This assumes $10 billion EBITDA in 2021, representing ~65% growth Y-o-Y.

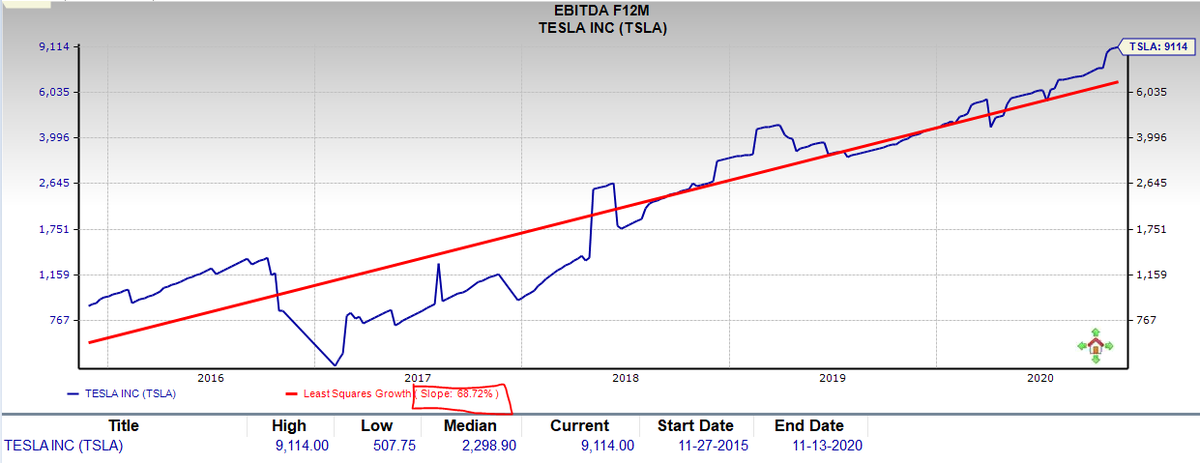

I do think Tesla will beat this number by a fair amount, because the 65% '21 growth that WS analysts expect is not much different from the 5-yr trend growth in their EBITDA estimates of 68%:

I do think Tesla will beat this number by a fair amount, because the 65% '21 growth that WS analysts expect is not much different from the 5-yr trend growth in their EBITDA estimates of 68%:

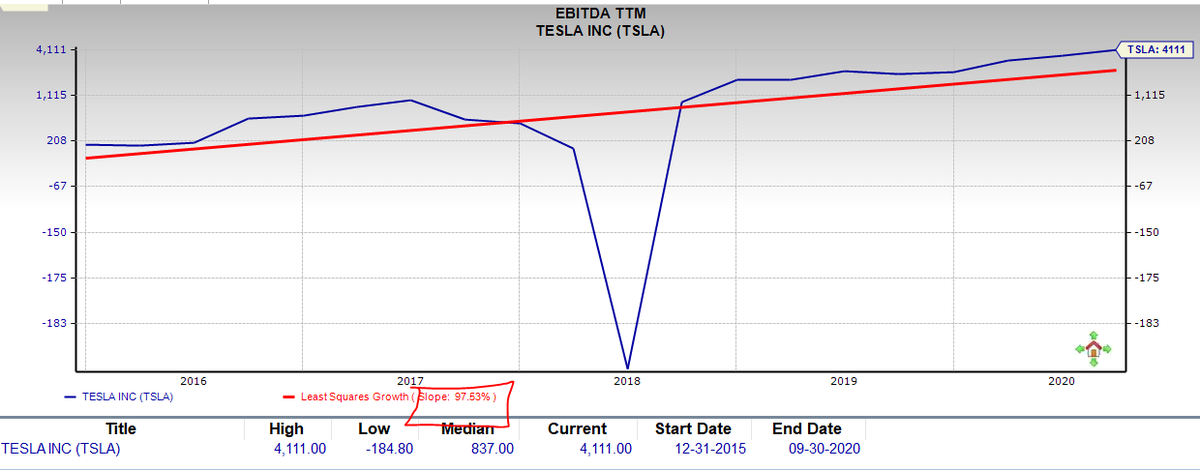

Analysts have always underestimated $TSLA's growth, with actual 5-yr EBITDA annualized growth (using the least squares method, not CAGR) clocking in at nearly 100%:

Ostensibly this is because we're starting off from a very small base, but...

Ostensibly this is because we're starting off from a very small base, but...

Tesla should be poised to break out well above this historical trend growth of 97%, thanks to incr vols, higher mix of hi-margin Y and MiC builds, + 4680 cells which will allow incr. capacity utilization, & most importantly, increasing FSD take-rate + deferred rev recognition.

