The Triumph of Injustice is now available in paperback!

To celebrate, here is a thread with some of the key charts — telling the story of what happened to US inequality and to its tax system

To celebrate, here is a thread with some of the key charts — telling the story of what happened to US inequality and to its tax system

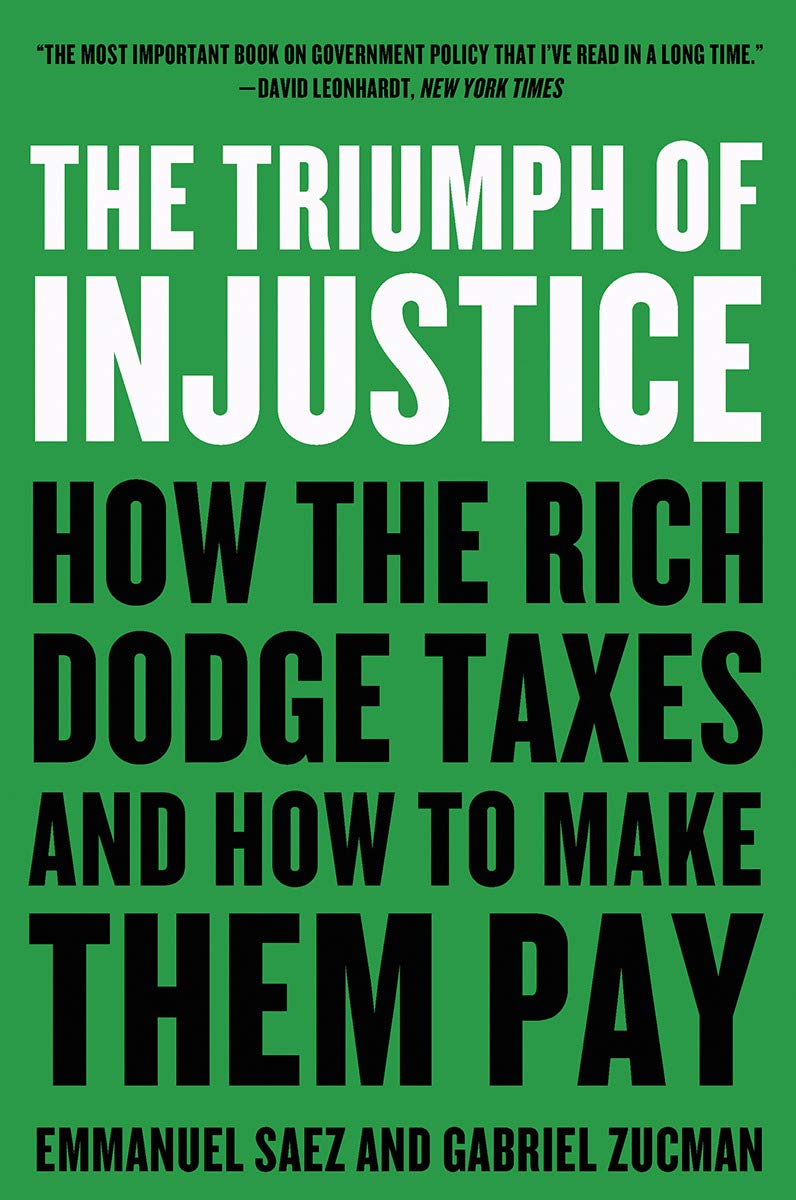

Since 1980, the top 1% and bottom 50% have switched their share of US income

The top 1% now earns close to 20% of total income, vs. 13% for the bottom 50%... a group by definition 50 times larger

The top 1% now earns close to 20% of total income, vs. 13% for the bottom 50%... a group by definition 50 times larger

Who pays what in taxes?

