Some folks assume taxing the rich divides Democrats--progressives support, moderates oppose.

But this issue only divides *elected* Democrats. The vast majority of Democratic *voters* (and half of Republicans!) want to tax the rich.

Let's do a thread: https://twitter.com/DelegateStewart/status/1329158555459596288?s=20

But this issue only divides *elected* Democrats. The vast majority of Democratic *voters* (and half of Republicans!) want to tax the rich.

Let's do a thread: https://twitter.com/DelegateStewart/status/1329158555459596288?s=20

Nationwide, there are few policy proposals more popular than taxing the rich.

For example, a @politico/ @MorningConsult poll from 2019 found 76% of all American want to tax the rich more, including almost all Democrats and 54% of Republicans. https://www.politico.com/story/2019/02/04/democrats-taxes-economy-policy-2020-1144874

For example, a @politico/ @MorningConsult poll from 2019 found 76% of all American want to tax the rich more, including almost all Democrats and 54% of Republicans. https://www.politico.com/story/2019/02/04/democrats-taxes-economy-policy-2020-1144874

New Jersey recently passed a millionaire's tax. Maryland had one, but it expired a few years ago. The idea will be back on the table for the upcoming legislative session.

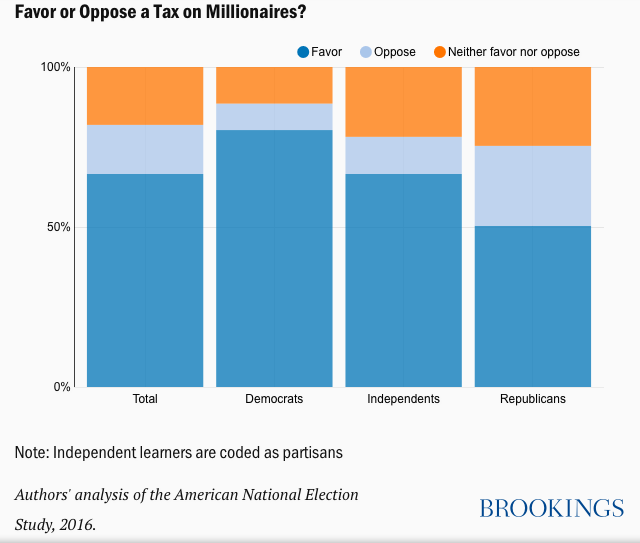

Nationwide, nearly 70% supported such a tax in 2016, including 80% of Democrats and half of Republicans.

Nationwide, nearly 70% supported such a tax in 2016, including 80% of Democrats and half of Republicans.

Here in Maryland, the @GoucherPoll regularly asks residents who they think the tax system is skewed toward.

60% of both Democrats and independents (rightly!) say it favors the wealthy, and less than 10% think it favors either the middle class or poor. https://www.goucher.edu/hughes-center/documents/SEPT18_Goucher_Poll_Part_One.pdf

60% of both Democrats and independents (rightly!) say it favors the wealthy, and less than 10% think it favors either the middle class or poor. https://www.goucher.edu/hughes-center/documents/SEPT18_Goucher_Poll_Part_One.pdf

Of course, these polls are pre-pandemic.

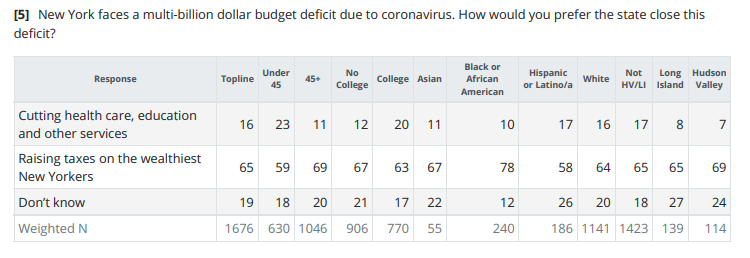

A 2020 @DataProgress poll from NY (which voted far less overwhelmingly for Joe Biden than did MD) found that 65% of residents preferred taxing the rich to close a COVID-induced budget shortfall. Only 16% preferred cutting services.

A 2020 @DataProgress poll from NY (which voted far less overwhelmingly for Joe Biden than did MD) found that 65% of residents preferred taxing the rich to close a COVID-induced budget shortfall. Only 16% preferred cutting services.

You'll hear about how we should avoid tax increases during a pandemic. It sounds like common sense!

But refusing to even *think about* raising taxes on the rich isn't just bad policy that will trigger painful cuts. It's also an extreme position wildly out of step with voters.

But refusing to even *think about* raising taxes on the rich isn't just bad policy that will trigger painful cuts. It's also an extreme position wildly out of step with voters.

Read on Twitter

Read on Twitter