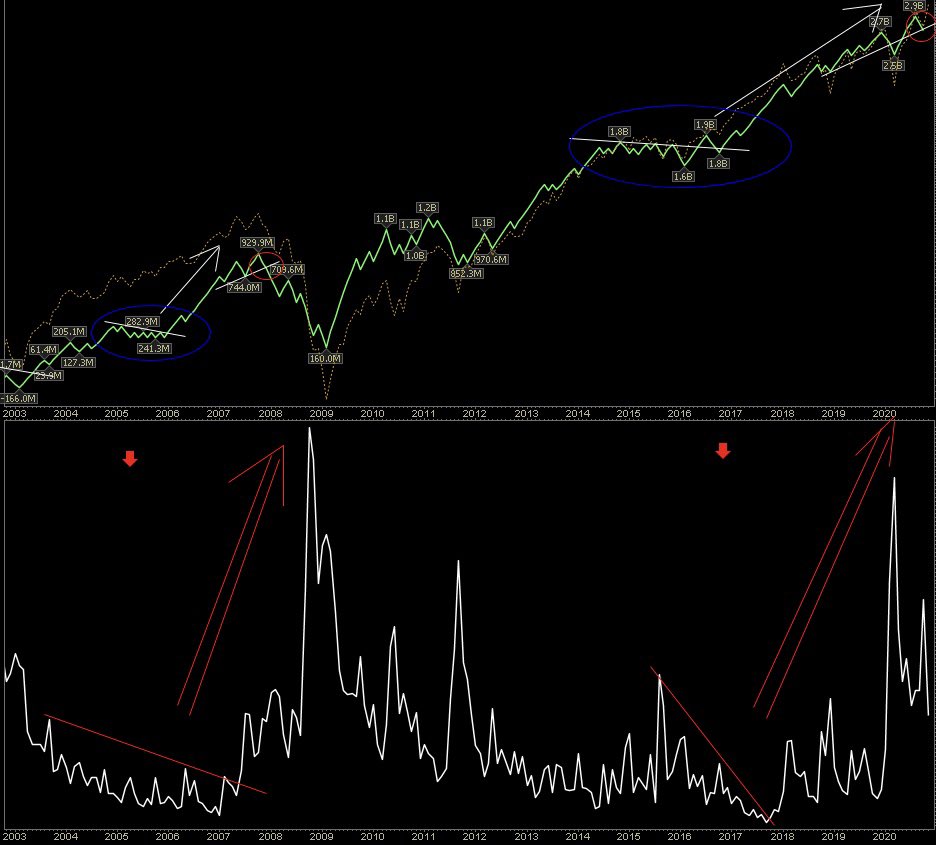

1/6 Thread. Volume and Flows. The most important aspect of trading is understanding the dynamic of flows. Here is a measure I have used for years. Simple metric that cumulatively adds up volume and deducts down vol. It’s a good proxy for accumulation/distribution. LP $VIX

2/6 Every bull market has a very important accumulation phase (large blue circle) where vol gets crushed and higher powers accumulate on low volumes. This is immediately followed by a the ending thrust of a bull where suckers pile in with large volumes.

3/6 this phase is always characterized with higher IV and then the thrust exhausts itself (red circle) and after shaking weak hands, higher powers establish a path of least resistance to the downside. This is today. Let’s look at this distribution phase closer and check with past

4/6 Relative volume candles. LP is an accumulation/distribution measure. You can see that while the market is making ATH, the big boys are unloading stocks. Distribution pressure is increasing while Accumulation is weakening. Why does it take so long? To shake-out weak shorts

5/6 is this how topping processes work? Let’s have a look at 2007. Well...looks like it worked exactly like this back then. Why is this such an important phase? Because it allows to lay the grounds for a no resistance bear market by annihilating early bears that would buy back

Read on Twitter

Read on Twitter