With less than a week to go until the Chancellor's Sending Review, the @ONS has just published the latest public sector finances data for October, so we can see the impact of the crisis through the first seven months of the year. A short thread on the main takeaways...

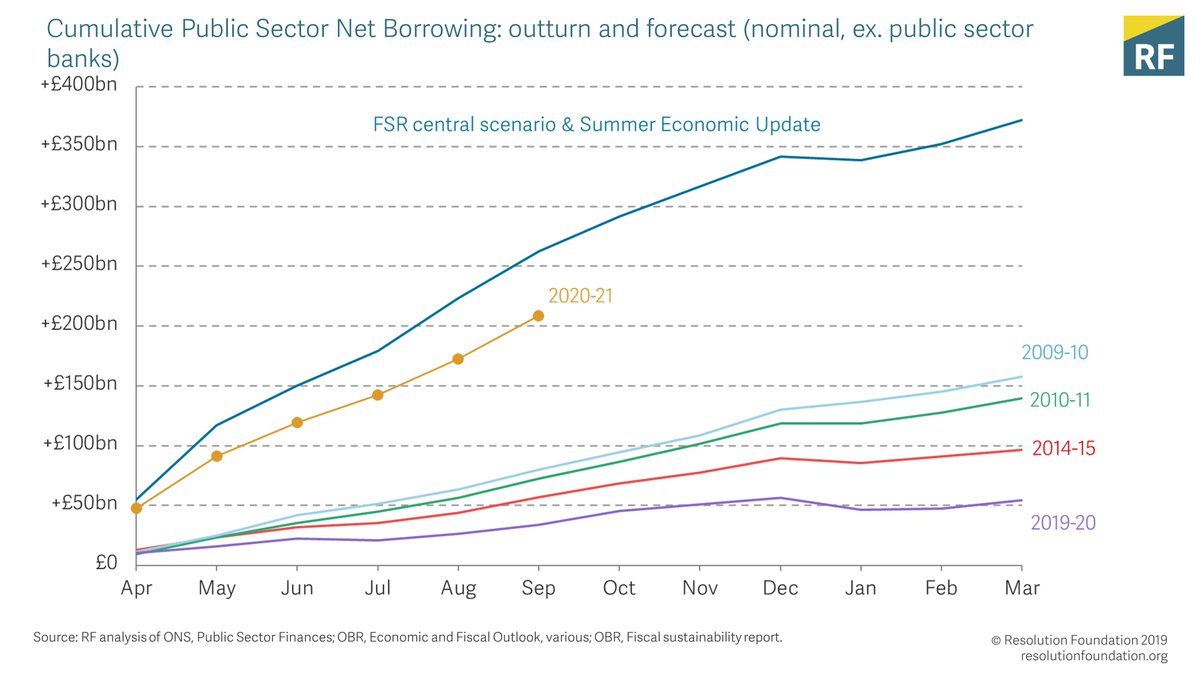

Borrowing is estimated to have been £214.9 billion since the start of the financial year, better than the OBR's central scenario (updated on 25th Nov) - reflecting lower than expected receipts and higher spending. But with the outlook deteriorating, this good news may not last.

