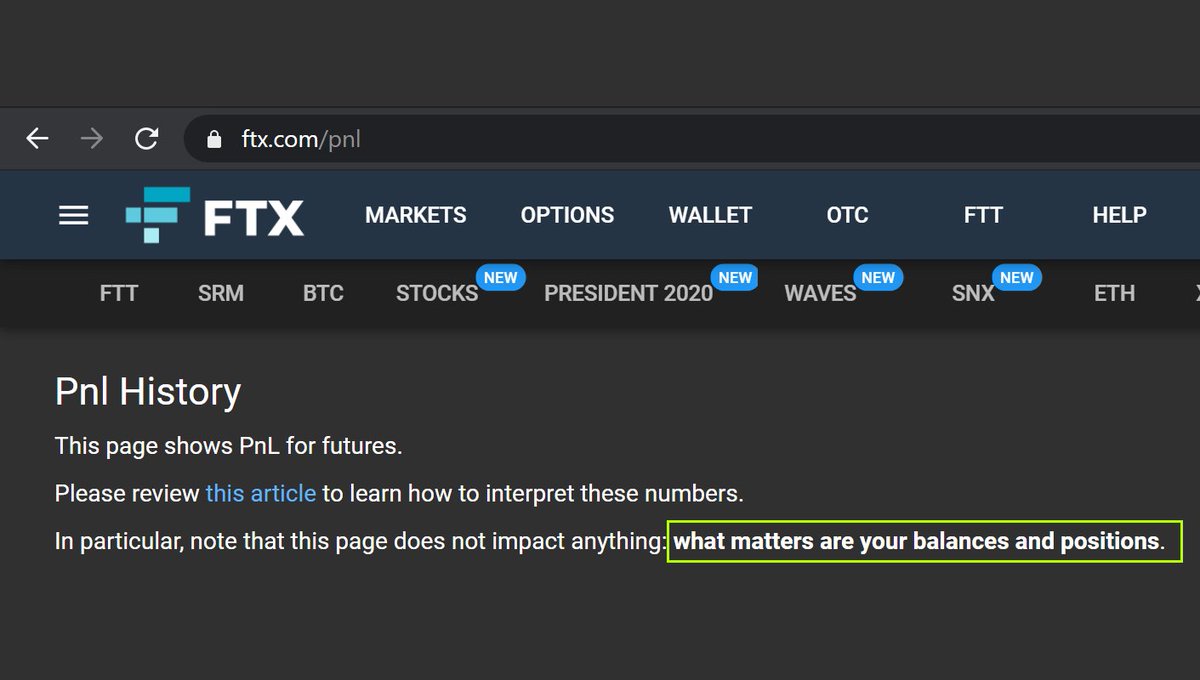

That share of RUG is worth $200. That's your position. All that matters are your balances and your positions, dumbass.

On the #1 exchange, FTX (even for normies like you) it even teaches you this on the PNL screen.

4/23

On the #1 exchange, FTX (even for normies like you) it even teaches you this on the PNL screen.

4/23

Now, I'd show you my PNL, but you couldn't handle that many digits.

But if you ape now, you'll get gains, promise. Lowest fees, plus 10% off (not 5) because I put in work.

FTX is where I trade $600m a month - I think your $600 is fine bro.

https://ftx.com/#a=wice

5/23

But if you ape now, you'll get gains, promise. Lowest fees, plus 10% off (not 5) because I put in work.

FTX is where I trade $600m a month - I think your $600 is fine bro.

https://ftx.com/#a=wice

5/23

Back to talking about shitty takes.

Of course, because RUG was a pump and dump rugpull, and you were dumped on (how pathetic), now the share goes to $3. Your position is $3.

"It's not a loss until you sell."

STOP.

6/23

Of course, because RUG was a pump and dump rugpull, and you were dumped on (how pathetic), now the share goes to $3. Your position is $3.

"It's not a loss until you sell."

STOP.

6/23

Your position is $3, that's what you have. The $100 entry doesn't matter. It's completely memoryless.

You could buy in at $100,000 (as if you weren't poor) and it doesn't matter. Your position is $10.

7/23

You could buy in at $100,000 (as if you weren't poor) and it doesn't matter. Your position is $10.

7/23

This should be dead obvious by now, but I'll need an analogy because most of you still don't get it.

She left you. It's over. It doesn't matter what was or what could have been. Your position is zero, nada, zilch.

Got it? All that matters is your position.

8/23

She left you. It's over. It doesn't matter what was or what could have been. Your position is zero, nada, zilch.

Got it? All that matters is your position.

8/23

Now, to understand a position in context, we talk about exposure in terms of a percentage of your portfolio.

