Please read this excellent thread by @jasonfurman. Even better: watch the full video from yesterday's @Princeton @MarkusEconomist webinar - it's worth it!

I was wondering what his recommendations imply for Europe, and for Germany in particular. Here's a little thread. https://twitter.com/jasonfurman/status/1329817574633304066

I was wondering what his recommendations imply for Europe, and for Germany in particular. Here's a little thread. https://twitter.com/jasonfurman/status/1329817574633304066

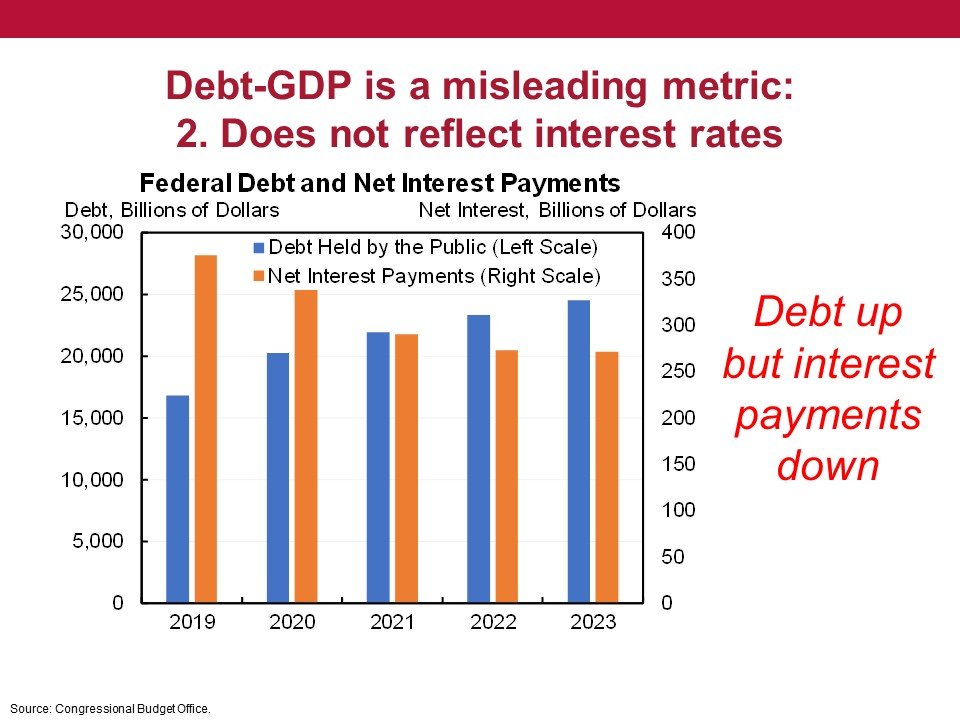

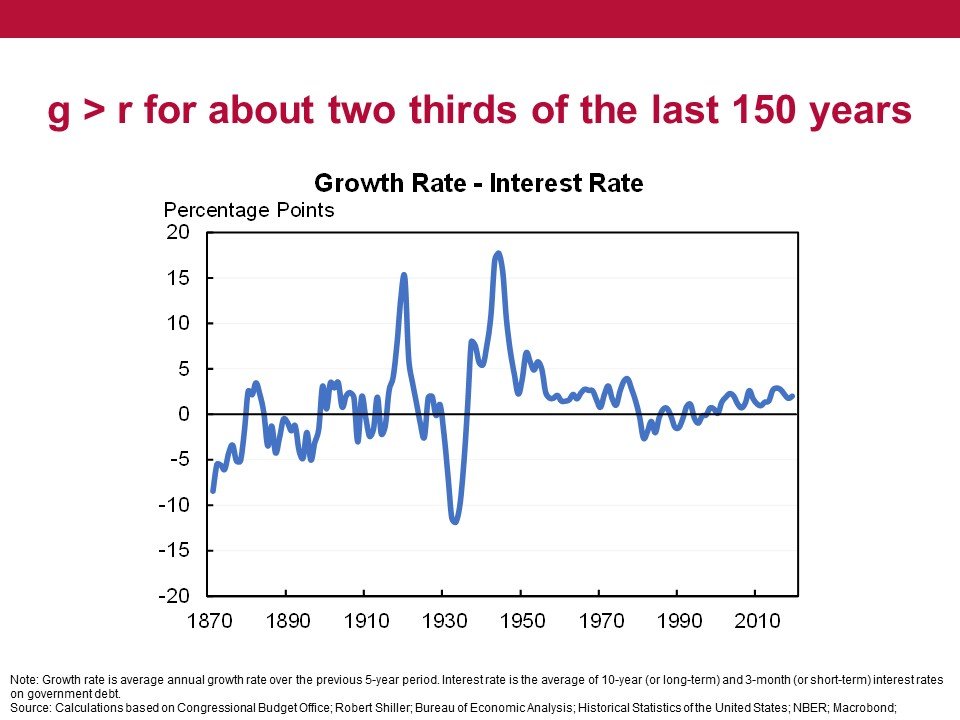

Jason's main point is that public debt is essentially no major concern for the US in the foreseable future.

