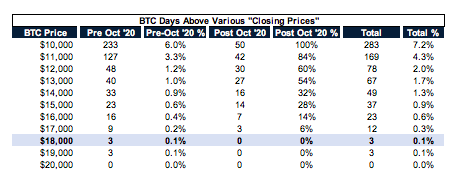

0/ With $BTC trading at $18.8K a "close" today above $18K would be the 4th time that's ever happened & the first since 12/19/17 (the 3 days were 12/12-12/19/17).

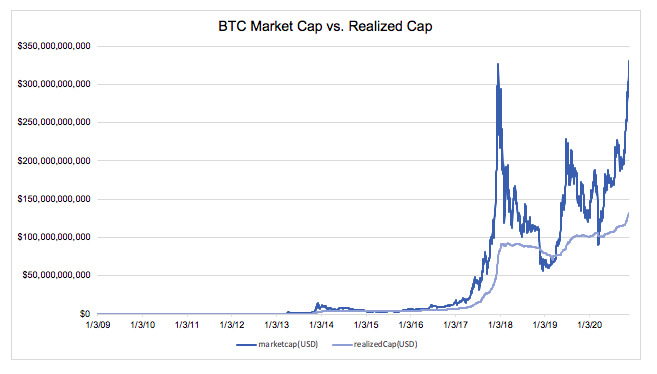

1/ As some have pointed out such as @nic__carter & @APompliano $BTC has already reached an ATH in terms of both Market Cap & Realized Cap given the increased supply. @nic__carter had a good post here:

https://medium.com/@nic__carter/nine-bitcoin-charts-already-at-all-time-highs-78abbfe82804

https://medium.com/@nic__carter/nine-bitcoin-charts-already-at-all-time-highs-78abbfe82804

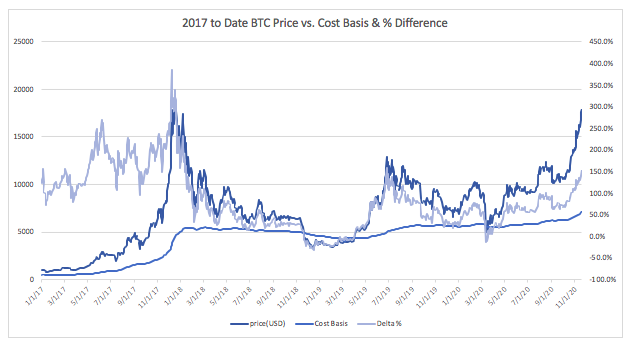

2/ Looking at Realized Cap on a per $BTC basis you've crossed $7K for the first time & while the delta b/w RC & MC is ~1/2 of what it was in Dec '18 it's the highest we've been since 6/26/19 (which was a local top) & prior to that Dec '17-Jan '18.

3/ The good thing about this move versus that in this composition of mkt participants. This is very much a spot driven rally with new "institutional buyers" including HF's, FO's, and even Corporate Treasuries. When people like @RickRieder talk about $BTC vs gold the "mkt" listens

4/ This makes that "relative cost basis" delta slightly less impactful as these new market participants have a lot more capital to offset existing retail holders taking profits (not to mention ~60% of $BTC hasn't changed hands in more than a year).

5/ In '17-'18 macro investors like PTJ, Druckenmiller, and Rieder weren't talking about $BTC, corporate treasuries like $MSTR & $SQ weren't buying $BTC, $GBTC has nearly doubled the amount of $BTC they own over that time period, and firms like $PYPL / Fidelity werent offering it

6/ We wrote a piece in June about $BTC & the macro environment (when it was trading ~$9K). Many of the thoughts still hold true but $BTC has doubled since that point. https://john-street-capital.medium.com/bitcoin-the-macro-environment-7c774aaa528c

7/ We'll see some pullbacks & consolidation but it feels like the $BTC "floor" has rebased higher making r/r much more attractive than last time we were at these levels.

Read on Twitter

Read on Twitter