So I've done a deep dive on NFT sleeper #VeVe / $OMI

I knew it had the licenses & tech but jfc, the tokenomics

HYPER-DEFLATIONARY

HYPER-DEFLATIONARY

BUYBACKS from 10% of new sales & 100% secondary sales of big-brand augmented reality NFTs

BUYBACKS from 10% of new sales & 100% secondary sales of big-brand augmented reality NFTs

Mass market brands + tokemomics =

THREAD

I knew it had the licenses & tech but jfc, the tokenomics

HYPER-DEFLATIONARY

HYPER-DEFLATIONARY BUYBACKS from 10% of new sales & 100% secondary sales of big-brand augmented reality NFTs

BUYBACKS from 10% of new sales & 100% secondary sales of big-brand augmented reality NFTsMass market brands + tokemomics =

THREAD

The basics

Ve-Ve is an NFT ecosystem with 100+ brands signed

( https://medium.com/ecomi/huge-international-licenses-announced-for-ve-ve-d84f747c96ce) including @NFL @DCComics @cartoonnetwork

@startrek @CapcomUSA_

@warnerbros

Global fanbases and distribution channels.

Runway? They own the damn airport

Ve-Ve is an NFT ecosystem with 100+ brands signed

( https://medium.com/ecomi/huge-international-licenses-announced-for-ve-ve-d84f747c96ce) including @NFL @DCComics @cartoonnetwork

@startrek @CapcomUSA_

@warnerbros

Global fanbases and distribution channels.

Runway? They own the damn airport

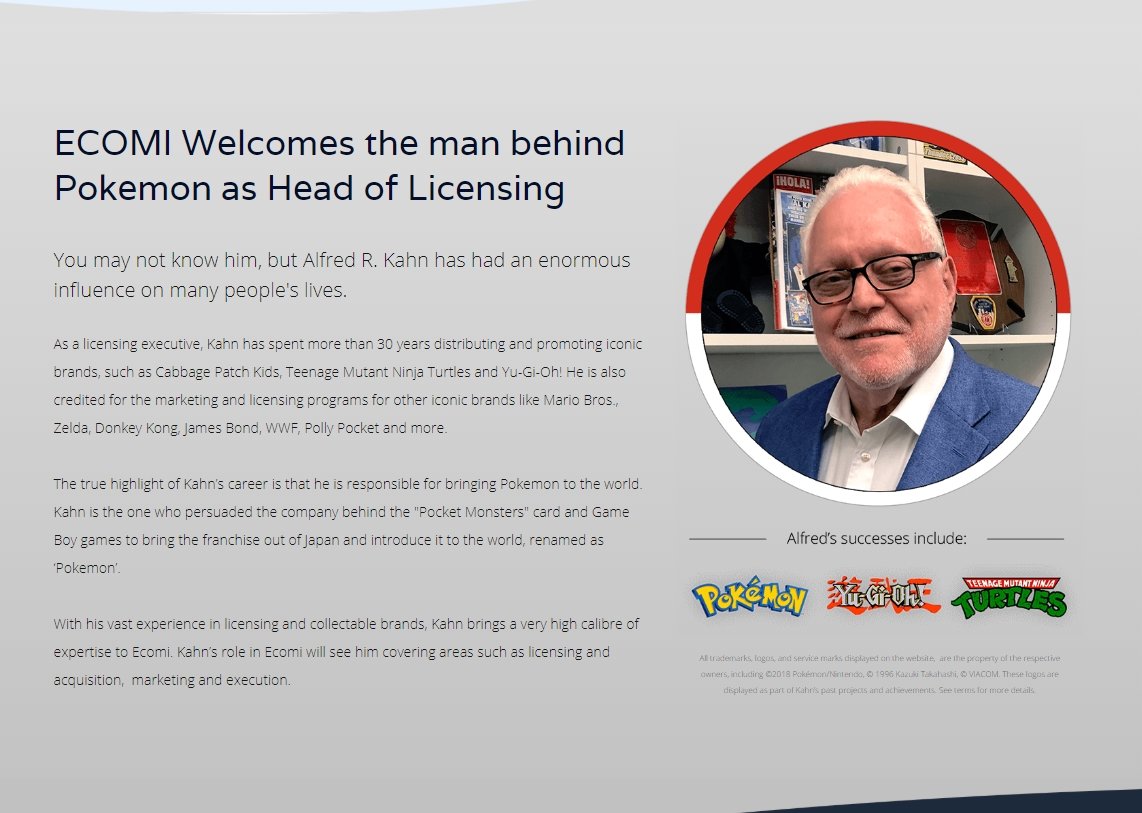

Many come courtesy of Licensing Hall of Famer Alfred Kahn - the man who brought Pokémon to the wider world. ( https://medium.com/ecomi/huge-international-licenses-announced-for-ve-ve-d84f747c96ce)

Ninja Turtles. James Bond. Polly Pockets. BIG-sounding Asian stuff You name it, Giga-Chad Alph managed it.