Even with debt/GDP >150%, interest payments are decreasing as high-yield bonds are constantly replaced by low-yield bonds.

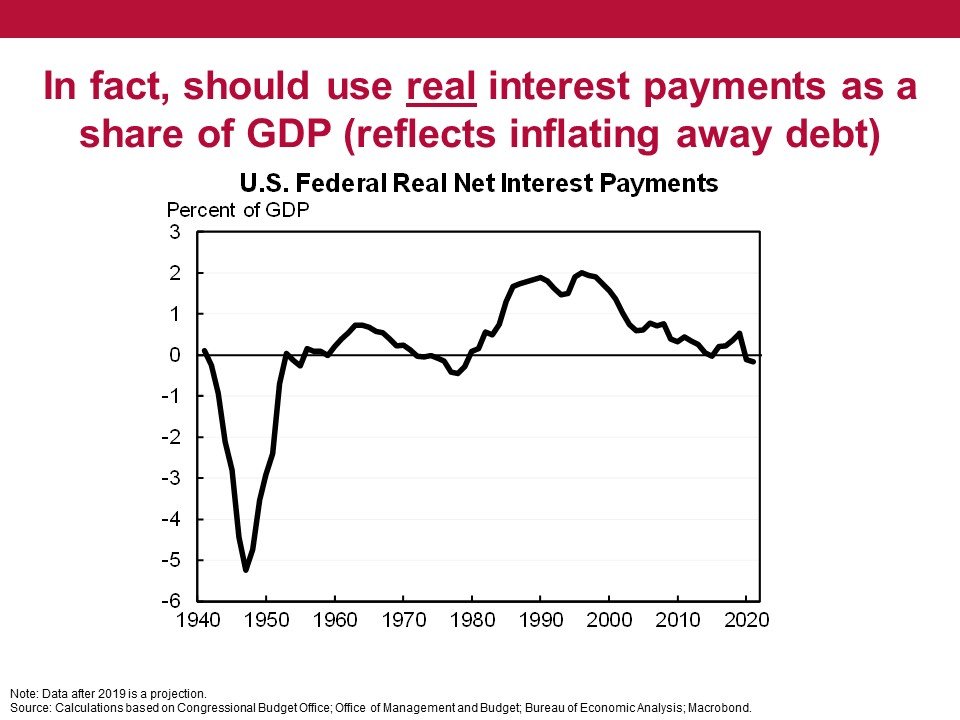

In real terms, US interest payments are zero!

Even with debt/GDP >150%, interest payments are decreasing as high-yield bonds are constantly replaced by low-yield bonds.

In real terms, US interest payments are zero!

His advice was to focus on this metric, essentially (average nominal interest on gov bonds-inflation)/GDP, and aim for something like 1% in 10y

If Biden follows that plan (after all, Jason was Obama's chief economist), it means the US gov will continue to spend A LOT of money

If Biden follows that plan (after all, Jason was Obama's chief economist), it means the US gov will continue to spend A LOT of money

Now, looking at the relevant numbers, it seems to me that Germany could comfortably spend even more (in proportion to the size of it's economy) before even coming close to dangerous territory.

Here're some numbers:

Here're some numbers:

10y gov bond interest:  -0,6%

-0,6%  +0.8%

+0.8%

Inflation forecast (5y): 1.7%

1.7%  2.2%

2.2%

That is, real interest rates are negative everywhere, but even more so in than in

than in

Sources:

https://de.investing.com/rates-bonds/germany-10-year-bond-yield

https://www.ecb.europa.eu/stats/ecb_surveys/survey_of_professional_forecasters/html/table_hist_hicp.en.html

https://knoema.de/kyaewad/us-inflation-forecast-2020-2021-and-long-term-to-2060-data-and-charts#:~:text=PCE%20inflation%20is%20used%20by,to%20set%20the%20inflation%20goal.&text=All%20agencies%20are%20consistent%20that,to%20be%20around%202.3%20percent.