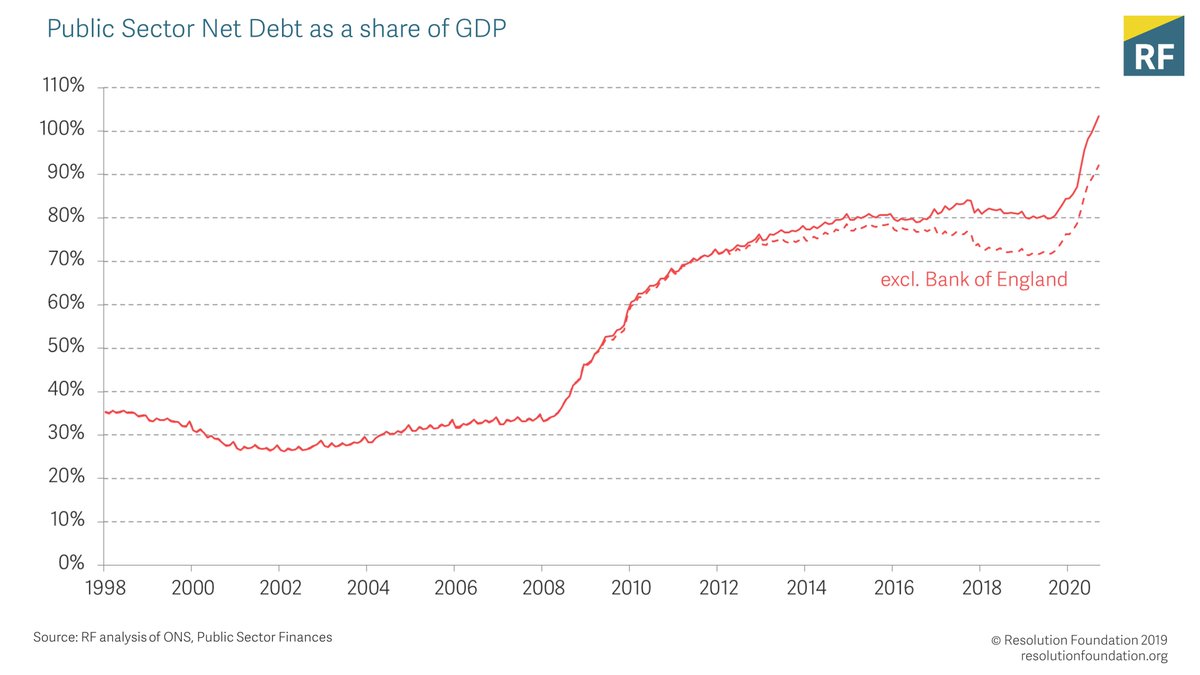

As a result of record borrowing, debt has risen to reach 100.8% of GDP in October 2020 - or £2,076.8 billion. This is the highest debt to GDP ratio since the financial year ending 1961.

These high fiscal costs of the crisis look to be manageable, though. 1) @UK_DMO has raised over £240bn since mid-March. 2) While debt is rising, debt costs are falling. Changes in debt interest are largely a result of movements in RPI to which index-linked bonds are pegged.

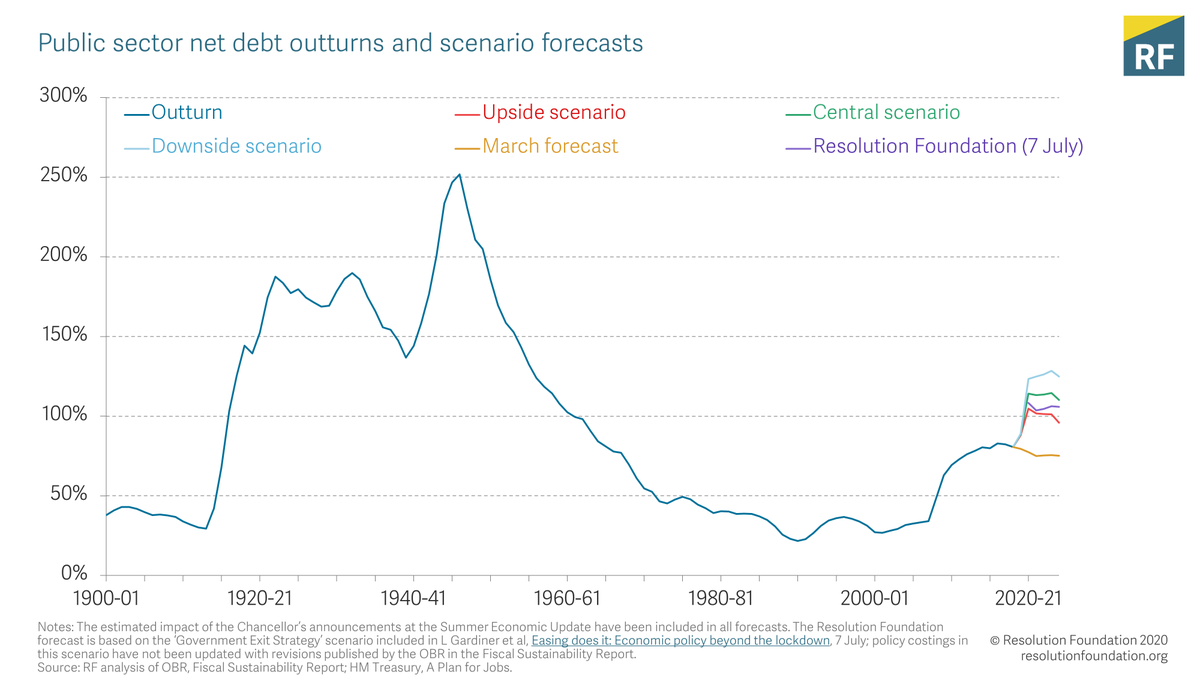

Back in July @OBR_UK forecast debt to rise sharply (as shown in this chart). This will continue into next year as high, but necessary, Government spending continues - from rolling out a vaccine to tackling high unemployment.

Tomorrow we will publish new research examining the economic and fiscal outlook ahead of the Spending Review, what this means for government spending this year and next and how it might affect the Chancellor’s appetite for setting out a post-Covid economic plan. Watch this space!

Read on Twitter

Read on Twitter