You name it, Giga-Chad Alph managed it.

Licenses?

Ninja Turtles. James Bond. Polly Pockets. BIG-sounding Asian stuff

You name it, Giga-Chad Alph managed it.

You name it, Giga-Chad Alph managed it.Licenses?

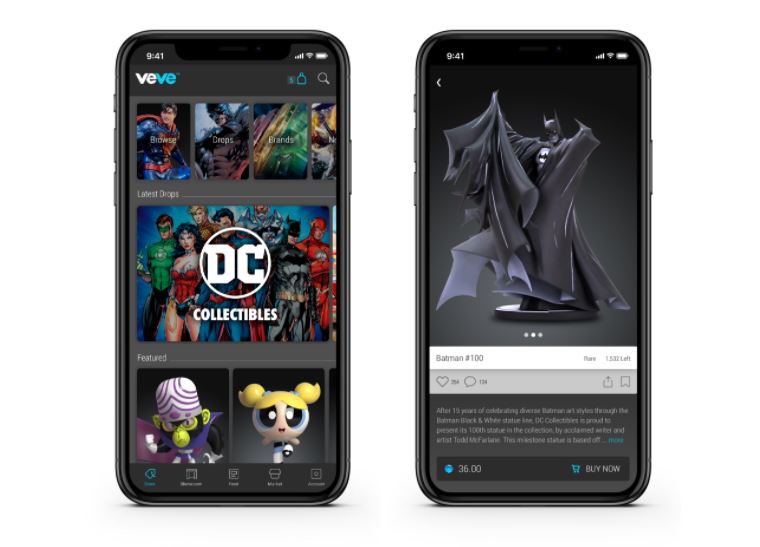

Product -

The app is gradually coming out of beta, but looks ace:

Check out this augmented reality NFT Dark Knight - chilling on the rug with someone's real life dog

These instagrammable AR NFTs will take social media by storm.

The app is gradually coming out of beta, but looks ace:

Check out this augmented reality NFT Dark Knight - chilling on the rug with someone's real life dog

These instagrammable AR NFTs will take social media by storm.

Show off your DeLorean in a parking lot beside actual cars. Drive it around remotely.

Crash it for all I care

The tech is

Crash it for all I care

The tech is

What people don't realise is

𝗦𝗼 𝗮𝗿𝗲 𝘁𝗵𝗲 𝘁𝗼𝗸𝗲𝗻𝗼𝗺𝗶𝗰𝘀.

$omi, on which everything runs, is:

radically deflationary

radically deflationary

&

uses in-app revenues to fund huge buy-backs from exchanges.

uses in-app revenues to fund huge buy-backs from exchanges.

𝗦𝗼 𝗮𝗿𝗲 𝘁𝗵𝗲 𝘁𝗼𝗸𝗲𝗻𝗼𝗺𝗶𝗰𝘀.

$omi, on which everything runs, is:

radically deflationary

radically deflationary&

uses in-app revenues to fund huge buy-backs from exchanges.

uses in-app revenues to fund huge buy-backs from exchanges.