If you have a $10 position in RUG and $10 cash, then your %exposure of RUG is 50%. If you have $90 cash instead, your exposure is 10%.

9/23

If you have a $10 position in RUG and $10 cash, then your %exposure of RUG is 50%. If you have $90 cash instead, your exposure is 10%.

9/23

So, all that matters is your balances and positions, but to understand your financial portfolio in context, really all that matters is your percentage exposure to each asset. Too much exposure to RUG will get you... rugged. Not in the good way.

10/23

10/23

Now let's look at how these shitty takes can destroy your bankroll.

Don't worry, I've made these mistakes too, for more than your net worth. That receipt is 1 day, my worst trade ever.

But if you ape enough, you can outrun any loss.

You'll get there eventually, junior.

11/23

Don't worry, I've made these mistakes too, for more than your net worth. That receipt is 1 day, my worst trade ever.

But if you ape enough, you can outrun any loss.

You'll get there eventually, junior.

11/23

You enter a trade and it moves very unexpectedly against you.

"Obviously, double down losses so that if it goes back up by half, you come out even."

STOP.

12/23

"Obviously, double down losses so that if it goes back up by half, you come out even."

STOP.

12/23

Every trade has a counterparty. When it did something you didn't expect, on average your counterparty knows more than you and probably still does.

13/23

13/23

Probably you should update your perceived edge to be lower. Probably you are in a position where you have negative alpha. That means you're the sucker, so exit.

Remember: "Double down losers to triple the loss."

14/23

Remember: "Double down losers to triple the loss."

14/23

New situation.

You are in a trade and it moves well according to your expectation, though you think it will still continue.

"Obviously, take some profit so that you book a win."

STOP.

15/23

You are in a trade and it moves well according to your expectation, though you think it will still continue.

"Obviously, take some profit so that you book a win."

STOP.

15/23

Two examples:

1. A wise person once told me, if you see a good idea quickly, look for a great idea. Because "quickly" implies the space you're searching is rich with ideas.

16/23

1. A wise person once told me, if you see a good idea quickly, look for a great idea. Because "quickly" implies the space you're searching is rich with ideas.

16/23

2. Imagine you are playing someone heads up in Poker and you win a lot because your name is @DougPolkVids. Probably your opponent sucks and you should try to double the stakes (or equally bad opponents, hah) while they are still willing to play you.

17/23

17/23

What are these examples teaching?

Whenever you are winning, ask yourself this question:

CAN I WIN MORE?

Stop thinking how to "lock in" your tiny profit and limit your win. Ask yourself does it still make sense? If it does, then ask how can you be positioned to win more.

18/23

Whenever you are winning, ask yourself this question:

CAN I WIN MORE?

Stop thinking how to "lock in" your tiny profit and limit your win. Ask yourself does it still make sense? If it does, then ask how can you be positioned to win more.

18/23

Here is a real life example where I made $5.2m instead of $1.7m because I continued to press my advantage, instead of "taking profit." I took MORE profit, dumbass. Full ape. Now that's "taking profit."

When you want to "take profit", consider "taking more profit."

19/23

When you want to "take profit", consider "taking more profit."

19/23

If you are sleeping with one chick, instead of going exclusive and giving her 2 btc on her birthday (cc @bigmagicdao), consider sleeping with her friends.

"Take more profit."

20/23

"Take more profit."

20/23

Extra bonus poker content: If you are decent at poker, "taking profit" is like "pot controlling" (checking back) the turn with AK on Axxx because you didn't want to get check raised.

Pathetic.

The fuck are you doing?

TAKE MORE PROFIT.

21/23

Pathetic.

The fuck are you doing?

TAKE MORE PROFIT.

21/23

Of course, there are legitimate reasons to exit the trade - it's bad, risk management, and more.

I'm just highlighting the most common fallacy which is to exit the trade because of a meaningless comparison against your entry. Your entry doesn't matter, ONLY YOUR POSITION.

22/23

I'm just highlighting the most common fallacy which is to exit the trade because of a meaningless comparison against your entry. Your entry doesn't matter, ONLY YOUR POSITION.

22/23

Here are the takeaways:

Only percentage exposure really matters.

Double down to triple the loss.

Take more profit.

23/23

~fin~

https://ftx.com/#a=wice

10% off and lowest fees.

Ape now or forever be a poor.

Only percentage exposure really matters.

Double down to triple the loss.

Take more profit.

23/23

~fin~

https://ftx.com/#a=wice

10% off and lowest fees.

Ape now or forever be a poor.

PS.

In one of the tweets we wrote $10 instead of $3. Figure that shit out. We tweet in prod.

In one of the tweets we wrote $10 instead of $3. Figure that shit out. We tweet in prod.

Read on Twitter

Read on Twitter