-0,6%

-0,6%  +0.8%

+0.8%Inflation forecast (5y):

1.7%

1.7%  2.2%

2.2%That is, real interest rates are negative everywhere, but even more so in

than in

than in

Sources:

https://de.investing.com/rates-bonds/germany-10-year-bond-yield

https://www.ecb.europa.eu/stats/ecb_surveys/survey_of_professional_forecasters/html/table_hist_hicp.en.html

https://knoema.de/kyaewad/us-inflation-forecast-2020-2021-and-long-term-to-2060-data-and-charts#:~:text=PCE%20inflation%20is%20used%20by,to%20set%20the%20inflation%20goal.&text=All%20agencies%20are%20consistent%20that,to%20be%20around%202.3%20percent.

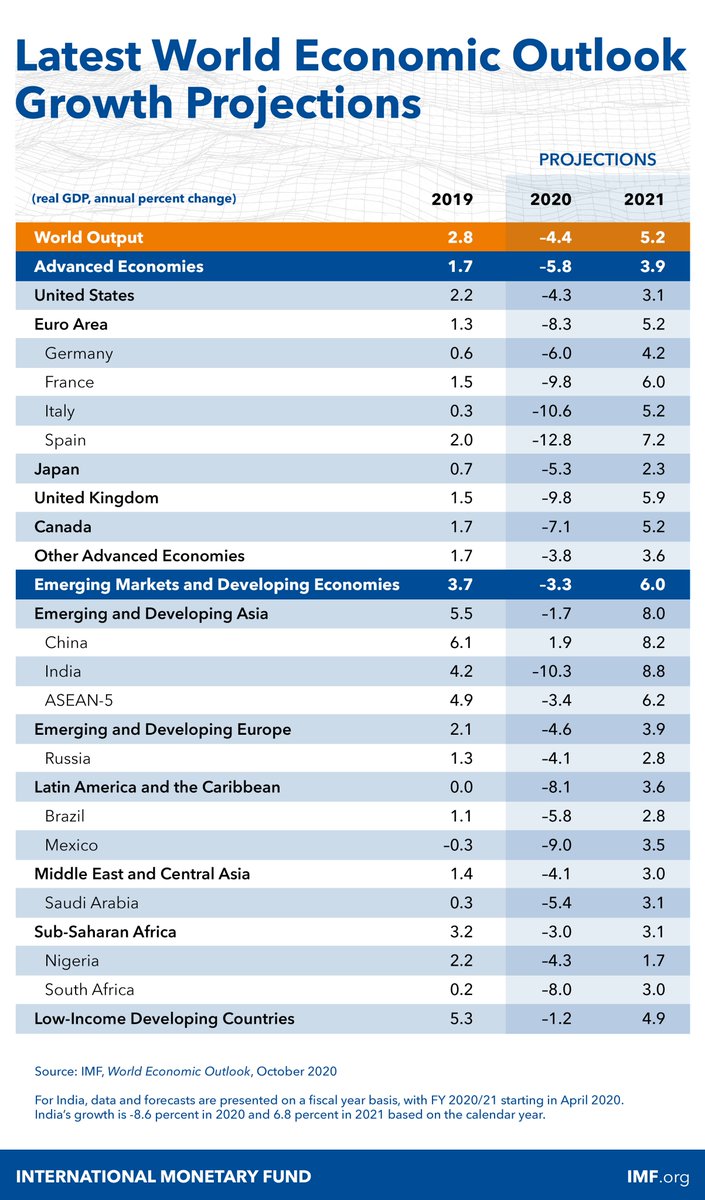

Future growth rates are, naturally, unknown.

The current IMF projection for 2021 even puts ahead of

ahead of  , although this was not true for 2019 and might turn out to be false and too optimistic.

, although this was not true for 2019 and might turn out to be false and too optimistic.

https://www.imf.org/en/Publications/WEO/Issues/2020/09/30/world-economic-outlook-october-2020

The current IMF projection for 2021 even puts

ahead of

ahead of  , although this was not true for 2019 and might turn out to be false and too optimistic.

, although this was not true for 2019 and might turn out to be false and too optimistic.https://www.imf.org/en/Publications/WEO/Issues/2020/09/30/world-economic-outlook-october-2020

But anyway, given the much lower interest rates, the magical (g-r) differential is certainly larger in  than in

than in

Say, 1.5% real growth, 1.5% inflation, -0.5% nominal interest. Then (g-r) ~ 3.5% in , compared to something like 2% in

, compared to something like 2% in

than in

than in

Say, 1.5% real growth, 1.5% inflation, -0.5% nominal interest. Then (g-r) ~ 3.5% in