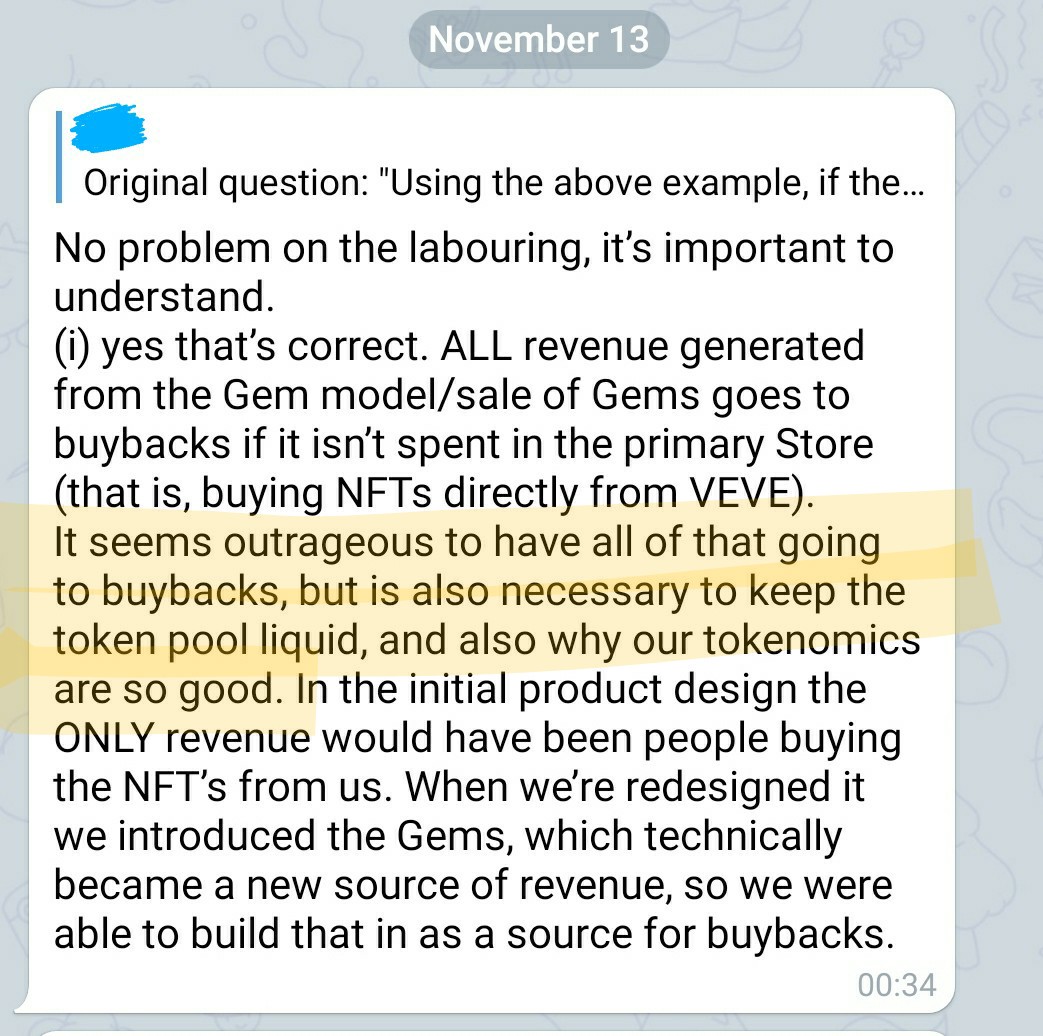

1. Deflation

𝗪𝗵𝗲𝗻 𝗮 𝘂𝘀𝗲𝗿 𝗯𝘂𝘆𝘀 𝗮 𝗻𝗲𝘄 𝗡𝗙𝗧, 𝗔𝗟𝗟 𝗼𝗳 𝘁𝗵𝗲 $𝗼𝗺𝗶 𝗶𝘀 𝗽𝗲𝗿𝗺𝗮𝗻𝗲𝗻𝘁𝗹𝘆 𝘀𝗲𝗻𝘁 𝗳𝗿𝗼𝗺 𝘁𝗵𝗲 𝗥𝗲𝘀𝗲𝗿𝘃𝗲 𝘁𝗼 𝗮𝗻 𝗢𝘂𝘁-𝗼𝗳-𝗖𝗶𝗿𝗰𝘂𝗹𝗮𝘁𝗶𝗼𝗻 𝗪𝗮𝗹𝗹𝗲𝘁.

So far, the 40 users in beta have burned 206m tokens.

𝗪𝗵𝗲𝗻 𝗮 𝘂𝘀𝗲𝗿 𝗯𝘂𝘆𝘀 𝗮 𝗻𝗲𝘄 𝗡𝗙𝗧, 𝗔𝗟𝗟 𝗼𝗳 𝘁𝗵𝗲 $𝗼𝗺𝗶 𝗶𝘀 𝗽𝗲𝗿𝗺𝗮𝗻𝗲𝗻𝘁𝗹𝘆 𝘀𝗲𝗻𝘁 𝗳𝗿𝗼𝗺 𝘁𝗵𝗲 𝗥𝗲𝘀𝗲𝗿𝘃𝗲 𝘁𝗼 𝗮𝗻 𝗢𝘂𝘁-𝗼𝗳-𝗖𝗶𝗿𝗰𝘂𝗹𝗮𝘁𝗶𝗼𝗻 𝗪𝗮𝗹𝗹𝗲𝘁.