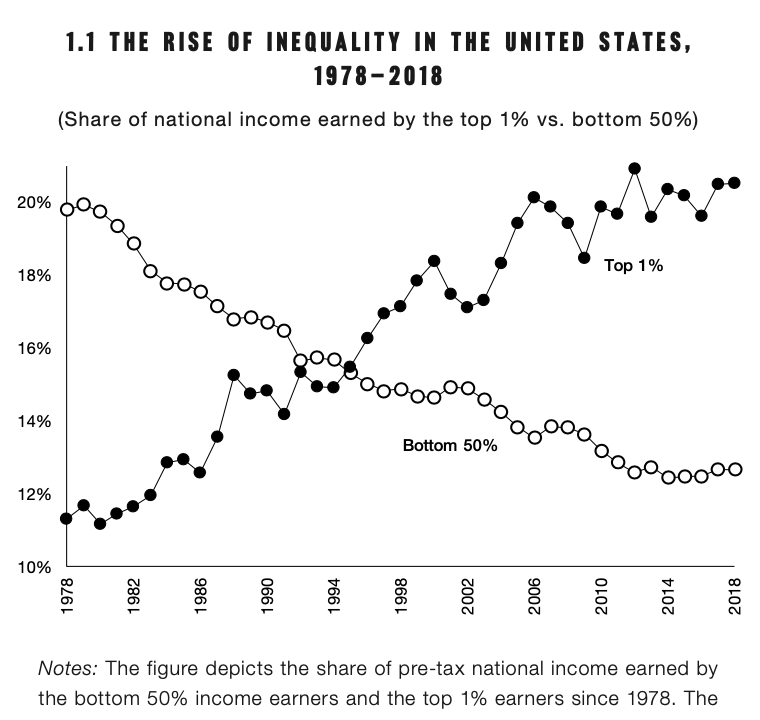

In 2018 (post Trump tax reform), when taking into account all taxes at all levels of government, the US system looks mildly progressive...

... except at the very top — with billionaires paying less than the average American

In 2018 (post Trump tax reform), when taking into account all taxes at all levels of government, the US system looks mildly progressive...

... except at the very top — with billionaires paying less than the average American

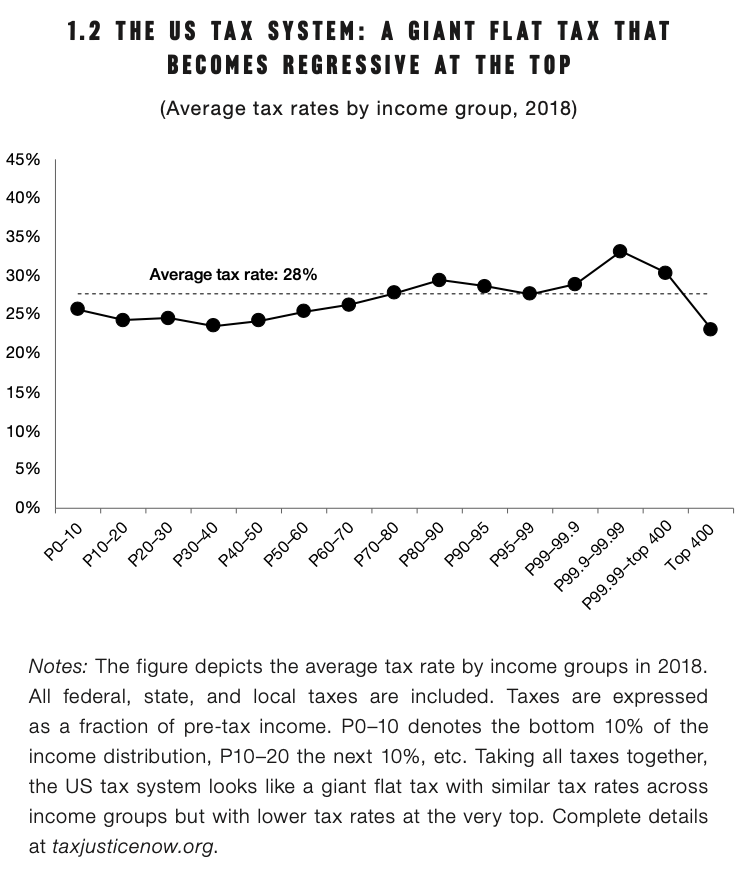

How is this possible?

The poor pay a lot because of sales taxes and payroll taxes — both highly regressive

The ultra-wealthy don't pay much, because for billionaires it's easy to avoid the income tax — by owning companies that do not distribute dividends

The poor pay a lot because of sales taxes and payroll taxes — both highly regressive

The ultra-wealthy don't pay much, because for billionaires it's easy to avoid the income tax — by owning companies that do not distribute dividends