, compared to something like 2% in

, compared to something like 2% in

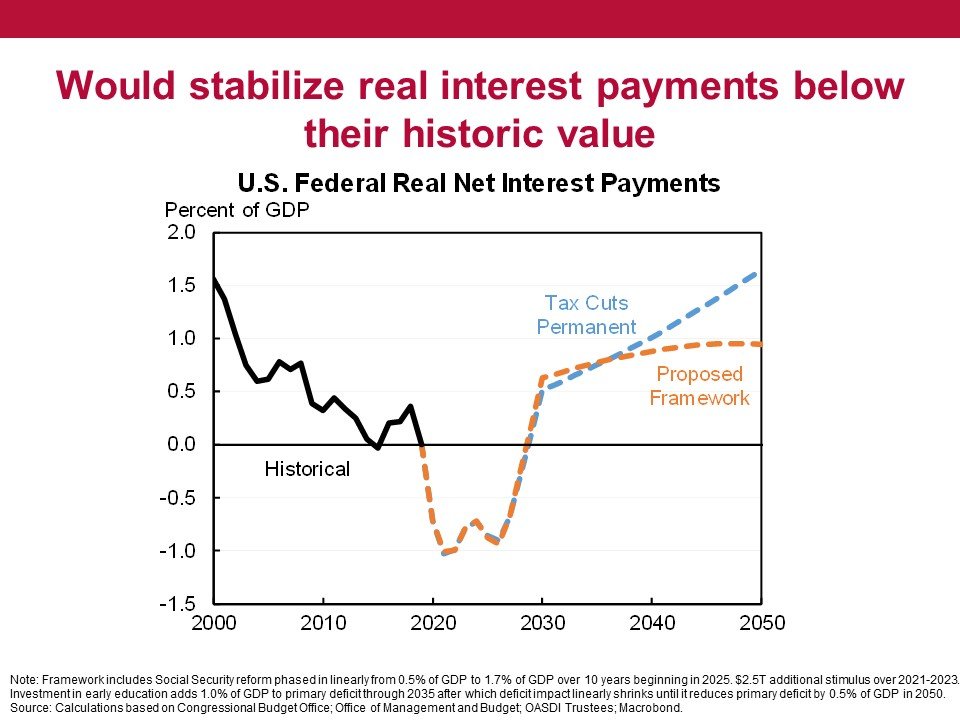

Now let's suppose, Germany (or even better: the European Union) would follow Jason's advice and aim for real net interst payments/GDP ~ 1% looking 10y ahead.

I can't easily calculate how much additional debt this would allow. But given the starting point, it'll be A LOT!

I can't easily calculate how much additional debt this would allow. But given the starting point, it'll be A LOT!

It would also depend by how much the interest rate on German gov bonds would increase if  were to increase public debt substantially

were to increase public debt substantially

This is hard to predict. But whatever it is, risk-averse savers should be happy about rising real interest rates on their domestic safe asset

savers should be happy about rising real interest rates on their domestic safe asset

were to increase public debt substantially

were to increase public debt substantiallyThis is hard to predict. But whatever it is, risk-averse

savers should be happy about rising real interest rates on their domestic safe asset

savers should be happy about rising real interest rates on their domestic safe asset

Thus, drawing on Jason's reasoning, it appears that  has *enormous* fiscal space

has *enormous* fiscal space

It could pay for a lot of good things, from green new deal, better schools, digital infrastructure, resilient health care, social security, etc., with "lack of money" being no viable excuse.

has *enormous* fiscal space

has *enormous* fiscal spaceIt could pay for a lot of good things, from green new deal, better schools, digital infrastructure, resilient health care, social security, etc., with "lack of money" being no viable excuse.

But Jason emphasized, and I very much agree, that even though money appears to be "free", there're still real constraints to worry about.

Who'll build all those wind turbines, 5G networks, etc., and who ensures an efficient allocation of resources? https://twitter.com/jasonfurman/status/1329817630253965313?s=20

Who'll build all those wind turbines, 5G networks, etc., and who ensures an efficient allocation of resources? https://twitter.com/jasonfurman/status/1329817630253965313?s=20

That sounds like the discussion we should be having. How to prioritize different projects, and how to make sure they're actually put on the road

Unfortunately, we won't reach that stage in or

or  , because there's no way current fiscal rules would allow that much debt.

, because there's no way current fiscal rules would allow that much debt.

Unfortunately, we won't reach that stage in

or

or  , because there's no way current fiscal rules would allow that much debt.

, because there's no way current fiscal rules would allow that much debt.

But don't blame it on the rules alone.

As a matter of fact, the general public (and politicians, for that matter) are not ready to seriously contemplate such fiscal policies, especially in , because we're all too used to freak out about the non-sense debt/GDP. Sorry!

, because we're all too used to freak out about the non-sense debt/GDP. Sorry!

/END

As a matter of fact, the general public (and politicians, for that matter) are not ready to seriously contemplate such fiscal policies, especially in

, because we're all too used to freak out about the non-sense debt/GDP. Sorry!

, because we're all too used to freak out about the non-sense debt/GDP. Sorry!/END

Read on Twitter

Read on Twitter