So far, the 40 users in beta have burned 206m tokens.

What happens when there are 1,000 users?

Or 10,000?

Or 10,000?

To replenish the Reserve there are buybacks paid for with:

ALL the income from secondary market sales (expected to be the bigger market)

ALL the income from secondary market sales (expected to be the bigger market)

10% of income from new NFT sales

10% of income from new NFT sales

Sounds too good to be true but BIG burns require BIG buybacks, say team

ALL the income from secondary market sales (expected to be the bigger market)

ALL the income from secondary market sales (expected to be the bigger market) 10% of income from new NFT sales

10% of income from new NFT salesSounds too good to be true but BIG burns require BIG buybacks, say team

Let me spell it out - these buybacks are NOT the mere yields/tx fees of protocols feeding on themselves/each other.

They are the in-app revenues from customers buying collectibles. The buybacks will scale with sales. They have the potential to be FRICKIN HUGE.

They are the in-app revenues from customers buying collectibles. The buybacks will scale with sales. They have the potential to be FRICKIN HUGE.

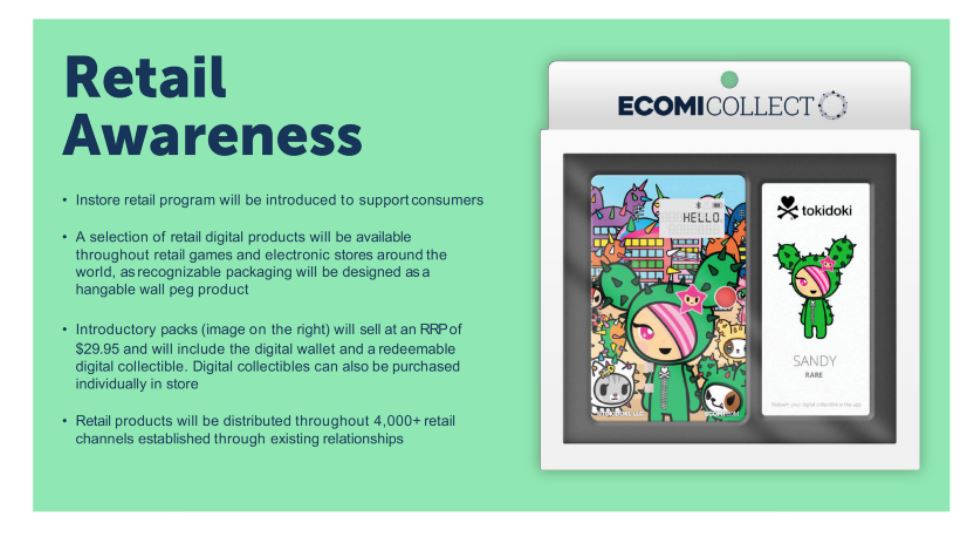

How big will sales be?

Your guess is as good as mine but:

4000+ retail channels...

4000+ retail channels...

Big brands co-marketing the product...

Big brands co-marketing the product...

In-store advertising...

In-store advertising...

A physical product to act as a gateway...

A physical product to act as a gateway...

Currently sitting at a $3.25m mcap, GTFOH

Your guess is as good as mine but:

4000+ retail channels...

4000+ retail channels...  Big brands co-marketing the product...

Big brands co-marketing the product... In-store advertising...

In-store advertising... A physical product to act as a gateway...

A physical product to act as a gateway...Currently sitting at a $3.25m mcap, GTFOH

But Sir

With such extreme deflationary mechanics

And only a % of total $ being spent on buybacks, however big

Supply still go down

won't Reserve run out?

𝗜𝘁 𝘄𝗼𝘂𝗹𝗱, 𝘂𝗻𝗹𝗲𝘀𝘀 𝘀𝗼𝗺𝗲𝘁𝗵𝗶𝗻𝗴 𝗲𝗹𝘀𝗲 𝘄𝗲𝗻𝘁 𝘂𝗽.

With such extreme deflationary mechanics

And only a % of total $ being spent on buybacks, however big

Supply still go down

won't Reserve run out?

𝗜𝘁 𝘄𝗼𝘂𝗹𝗱, 𝘂𝗻𝗹𝗲𝘀𝘀 𝘀𝗼𝗺𝗲𝘁𝗵𝗶𝗻𝗴 𝗲𝗹𝘀𝗲 𝘄𝗲𝗻𝘁 𝘂𝗽.

