In the global family of financial assets, gold is #Bitcoin  's closest cousin. They are both non-sovereign monetary goods valued for their superior monetary properties (relative to fiat).

's closest cousin. They are both non-sovereign monetary goods valued for their superior monetary properties (relative to fiat).

However, the ownership distribution of these close cousins is very different. A thread

's closest cousin. They are both non-sovereign monetary goods valued for their superior monetary properties (relative to fiat).

's closest cousin. They are both non-sovereign monetary goods valued for their superior monetary properties (relative to fiat).However, the ownership distribution of these close cousins is very different. A thread

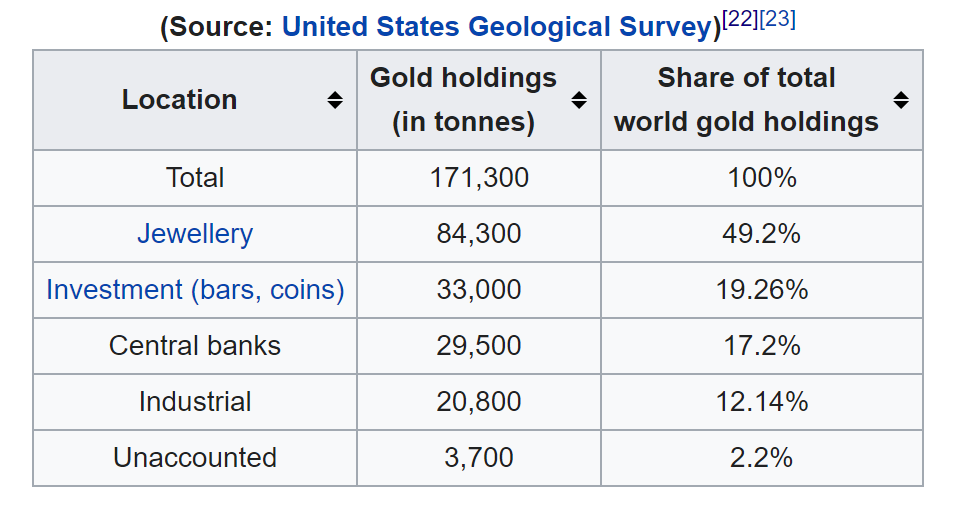

A very large fraction of gold is owned as jewelry (dominated by India) and (ironically) by global central banks. Investment usage in the form of bullion is the next dominant usage and this, in turn, comes in large part through demand from gold ETFs such as SPDR Gold Shares (GLD).

Much of the jewelry demand for gold is actually use as an ostentatious store-of-value. This is particularly so in India.

However, outside of India, there is very little retail demand for gold as a store of value, especially among younger savers in Western nations (millennials).

However, outside of India, there is very little retail demand for gold as a store of value, especially among younger savers in Western nations (millennials).

#Bitcoin  's ownership distribution on the other hand is dominated by retail investors and, in particular, the technologically savvy and ideologically motivated early investors who still own a large fraction of its total supply.

's ownership distribution on the other hand is dominated by retail investors and, in particular, the technologically savvy and ideologically motivated early investors who still own a large fraction of its total supply.

's ownership distribution on the other hand is dominated by retail investors and, in particular, the technologically savvy and ideologically motivated early investors who still own a large fraction of its total supply.

's ownership distribution on the other hand is dominated by retail investors and, in particular, the technologically savvy and ideologically motivated early investors who still own a large fraction of its total supply.

Ownership of #Bitcoin  skews much younger and the trend is likely to continue. If millennial investors were surveyed, only a tiny fraction will have considered gold as an investment, let alone put meaningful savings in it. #Bitcoin

skews much younger and the trend is likely to continue. If millennial investors were surveyed, only a tiny fraction will have considered gold as an investment, let alone put meaningful savings in it. #Bitcoin  on the other hand is their darling investment.

on the other hand is their darling investment.

skews much younger and the trend is likely to continue. If millennial investors were surveyed, only a tiny fraction will have considered gold as an investment, let alone put meaningful savings in it. #Bitcoin

skews much younger and the trend is likely to continue. If millennial investors were surveyed, only a tiny fraction will have considered gold as an investment, let alone put meaningful savings in it. #Bitcoin  on the other hand is their darling investment.

on the other hand is their darling investment.

It is possible to see the future in the present, if one has a keen enough eye. The transition of investment interest among the young from gold to #Bitcoin  is likely to accelerate in the coming years. However an important question is whether current gold demand will shift to BTC

is likely to accelerate in the coming years. However an important question is whether current gold demand will shift to BTC

is likely to accelerate in the coming years. However an important question is whether current gold demand will shift to BTC

is likely to accelerate in the coming years. However an important question is whether current gold demand will shift to BTC

It is unlikely that in the current bull market cycle that gold's main sources of demand (central banks and store-of-value use in India) will dramatically decline. However family offices that invest via gold ETFs are likely to consider the greater upside of #Bitcoin  .

.

.

.

Where gold is an ancient store-of-value, #Bitcoin  is a *nascent* store-of-value with superior monetary properties to gold. If one were to believe it eclipses gold's market capitalization, due to these superior properties, #Bitcoin

is a *nascent* store-of-value with superior monetary properties to gold. If one were to believe it eclipses gold's market capitalization, due to these superior properties, #Bitcoin  becomes a very attractive asymmetric bet.

becomes a very attractive asymmetric bet.

is a *nascent* store-of-value with superior monetary properties to gold. If one were to believe it eclipses gold's market capitalization, due to these superior properties, #Bitcoin

is a *nascent* store-of-value with superior monetary properties to gold. If one were to believe it eclipses gold's market capitalization, due to these superior properties, #Bitcoin  becomes a very attractive asymmetric bet.

becomes a very attractive asymmetric bet.

We are now seeing billionaires and corporations slowly come to this realization and this trend will play out meaningfully during this bull market. We will need to wait for subsequent cycles for gold's core demand to drain out into #Bitcoin  , however.

, however.

, however.

, however.

In the current bull market while some investment demand will shift from gold to #Bitcoin  , it is more likely that "risk-on" money will dominate flows into this nascent store-of-value. #Bitcoin

, it is more likely that "risk-on" money will dominate flows into this nascent store-of-value. #Bitcoin  will be draining fund flows from the stock market, primarily.

will be draining fund flows from the stock market, primarily.

, it is more likely that "risk-on" money will dominate flows into this nascent store-of-value. #Bitcoin

, it is more likely that "risk-on" money will dominate flows into this nascent store-of-value. #Bitcoin  will be draining fund flows from the stock market, primarily.

will be draining fund flows from the stock market, primarily.

Only when established as a store-of-value of comparable size to gold will we see a major global transition away from the ancient means of wealth preservation to the primary store-of-value that will be used by our posterity.

Read on Twitter

Read on Twitter