1) A Tale of Two Calls.

Interesting to examine two similar thesis trades that took place over the last couple of months.

Despite BTC move, just one performed.

a) Sep13, BTC 10.3k. Dec 36k Calls bought x1k from $50 up to $200.

b) Oct20, BTC 13.3k. Jan 36k Calls bought x16k at $40.

Interesting to examine two similar thesis trades that took place over the last couple of months.

Despite BTC move, just one performed.

a) Sep13, BTC 10.3k. Dec 36k Calls bought x1k from $50 up to $200.

b) Oct20, BTC 13.3k. Jan 36k Calls bought x16k at $40.

2) Original levels:

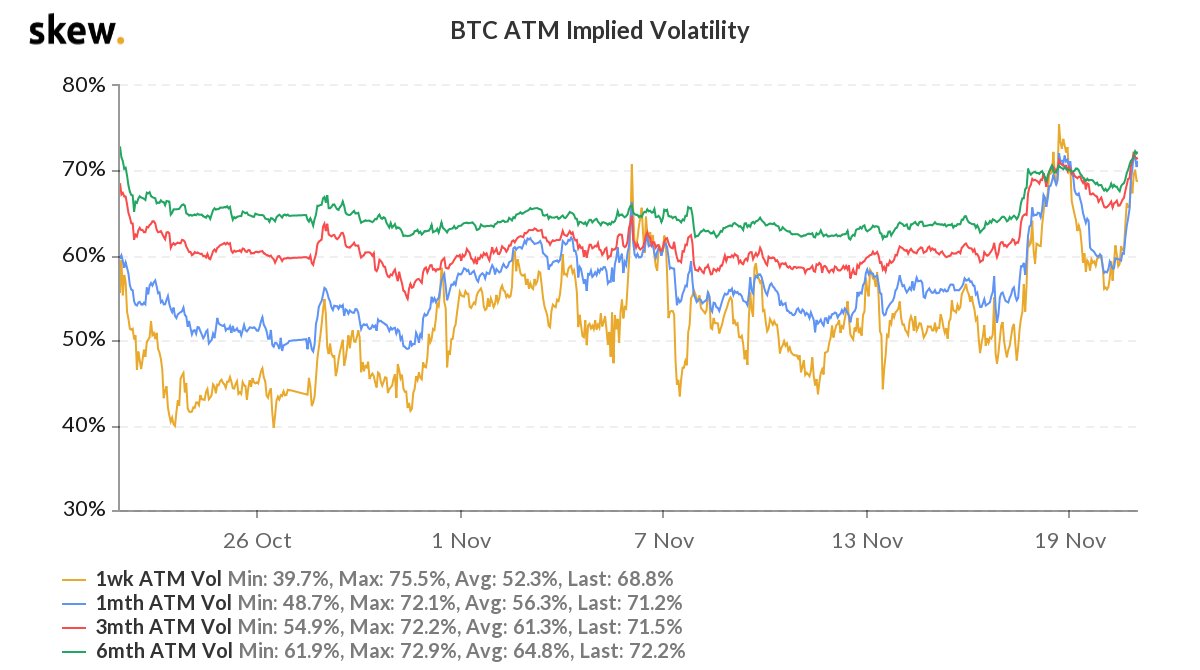

a) Dec's x1k paid $50-$200, IV 105-130%. 1m ATM 65%

b) Jan's x16k paid $40, IV 87.5%. 1m ATM 55%

Now BTC 18.6k

a) Dec Calls mark $85. IV 110%

b) Jan Calls mark $325. IV 99%

Dec Calls have not performed, despite BTC 8k+ rally.

Jan Calls have 8x, on 5k+ rally.

a) Dec's x1k paid $50-$200, IV 105-130%. 1m ATM 65%

b) Jan's x16k paid $40, IV 87.5%. 1m ATM 55%

Now BTC 18.6k

a) Dec Calls mark $85. IV 110%

b) Jan Calls mark $325. IV 99%

Dec Calls have not performed, despite BTC 8k+ rally.

Jan Calls have 8x, on 5k+ rally.

3) Several factors stand out as to why the Dec Calls underperformed the Jan Calls.

- Dec Calls: ATM vol high. Strike IV paid through the offer on an illiquid Sunday. There was plenty supply in 20k+ Calls. Market trended sideways for a month so options decayed in theta+vol+delta.

- Dec Calls: ATM vol high. Strike IV paid through the offer on an illiquid Sunday. There was plenty supply in 20k+ Calls. Market trended sideways for a month so options decayed in theta+vol+delta.

4) - Jan Calls: ATM low. Buyer found excellent size liquidity post expiry near marks. Outsized trades attract interest and followers. Vols squeezed higher as other buyers entered. Within a few days, the BTC rally from 13-18k took off. Increasing IV and delta offset theta decay.

5) Could say the Dec Call buyer was unlucky - he actually timed the market to perfection in terms of level - 10.3k BTC.

But, horrific execution aside, the vol levels are critical and consequently, a decision has to be made on use of options or the structure of the options trade.

But, horrific execution aside, the vol levels are critical and consequently, a decision has to be made on use of options or the structure of the options trade.

6) Almost all theoretical options books show a Call value increasing with a market rally. But we trade in the real world. And in the real world if you pay the wrong vol level your Call can perform like the Dec Call, or far worse.

Experienced traders get this wrong too. #noteasy!

Experienced traders get this wrong too. #noteasy!

7) This is why these threads talk about Implied Vol levels and Skew so much.

If you are bullish and IV is low, get your timing right and buy OTM Calls. But if Call skew is v.high and ATM vol is high, a Call spread is arguably a better option strategy, to mitigate adverse greeks.

If you are bullish and IV is low, get your timing right and buy OTM Calls. But if Call skew is v.high and ATM vol is high, a Call spread is arguably a better option strategy, to mitigate adverse greeks.

8) Implied vols are now relatively high (ATM and Call Skew). Both Calls have an opportunity of performing only if the market rally continues strongly. A breach of 20k (or expectation of) will very likely result in a further surge in Implied vols, compounding the delta impact.

9) The same day the Jan36k Calls were bought, the 32k Calls were bought x4k at 0.0047BTC, 84.3%.

Today Jan 52k Calls; initially, a seller of 3k at 0.00465.

One narrative is the buyer of the 32k Calls now has a Call spread for zero BTC premium. Also seller 32ks ~1k at 0.023 (5x?).

Today Jan 52k Calls; initially, a seller of 3k at 0.00465.

One narrative is the buyer of the 32k Calls now has a Call spread for zero BTC premium. Also seller 32ks ~1k at 0.023 (5x?).

Read on Twitter

Read on Twitter