Ve-Ve / $omi is a beast:

A major entrant in a 200bn market with the licenses & tech to ensure the fiat flows

A major entrant in a 200bn market with the licenses & tech to ensure the fiat flows

Using that fiat to Valhalla a hyper-deflationary token with large-scale buybacks

Using that fiat to Valhalla a hyper-deflationary token with large-scale buybacks

Uni pnd plays don't have pumpamentals this wild

Some inside Chad wired this

A major entrant in a 200bn market with the licenses & tech to ensure the fiat flows

A major entrant in a 200bn market with the licenses & tech to ensure the fiat flows Using that fiat to Valhalla a hyper-deflationary token with large-scale buybacks

Using that fiat to Valhalla a hyper-deflationary token with large-scale buybacksUni pnd plays don't have pumpamentals this wild

Some inside Chad wired this

Will $omi be the NFT ecosystem to rule them all?

No such thing, but its aim is to be the Netflix of (mainstream) digital collectibles. With those licenses, I wouldn't bet against it

And AS A BET, w/ the tokenomics, at a $3.25m mcap?

Brace yourselves mofos

#FOMI is coming

No such thing, but its aim is to be the Netflix of (mainstream) digital collectibles. With those licenses, I wouldn't bet against it

And AS A BET, w/ the tokenomics, at a $3.25m mcap?

Brace yourselves mofos

#FOMI is coming

///ENDS

bonus extra: fud smackdown

bonus extra: fud smackdown

1. "tokenomics look complicated"

Read this, CAREFULLY: https://medium.com/ecomi/ve-ve-tokenomics-in-app-funds-and-token-buybacks-7ea8ac1a19c9

The stablecoin and Reserve are there to allow seamless in-app payments in fiat for 12yo's and their moms with $ but no trezor, who don't want to full degen ape.

Hate mass adoption? Don't apply

Read this, CAREFULLY: https://medium.com/ecomi/ve-ve-tokenomics-in-app-funds-and-token-buybacks-7ea8ac1a19c9

The stablecoin and Reserve are there to allow seamless in-app payments in fiat for 12yo's and their moms with $ but no trezor, who don't want to full degen ape.

Hate mass adoption? Don't apply

2. "Scary Reserve & Vault"

These hold 340bn omi (45% supply). This is an in-app Reserve and NOT 'owned' by anyone. It provides liquidity for in-app txs.

These tokens will never flood the market, mostly they'll sit in Reserve/be burned for new NFT purchases.

These hold 340bn omi (45% supply). This is an in-app Reserve and NOT 'owned' by anyone. It provides liquidity for in-app txs.

These tokens will never flood the market, mostly they'll sit in Reserve/be burned for new NFT purchases.

Some may enter circulation over time:

eg Rhys can sell an NFT for gems, convert to omi, and send to an exchange to cash out increasing supply on exchanges

increasing supply on exchanges

BUT!

The $ that Benn paid for gems to buy Rhys' NFT with pay for buybacks reducing supply on exchanges

reducing supply on exchanges

Equilibrium

eg Rhys can sell an NFT for gems, convert to omi, and send to an exchange to cash out

increasing supply on exchanges

increasing supply on exchangesBUT!

The $ that Benn paid for gems to buy Rhys' NFT with pay for buybacks

reducing supply on exchanges

reducing supply on exchangesEquilibrium

3. Presale

At ICO 110bn tokens sold for 1 sat - $0.00006-7 per at the time

Team etc have an allocation of 20% supply. Vesting staggered from May 2021. 45% in reserves shouldn't be counted (see above)

App coming out of beta. Price won't be $0.00003 once hype starts.

At ICO 110bn tokens sold for 1 sat - $0.00006-7 per at the time

Team etc have an allocation of 20% supply. Vesting staggered from May 2021. 45% in reserves shouldn't be counted (see above)

App coming out of beta. Price won't be $0.00003 once hype starts.

4. Mcap

Circulating supply is 110 bn.

Price is lower than ICO.

$3.25m mcap rn.

For a product this hot? Going into an NFT hype cycle in a full bull?

///ENDS

Circulating supply is 110 bn.

Price is lower than ICO.

$3.25m mcap rn.

For a product this hot? Going into an NFT hype cycle in a full bull?

///ENDS

Read on Twitter

Read on Twitter