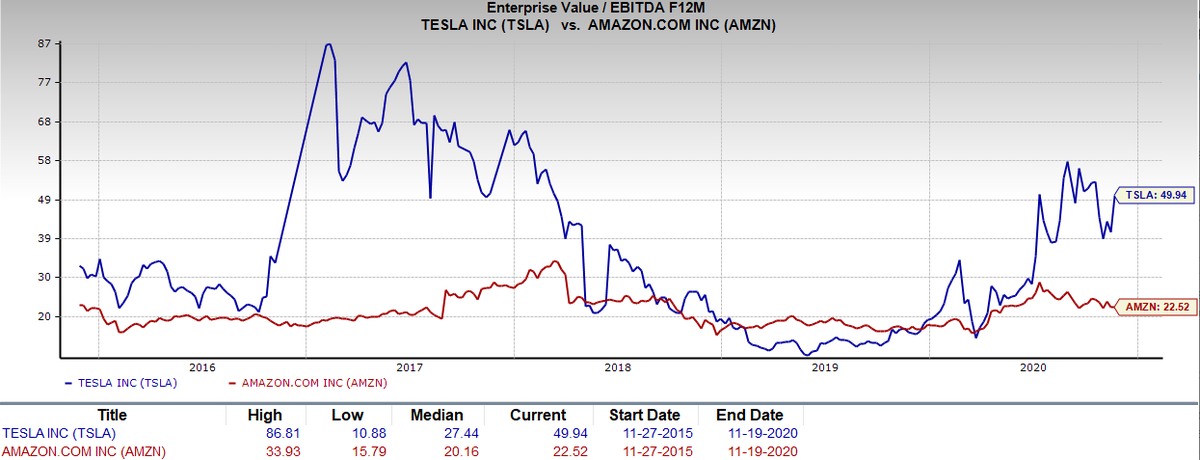

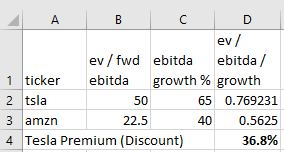

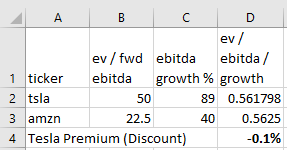

Given the basic forward EV / EBITDA and EBITDA growth rates, we can calculate a "PEG" like number:

Using WS estimates, $TSLA appears to be trading at a 36.8% premium to $AMZN after adjusting for WS expected EBITDA growth of 65%:

Using WS estimates, $TSLA appears to be trading at a 36.8% premium to $AMZN after adjusting for WS expected EBITDA growth of 65%:

In order for $TSLA to trade at parity with $AMZN, we would need to see EBITDA growth come in at a clip closer to about 88-89%, all else held equal.

That means if Tesla simply delivers the same growth it's been doing for the past 5 years, and we'd actually trade at a discount.

That means if Tesla simply delivers the same growth it's been doing for the past 5 years, and we'd actually trade at a discount.

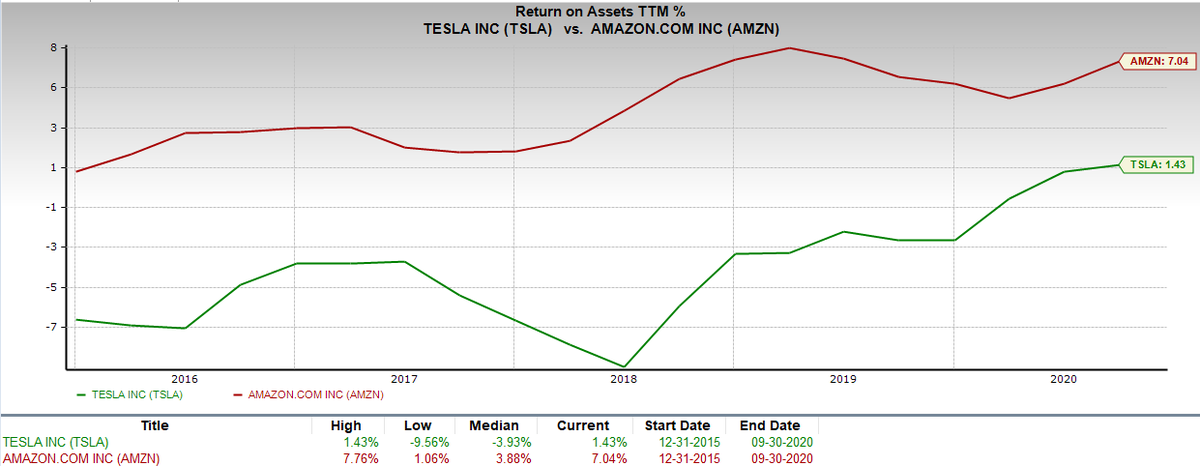

Further supporting this valuation is Tesla's increasing efficiency (ROA), which I believe will be the best in the entire auto industry and begin knocking on the door of tech ROA, netting something close to $AMZN 7% by the end of '21. Important to note is the trend rate of change:

I'm not selling a single share, even though $TSLA would be susceptible to a Nasdaq bear which I believe is coming in the next few mos. Everyone invested in this should be prepared to accept large drawdowns and focus on these important growth & efficiency trends over the long-run.

Read on Twitter

Read on Twitter