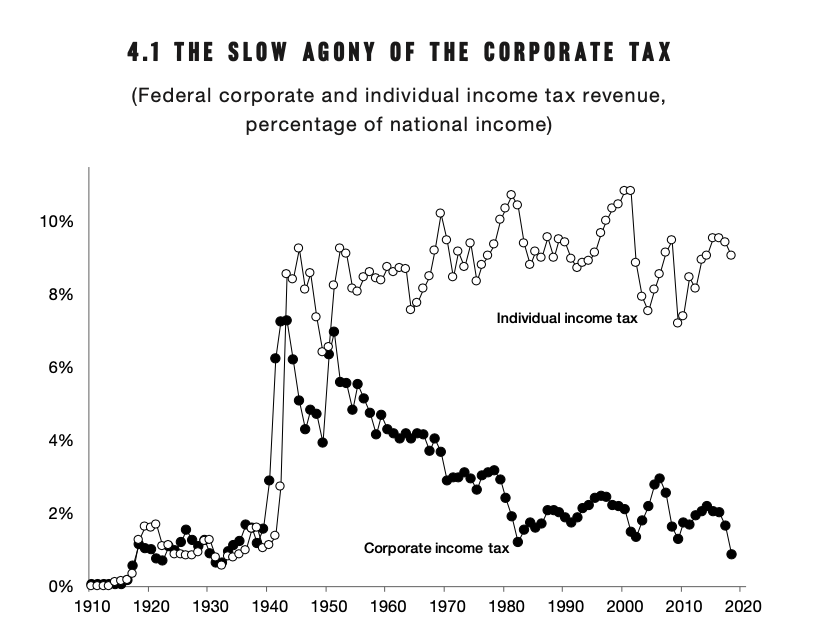

Once upon a time, the corporate tax addressed this problem — it generated a lot of revenue, and acted as a de facto high minimum tax on the wealthy

But now it's also gone

But now it's also gone

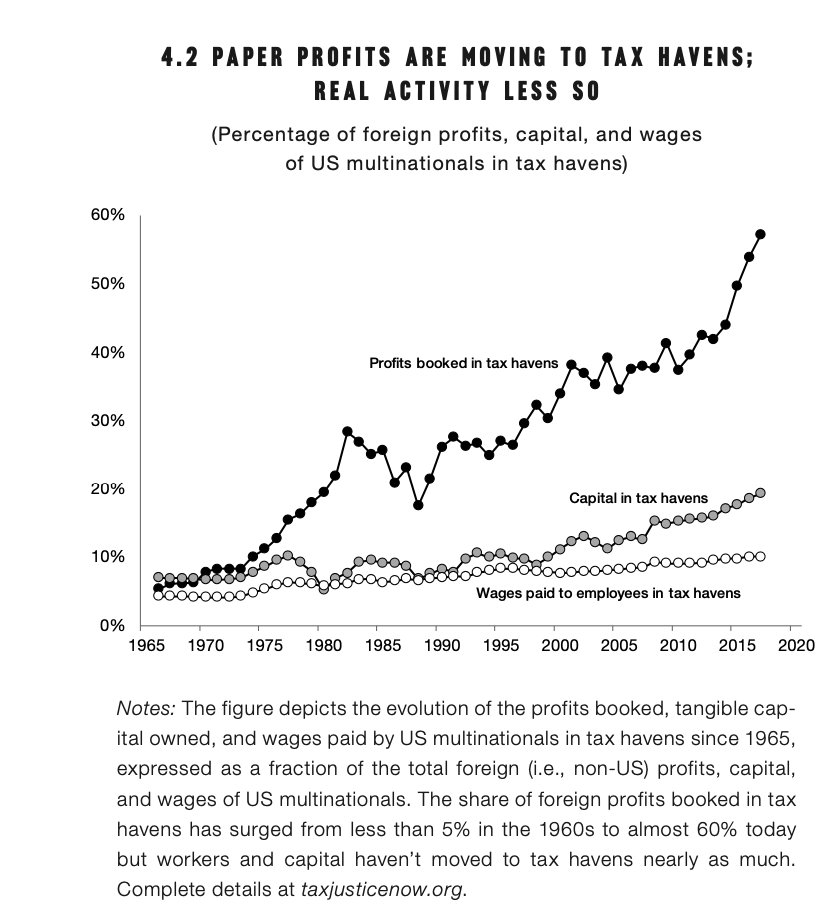

Behind all the episodes of decline in tax progressivity, there is an outburst of "innovation" in the market for tax dodging

Nowadays, US multinationals book more than half of their foreign profit in tax havens — where they employ very few workers

Nowadays, US multinationals book more than half of their foreign profit in tax havens — where they employ very few workers

Read on Twitter

Read on Twitter