Genius Sports Group

Is a founder led, SaaS, UK based, sports data provider being brought public by @NiccoloDeMasi through a reverse merger with $DMYD. The company is going to have $150m cash on hand and be debt free post-merger which is expected to close in Q1. EV $1.4 billion.

Is a founder led, SaaS, UK based, sports data provider being brought public by @NiccoloDeMasi through a reverse merger with $DMYD. The company is going to have $150m cash on hand and be debt free post-merger which is expected to close in Q1. EV $1.4 billion.

GSG could be thought of a middle hand between sports leagues and sportsbooks. They have invested over $110m in their technology that is integrated in sport venues globally where they have over 7000 employees tasked to collect data. GSG stands on 3 legs: Sports, Betting and Media

SPORTS 11% of rev.

Partnerships with +400 sports leagues and federations. The strategy is to acquire exclusive rights and monetize official data. In some cases access to the software is given in return for the right to sell the data. GSG only lost 1 client the last 3 yrs.

Partnerships with +400 sports leagues and federations. The strategy is to acquire exclusive rights and monetize official data. In some cases access to the software is given in return for the right to sell the data. GSG only lost 1 client the last 3 yrs.

BETTING 74% of rev

B2B partnerships with all major sportsbooks based on a fixed base fee and a rev share model. 4-5 year contracts with low churn. Just like other B2B companies such as KAMBI or EVO it’s a “pick and shovel” play for the booming iGaming industry.

B2B partnerships with all major sportsbooks based on a fixed base fee and a rev share model. 4-5 year contracts with low churn. Just like other B2B companies such as KAMBI or EVO it’s a “pick and shovel” play for the booming iGaming industry.

USA

Estimated compound annual growth rate of 31%.

Gross gaming rev $2bn 2020 rising to $8bn 2025

Expected total addressable market doubling in 5 years.

GSG already establishing itself as a leader.

Live in 10 states and pending approval in Michigan and Illinois.

Estimated compound annual growth rate of 31%.

Gross gaming rev $2bn 2020 rising to $8bn 2025

Expected total addressable market doubling in 5 years.

GSG already establishing itself as a leader.

Live in 10 states and pending approval in Michigan and Illinois.

GROWTH

Invested heavily in 2018 and 2019. Now in a perfect position going forward focusing on scaling up. Same cost to provide an event to 1 customer as it does to provide same event to 90 customers. Almost no costs are directly related to revenue.

Invested heavily in 2018 and 2019. Now in a perfect position going forward focusing on scaling up. Same cost to provide an event to 1 customer as it does to provide same event to 90 customers. Almost no costs are directly related to revenue.

FINANCIALS

60% recurring revenue with 30% from Top10 customers.

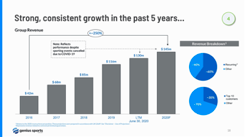

250% increase of revenue from 2016-2020

25% YoY 2019-2020 despite sporting events cancelled due to COVID.

EBITDA $14m 10% forecasted to rise to $35m 18% 2021.

Rev. Multiples 7,4x 2021F and 5,9x 2022F.

60% recurring revenue with 30% from Top10 customers.

250% increase of revenue from 2016-2020

25% YoY 2019-2020 despite sporting events cancelled due to COVID.

EBITDA $14m 10% forecasted to rise to $35m 18% 2021.

Rev. Multiples 7,4x 2021F and 5,9x 2022F.

SUMMARY

SPAC.

SKIN IN THE GAME. CEO & Founder Mark Locke.

MOAT. Exclusive partnerships and +100m investments.

MARKET LEADER. Only 1 true competitor, Sportsradar.

USA. Massive opportunity in booming market

LOW CHURN. Lost 1 client in 3 years

DEBT. 0.

CHEAP. NAV as of 20Nov: $10,48

SPAC.

SKIN IN THE GAME. CEO & Founder Mark Locke.

MOAT. Exclusive partnerships and +100m investments.

MARKET LEADER. Only 1 true competitor, Sportsradar.

USA. Massive opportunity in booming market

LOW CHURN. Lost 1 client in 3 years

DEBT. 0.

CHEAP. NAV as of 20Nov: $10,48

THE END

Hope you enjoyed it! Please let me know if I got something wrong or if you want to add something.

Disclosure: I own DMYD warrants.

This should not be considered financial advice. This thread contains errors.

Source:

https://www.sec.gov/Archives/edgar/data/1816101/000119312520277544/d54187dex992.htm

https://www.sec.gov/Archives/edgar/data/1816101/000119312520279470/d61024ddefa14a.htm

Hope you enjoyed it! Please let me know if I got something wrong or if you want to add something.

Disclosure: I own DMYD warrants.

This should not be considered financial advice. This thread contains errors.

Source:

https://www.sec.gov/Archives/edgar/data/1816101/000119312520277544/d54187dex992.htm

https://www.sec.gov/Archives/edgar/data/1816101/000119312520279470/d61024ddefa14a.htm

Would really appreciate if someone “in the know” could give a brief comment on @GeniusSports and market share comparing to Sportsradar. Why would a sports betting operator have more than one sports data provider?

@dividendblower @henrikinvest @Bullx33 @Symmetry_Invest

@dividendblower @henrikinvest @Bullx33 @Symmetry_Invest

I love how the images makes me feel like I’m on a 56K modem 1995, thanks Twitter.

Read on Twitter

Read on Twitter